Endeavour Reports Q3-2024 Results

ENDEAVOUR REPORTS Q3-2024

RESULTS

Adjusted EBITDA of $317m • Free Cash Flow of $97m •

Shareholder returns paid of $229m

|

OPERATIONAL AND FINANCIAL HIGHLIGHTS |

-

Strongest quarterly production this year of 270koz at AISC

of $1,287/oz; YTD-2024 production of 741koz at AISC of $1,256/oz

with FY-2024 production expected at or around the low end of

guidance with AISC above the top end

|

-

YTD-2024 AISC impact of $149/oz by higher royalty costs

driven by higher gold prices, low grid power availability in

H1-2024 and underperformance at the Sabodala-Massawa

CIL

|

- Adj.

EBITDA of $317m for Q3-2024, up 27% over Q2-2024, and Adj. Net

Earnings of $74m (or $0.30/sh) for Q3-2024

|

- Operating

cash flow before changes in working capital of $245m (or $1.00/sh),

up 15% over Q2-2024

|

- Free

Cash Flow of $97m (or $0.40/sh) for Q3-2024, up 20% over

Q2-2024

|

- Healthy

financial position with improved net debt of $834m and leverage of

0.77x tracking towards 0.5x target following completion of growth

phase

|

-

Shareholder returns paid of $229m; H1-2024 dividend of

$100m (or $0.41/sh) and $29m of share buybacks year to

date

|

| ORGANIC

GROWTH |

-

Commercial production achieved on budget and on schedule at

both Sabodala-Massawa BIOX® Expansion and Lafigué on 1 August 2024;

both project ramp-ups tracking in line with

expectations

|

- Strong

exploration efforts with

$74m spent

YTD-2024; high priority Tanda-Iguela

exploration programme has identified continuous shallow

mineralisation at the Pala Trend 3 target within close proximity to

the Assafou project

|

London, 7 November 2024 –

Endeavour Mining plc (LSE:EDV, TSX:EDV, OTCQX:EDVMF) (“Endeavour”,

the “Group” or the “Company”) is pleased to announce its operating

and financial results for Q3-2024 and YTD-2024, with highlights

provided in Table 1 below.

Table 1: Q3-2024 and YTD-2024

Highlights from continuing

operations1

| All amounts in

US$ million unless otherwise specified |

THREE MONTHS

ENDED |

NINE MONTHS ENDED |

30

September

2024 |

30 June

2024 |

30

September

2023 |

30

September

2024 |

30

September

2023 |

Δ Q3-2024

vs. Q2-2024 |

|

OPERATING DATA |

|

|

|

|

|

|

| Gold Production, koz |

270 |

251 |

281 |

741 |

792 |

+8% |

| Gold sold, koz |

280 |

238 |

278 |

743 |

799 |

+18% |

| All-in Sustaining

Cost2,3, $/oz |

1,287 |

1,287 |

967 |

1,256 |

974 |

—% |

|

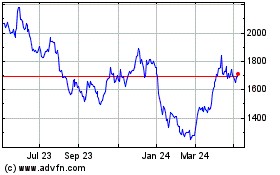

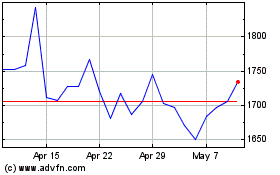

Realised Gold Price4, $/oz |

2,342 |

2,287 |

1,903 |

2,233 |

1,910 |

+2% |

| CASH

FLOW |

|

|

|

|

|

|

| Operating Cash Flow before

changes in working capital |

245 |

213 |

121 |

595 |

500 |

+15% |

| Operating Cash Flow before

changes in working capital2, $/sh |

1.00 |

0.87 |

0.49 |

2.43 |

2.02 |

+15% |

| Operating Cash Flow |

255 |

258 |

115 |

568 |

453 |

(1)% |

| Operating Cash

Flow2, $/sh |

1.04 |

1.05 |

0.47 |

2.32 |

1.83 |

(1)% |

| Free Cash

Flow2,5 |

97 |

81 |

(80) |

45 |

(130) |

+20% |

| Free Cash Flow2,5,

$/sh |

0.40 |

0.33 |

(0.32) |

0.18 |

(0.53) |

+21% |

|

PROFITABILITY |

|

|

|

|

|

|

| Net Earnings Attributable to

Shareholders |

(95) |

(60) |

60 |

(175) |

137 |

n.a. |

| Net Earnings, $/sh |

(0.39) |

(0.24) |

0.24 |

(0.71) |

0.55 |

n.a. |

| Adj. Net Earnings Attributable

to Shareholders2 |

74 |

3 |

70 |

117 |

188 |

+2367% |

| Adj. Net Earnings2,

$/sh |

0.30 |

0.01 |

0.28 |

0.48 |

0.76 |

+2900% |

| EBITDA2 |

128 |

193 |

262 |

477 |

704 |

(34)% |

| Adj. EBITDA2 |

317 |

249 |

263 |

779 |

755 |

+27% |

|

SHAREHOLDER RETURNS2 |

|

|

|

|

|

|

| Shareholder dividends

paid |

— |

— |

100 |

100 |

200 |

n.a. |

| Share buybacks |

9 |

8 |

20 |

29 |

40 |

+13% |

|

FINANCIAL POSITION HIGHLIGHTS2 |

|

|

|

|

|

|

| Net Debt |

834 |

835 |

445 |

834 |

445 |

—% |

| Net

Debt / LTM Trailing adj. EBITDA6 |

0.77x |

0.81x |

0.40x |

0.77x |

0.40x |

(5)% |

1 Continuing Operations excludes the

non-core Boungou and Wahgnion mines which were divested on

30 June 2023. 2This is a non-GAAP

measure, refer to the non-GAAP Measures section for further

details. 3Excludes pre-commercial

costs and ounces sold. 4Realised gold

prices are inclusive of the Sabodala-Massawa stream and the

realised gains/losses from the Group’s revenue protection

programme.5From all operations;

calculated as Operating Cash Flow less Cash used in investing

activities 6Last Twelve Months (“LTM”)

Trailing EBITDA adj includes EBITDA generated by

discontinued operations.

Management will host a conference call and

webcast today, 7 November 2024, at 8:30 am EST / 1:30 pm GMT. For

instructions on how to participate, please refer to the conference

call and webcast section at the end of the news release. A copy of

the Management Report and Financial Statements have been submitted

to the National Storage Mechanism and will be filed on SEDAR+. The

documents will shortly be available for inspection on the Company’s

website and at:

https://data.fca.org.uk/#/nsm/nationalstoragemechanism.

Ian Cockerill, Chief Executive Officer,

commented: “During Q3-2024 we continued to deliver against our

strategic objectives as we successfully completed our growth phase,

achieving commercial production at our two organic growth projects,

which supported our strongest quarter of production this year and

underpinned our transition to a phase focused on free cash flow

generation.

On the operational front, we expect full-year production to

be at or around the low end of the guidance range, while our all-in

sustaining cost is expected to be above the top end of the range,

due to higher royalty and power costs as well as lower production

at the Sabodala-Massawa CIL operation. Despite above average

rainfall early in the Q4, our performance is expected to be

significantly stronger than Q3, supported by the ramp ups of our

growth projects as well as increased production at the Houndé and

Mana mines, in line with their mine sequences.

During the quarter, we completed construction and achieved

commercial production at the Sabodala-Massawa BIOX Expansion and

the Lafigué mine, with both projects ramping up in line with

expectations and achieving nameplate throughput capacity during the

quarter. At the top tier Assafou project, where the preliminary

feasibility study is on track for completion in Q4, we continue to

see significant exploration upside, both at the Assafou project,

and on the wider Tanda-Iguela property.

We achieved a significant free cash inflection during the

quarter, generating approximately $100 million of free cash flow,

and given our strong outlook, we are now focused on shareholder

returns and our balance sheet. We repaid $160 million of our

revolving credit facility during the quarter, while our stronger

earnings supported an improvement in our leverage, as we advanced

towards our 0.5x leverage target. On shareholder returns, we paid

our H1-2024 dividend of $100 million and we have now returned $229

million to shareholders this year through dividends and share

buybacks. We will increase our focus on supplemental shareholder

returns over the coming quarters.

Looking forward, we have visibility to organically grow the

production profile to our 1.5 million ounce portfolio objective by

the end of the decade, while maintaining best in class margins. We

expect to outline our new outlook next year, which will underpin

our continued commitments to disciplined capital allocation and

delivering attractive shareholder returns.”

