Endeavour Announces Positive PFS Results for Assafou Project in

Côte d’Ivoire

ENDEAVOUR ANNOUNCES POSITIVE PFS RESULTS

FOR ASSAFOU PROJECT IN CÔTE D’IVOIRE

$1,526m

NPV(5%) and IRR of 28%

at $2,000/oz • 329kozpa at AISC of $892/oz over first 10

years

HIGHLIGHTS:

- PFS

confirms Assafou's potential to become a tier 1 asset for

Endeavour

- PFS

highlights 329kozpa production at AISC of $892/oz over first 10

years:

- 15-year

mine life based on maiden reserve of 4.1Moz

- Robust

project economics with after-tax

NPV(5%)

of $1,526m and IRR of 28%, at a $2,000/oz gold

price

- Initial

capital of $734m based on a 5Mtpa design nameplate capacity with a

similar processing plant configuration as the nearby Lafigué

mine

- 90%

resource to reserve conversion with defined maiden reserves of

72.8Mt at 1.76g/t for 4.1Moz

-

Indicated resources of 73.6Mt at 1.95g/t for 4.6Moz based

on a drilling cutoff in October 2023, with over 70,000 metres of

drilling completed subsequently

- Further

resource expansion and definition at Assafou, and satellite

deposits in close proximity to Assafou, is expected to be

incorporated into the DFS

- Given

the high-quality project and attractive economics, the DFS will now

commence with completion expected between late 2025 and early

2026

|

Abidjan, 11 December

2024 – Endeavour Mining plc (LSE:EDV, TSX:EDV,

OTCQX:EDVMF) (“Endeavour”, the “Group” or the “Company”) is pleased

to announce that it has recently completed a positive

Pre-Feasibility Study (“PFS”) for the Assafou-Dibibango (“Assafou”)

project on the Tanda-Iguela property in Côte d’Ivoire. The PFS

results meet Endeavour’s strategic targets and confirm Assafou’s

potential to be a tier 1 asset, which justifies advancing the

project to the Definitive Feasibility Study (“DFS”) stage.

Ian Cockerill, CEO, commented: “I am

delighted with the results of this pre-feasibility study that

highlight the potential for Assafou to become a tier 1 asset for

Endeavour.

We have defined a large, low-cost and long

mine life project, capable of producing 330koz a year over the

first ten years, while remaining firmly in the lowest cost

quartile. The attractive returns profile ensures this project will

remain a capital allocation priority for us and it demonstrates our

ability to generate highly value accretive projects, organically,

through our pipeline.

Our exploration team discovered Assafou in

late 2021, and in less than three years we have defined a

high-quality project with close to 5 million ounces of high-grade

Indicated resource endowment. We expect that we will continue to

grow the Assafou deposit’s resource, and delineate several exciting

near-mine targets across the wider Tanda-Iguela property.

Given the excellent project economics, we

will now launch the Definitive Feasibility Study and simultaneously

advance the permitting process so that we are well positioned to

potentially launch construction, with our best-in-class projects

team, in the second half of 2026.

With a robust pipeline of organic growth

opportunities, we expect to continue to unlock value and deliver

long-term production growth towards our 1.5 million ounce target,

from a diversified portfolio of assets, by the end of the decade,

while maintaining best-in-class margins. This underpins our capital

allocation framework, and we expect to continue to deliver

supplemental shareholder returns in line with our existing policy,

and maintain attractive shareholder returns through this next

growth phase.”

Table 1: Assafou Project

Highlights

|

|

|

ASSAFOU |

STRATEGIC TARGETS |

|

P&P Reserve, Moz1 |

4.1 |

>2.0 |

|

Mine life, years |

14.5 |

>10 |

Average annual production, kozpa

|

First 10 years |

329 |

>200 |

| Life of

mine |

265 |

AISC, $/oz2

|

First 10 years |

892 |

Best-in-class

|

| Life of

mine |

936 |

|

Post-tax NPV5%, $m2 |

1,526 |

n.a. |

|

Post-tax IRR, %2 |

28 |

>20 |

1Based on a $1,500/oz reserve

price. 2Based on a gold price

of $2,000/oz

The key operational and economic highlights of

the Assafou PFS are summarised in Tables 2 and 3 below.