SHAREHOLDER RETURNS PROGRAMME

-

Endeavour implemented a shareholder returns programme for the 2021

- 2023 period that was comprised of three annual minimum dividends

totalling $450.0 million, supplemented by additional dividends and

share buybacks. Over the shareholder returns programme period,

Endeavour returned $903.0 million to shareholders comprised of

$600.0 million of dividends and $303.0 million of share buybacks;

more than double the minimum commitment and equivalent to $211

returned for every ounce produced over the 2021-2023 period.

-

During Q3-2024, Endeavour implemented a new shareholder returns

programme to reflect its transition from a phase focused on

investment to one focused on free cash flow generation. The new

programme is comprised of minimum dividends of $435.0 million over

the 2024-2025 period, that are expected to be supplemented with

additional dividends and share buybacks.

-

Dividends are expected to be paid semi-annually, provided that the

prevailing gold price for the dividend period is at or above

$1,850/oz and the Company has a healthy financial position.

Supplemental returns are expected to be paid in the form of

dividends and opportunistic share buybacks, if the gold price

exceeds $1,850/oz and if the Company has a healthy financial

position.

-

Since the beginning of the year, Endeavour has paid $200.0 million

in dividends including the H2-2023 dividend of $100.0 million

($0.41/sh) paid on 25 March 2024 (within the 2021 - 2023 programme)

and the H1-2024 dividend of $100.0 million ($0.41/sh) paid on 10

October 2024 and returned an additional $28.9 million or 1.46

million shares through opportunistic share buybacks, of which $8.8

million or 0.42 million shares were repurchased during

Q3-2024.

-

Since payment of the first dividend in FY-2021, Endeavour has

returned more than $1,032.0 million to shareholders, including

$700.0 million of dividends and $332.0 million of share

buybacks.

Table 2: Cumulative Shareholder

Returns

|

(All amounts in US$m) |

|

MINIMUM DIVIDEND COMMITMENT |

SUPPLEMENTAL DIVIDENDS |

BUYBACKS COMPLETED |

TOTAL RETURN |

△ ABOVE MINIMUM COMMITMENT |

|

|

FY-2020 |

— |

60 |

— |

60 |

+60 |

|

2021-2023 Shareholder Returns Programme (completed) |

FY-2021 |

125 |

15 |

138 |

278 |

+153 |

| FY-2022 |

150 |

50 |

99 |

299 |

+149 |

|

FY-2023 |

175 |

25 |

66 |

266 |

+91 |

|

2024-2025 Shareholder Returns Programme (ongoing) |

H1-2024 |

100 |

— |

20 |

120 |

+20 |

| H2-2024 (Minimum) |

110 |

— |

9 |

119 |

+9 |

|

FY-2025 (Minimum) |

225 |

— |

— |

225 |

— |

|

TOTAL |

885 |

150 |

332 |

1,367 |

+482 |

OPERATING SUMMARY

-

Strong safety performance for the Group, with a Lost Time Injury

Frequency Rate (“LTIFR”) from continuing operations of 0.12 for the

trailing twelve months ended 30 September 2024.

-

Q3-2024 production amounted to 270koz, an increase of 19koz over

Q2-2024, due to the ramp up of the Sabodala-Massawa BIOX and

Lafigué operations to commercial production, both of which were

achieved on 1 August 2024, as well as higher production at Houndé,

which was partially offset by lower production at Ity, Mana and the

Sabodala-Massawa CIL operation. Production increased at Houndé due

to higher average grades processed and at Lafigué due to the

ramp-up of the mine towards nameplate capacity, which was achieved

late in Q3. Production decreased at Ity due to lower average grades

processed in line with the mine sequence, at Mana due to lower

tonnes milled following the depletion of the Maoula open pit, and

at Sabodala-Massawa CIL due to the continued lower grade mill feed

as well as strike action, maintenance activity and significantly

above average rainfall lowering throughput levels.

-

Q3-2024 AISC was stable quarter on quarter at $1,287/oz as

commercial production commenced at the low cost Lafigué mine

coupled with lower AISC at Houndé, which was offset by higher AISC

at Ity, Sabodala-Massawa and Mana. Lower AISC at Houndé was due to

higher grades processed and lower power costs as grid power

availability improved significantly compared to Q2-2024. Higher

AISC at Ity, Sabodala-Massawa and Mana were largely due to lower

volumes of gold sold and higher royalty costs due to higher gold

prices, as well as higher sustaining capital at Ity and

Sabodala-Massawa.

Table 3: Group

Production

| |

THREE MONTHS ENDED |

NINE MONTHS ENDED |

|

All amounts in koz, on a 100% basis |

30 September

2024 |

30 June

2024 |

30 September

2023 |

30 September

2024 |

30 September

2023 |

|

Houndé |

74 |

64 |

109 |

179 |

228 |

| Ity |

77 |

96 |

73 |

259 |

250 |

| Mana |

30 |

35 |

30 |

107 |

106 |

|

Sabodala-Massawa1 |

54 |

57 |

69 |

159 |

209 |

|

Lafigué1 |

36 |

— |

— |

36 |

— |

|

PRODUCTION FROM CONTINUING OPERATIONS |

270 |

251 |

281 |

741 |

793 |

|

Boungou2 |

— |

— |

— |

— |

33 |

| Wahgnion2 |

— |

— |

— |

— |

68 |

|

GROUP PRODUCTION |

270 |

251 |

281 |

741 |

893 |

1Includes pre-commercial ounces that are

not included in the calculation of All-In Sustaining

Costs.

2The Boungou and Wahgnion mines were

divested on 30 June 2023.

Table 4: Group All-In Sustaining

Costs

| All

amounts in US$/oz |

THREE MONTHS ENDED |

NINE MONTHS ENDED |

30 September

2024 |

30 June

2024 |

30 September

2023 |

30 September

2024 |

30 September

2023 |

|

Houndé |

1,379 |

1,472 |

787 |

1,457 |

959 |

| Ity |

928 |

885 |

864 |

898 |

793 |

| Mana |

1,987 |

1,927 |

1,734 |

1,756 |

1,408 |

|

Sabodala-Massawa1 |

1,219 |

1,164 |

840 |

1,112 |

795 |

| Lafigué1 |

938 |

— |

— |

938 |

— |

|

Corporate G&A |

45 |

48 |

40 |

47 |

50 |

|

AISC FROM CONTINUING OPERATIONS |

1,287 |

1,287 |

967 |

1,256 |

974 |

|

Boungou2 |

— |

— |

— |

— |

1,639 |

| Wahgnion2 |

— |

— |

— |

— |

1,566 |

|

GROUP AISC3 |

1,287 |

1,287 |

967 |

1,256 |

1,045 |

1Excludes pre-commercial costs

associated with ounces from the BIOX expansion project and the

Lafigué mine. 2The Boungou and

Wahgnion mines were divested on 30 June 2023.

3This is a non-GAAP measure, refer to

the non-GAAP Measures section for further

details.

FY-2024 OUTLOOK

-

Group production is expected to be at or around the low end of the

FY-2024 production guidance of 1,130 – 1,270koz as outperformance

at Ity coupled with strong performances at Houndé and Lafigué are

expected to be partially offset by the lower performance at the

Sabodala-Massawa CIL operation

-

Group AISC is expected to be above the top end of the $955 –

1,035/oz guided range, due to underperformance at the

Sabodala-Massawa CIL operation driving lower production and higher

AISC, compounded by higher royalty costs associated with the

prevailing higher gold prices and low grid power availability

during H1-2024 affecting assets in Burkina Faso and Côte

d’Ivoire.

Table 5: FY-2024 Production

Outlook

|

|

YTD-2024

ACTUALS |

FY-2024

GUIDANCE |

FY-2024

OUTLOOK |

|

(All amounts in koz, on a 100% basis) |

|

Houndé |

179 |

260 - 290 |

ON TRACK |

| Ity |

259 |

270 - 300 |

ABOVE TOP END |

| Mana |

107 |

150 - 170 |

ON TRACK |

|

Sabodala-Massawa1 |

159 |

360 - 400 |

BELOW LOWER END |

|

Lafigué1 |

36 |

90 - 110 |

ON TRACK |

|

Group Production |

741 |

1,130 - 1,270 |

NEAR LOW END |

1Includes pre-commercial production

ounces

-

As previously guided, FY-2024 operational performance is weighted

towards Q4-2024, which is expected to be the strongest quarter year

to date. Q4-2024 production is predicated on expected improvements

at the Houndé, Mana, Sabodala-Massawa and Lafigué mines in Q4-2024.

Houndé is expected to benefit from higher grade ore from the Kari

Pump pit in the mill feed, which historically has had slightly

lower recoveries. At Mana, improved access to higher grade

undergound stopes should support higher grade and volumes of

throughput, if the above average rainfall seen in Q3-2024

decreases. The Sabodala-Massawa CIL operation will be supported by

new non-refractory higher-grade ore sources, where pre-stripping

activity is largely complete. The Sabodala-Massawa BIOX and Lafigué

operations are expected to continue to improve as they complete a

full quarter at nameplate production. Conversely at Ity average

grades processed are expected to decrease as a lower proportion of

Ity and Bakatouo ore will be in the mill feed.

-

At Sabodala-Massawa, FY-2024 production is expected to be below the

guided range due to lower availability of high-grade non-refractory

ore, particularly from the Sabodala pit as mining activities

focused on depleting the pit ahead of the potential commencement of

in-pit tailings deposition in 2025. To supplement the mill feed at

the Sabodala-Massawa CIL plant, the Kiesta C and Niakafiri East

deposits have been accelerated into the mine plan, adding

higher-grade non-refractory oxide ores into the FY-2024 mine plan,

that were previously in the plan for FY-2025, resulting in a

decrease in availability of higher-grade non-refractory oxide ores

in the FY-2025 mine plan. The Sabodala-Massawa exploration

programme is prioritising the delineation of potential high-grade

non-refractory oxide targets Sekoto, Mamassato and Koulouqwinde,

that could be incorporated into the near term mine plan.

Table 6: FY-2024 All-In Sustaining

Cost Outlook

|

|

YTD-2024

ACTUALS |

FY-2024

GUIDANCE |

FY-2024

OUTLOOK |

|

(All amounts in US$/oz) |

|

Houndé |

1,457 |

1,000 - 1,100 |

ABOVE TOP END |

| Ity |

898 |

850 - 925 |

ON TRACK |

| Mana |

1,756 |

1,200 - 1,300 |

ABOVE TOP END |

|

Sabodala-Massawa1 |

1,112 |

750 - 850 |

ABOVE TOP END |

| Lafigué1 |

938 |

900 - 975 |

ON TRACK |

|

Corporate G&A |

47 |

40 |

ON TRACK |

|

Group AISC |

1,256 |

955 - 1,035 |

ABOVE TOP END |

1Excludes pre-commercial production

costs and ounces

-

Group AISC guidance is expected to be above the top end of the

guided range due to higher gold prices increasing royalty costs

(realised gold price exclusive of hedges of $2,321/oz in YTD-2024

above guidance gold price of $1,850/oz, resulting in a +$34/oz

impact on YTD-2024 AISC), lower grid power availability in H1-2024

(+$35/oz impact on group AISC YTD-2024) impacting Houndé

(approximately $58/oz YTD-2024 impact) and Mana (approximately

+$117/oz YTD-2024 impact) and lower levels of production at higher

costs at Sabodala-Massawa (+$80/oz impact on YTD-2024) due to lower

availability of high grade non-refractory ore as mining activities

focussed on depleting the Sabodala pit.

Table 7: YTD-2024 All-In Sustaining

Cost Impacts

|

|

|

YTD-2024

ACTUALS |

FY-2024

OUTLOOK |

|

(All amounts in US$/oz) |

|

Group AISC at

$1,850/oz1 |

|

955 - 1,035 |

| |

Royalties at $2,321/oz2realised gold price |

+34 |

(+) Increase expected in Q4-2024 given high gold price |

| |

Low grid power availability in

H1-20243 |

+35 |

(-) Availability largely improved in early Q3-2024 |

|

|

Sabodala-Massawa CIL performance |

+80 |

(-) Significantly stronger performance expected in Q4-2024 |

|

Group AISC at

$2,321/oz2(actual) |

1,256 |

(-) Stronger production at lower AISC improving FY-2024

AISC |

1FY-2024 group AISC guidance was issued

at a $1,850/oz gold price 2The

realised YTD-2024 gold price, exclusive of the

Sabodala-Massawa stream and the realised gains/losses from the

Group’s revenue protection programme, amounted to $2,321/oz.

3As previously disclosed, grid availability

issues increased self-generated power costs across Burkina Faso and

Côte d’Ivoire assets during the YTD-2024 period.

-

The impact of higher gold prices on royalty costs, low grid power

availability in H1-2024 and Sabodala-Massawa CIL underperformance

on YTD-2024 AISC has been approximately $149/oz, while Q4-2024 AISC

is expected to be significantly lower than YTD-2024 AISC due to

higher levels of production and gold sales, which is expected to be

partially offset by higher royalty costs due to the higher

prevailing gold prices quarter to date.

-

Group sustaining capital expenditure outlook for FY-2024 has been

lowered by $5.0 million to $120.0 million, with $80.5 million

incurred in YTD-2024 (net of YTD-2024 corporate sustaining capital

of $2.1 million), and $30.2 million incurred in Q3-2024 (net of

Q3-2024 corporate sustaining capital of $1.1 million). The decrease

is due to the lower sustaining capital outlook expected at

Sabodala-Massawa due to lower levels of production and a decrease

in planned waste development, and at Lafigué due to the redesign of

the main pit pushback, which was partially offset by higher

sustaining capital at Mana due to increased underground development

and leasing payments to contractors.

-

Group non-sustaining capital expenditure outlook for FY-2024 has

been increased by $35.0 million to $225.0 million, with $162.0

million incurred in YTD-2024, and $68.9 million incurred in

Q3-2024. The increase is due to increased non-sustaining capital at

Ity due to accelerated waste stripping and TSF 2 construction

resulting from higher than guided levels of production, at Mana due

to increased underground development to gain more access to

underground stopes, and at Lafigué due to the main pit pushback

redesign.

-

Growth capital expenditure outlook for FY-2024 remains unchanged at

$245.0 million, with $227.4 million incurred in YTD-2024, primarily

related to construction activities at the Sabodala-Massawa BIOX®

expansion project ($62.4 million incurred in YTD-2024 compared to

FY-2024 guidance of $75.0 million), the Lafigué mine ($157.2

million incurred in YTD-2024 compared to guidance of $170.0

million) and additional spend related to the Kalana project.

-

Exploration expenditure outlook for FY-2024 is expected to be

slightly above the $77.0 million guidance, of which $74.4 million

was incurred in YTD-2024, due to the accelerated exploration

activity at Sabodala-Massawa focused on delineating near-term

non-refractory targets. Exploration expenditure is expected to

decrease into Q4-2024 as the programmes focus on compilation and

desktop work for reserve and resource updates as well as targeting

for next year and beyond. More details on the allocation of the

Group’s increased exploration budget are provided in the sections

below.

Table 8: FY-2024 Sustaining &

Non-Sustaining Capital Expenditure

|

|

YTD-2024

SPEND |

FY-2024

GUIDANCE |

REVISED FY-2024

GUIDANCE |

|

(All amounts in US$m) |

|

Houndé |

39 |

40 |

40 |

| Ity |

6 |

10 |

10 |

| Mana |

18 |

15 |

25 |

| Sabodala-Massawa |

15 |

35 |

30 |

|

Lafigué |

3 |

25 |

15 |

|

Total Sustaining Capital Expenditure |

81 |

125 |

120 |

|

Houndé |

5 |

10 |

10 |

| Ity |

52 |

45 |

60 |

| Mana |

44 |

40 |

50 |

| Sabodala-Massawa |

22 |

40 |

40 |

| Sabodala-Massawa Solar

Plant |

31 |

45 |

45 |

| Lafigué |

4 |

5 |

15 |

|

Corporate G&A |

4 |

5 |

5 |

|

Total Non-Sustaining Capital Expenditure |

162 |

190 |

225 |

|

Total Mine Capital Expenditure |

243 |

315 |

345 |

CASH FLOW SUMMARY

The table below presents the cash flow and net

debt position for Endeavour for the three-month periods ended 30

September 2024, 30 June 2024, and 30 September 2023, and the nine

month periods ended 30 September 2024 and 30 September 2023 with

accompanying explanations below.