Table 2: Assafou PFS

Summary

|

|

|

|

OPERATION TYPE |

|

| Mine type |

Open Pit |

| Plant type |

5.0Mtpa Gravity / CIL Plant |

| RESERVES

& RESOURCES1 |

|

| P&P

reserves |

72.8Mt at 1.76g/t Au for 4.1Moz |

| M&I

resources (inclusive of reserves) |

73.6Mt at 1.95g/t Au for 4.6Moz |

| Inferred

resources |

3.3Mt at 1.97g/t Au for 0.2Moz |

| LIFE OF

MINE PRODUCTION |

|

| Mine life,

years |

14.5 |

| Strip ratio,

W:O |

5.9 |

| Tonnes

processed, Mt |

72.8 |

| Grade processed,

Au g/t |

1.76 |

| Gold contained

processed, Moz |

4.1 |

| Average recovery

rate, % |

94 |

| Gold production,

Moz |

3.9 |

| Average annual

production, kozpa |

265 |

| Cash costs,

$/oz |

863 |

| AISC,

$/oz2 |

936 |

| AVERAGE

FOR YEARS 1 TO 10 |

|

| Production,

kozpa |

329 |

| Cash costs,

$/oz |

812 |

| AISC,

$/oz2 |

892 |

| CAPITAL

COST |

|

| Upfront capital

cost, $m |

734 |

|

ENVIRONMENTAL DATA |

|

| GHG Emissions

Intensity3, t CO2e/oz |

0.55 |

|

Energy Intensity, GJ/oz |

7.23 |

1Based on a

reserves gold price of $1,500/oz and a resource gold price of

$1,900/oz 2Based on a gold price of

$2,000/oz

3GHG Emissions Intensity considers only

Scope 1 and 2 emissions

Table 3: Assafou PFS Project

Economics

| |

|

|

|

Gold Price |

$1,500/oz |

$1,900/oz |

$2,000/oz |

$2,500/oz |

|

|

PRE-TAX |

|

|

|

|

|

| NPV5%,

$m |

860 |

1,882 |

2,148 |

3,408 |

|

| IRR, % |

18 |

31 |

34 |

48 |

|

| Payback Period,

yr1 |

5.6 |

3.6 |

3.3 |

2.4 |

|

|

AFTER-TAX |

|

|

|

|

|

| NPV5%,

$m |

536 |

1,322 |

1,526 |

2,485 |

|

| IRR, % |

14 |

25 |

28 |

40 |

|

|

Payback Period, yr1 |

6.4 |

4.2 |

3.8 |

2.7 |

|

1Payback

period calculated from the start of commercial production

Endeavour expects to file a Technical Report

pursuant to National Instrument 43-101 – Standards of Disclosure

for Mineral Projects (“the NI 43-101”) in respect of the Assafou

PFS within 45 days of this news release.

Overview

The 100% owned Tanda and Iguela permits

(“Tanda-Iguela”) are located in the eastern region of Côte

d’Ivoire, approximately 600km northeast of Abidjan, adjacent to the

Ghana border. The northern permit, Tanda, was added to Endeavour’s

portfolio in late 2015 following Endeavour’s transaction with La

Mancha. Endeavour conducted an initial drilling campaign in early

2016 that yielded positive results and quickly identified the

southern permit, Iguela, as having a high degree of geological

prospectivity. The Iguela permit was awarded to Endeavour in May

2017, through Côte d’Ivoire’s permitting application process.

Figure 1 : Tanda-Iguela

Map

Please refer to Figure 1 in the attached release.

A maiden Indicated resource of 1.1Moz at 2.33

g/t Au was published on 21 November 2022 and was subsequently

increased to 4.5Moz at 1.97 g/t Au on 29 November 2023, based on a

$1,500/oz gold price.

As shown in Figure 2 below, the PFS demonstrates

Assafou’s ability to deliver 329kozpa at AISC of $892/oz over the

first ten years of operations, with average production exceeding

350kozpa over an 8-year period once the operation is ramped up, and

average production of 265kozpa and AISC of $936/oz over life of

mine.

Figure 2: Assafou PFS Production and

AISC Profile1,2

Please refer to Figure 2 in the attached

release.

The PFS production profile is based on the

mineral reserves only with an effective date of 31 August 2024,

which are constrained by a resource with a drilling cutoff of 31

October 2023. Significant exploration drilling has been completed

since this cutoff, which is expected to contribute to resource and

reserve upside supporting higher levels of production, particularly

in years 10 to 15 of the production profile.

Reserves and

Resources

As shown in Table 4 below, the PFS mineral

resource is based on the 2023 Mineral Resource Estimate (“MRE”), as

published on 29 November 2023, which has been restated using a

$1,900/oz gold price, compared to the $1,500/oz gold price used

when it was published. The drilling cut-off for the 2023 MRE was 31

October 2023, with the MRE constituting 183,000 metres of drilling

at the Assafou deposit. Subsequently, a further 70,000 metres of

drilling has been completed during late 2023 and year-to-date 2024

at the Assafou deposit and satellite targets in close proximity to

Assafou, which are expected to be incorporated into a future

mineral resource update that will underpin the DFS.

Table 4: Assafou Reserves and

Resources

|

On a 100% basis |

|

Tonnage |

Grade |

Content |

|

(Mt) |

(Au g/t) |

(Au koz) |

| Proven

Reserves |

|

- |

- |

- |

| Probable

Reserves |

|

72.8 |

1.76 |

4,115 |

| P&P

Reserves |

|

72.8 |

1.76 |

4,115 |

| Measured

Resource (incl. reserves) |

|

- |

- |

- |

| Indicated

Resources (incl. reserves) |

|

73.6 |

1.95 |

4,604 |

| M&I

Resources |

|

73.6 |

1.95 |

4,604 |

|

Inferred Resources |

|

3.3 |

1.97 |

208 |

1Mineral Resource

Estimate effective 30 June 2024. Mineral Reserve Estimate effective

31 August 2024. Mineral Resource and Reserve Estimates follow the

Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”)

Definitions Standards for Mineral Resources and Reserves and have

been completed in accordance with the Standards of Disclosure for

Mineral Projects as defined by National Instrument 43-101. Reported

tonnage and grade figures have been rounded from raw estimates to

reflect the relative accuracy of the estimate. Minor variations may

occur during the addition of rounded numbers. Mineral Resources

that are not Mineral Reserves do not have demonstrated economic

viability. Resources were constrained by MII Pit

Shell based on a cut-off grade of

0.5g/t at a $1,900/oz gold price. Reserves

are based on a cut-off grade of 0.4g/t for oxide ore and

0.5g/t for fresh ore and $1,500/oz gold price.

The updated mineral resource estimate for the

Assafou deposit comprises an Indicated resource of 73.6Mt at

1.95g/t for 4.6Moz and an Inferred resource of 3.3Mt at 1.97g/t for

0.2Moz, based on a cut-off grade of 0.5 g/t Au and a $1,900/oz gold

price. The mineral resource at the Assafou deposit is robust, as it

is high-grade and hosted in thick, continuous lenses, as

demonstrated by the sensitivity analysis presented in Table 5

below. Inferred material within the pit design was treated as waste

in the PFS.

Table 5: Assafou Mineral Resource

Estimate

Sensitivity1

|

|

TONNAGE |

GRADE |

CONTENT |

|

|

(Mt) |

(Au g/t) |

(Au koz) |

|

INDICATED RESOURCE |

|

|

|

|

Based on a gold price of

$1,500/oz |

70.9 |

1.97 |

4,493 |

|

Based on a gold price of

$1,700/oz |

72.7 |

1.95 |

4,560 |

|

Based on a gold price of

$1,900/oz |

73.6 |

1.95 |

4,604 |

|

Based on a gold price of

$2,000/oz |

74.1 |

1.94 |

4,620 |

| |

|

|

|

|

INFERRED RESOURCE |

|

|

|

|

Based on a gold price of

$1,500/oz |

2.9 |

1.91 |

176 |

|

Based on a gold price of

$1,700/oz |

3.2 |

1.98 |

203 |

|

Based on a gold price of

$1,900/oz |

3.3 |

1.97 |

208 |

|

Based on a gold price of

$2,000/oz |

3.4 |

2.01 |

220 |

1 Mineral

Resource is estimated effective

30 June 2024. No Measured resources have been

estimated. Mineral Resources estimates follow the Canadian

Institute of Mining, Metallurgy and Petroleum ("CIM") definitions

standards for mineral resources and have been completed in

accordance with the Standards of Disclosure for Mineral Projects as

defined by National Instrument 43-101. Reported tonnage and grade

figures have been rounded from raw estimates to reflect the

relative accuracy of the estimate. Minor variations may occur

during the addition of rounded numbers. Mineral Resources that are

not Mineral Reserves do not have demonstrated economic viability.

Resources are reported undiluted and were constrained by MII

$1,900/oz Pit Shell and for sensitivity

purpose by approximate MII at

$1,500/oz and

$1,700/oz and $2,000/oz

pit shells and based on a cut-off of 0.5 g/t Au.

For technical notes and drilling results from

the Assafou drill programme, please see the Technical Notes section

below.

Mining Operations

The Assafou deposit mineralisation extends from

surface to depths in excess of 300 metres and is amenable to

conventional open-pit mining. The mine planning, resource and cost

estimation for the PFS is based on a contract mining operation with

a maximum mining capacity of 62.5 Mt per year. Mining capacity is

expected to exceed processing capacity in order to accumulate

stockpiles to allow high grade material to be preferentially

processed early in the mine life. During the pre-commercial

production period approximately 36.5 Mt of pre-stripping is

expected to support an accelerated ramp up of the production

profile. The DFS will review opportunities to reduce the impact of

pre-stripping at the Assafou deposit through supplementing the ore

feed with near-surface ore from the Pala Trend 3 deposit, located

1km away from Assafou.

Diesel excavators and trucks will be used for

loading and haulage, with a contractor fleet expected to comprise

of 300-tonne and 200-tonne class face excavators to load 140-tonne

capacity dump trucks for waste mining, and 200-tonne class

excavators to load 140-tonne capacity dump trucks for ore

mining.

Processing

Operations

Ore will be processed via a 5.0 Mtpa processing

plant. Over the life of mine, the plant will be fed with

approximately 89% fresh ore and 11% oxide and transitional ore.

Two-stage crushing followed by a high-pressure

grinding roll and a ball milling circuit is planned. A primary

gyratory crusher will crush ore to a coarse crush size, followed by

dual secondary cone crushers. This will feed a crushed ore

stockpile that feeds into a high-pressure grinding roll circuit.

Ore will then be passed through a conventional ball mill and milled

to 80% passing 106µm (microns).

The milled ore will pass through a gravity

circuit comprising two Knelson concentrators for separation and

recovery of coarse free gold, to produce a gravity concentrate for

cyanidation and electrowinning that can be smelted to produce gold

doré. High gravity recovery of approximately 60% is estimated for

fresh and oxide/transitional ores at Assafou.

The remaining milled gravity tail will be

screened and passed to a carbon-in-leach (“CIL”) circuit containing

one pre-leach tank and six CIL tanks in series for leaching and

absorption. Leach residence time will be approximately 36

hours.