Table 9: Cash Flow and Net

Debt

| |

|

THREE MONTHS ENDED |

NINE MONTHS ENDED |

|

All amounts in US$ million unless otherwise specified |

Notes |

30 September

2024 |

30 June

2024 |

30 September

2023 |

30 September

2024 |

30 September

2023 |

|

Net cash from/(used in), as per cash flow

statement: |

|

|

|

|

|

|

| Operating cash flows before

changes in working capital1 |

|

245 |

213 |

121 |

595 |

500 |

| Changes

in working capital1 |

|

10 |

45 |

(5) |

(27) |

(47) |

|

Cash generated from operating activities from continuing

operations |

[1] |

255 |

258 |

115 |

568 |

453 |

| Cash

generated from discontinued operations |

|

— |

(6) |

— |

(6) |

27 |

|

Cash generated from operating activities |

[1] |

255 |

252 |

115 |

562 |

480 |

| Cash

used in investing activities |

[2] |

(158) |

(171) |

(195) |

(517) |

(610) |

|

Free Cash Flow2,3 |

|

97 |

81 |

(80) |

45 |

(130) |

|

Cash generated/(used) in financing activities |

[3] |

(241) |

(150) |

(125) |

(303) |

(198) |

| Effect

of exchange rate changes on cash |

|

9 |

(5) |

(15) |

(7) |

2 |

|

DECREASE IN CASH |

|

(135) |

(74) |

(219) |

(265) |

(326) |

|

Cash and cash equivalent position at beginning of

period4 |

|

387 |

461 |

845 |

517 |

951 |

|

CASH AND EQUIVALENT POSITION AT END OF

PERIOD4 |

[4] |

252 |

387 |

625 |

252 |

625 |

|

Principal amount of $500m Senior Notes |

|

500 |

500 |

500 |

500 |

500 |

| Drawn portion of Lafigué Term

Loan |

|

147 |

147 |

35 |

147 |

35 |

| Drawn portion of Sabodala Term

Loan |

|

23 |

— |

— |

23 |

— |

| Drawn portion of $645m

Revolving Credit Facility |

|

415 |

575 |

535 |

415 |

535 |

|

NET DEBT2 |

[5] |

834 |

835 |

445 |

834 |

445 |

|

Trailing twelve month adjusted EBITDA2,5 |

|

1,082 |

1,028 |

1,113 |

1,082 |

1,113 |

|

Net Debt / Adjusted EBITDA (LTM)

ratio2,5 |

|

0.77x |

0.81x |

0.40x |

0.77x |

0.40x |

1 Continuing operations

excludes the Boungou and Wahgnion mines which were

divested on 30 June 2023.

2 Free cash flow, net debt, and adjusted

EBITDA are Non-GAAP measures. Refer to the non-GAAP measure section

in this press release and in the Management Report.

3Calculated as Operating Cash Flow less

Cash used in investing activities.

4Cash and cash equivalents are net of bank

overdrafts ($62.2 at 30 September 2024; $21.1 million at 30 June

2024; Nil at 31 December 2023; Nil at 30 September 2023; Nil at 30

June 2023; Nil at 31 December 2022).

5Trailing twelve month adjusted EBITDA

includes EBITDA generated by discontinued operations.

NOTES:

1) Operating cash flows remained

stable with $254.8 million (or $1.04 per share) in Q3-2024 due to

higher revenues and lower income tax payments which were largely

offset by higher operating costs, royalties, gold collar and

inter-quarter forward settlement outflows and a decrease in working

capital inflows as well as the inclusion of a $150.0 million

operating cash inflow related to the pre-payment agreement as

detailed further below.

Operating cash flows increased by $82.1 million from $479.8 million

(or $1.94 per share) in YTD-2023 to $561.9 million (or $2.29 per

share) in YTD-2024 due to higher revenues, higher working capital

inflows, lower exploration costs and the proceeds from the $150.0

million gold prepayment, partially offset by higher operating

costs, increased royalties and cash settlements for gold

hedges.

Notable variances are summarised below:

• Working capital was an inflow of $10.1 million in

Q3-2024, a decrease of $34.9 million over the Q2-2024 inflow of

$45.0 million. The inflow in Q3-2024 consisted of (i) a trade and

other payables inflow of $49.6 million related to increases in

supplier payables, royalties payable and payroll-related

liabilities, partially offset by (ii) a receivables outflow of

$31.5 million due to a build-up of VAT receivables, (iii) an

inventory outflow of $4.8 million due to an increase in operational

consumables at Lafigué and stockpile inventory at Sabodala-Massawa

and (iv) a prepaid expenses and other outflow of $3.2 million

related to the timing of payments.

Working capital was an outflow of $27.2 million in YTD-2024, a

decrease of $20.2 million over the YTD-2023 outflow of $47.4

million, largely driven by an increase in inflows in trade and

other payables, partially offset by an increase in inventory

outflows related to a build-up of stockpiles and consumables at

growth projects and an increase in trade and other receivables due

to a build-up of VAT receivables.

• Gold sales

from continuing operations increased from 238koz in Q2-2024 to

280koz in Q3-2024 due to higher group production in Q3-2024 and the

timing of gold shipments at Sabodala-Massawa. The realised gold

price from continuing operations for Q3-2024 was $2,506 per ounce

compared to $2,322 per ounce for Q2-2024. Inclusive of the Group’s

Revenue Protection Programme (-$106/oz Q3-2024 impact) and London

Bullion Market Association (“LBMA”) gold price averaging strategy

(-$57/oz Q3-2024 impact), the realised gold price for Q3-2024 was

$2,342 per ounce compared to $2,287 per ounce for Q2-2024.

Gold sales from continuing operations decreased from 799koz in

YTD-2023 to 743koz in YTD-2024, following lower Group production in

YTD-2024. The realised gold price from continuing operations for

YTD-2024 was $2,321 per ounce compared to $1,915 per ounce for

YTD-2023. Inclusive of the Group’s Revenue Protection Programme

(-$60/oz YTD-2024 impact) and LBMA gold price averaging strategy

(-$28/oz YTD-2024 impact), the realised gold price for YTD-2024 was

$2,233 per ounce compared to $1,910 per ounce for YTD-2023.

• Total cash

cost per ounce decreased from $1,148 per ounce in Q2-2024 to $1,128

per ounce in Q3-2024 due to higher volumes of gold sold and lower

processing unit costs reflecting improved grid availability across

sites in Burkina Faso and Cote d’Ivoire partially offset by higher

royalties due to higher revenue and higher unit processing costs at

Sabodala-Massawa reflecting lower plant availability and

utilisation during the quarter.

Total cash cost per ounce increased from $837 per ounce in YTD-2023

to $1,097 per ounce in YTD-2024 due to higher royalties, higher

processing costs associated with an increased reliance on

self-generated power, higher open-pit mining costs due to increased

drill & blast (Houndé), grade control drilling (Houndé and

Sabodala-Massawa) and longer haulage distances (Houndé, Ity and

Sabodala-Massawa), lower volumes of gold sold, and a reduction in

capitalised stripping costs (Houndé, Sabodala-Massawa and Ity),

partially offset by decreased underground mining costs at Mana.

• Income taxes

paid decreased by $98.8 million from $163.3 million in Q2-2024 to

$64.5 million in Q3-2024 due largely to the timing of tax payments

in Senegal, Cote d’Ivoire and Burkina Faso from our

Sabodala-Massawa, Ity and Houndé mines, and a decrease in

withholding tax payments related to the upstreaming of cash in the

prior quarter.

Income taxes paid increased by $9.1 million from $270.0 million in

YTD-2023 to $279.1 million in YTD-2024 due largely to the increase

in taxes paid at Ity as provisional tax payments made in YTD-2024

are calculated from a higher FY-2023 tax base when compared to the

prior year and higher withholding taxes paid due to an increased

quantum of cash upstreamed compared to the prior year-to-date

period, partially offset by decreased tax payments at Mana and

Sabodala-Massawa due to lower estimated taxable profit.

Table 10: Tax Payments from

continuing operations

| |

THREE MONTHS ENDED |

NINE MONTHS ENDED |

|

All amounts in US$ million |

30 September

2024 |

30 June

2024 |

30 September

2023 |

30 September

2024 |

30 September

2023 |

|

Houndé |

12 |

17 |

11 |

40 |

35 |

| Ity |

25 |

50 |

9 |

75 |

43 |

| Mana |

2 |

3 |

5 |

9 |

21 |

| Sabodala-Massawa |

— |

45 |

65 |

76 |

116 |

| Lafigué |

— |

— |

— |

1 |

— |

|

Other1 |

25 |

49 |

51 |

79 |

54 |

|

Taxes paid by continuing operations |

65 |

163 |

142 |

279 |

270 |

1Included in the “Other” category is

income and withholding taxes paid by Corporate and Exploration

entities.

As previously disclosed, on 26 April 2024 the

Company entered into two separate gold prepayment agreements for a

total consideration of $150.0 million in exchange for the delivery

of approximately 76koz in Q4-2024. The gold prepayments secured

$150.0 million of financing for a low cost of capital of

approximately 5.3% and supported the Company’s offshore cash

position during its investment and de-levering phase. The

prepayments are structured as follows:

• A $100.0 million prepayment

agreement with the Bank of Montreal based on a floating arrangement

for the delivery of approximately 54koz in reference to prevailing

spot prices for the settlement of $105.1 million (inclusive of $5.1

million in financing costs) in Q4-2024. The value of the 54koz

above the contracted $105.1 million reimbursement at the time of

delivery will be returned to Endeavour as cash.

• A $50.0 million prepayment

agreement with ING Bank N.V. is based on a fixed arrangement for

the delivery of approximately 22koz for the settlement of $50.0

million in Q4-2024. To mitigate the Group’s exposure to gold price

associated with the delivery of ounces under the fixed arrangement

prepayment agreement, Endeavour has entered into forward purchase

contracts for 22koz at an average gold price of $2,408/oz due in

Q4-2024, locking in a financing cost of approximately $3.0

million.

2) Cash flows used in investing

activities decreased by $13.5 million from $171.4 million in

Q2-2024 to $157.9 million in Q3-2024 due to proceeds of $29.8

million related to the sale of Allied Gold shares, the receipt of

$25.1 million in proceeds related to the settlement agreement for

the disposal of Boungou and Wahgnion (subsequent to quarter-end

Endeavour received the remaining outstanding $5.0 million from the

first $30.0 million tranche on 9 October 2024, with an additional

$10.0 million received on 23 October 2024 related to the second

$30.0 million tranche) and decreased growth capital expenditure

related to closing payments for the Lafigué and BIOX growth

projects partially offset by an increase in sustaining capital

expenditure at Houndé (HME replacement) and Sabodala-Massawa

(purchase of drill rigs for owner-operated grade control) and

increased non-sustaining capital expenditure at Sabodala-Massawa

related to the purchase of additional haulage fleet

capacity.

Cash flows used in investing activities decreased by $93.0 million

from $609.8 million in YTD-2023 to $516.8 million in YTD-2024

largely due to lower growth capital related to the timing of growth

project payments, a $39.8 million inflow related to the sale of

Allied Gold Shares, $25.1 million in proceeds received for the

disposal of Boungou and Wahgnion mentioned above and a decrease in

non-sustaining capital associated with decreased pre-stripping

activities at Ity and Houndé, partially offset by increased

sustaining capital at Houndé (waste development) and Mana

(underground development).

• Sustaining capital from

continuing operations increased from $21.6 million in Q2-2024 to

$31.3 million in Q3-2024, largely due to increased expenditure at

Houndé related to replacement of heavy mining equipment, at Lafigué

due to classification of stripping to sustaining capital after the

declaration of commercial production on 1 August 2024, and at

Sabodala-Massawa due to the timing of purchases of new drill

rigs.

Sustaining capital from continuing operations increased from $71.8

million in YTD-2023 to $82.6 million in YTD-2024 due to higher

sustaining capital expenditure at Houndé related to increased

stripping activity, and at Mana related to increased underground

development and inaugural sustaining capital expenditure at

Lafigué, partially offset by reduced expenditure at

Sabodala-Massawa and Ity.

• Non-sustaining capital from

continuing operations increased from $51.8 million in Q2-2024 to

$68.9 million in Q3-2024 largely due to an increase at

Sabodala-Massawa as spending on the Solar Power Plant optimisation

initiative accelerated and at Lafigué related to the pre-stripping

activities following the declaration of commercial production from

1 August 2024.

Non-sustaining capital from continuing operations decreased from

$192.8 million in YTD-2023 to $162.0 million in YTD-2024 largely

due to decreased expenditure at Ity due to decreased pre-stripping

activities at Le Plaque and expenditure related to the Recyn

optimisation initiative and decreased expenditure at Houndé due to

reduced pre-stripping activities at the Kari Pump pit, partially

offset by increased expenditure at Sabadola-Massawa related to the

ongoing solar power plant optimisation initiative.

• Growth capital decreased from

$93.4 million in Q2-2024 to $35.3 million in Q3-2024, as the

Sabodala-Massawa BIOX® Expansion and Lafigué growth projects were

completed during the quarter.

Growth capital decreased from $292.5 million in YTD-2023 to $227.4

million in YTD-2024 due to the timing of construction activities at

the Sabodala-Massawa BIOX® Expansion, which was launched in

Q2-2022, and the Lafigué development project, which was launched in

Q4-2022.

3) Cash flows used in financing

activities increased by $91.2 million from an outflow of $149.8

million in Q2-2024 to an outflow of $241.0 million in Q3-2024

largely due to $190.1 million in repayments of debt made during the

quarter. Financing cash outflows in Q3-2024 included $190.1 million

in repayments of debt including $185.0 million in repayment of the

Company’s RCF ($415.0 million drawn as at Q3-2024) and $5.1 million

in repayment of the Sabodala Term Loan, payment of dividends to

minorities of $74.9 million related to the upstreaming of cash,

payments of financing and other fees of $15.4 million,

acquisition of the Company’s own shares through its share buyback

programme of $8.2 million, and payment of finance and lease

obligations of $5.6 million. Outflows were partially offset by

$53.2 million in proceeds from long-term debt including $25.0

million drawn from the Company’s RCF and $28.2 million drawn from

the Sabodala-Massawa Term loan.

On 29 July 2024, the Group entered into a $28.2 million term loan

with Ecobank, a local banking partner in Senegal, as part of the

Group’s strategy to progressively move its debt onshore to reduce

leakages associated with debt service and repayments of offshore

debt. During Q3-2024, the Group drew down the full $28.2 million

and subsequently repaid $5.1 million. The term loan bears interest

at an attractive fixed rate of 6.0% per annum, payable monthly,

maturing in December 2024.

On 5 November 2024, subsequent to quarter end, the Group signed a

new $700.0 million sustainability-linked Revolving Credit Facility

(“RCF”) at the same favourable terms as the 2021 $645.0 million RCF

that will be re-financed. The new RCF will bear interest at a rate

equal to SOFR plus between 2.40% to 3.40% per annum based on

leverage, in line with the 2021 RCF, and will have 4-year term with

the potential for a 1-year extension. The new facility was

coordinated by Citibank and comprises a syndicate of eight banks

including Citibank, Bank of Montreal who acted as the

Sustainability Co-ordinator, HSBC Bank, ING Bank, Macquarie Bank,

Nedbank, Standard Bank of South Africa, and Standard Chartered

Bank. The new sustainability-linked RCF integrates the core

elements of Endeavour’s sustainability strategy into its financing

strategy, specifically climate change, biodiversity and malaria,

with clear sustainability-linked performance metrics that will be

measured on an annual basis and reviewed by an independent external

verifier. For more details on the sustainability-linked RCF, please

refer to the MD&A.

Cash flows used in financing activities increased by $105.5 million

from an outflow of $197.6 million in YTD-2023 to an outflow of

$303.1 million in YTD-2024 largely due a net inflow of $273.3

million in proceeds from debt in the prior period.

4) At quarter end, Endeavour’s cash

and cash equivalents, net of $62.2 million in drawn cash on bank

overdraft facilities, stood at $251.8 million.

5) Endeavour’s net debt position

decreased by $1.8 million, from $835.4 million at the end of

Q2-2024 to $833.6 million at the end of Q3-2024 and the net debt /

Adjusted EBITDA (LTM) leverage ratio decreased from 0.81x at the

end of Q2-2024 to 0.77x at the end of Q3-2024, reflecting the

completion of the Company’s growth phase and a transition towards a

phase focused on de-levering and shareholder returns.

EARNINGS FROM CONTINUING OPERATIONS

The table below presents the earnings and

adjusted earnings for Endeavour for the three-month periods ended

30 September 2024, 30 June 2024, and 30 September 2023, and the

nine month periods ended 30 September 2024 and 30 September 2023

with accompanying explanations below.