Following leaching and absorption, gold will be

recovered from activated carbon by elution, electrowinning, and

gold smelting to produce gold doré.

Extensive and representative metallurgical

testwork has indicated that gold is free milling with very high

gravity and leach extraction potential, with a projected gold

recovery rate of 94% over the life of mine.

Operating Cost

Summary

Mining operating cost estimates, prepared by

Endeavour, are based on a contractor mining model. Process

operating cost estimates were prepared by Lycopodium, who have

successfully supported Endeavour through five engineering and

construction projects in West Africa over the last ten years.

General and Administration (“G&A”) cost estimates were also

prepared by Lycopodium with input from Endeavour, as summarised in

the table below.

Table 6: Assafou Life of Mine

Operating Unit Costs (-15/+20%)

|

|

UNIT COSTS (US$) |

| Open Pit Mining &

Rehandling |

$4.08/t mined |

| Processing |

$12.25/t processed |

|

G&A |

$4.10/t processed |

Based on estimates that exclude escalation

Operating costs have been based on a delivered

diesel price of $0.92 per litre and are in line with current local

pricing. Power will be sourced from the grid supplying 90kV to site

via a ring main system providing power from two different sources

of transmission to increase reliability, with power costs estimated

at $0.16/kWh.

Capital Cost and Infrastructure

Summary

The project capital cost estimate was compiled

by Lycopodium with input from Knight Piésold on the TSF, water

infrastructure, site access roads and airstrip, from Digby Wells on

relocation, and from ECG Engineering on the power infrastructure.

Endeavour has provided project specific estimates for mine

establishment, facilities and owner’s costs.

The initial capital cost is summarized in the

table below.

Table

7: Assafou Upfront Capital Cost

Estimate Summary (-20/+25%)

|

|

CAPITAL COSTS (US$M) |

| Mining |

156.3 |

| Treatment Plant Costs |

115.5 |

| Reagents and Plant

Services |

34.9 |

| Site Infrastructure |

109.2 |

| Offsite Infrastructure |

79.7 |

| Contractor Distributables |

36.6 |

|

Indirect Costs |

120.3 |

| Subtotal |

652.5 |

| Contingency |

79.0 |

| Taxes and Duties |

2.7 |

|

Total Upfront Capital Cost |

734.2 |

Based on estimates that exclude escalation

The Assafou project capital cost estimate

assumes a contractor mining model, selected due to the lower

upfront capital costs and the additional fleet flexibility that can

accommodate the pre-production mining ramp-up. Within the

subsequent DFS, a hybrid approach to contract and owner mining may

be considered to ensure capital and operating costs are optimised,

while the mining ramp-up is de-risked.

The Assafou project benefits from good

surrounding infrastructure, including access to the 90kV power

supply within 14km of the project, and access to the A1 national

road, which will be diverted around the operation and provide

access to the operation. An airstrip will be built 3.5km from the

permanent accommodation. Resettlement of two villages within close

proximity to the project is required and is included in the capital

cost estimate.

The tailings storage facility (“TSF”) is

expected to be a cross-valley storage facility, utilising the

natural topography of the project area, that will be formed by

multi-zoned earth fill embankments, with a total footprint area

(including the basin area) of approximately 252ha for the stage 1

TSF to 278ha for the final TSF. TSF construction will benefit from

the high availability of fresh waste rock from the mining

pre-stripping activities. The TSF is designed to a life-of-mine

capacity accommodating a total of 73Mt of tailings, with the

potential to be expanded to 110Mt. The Stage 1 TSF is designed for

7.5Mt, approximately 18 months storage capacity, and subsequently,

downstream raise construction will be used to progressively

increase capacity.

The recommendations from the Environmental

Social Impact Assessment (“ESIA”) which is underway, will be used

to compile an Environmental and Social Management Plan (“ESMP”)

which will guide Endeavour’s local community engagement as well as

ensuring it fulfils its environment obligations, minimising the

mine’s impacts where possible. The ESMP will be used to monitor and

ensure compliance with environmental specifications, monitoring and

management measures and will be implemented from site preparation

through to decommissioning and closure.

Figure 3 below highlights the proposed site and

infrastructure layout.

Figure 3: Assafou Schematic Site

Layout

Please refer to

Figure 3 in the attached release.

Ownership, Permitting, Taxes and

Royalties

Endeavour acquired the Tanda exploration permit

in 2015, subsequently acquiring the Iguela permit, which contains

the Assafou project, in 2017. Endeavour will retain full ownership

of the Tanda-Iguela permits until the permits are converted into an

exploitation permit. Based on the current 2014 Mining Convention,

once the exploitation permit is granted, Endeavour will be entitled

to an 80% stake in the Assafou project, while SODEMI (the Ivorian

state-owned mining company) and the Government of Côte d’Ivoire

will each have a 10% stake.

A corporate tax rate of 25% of gross profit has

been applied in the PFS. A royalty of 5.0% and a community levy

royalty of 0.5% was applied to all sales. Gold royalties in Côte

d’Ivoire are based on a sliding scale with the gold price, and vary

between 3.0% and 6.0%. A transport and refining charge of $4/oz Au

was also applied.

The mining code is currently under review and if

the proposed new mining code is passed into law before the Assafou

exploration permit is converted into an exploitation permit, then

the fiscal terms applicable to the Assafou project are expected to

reflect those of the new mining code. If the new mining code is

passed into law in its current draft state, it is expected to

include an increase in the Governments free-carried interest from

10% to 15%. This would result in Endeavour’s potential stake in the

Assafou project, once the exploration permit has been converted

into an exploitation permit, decreasing from 80% to 75%.

Geology

Mineralisation at the Assafou deposit is both

disseminated and hosted in quartz veins within the Tarkwaian

Sandstones. The deposit appears to be monometallic containing no

potentially penalising elements associated with the gold.

Mineralisation starts at surface, extending down to more than 300

metres in depth, and is continuous along strike, along the

prominent northwest trending structure that separates the Tarkwaian

Sandstones from the mafic Birimian Basement rocks. The deposit

comprises a thick main (up to 60 metres) continuous lens, appearing

to be dipping at a low angle to the southwest, overlaid by a series

of stacked lenses.

High grade mineralisation and the thickest

mineralised intercepts are located adjacent to the structural

contact between the mafic Birimian Basement rocks and the Tarkwaian

Sandstones along the northeast boundary of the Assafou deposit.

Mineralisation at Assafou remains open along strike towards the

northwest and towards the southeast, as well as at depth, where

deep drilling below 250 metres intercepted mineralisation below the

existing resource pit shell and within the Birimian Basement rocks

below the sedimentary basin.

Assafou

Exploration

The Assafou deposit was discovered in late 2021

and the maiden Indicated resource of 14.9Mt at 2.33g/t containing

1.1Moz and an Inferred resource of 32.9Mt at 1.80g/t containing

1.9Moz was defined on 31 October 2022, less than one year after the

initial discovery, based on 58,000 metres of drilling.

Subsequently, an updated Indicated resource of

70.9Mt at 1.97g/t containing 4.5Moz and an Inferred resource of

2.9Mt at 1.91g/t containing 0.2Moz was defined on 14 November 2023,

based on 183,000 metres of drilling.

Since the 14 November 2023 resource was defined,

a further 44,000 metres of drilling has been completed at the

Assafou deposit, extending the mineralised trend by over 0.4km or

12%, to 3.7km, and 26,000 metres of drilling has been completed at

near-mine targets, within less than 5km of the Assafou deposit.

Mineralisation at Assafou remains open along

strike along the 20km long structural corridor extending from Koume

Nangare in the northwest to Kongojdan in the southeast, as well as

at depth where mineralisation has been identified below the current

resource pit shell, and within the basement mafic Birimian volcanic

rocks.

During the first nine months of 2024, 67,000

metres of drilling has been completed for a total spend of $13.4

million, consisting of resource expansion and resource infill

drilling at the Assafou deposit, resource definition drilling at

the Pala Trend 3 target and reconnaissance drilling at other

satellite targets in close proximity to Assafou.

Figure 4: Assafou Deposit

Map

Please refer to Figure 4 in the

attached release.

Figure 5 below highlights that 2024 drilling,

that has not been included in the PFS reserves and resources

estimate, has identified mineralisation that extends towards the

northwest of Assafou, outside of the existing pit shell.

Mineralisation starts at surface within the Tarkwaian Sandstones

but extends into the Birimian Basement and it remains open, with

further drilling planned for FY-2025.

Figure 5: Assafou Cross Section

A3600

Please refer to Figure 5 in the attached

release.

Figure 6 below highlights the occurrence of

high-grade, stacked lenses of mineralisation in the southeast of

the Assafou deposit, where additional drilling was completed in

2023 and 2024.

Figure 6: Assafou Cross Section

A0533

Please refer to Figure 6 in the attached

release.

Figure 7 below highlights that 2024 drilling

towards the southeast of the Assafou deposit has identified

high-grade mineralisation below the current Assafou pit shell.

Figure 7: Assafou Cross Section

A0300

Please refer to Figure 7 in the attached

release.

Figure 8 below highlights that drilling

completed in 2023 and 2024 towards the southeast of the Assafou

deposit, that was not included in the reserves and resources

estimate for the PFS, has identified multiple lenses of

mineralisation below the current Assafou pit shell, with follow-up

drilling planned for 2025.

Figure 8: Assafou Cross Section

A0200

Please refer to Figure 8 in the

attached release.

Regional

Exploration

Regional exploration continues to advance at

nine targets within 6km of the Assafou deposit. The regional

exploration programme is targeting both Tarkwaian and Birimian

style deposits within close proximity to Assafou that could

potentially form satellite pits to the Assafou project.

Figure 9 below, highlights some of the

high-grade mineralised intercepts identified at these potential

satellite targets, of which the Pala trend 3 target is the most

advanced, while further delineation drilling will continue at the

other high priority Koume Nangare and Pala Trend 1 and 2

targets.

Figure 9: Iguela Regional

Map

Please refer to Figure 9 in the attached

release.

Figure 10 below highlights the drilling

completed at the Pala Trend 3 target in 2024. Pala Trend 3 is

located approximately 1km west of the Assafou deposit, within the

same sedimentary basin.