Table 11: Earnings from Continuing

Operations

| |

|

THREE MONTHS ENDED |

NINE MONTHS ENDED |

|

All amounts in US$ million unless otherwise specified |

Notes |

30 September

2024 |

30 June

2024 |

30 September

2023 |

30 September

2024 |

30 September

2023 |

|

Revenue |

[6] |

706 |

557 |

530 |

1,735 |

1,535 |

| Operating expenses |

[7] |

(272) |

(241) |

(205) |

(714) |

(579) |

| Depreciation and

depletion |

[7] |

(147) |

(128) |

(114) |

(384) |

(316) |

|

Royalties |

[8] |

(52) |

(40) |

(32) |

(126) |

(93) |

|

Earnings from mine operations |

|

234 |

148 |

178 |

512 |

548 |

|

Corporate costs |

[9] |

(12) |

(11) |

(10) |

(33) |

(38) |

| Impairment of mining interests

and goodwill |

|

— |

— |

— |

— |

(15) |

| Share-based compensation |

|

(4) |

(5) |

(5) |

(13) |

(22) |

| Other expense |

[10] |

(23) |

(13) |

(1) |

(53) |

(4) |

| Derecognition and impairment

of financial assets |

[11] |

(112) |

(17) |

(6) |

(129) |

(6) |

|

Exploration costs |

[12] |

(4) |

(4) |

(15) |

(14) |

(42) |

|

Earnings from operations |

|

79 |

97 |

141 |

270 |

421 |

|

(Loss)/gain on financial instruments |

[13] |

(98) |

(32) |

7 |

(176) |

(34) |

| Finance costs |

|

(29) |

(26) |

(19) |

(79) |

(52) |

|

Earnings before taxes |

|

(49) |

39 |

129 |

15 |

336 |

|

Current income tax expense |

[14] |

(68) |

(135) |

(54) |

(244) |

(193) |

| Deferred income tax

recovery |

|

40 |

51 |

(2) |

98 |

47 |

|

Net comprehensive (loss)/earnings from continuing

operations |

[15] |

(77) |

(45) |

74 |

(131) |

190 |

|

Add-back adjustments |

[16] |

169 |

65 |

13 |

300 |

58 |

|

Adjusted net earnings from continuing

operations |

|

91 |

20 |

87 |

168 |

248 |

|

Portion attributable to non-controlling interests |

|

18 |

17 |

17 |

51 |

60 |

|

Adjusted net earnings from continuing operations

attributable to shareholders of the Company |

[17] |

74 |

3 |

69 |

117 |

188 |

|

Adjusted net earnings per share from continuing

operations |

|

0.30 |

0.01 |

0.28 |

0.48 |

0.76 |

NOTES:

6) Revenue increased by $149.1

million from $556.8 million in Q2-2024 to $705.9 million in Q3-2024

due to higher volumes of gold sales and a $184 per ounce increase

in the realised gold price from $2,322 per ounce in Q2-2024 to

$2,506 per ounce in Q3-2024, exclusive of the Company’s Revenue

Protection Programme (Gold collars and London Bullion Market

Association (“LBMA”) gold price averaging strategy).

Revenue increased by $200.1 million from $1,535.3 million in

YTD-2023 to $1,735.4 million in YTD-2024 due to a higher realised

gold price for YTD-2024 of $2,321 per ounce compared to $1,915 per

ounce for YTD-2023, exclusive of the Company’s Revenue Protection

Programme (Gold collars and LBMA gold price averaging strategy),

partially offset by lower volumes of gold sold.

7) Operating expenses increased by

$31.2 million from $241.2 million in Q2-2024 to

$272.4 million in Q3-2024 largely due to the ramp-up of

production at Lafigué and the Sabodala-Massawa BIOX® Expansion and

the drawdown of gold inventory sold in excess of production.

Depreciation and depletion increased by $19.4 million from

$127.8 million in Q2-2024 to $147.2 million in Q3-2024 due to

the commencement of depreciation and depletion of the BIOX plant

and refractory ore reserves, coupled with inaugural depreciation

and depletion expenses at Lafigué subsequent to commercial

production declaration.

Operating expenses increased by $135.0 million from

$578.5 million in YTD-2023 to $713.5 million in YTD-2024

due to increased processing costs across the Group, increased

underground mining costs at Mana driven by higher volumes and

increased mining costs at Ity, Houndé and Sabodala-Massawa, largely

reflecting increased diesel consumption and increased drill and

blast activities. Depreciation and depletion increased by

$67.9 million from $315.8 million in YTD-2023 to

$383.7 million in YTD-2024 due to the lower reserves bases at

Ity and Sabodala-Massawa following the December 2023 reserves and

resource update, higher levels of production at Ity, increased

depreciation at Sabodala-Massawa related to higher depreciation

rates associated with the Sabodala pit as it approaches the end of

its mine life and inaugural depreciation and depletion charges at

Lafigué and the Sabodala-Massawa BIOX project subsequent to

commercial production from 1 August 2024.

8) Royalties increased by

$11.9 million from $40.2 million in Q2-2024 to

$52.1 million in Q3-2024 due to a higher realised gold price

and higher gold sales volumes.

Royalties increased by $32.8 million from $93.4 million

in YTD-2023 to $126.2 million in YTD-2024 due to a higher

realised gold price and the increase to the sliding scale royalty

rate structure in Burkina Faso effective from November 2023,

partially offset by a decrease in gold sales.

9) Corporate costs of $11.9 million

in Q3-2024 were largely consistent with the prior quarter.

Corporate costs decreased from $37.9 million in YTD-2023 to

$33.3 million in YTD-2024 due to decreased corporate employee

compensation and professional service costs, partially offset by an

increase in administrative and other overhead costs.

10) Other expenses increased by

$9.4 million from $13.4 million in Q2-2024 to

$22.8 million in Q3-2024. For Q3-2024, other expenses included

$15.6 million in restructuring and settlement costs associated

with Sabodala-Massawa, $2.1 million in legal and other costs

primarily related to the Lilium settlement, $2.2 million in

disturbance costs, $2.0 million in community contributions,

$0.8 million in realised losses on the disposal of assets and

$0.1 million in tax claims.

11) De-recognition and impairment of

financial assets increased by $95.1 million from $17.1 million in

Q2-2024 to $112.2 million in Q3-2024 due to the write-down of

expected proceeds from the divestment of the non-core Boungou and

Wahgnion mines as a result of the previously announced settlement

agreement between Endeavour, Lilium and the Government of Burkina

Faso, which comprises a lower consideration than the original

divestment transaction consideration with Lilium in Q2-2023.

Pursuant to the settlement, Endeavour will receive a cash

consideration of $60.0 million comprised of $15.0 million of

upfront cash, $15.0 million cash payable by the end of Q3-2024 and

$30.0 million payable by the end of Q4-2024 in addition to a 3%

royalty on up to 400,000 ounces of gold sold from the Wahgnion

mine. Endeavour received $25.1 million in cash during Q3-2024 and

$14.9 million in early Q4-2024, with the outstanding $20.0 million

expected to be received by the end of Q4-2024 in line with the

payment schedule.

De-recognition and impairment of financial assets increased by

$122.9 million from $5.8 million in YTD-2023 to $128.7 million in

YTD-2024 due largely to the above mentioned write-down of expected

proceeds from the divestment of the Boungou and Wahgnion mines.

12) Exploration costs of

$4.3 million in Q3-2024 were consistent with the prior

quarter.

Exploration costs decreased from $41.9 million in YTD-2023 to

$14.0 million in YTD-2024 largely due to a decrease in

exploration expense at the Assafou project on the Tanda-Iguela

property, as increasingly, exploration activities are being

capitalised at the Assafou project following the commencement of

the pre-feasibility study, which is expected to be published in

Q4-2024.

13) The loss on financial instruments

increased from a loss of $31.8 million in Q2-2024 to a loss of

$98.3 million in Q3-2024 largely due to an increase in net losses

on gold collars and inter-quarter forward contracts. The loss on

financial instruments during the quarter included an unrealised

loss on gold collars and inter-quarter forward contracts of $49.2

million, a realised loss on gold collars and inter-quarter forward

contracts of $45.7 million (including a $29.7 million realised loss

on gold collars and a $16.0 million realised loss on inter-quarter

forward contracts related to London Bullion Market Association

(“LBMA”) gold price averaging), unrealised foreign exchange losses

of $10.3 million and a $1.4 million unrealised loss on other

financial instruments partially offset by a gain on marketable

securities (Turaco Gold Limited and Allied Gold Corporation) of

$7.6 million, an unrealised fair value gain on NSRs and deferred

considerations of $0.5 million and an unrealised gain on the early

redemption feature of senior notes of $0.2 million.

The loss on financial instruments increased from a loss of $33.7

million in YTD-2023 to a loss of $176.3 million in YTD-2024, due

largely to realised and unrealised losses in relation to the

Revenue Protection Programme and exchange rate movements between

the Euro and the US dollar.

As previously disclosed, in order to increase cash flow visibility

during its construction and de-leveraging phases, Endeavour entered

into a Revenue Protection Programme, using a combination of zero

premium gold collars and forward sales contracts, to cover a

portion of its 2023, 2024 and 2025 production.