Drilling has identified continuous, stacked

lenses of shallow mineralisation that are dipping towards the

northeast, towards the Assafou deposit. While mineralisation at

Assafou is largely hosted within the Tarkwaian Sandstones, at Pala

Trend 3 mineralisation is largely hosted within the Birimian

greenstone rocks, similar to other Birimian greenstone deposits in

the region. The Tanda-Iguela property remains highly prospective

for both types of mineralisation.

The exploration programme will continue to

advance the Pala Trend 3 target and a maiden resource is expected

to be defined in 2025 and incorporated into the DFS.

Figure 10: Pala Trend 3

P1300

Please refer to Figure 10 in the attached

release.

Next Steps

- The DFS is expected

to commence immediately and is due to be completed between late

2025 and early 2026

- Updated mineral

reserves and resources will be defined during 2025, which will

include additional drilling at the Assafou deposits and the Pala

Trend 3 satellite target, and will be incorporated into the

DFS

- The exploitation

permit application process and the ESIA submission are expected to

commence in early 2025

- Further exploration

is planned during 2025 on the Assafou deposit and on near-mine

satellite targets within close proximity to Assafou

ASSAFOU TECHNICAL NOTES

All figures are expressed in United States

dollars unless otherwise stated.

Assafou Geology

Mineralisation at Assafou is mainly hosted in

Tarkwaian Sandstone, at/or immediately in the vicinity of the

structural contact with Birimian Basement rocks (mainly mafic

rocks). Gold mineralisation occurs both as disseminated occurrences

within pervasively altered sandstone and within, or at the edges

of, quartz (±carbonate) veins and breccias that crosscut the

altered sandstones. Alteration is reflected by an induration

(silicification) and by the presence of sulphides (pyrite),

disseminated within the matrix and distributed along the sandstone

bedding. The more intense the silicification (and presence of

pyrite), the more mineralised the sandstones tend to be.

The structural contact likely controlled the

initial sandstone deposition (normal fault in extensional regime).

It was then reactivated under an SSW-NNE compressive regime at the

brittle-ductile transition, associated with strong mylonitisation

and alteration (quartz, carbonate, pyrite, ± sericite, ± chlorite)

of the Birimian Basement rocks, and to mafic and felsic intrusions

as dykes and sills. Gold mineralisation is likely to have occurred

during this reversal, in the post-Tarkwaian reactivation event.

Mineralising hydrothermal fluids are believed to have

preferentially invaded the Tarkwaian Sandstones rather than the

Birimian Basement rocks, due to their higher initial porosity,

permeability and competency.

Assafou Resource

Modelling

The statistical analysis, geological modelling

and resource estimation were prepared by a resource team of

Endeavour. The Qualified Person as defined by NI 43-101 is Kevin

Harris, Vice President of Resources with Endeavour Mining.

The Assafou mineral resource model was developed

in Seequent’s Leapfrog Geo, Snowden’s Supervisor and Geovia’s

Surpac software. The database used to generate the mineral

resources comprised some 868 drill holes, totalling 183,081 metres.

The drill hole data was supported by industry-standard quality

assurance and quality control systems, with quality control

sampling comprising blanks, coarse blanks, certified reference

materials, and field and pulp duplicates. Endeavour’s resource team

has reviewed the QAQC data available and considers the assay data

to be suitable for use in the subsequent mineral resource

estimate.

Mineralisation domains were modelled with the

Vein System tool in Leapfrog Geo using the interval selection for

each vein. The gold assays from the drill holes were composited to

1.0 metre intervals. Grade capping values were applied depending on

the mineralised domain, between no cap and 45 g/t. Spatial analysis

of the gold distribution within the mineralised zone indicated good

continuity of the grades along strike and down dip within the

mineralised zones. Variography has been applied using Snowden’s

Supervisor for the largest mineralised zones (101, 102, 103, 104,

105, 106, 110 and 112) and variogram models were produced for these

domains. These largest domains represent almost half of the entire

population and have a good geological and grade continuity.

Density measurements from 401 drill holes and

covering each of the lithologies, were averaged based on the

material type (and lithology, in the case of fresh material).

Average density values were applied to the associated portions of

the block model as outlined below:

- Laterite 1.79 g/cm3

- Saprolite: 1.96

g/cm3

- Saprock: 2.36 g/cm3

- Fresh: 2.76 g/cm3

Gold grades were estimated in Geovia’s Surpac

using Inverse Distance Squared (‘’IDW2’’) for most of the modelled

mineralisation. Ordinary Kriging was only used for the largest

domains which include sufficient data for variogram models. The

Ordinary Kriging estimation represents almost half of the

mineralised volume. The grade was estimated in multiple

passes to define the higher confidence areas and extend the grade

to the interpreted mineralised zone extents.

The grade estimation was validated with visual

and statistical analysis, and comparison with the drilling data on

sections with swath plots comparing the block grades with the

composites.

The majority of the resource is within the fresh

rock, approximately 0.5% of the ounces is oxide, 5.7% is transition

and 93.8% is fresh rock.

Endeavour considers that the quality and spatial

distribution of the data used, the geological continuity of the

mineralisation and the quality of the estimated block model for the

Assafou deposit are sufficient for the reporting of Indicated and

Inferred mineral resources, in accordance with the CIM Definition

Standards. Indicated mineral resources have typically been defined

in areas with a drill hole spacing of 30-40 metres along sections,

and 30-40 metres between sections, where there is a reasonable

level of confidence in geological and grade continuity. Inferred

mineral resources have typically been defined in areas with a

drillhole spacing of 50 to 75 metres, and where the controls on

mineralisation are less well understood, or the continuity is

reduced.

Mineral resources are reported within an

optimised pit shell using a cut-off grade of 0.5 g/t Au and a gold

price of $1,900 per ounce. Technical and economic assumptions were

agreed for mining factors (mining and selling costs, mining

recovery and dilution, pit slope angles) and processing factors

(gold recovery, processing costs), which were used for

optimisation. The optimised factors are summarised below:

- Mining cost: $3.75/t ore and

$2.72/t waste

- Processing cost:

Oxide/Transitional: $1.08/t ore; Fresh: $11.66/t ore

- G&A cost: $4.68/t ore

- Sustaining Capital cost:

$1.45/t/ore

- Other ore related costs (including

grade control): $0.78/t ore

- Selling cost: $89.5/oz Au

- Mining recovery: 95%; Dilution

0%

- Processing recovery: 95.7% for

Oxide/Transition and 93.1% for Fresh at the average grade

- Average slope angles: 28-43°,

dependent on geotechnical domain

Drilling, Assay, Quality Assurance

and Quality Control Procedures

Reverse Circulation (“RC”) and Air Core (“AC”)

drilling uses high pressure compressed air to deliver rock

materials to the surface. The compressed air is delivered via a

dual tube drill rod system, with an outer tube for air going

down-hole, and an inner-tube for return going back to surface. In

RC drilling, compressed air drives a percussion hammer. In both RC

and AC drilling, compressed air carries rock particles back to

surface via the inner tube, minimizing potential contamination

affects.

The samples are collected from the cyclone at

surface at 1 metre intervals. The cyclone is cleaned after every

6-metre rod by flushing the hole and physical opening of the

cyclone and blowing out with compressed air at the end of each

hole. Additional manual cleaning is required in saprolitic or wet

ground, closely monitored by the site geologist / geo-technician to

ensure no sample-to-sample contamination occurs. Samples are

manually split at the drill site using several different riffle

splitters, based on bulk sample weight. 2 to 5 kilograms laboratory

samples and a second 2 to 5 kilograms reference sample are

collected. Bulk and laboratory sample weights, in addition to

moisture levels are recorded. Representative samples for each

interval were collected with a spear, sieved into chip trays and

retained for reference.

Drill core (PQ, HQ and NQ size) samples are

selected by Endeavour geologists and cut in half with a diamond

blade at the project site. Half of the core is retained at the site

for reference purposes. Sample intervals are generally 1 metre in

length, adjusted with geologic and/or structural contacts. All

samples are transported by road to Bureau Veritas in Abidjan. Each

laboratory sample is secured in poly-woven bags ensuring that there

is a clear record of the chain of custody. On arrival samples are

weighed. Complete samples are crushed to 2 mm (70% passing) with 1

kilogram split out for pulverization. The entire 1 kilogram is

pulverized to 75 μm (85% passing). A 50-gram sample is extracted

and analysed for gold using standard fire assay technique. An

Atomic Absorption (“AA”) finish provides the final gold value.

Blanks, field duplicates and certified reference

material (“CRM’s”) are inserted into the sample sequence by

Endeavour geologists at a rate of one of each samples type per 20

samples. This ensures that there is a 5% Quality Assurance /

Quality Control (“QA/QC”) sample insertion rate applied to each

fire assay batch. The sampling and assaying are monitored through

analysis of these QA/QC samples. This QA/QC program was audited by

a consultant, independent from Endeavour Mining and has been

verified to follow industry best practices.

In 2021 and 2022, 1,757 samples were sent to ALS

Ouagadougou for umpire (referee) analysis. Comparison of the

Original analysis against the umpire analysis revealed a very

strong Correlation Coefficient of 95.90% suggesting that the

original assays provided by Bureau Veritas in Abidjan are accurate.

Core sampling and assay data were monitored through a quality

assurance/quality control program designed to follow NI 43-101 and

industry best practice.

Assafou Mineral Reserve

estimate

This maiden Mineral Reserve Estimate (as at 30

August 2024) for the Project is supported by engineering designs

and modifying factors in accordance with CIM Definition

Standards.

The open pit is designed with two starter

phases, an interim stage, a final phase, and a southern extension.

The life of mine plan (LoMp) for the Project includes modification

to the Resource model to generate the mining block through

re-blocking, which introduces a degree of dilution, the pre-mining

topographic surface and the Open Pit optimisation analysis. The

same economic parameters were used to generate the pit shells for

the Mineral Resource and the Mineral Reserve, with the exception of

gold price and sales costs, which were $1900/oz and $1500/oz

respectively.