• During Q3-2024, 113koz were

delivered into gold collars at the call gold price of $2,400/oz.

For Q4-2024, approximately 113koz are expected to be delivered into

a collar with an average call price of $2,400/oz and an average put

price of $1,807/oz.

• For FY-2025, approximately

200koz are expected to be delivered into a collar with an average

call price of $2,400/oz and an average put price of $1,992/oz.

14) Current income tax expense

decreased by $66.8 million from $135.0 million in Q2-2024 to $68.2

million in Q3-2024 largely due to a decrease in recognised

withholding tax expenses in Q3-2024 compared to $73.6 million in

Q2-2024, due to the timing of local board approvals for cash

upstreaming, partially offset by an increase in current corporate

income taxes driven by higher taxable profits at Houndé and Ity as

well as the addition of tax provisions at Lafigué subsequent to the

declaration of commercial production.

Current income tax expense increased by $50.6 million from $193.1

million in YTD-2023 to $243.7 million in YTD-2024 due to an

increase in withholding taxes on dividends paid by operating

subsidiaries, an increase in current income taxes at Houndé and

Ity, and adjustments in respect of the prior year income tax mainly

in relation to the temporary contribution of 2% of net profit after

tax of operating mines in Burkina Faso.

15) Net comprehensive losses from

continuing operations increased by $32.4 million from a net

comprehensive loss of $44.8 million in Q2-2024 to a net

comprehensive loss of $77.2 million in Q3-2024. The increase in

losses is largely driven by the impairment of proceeds from Boungou

and Wahgnion divestment following the Lilium settlement, higher

losses on financial instruments related to the Revenue Protection

Programme, higher royalties and higher depreciation partially

offset by improved operating margins and a lower tax expense.

Net comprehensive earnings from continuing

operations decreased by $321.5 million from net comprehensive

earnings of $190.2 million in YTD-2023 to a net comprehensive loss

of $131.3 million in YTD-2024. The decrease in earnings was largely

driven by higher losses on financial instruments related to the

Revenue Protection Programme, the above-mentioned impairment, lower

production, lower operating margins, higher depreciation, higher

other expenses and higher royalties recorded in addition to higher

finance costs due to increased interest expenses reflecting higher

borrowings.

16) For Q3-2024, adjustments included

an impairment of $112.2 million related to the write-down of

proceeds from the sale of the Boungou and Wahgnion assets, an

unrealised loss on financial instruments of $52.7 million largely

related to the unrealised loss on forward sales and collars, and

other expenses of $22.8 million largely related to the

Sabodala-Massawa employee settlement and legal and other costs for

the now settled Lilium arbitration process, partially offset by a

gain on non-cash, tax and other adjustments of $19.1 million that

mainly relate to the impact of foreign exchange remeasurements of

deferred tax balances.

17) Adjusted net earnings

attributable to shareholders for continuing operations increased by

$70.6 million from earnings of $3.1 million (or $0.01 per share) in

Q2-2024 to adjusted net earnings of $73.7 million (or $0.30 per

share) in Q3-2024, due to improved operating margins and lower tax

expenses.

Adjusted net earnings attributable to shareholders for continuing

operations decreased by $70.7 million from $188.1 million (or $0.76

per share) in YTD-2023 to $117.4 million (or $0.48 per share) in

YTD-2024 due to lower production, lower operating margins, higher

royalties and higher realised losses on gold collars and

hedges.

OPERATING ACTIVITIES BY

MINE

Houndé Gold Mine, Burkina

Faso

Table 12: Houndé Performance

Indicators

|

For The Period Ended |

Q3-2024 |

Q2-2024 |

Q3-2023 |

|

YTD-2024 |

YTD-2023 |

|

Tonnes ore mined, kt |

1,111 |

1,301 |

1,209 |

|

3,136 |

3,921 |

| Total tonnes mined, kt |

9,567 |

11,619 |

10,603 |

|

32,283 |

35,687 |

| Strip ratio (incl. waste

cap) |

7.61 |

7.93 |

7.77 |

|

9.29 |

8.10 |

| Tonnes milled, kt |

1,348 |

1,313 |

1,400 |

|

3,743 |

4,189 |

| Grade, g/t |

2.00 |

1.70 |

2.68 |

|

1.71 |

1.84 |

| Recovery rate, % |

86 |

87 |

91 |

|

87 |

92 |

|

Production, koz |

74 |

64 |

109 |

|

179 |

228 |

|

Total cash cost/oz |

1,233 |

1,340 |

704 |

|

1,242 |

834 |

|

AISC/oz |

1,379 |

1,472 |

787 |

|

1,457 |

959 |

Q3-2024 vs Q2-2024 Insights

-

Production increased from 64koz in Q2-2024 to 74koz in Q3-2024, in

line with the mine sequence, due to higher average grades processed

and slightly higher tonnes milled, partially offset by a slight

decrease in recovery rates.

-

Total tonnes mined and tonnes of ore mined decreased due to the

higher than average rainfall impacting mining rates. Ore mining

activities during the quarter focused on the Kari Pump and Vindaloo

Main pits with some supplemental ore mined from the Kari West

pit.

-

Tonnes milled increased slightly due to higher mill availability

during the quarter.

- Average processed grades increased due to a higher proportion

of high grade, fresh ore sourced from the Kari Pump pit in the mill

feed.

-

Recovery rates slightly decreased due to the increased proportion

of Kari Pump ore in the mill feed, which has slightly lower

associated recoveries.

-

AISC decreased from $1,472/oz in Q2-2024 to $1,379/oz in Q3-2024

due to the higher volume of gold sold and lower processing costs

associated with reduced self-generated power usage as grid

availability significantly improved following lower availability in

the prior quarter, partially offset by higher sustaining capital

due to the accelerated purchase of new heavy mine equipment and

increased mining unit costs associated with lower mined volumes and

increased drill and blast and grade control drilling

activities.

-

Sustaining capital expenditure increased from $8.0 million in

Q2-2024 to $11.1 million in Q3-2024 and primarily related to the

accelerated purchase of new heavy mining equipment.

- Non-sustaining

capital expenditure decreased slightly from $1.6 million in Q2-2024

to $1.3 million in Q3-2024 and primarily related to the ongoing TSF

Stage 8 and 9 embankment raises.

YTD-2024 vs YTD-2023

Insights

-

Production decreased from 228koz in YTD-2023 to 179koz in YTD-2024

largely in line with the mine sequence primarily due to lower

tonnes milled as a result of the processing of harder fresh ore

from the Kari area pits, lower average grades processed associated

with a lower proportion of ore from the high-grade Kari Pump pit in

the mill feed year to date, and lower recovery rates due to an

increased proportion of ore from the Kari Pump pit with lower

associated recoveries, in addition to the impact of the 11-day

strike in Q1-2024.

-

AISC increased from $959/oz in YTD-2023 to $1,457/oz in YTD-2024,

due to lower volumes of gold sold, higher processing unit costs due

to the increased use of self-generated power in H1-2024, increased

sustaining capital due to increased sustaining waste development

activities and heavy mining equipment purchases, and higher

royalties following a higher realised gold price and the increase

in the royalty rate sliding scale in November 2023.

FY-2024

Outlook

-

Houndé is on track to achieve its FY-2024 production guidance of

260koz - 290koz, while AISC is expected to be above the top-end of

the guided $1,000/oz - $1,100/oz range due to the increased

reliance on self-generated power at higher cost in H1-2024 (+$58/oz

impact on YTD-2024 AISC) and higher royalties reflecting the

increased gold price compared to the guidance gold price of

$1,850/oz (+$47/oz impact on YTD-2024 AISC).

-

In Q4-2024, production is expected to increase as an increased

proportion of high-grade ore is expected to be sourced from the

Kari Pump pit, while throughput and recoveries are expected to

remain broadly consistent with Q3-2024. AISC is expected to

decrease due to higher levels of production and gold sales, which

is expected to be partially offset by higher royalty costs due to

the higher prevailing gold prices.

-

Sustaining capital expenditure outlook for FY-2024 remains

unchanged compared to the previously disclosed guidance of

$40.0 million, of which $38.5 million has been incurred

in YTD-2024. During Q4-2024 sustaining capital expenditure is

expected to primarily relate to mining fleet replacements, waste

stripping activities and plant upgrades.

- Non-sustaining

capital expenditure outlook for FY-2024 remains unchanged compared

to the previously disclosed guidance of $10.0 million of which

$4.9 million has been incurred in YTD-2024. During Q4-2024

non-sustaining capital expenditure is expected to mainly relate to

the ongoing TSF Stage 8 and 9 embankment raise and infrastructure

upgrades.

Ity Gold Mine, Côte

d’Ivoire

Table 13: Ity Performance

Indicators

|

For The Period Ended |

Q3-2024 |

Q2-2024 |

Q3-2023 |

|

YTD-2024 |

YTD-2023 |

|

Tonnes ore mined, kt |

2,027 |

1,840 |

1,246 |

|

5,692 |

5,069 |

| Total tonnes mined, kt |

7,761 |

7,132 |

6,020 |

|

22,299 |

20,542 |

| Strip ratio (incl. waste

cap) |

2.83 |

2.88 |

3.83 |

|

2.92 |

3.05 |

| Tonnes milled, kt |

1,631 |

1,761 |

1,494 |

|

5,167 |

5,121 |

| Grade, g/t |

1.64 |

1.79 |

1.60 |

|

1.71 |

1.63 |

| Recovery rate, % |

92 |

92 |

93 |

|

91 |

93 |

|

Production, koz |

77 |

96 |

73 |

|

259 |

250 |

|

Total cash cost/oz |

899 |

869 |

826 |

|

874 |

762 |

|

AISC/oz |

928 |

885 |

864 |

|

898 |

793 |

Q3-2024 vs Q2-2024 Insights

-

Production decreased from 96koz in Q2-2024 to 77koz in Q3-2024, in

line with the mine sequence, due to lower tonnes of ore milled at

lower average grades processed, while recoveries remained

consistent.

-

Total tonnes mined and tonnes of ore mined increased due to

improved fleet productivity. Mining activities during the quarter

sourced ore from the Ity, Walter, Bakatouo, Verse Ouest and Le

Plaque pits with supplemental contributions from stockpiles.

-

Tonnes milled slightly decreased due to the impact of higher than

average rainfall, increasing the moisture content in the ore,

increasing the frequency of blockages in the feed chute and

screens.

-

Average processed grades decreased due to a greater proportion of

lower grade ore from the Walter pit in the mill feed and lower

grades sourced from the Le Plaque pit, in line with the mine

sequence.

-

Recovery rates remained in line with the previous quarter.

-

AISC increased from $885/oz in Q2-2024 to $928/oz in Q3-2024 due to

the lower volumes of gold sold, a slight increase in sustaining

capital and higher royalty costs related to the higher gold price,

partially offset by lower mining and processing unit costs.

-

Sustaining capital expenditure increased from $1.6 million in

Q2-2024 to $2.4 million in Q3-2024 and was primarily related

to plant upgrades and dewatering borehole drilling.

-

Non-sustaining capital expenditure decreased from

$18.5 million in Q2-2024 to $17.3 million in Q3-2024 and

was primarily related to the construction and commissioning of the

mineral sizer optimisation initiative, plant upgrades, as well as

the ongoing cutback activities at the Walter pit.

YTD-2024 vs YTD-2023 Insights

-

Production increased from 250koz in YTD-2023 to 259koz in YTD-2024

due to higher average grades processed as higher-grade ore was

sourced from the Ity pit, and higher throughput due to plant

upgrades, which were partially offset by lower recoveries

associated with the processing of semi-refractory ore from the

Daapleu pit in Q1-2024.

-

AISC increased from $793/oz in YTD-2023 to $898/oz in YTD-2024 due

to higher royalty costs related to the higher gold price, increased

processing unit costs associated with the increased reliance on

self-generated power in H1-2024 and the commissioning of the Recyn

circuit, partially offset by an increase in gold volumes sold.

FY-2024

Outlook

-

Given the strong YTD-2024 performance, Ity is on track to achieve

above the top end of its FY-2024 production guidance of 270koz -

300koz at its AISC guidance of between $850/oz - $925/oz.

-

In Q4-2024, ore is expected to be sourced from the Le Plaque,

Walter, Bakatouo and Ity pits with supplemental feed sourced from

stockpiles. Average grades processed are expected to decrease due

to a lower proportion of high-grade ore from the Ity and Bakatouo

pits in the mill feed, which is expected to be partially offset by

an increase in throughput following the commissioning of the

mineral sizer primary crusher late in Q3-2024, as well as the

expected improved mill utilisation following the end of the wet

season.

-

Sustaining capital expenditure outlook for FY-2024 remains

unchanged at $10.0 million, of which $6.3 million has

been incurred in YTD-2024, and is mainly related to plant equipment

upgrades, purchase of capital spares and dewatering borehole

drilling.

- Non-sustaining

capital expenditure outlook for FY-2024 is expected to be $60.0

million, an increase on the previously disclosed guidance of

$45.0 million due to the accelerated waste striping and TSF 2

construction resulting from higher than guided levels of

production. $52.0 million has been incurred in YTD-2024

primarily related to waste stripping activities in the Walter pit,

mineral size primary crusher construction, TSF 2 construction and

site infrastructure.

Mana Gold Mine, Burkina

Faso

Table 14: Mana Performance

Indicators

|

For The Period Ended |

Q3-2024 |

Q2-2024 |

Q3-2023 |

|

YTD-2024 |

YTD-2023 |

|

OP tonnes ore mined, kt |

— |

66 |

297 |

|

185 |

1,129 |

| OP total tonnes mined, kt |

— |

219 |

1,508 |

|

930 |

5,194 |

| OP strip ratio (incl. waste

cap) |

0.00 |

2.32 |

4.08 |

|

4.03 |

3.60 |

| UG tonnes ore mined, kt |

484 |

429 |

349 |

|

1,359 |

882 |

| Tonnes milled, kt |

516 |

554 |

643 |

|

1,691 |

1,928 |

| Grade, g/t |

2.15 |

2.10 |

1.66 |

|

2.19 |

1.86 |

| Recovery rate, % |

88 |

89 |

88 |

|

88 |

92 |

|

Production, koz |

30 |

35 |

30 |

|

107 |

106 |

|

Total cash cost/oz |

1,766 |

1,729 |

1,599 |

|

1,587 |

1,311 |

|

AISC/oz |

1,987 |

1,927 |

1,734 |

|

1,756 |

1,408 |

Q3-2024 vs Q2-2024 Insights

-

Production decreased from 35koz in Q2-2024 to 30koz in Q3-2024 due

to lower tonnes milled and lower recoveries, partially offset by an

increase in average grades processed.

-

Total underground tonnes of ore mined increased as stoping

production ramped up, in line with underground mine sequence.

Development rates across the Wona and Siou underground deposits

amounted to 4,030 metres consistent with the prior quarter, as

higher fleet availability was offset by increased dewatering

activities during the wet season. Open pit mining activities ceased

in the prior quarter as the Maoula open pit was depleted.

-

Tonnes milled decreased due to the cessation of open pit mining

activities in the prior quarter in line with the mine sequence,

with the mill feed primarily sourced from the Siou and Wona

underground deposits with some supplementary material from

stockpiles.

-

Average grades processed increased due to mining and processing of

higher grade ore sourced from the Siou underground and the

cessation of the lower grade ore from the Maoula open pit in the

feed, which was partially offset by decreased stoping grades from

the Wona underground.

-

Recovery rates decreased slightly due to a higher proportion of ore

from the Wona underground deposit in the mill feed, which has a

lower associated recovery.

-

AISC increased slightly from $1,927/oz in Q2-2024 to $1,987/oz in

Q3-2024 due to lower gold volumes sold, higher royalties due to the

higher realised gold price and a slight increase in sustaining

capital, partially offset by lower processing unit costs.

-

Sustaining capital expenditure increased from $6.6 million in

Q2-2024 to $6.9 million in Q3-2024 and primarily related to

capitalised underground development at the Siou and Wona

underground deposits as well as leasing payments for contractor

mining equipment.

-

Non-sustaining capital expenditure increased slightly from

$15.0 million in Q2-2024 to $15.2 million in Q3-2024 and

primarily related to capitalised underground development at Wona

and the stage 5 TSF embankment raise.

YTD-2024 vs YTD-2023 Insights

-

Production increased slightly from 106koz in YTD-2023 to 107koz in

YTD-2024 largely due to higher average grades processed, reflecting

a higher proportion of underground ore sourced from the Wona

underground deposit, in the mill feed, which was partially offset

by lower tonnes milled, reflecting a lower proportion of open pit

ore sourced from the Maoula pit.

-

AISC increased from $1,408/oz in YTD-2023 to $1,756/oz in YTD-2024

due to increased underground mining activities, higher royalties

due to the higher gold prices, increased processing unit costs due

to an increased reliance on self-generated power in H1-2024 and