A marginal gold cut-off grade of 0.4 g/t was

used in the calculation of the open pit quantities for the

production schedule and the Mineral Reserve estimate. The economic

cut-off grade is calculated based on the processing cost parameters

including cost of; grade control and RoM re-handling; ore premium;

processing the ore, plant/infrastructure maintenance, general and

administration charges, and sustaining capital costs. Mineral

Reserve cut-off grades are 0.4 g/t Au for Laterite/, Saprolite/ and

Saprock, and 0.5 g/t Au for Fresh rock.

The Mineral Reserve is reported from an

engineered pit design, as a scheduled mining and processing

estimate, that includes stockpiling. The scheduled Mineral Reserve

is reported based on aggregating all Measured and Indicated Mineral

Resource blocks incorporated within the LoMp, and reported

inclusive of all appropriate dilution, diluted grade and losses;

and all inferred material treated as waste.

The Qualified Person as defined by NI 43-101 for

the Mineral Reserve estimate is Dr Salih Ramazan FAusIMM. Dr

Ramazan is a full-time employee of Endeavour Mining Corporation is

not considered to be independent from the company.

QUALIFIED PERSONS

Kevin Harris, Vice President of Resources with

Endeavour, a “Qualified Person” as defined by NI 43-101, has

reviewed and approved the statistical analysis, geological

modelling, and resource estimation disclosed herein in respect of

Assafou. Dr Salih Ramazan FAusIMM, Vice President of Mine Planning

with Endeavour, a “Qualified Person” as defined by NI 43-101, has

reviewed and approve the mineral reserve estimate disclosed herein

in respect of Assafou. Ross McMillan, SVP Technical Services of

Endeavour Mining plc., a Fellow of the Australian Institute of

Mining and Metallurgy, a “Qualified Person” as defined by NI

43-101, has reviewed and approved the technical information other

than in respect of the statistical analysis, geological modelling,

and resource estimation and mineral reserve estimate in respect of

Assafou disclosed in this release.

CONTACT INFORMATION

Jack Garman

Vice President, Investor

Relations

+44 203 011 2723

jack.garman@endeavourmining.com |

Brunswick Group LLP in London

Carole Cable,

Partner

+44 207 404 5959

ccable@brunswickgroup.com |

ABOUT ENDEAVOUR MINING PLC

Endeavour Mining is one of the world’s

senior gold producers and the largest in West Africa, with

operating assets across Senegal, Cote d’Ivoire and Burkina Faso and

a strong portfolio of advanced development projects and exploration

assets in the highly prospective Birimian Greenstone Belt across

West Africa.

A member of the World Gold Council,

Endeavour is committed to the principles of responsible mining and

delivering sustainable value to its employees, stakeholders and the

communities where it operates. Endeavour is listed on the London

and Toronto Stock Exchanges, under the symbol EDV.

For more information, please visit

www.endeavourmining.com.

CAUTIONARY NOTE REGARDING

FORWARD-LOOKING INFORMATION

This news release contains "forward-looking

statements" within the meaning of applicable securities laws.

All statements, other than statements of historical fact, are

"forward-looking statements". Generally, these forward-looking

statements can be identified by the use of forward-looking

terminology such as "expects", "expected", "budgeted", "forecasts",

and "anticipates".

Forward-looking statements, while based on

management's best estimates and assumptions, are subject to risks

and uncertainties that may cause actual results to be materially

different from those expressed or implied by such forward-looking

statements, including but not limited to: risks related to the

successful integration of acquisitions; risks related to

international operations; risks related to general economic

conditions and credit availability, actual results of current

exploration activities, unanticipated reclamation expenses; changes

in project parameters as plans continue to be refined; fluctuations

in prices of metals including gold; fluctuations in foreign

currency exchange rates, increases in market prices of mining

consumables, possible variations in ore reserves, grade or recovery

rates; failure of plant, equipment or processes to operate as

anticipated; accidents, labour disputes, title disputes, claims and

limitations on insurance coverage and other risks of the mining

industry; delays in the completion of development or construction

activities, changes in national and local government regulation of

mining operations, tax rules and regulations, and political and

economic developments in countries in which Endeavour operates.

Although Endeavour has attempted to identify important factors that

could cause actual results to differ materially from those

contained in forward-looking statements, there may be other factors

that cause results not to be as anticipated, estimated or intended.

There can be no assurance that such statements will prove to be

accurate, as actual results and future events could differ

materially from those anticipated in such statements. Accordingly,

readers should not place undue reliance on forward-looking

statements. Please refer to Endeavour's most recent Annual

Information Form filed under its profile at

www.sedarplus.ca for further information respecting the risks

affecting Endeavour and its business.

- 241211 - NR - Assafou PFS

- 241211 - Assafou PFS - NR Appendix

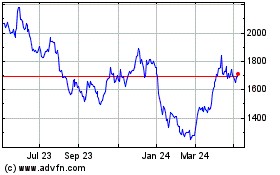

Endeavour Mining (LSE:EDV)

Historical Stock Chart

From Nov 2024 to Dec 2024

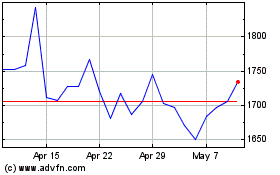

Endeavour Mining (LSE:EDV)

Historical Stock Chart

From Dec 2023 to Dec 2024