EPE Special Opportunities PLC Acquisition & loan issue (9641T)

July 24 2015 - 1:00AM

UK Regulatory

TIDMESO TIDMEC.P TIDMEO.P

RNS Number : 9641T

EPE Special Opportunities PLC

24 July 2015

EPE Special Opportunities plc

Acquisition of Secondary Interest in ESO Investments 1 LP

GBP4.75 million loan issue and issue of equity via private

placing

24 July 2015

EPE Special Opportunities plc ("ESO plc" or the "Company")

announces that it has acquired the Limited Partnership interest

held by DES Holdings IV(A) LLC ("ESD") in ESO Investments 1 LP

("ESO 1 LP"), a Limited Partnership in which ESO plc is the

majority Limited Partner (the "Acquisition"). Following the

transaction, ESO plc is now the sole Limited Partner in ESO 1

LP.

The total value of the Acquisition is GBP8.6 million, with

GBP5.7 million to be paid in cash at completion and GBP2.9 million

in cash before 30 September 2015. The Acquisition value represents

ESD's audited 31 January 2015 Net Asset Value ("NAV") in ESO 1 LP

at a fixed Pound to Euro exchange rate of 1 : 1.35.

The Acquisition continues the stated objective of buying out

Minority Interests and participants in all assets where the

Investment Advisor believes it represents value. The Acquisition is

also consistent with ESO plc's stated objective of having a

concentrated portfolio numbering between two and 10 assets at any

one time.

ESO plc also announces that certain private investors have

agreed to subscribe for loan notes issued by ESO plc in the

principal amount of GBP4.5 million (the "Loan Notes Issue") and the

principal amount of GBP0.25 million (175,895) ordinary shares of 5p

each of ESO plc at a price of 142.13p per ordinary share (being the

Company's NAV per ordinary share as at 31 January 2015), with such

issuance of ordinary shares conditional on Admission (see below)

(the "Equity Subscription").

The proceeds of the Loan Notes Issue and Equity Subscription

will be used to fund the acquisition of Minority Interests, the

refinancing of the convertible loan note and to support the making

of new investments by ESO plc.

Following the Acquisition, the Loan Notes Issue and the Equity

Subscription, the revised NAV as at 30 June 2015 is 141.87p per

share.

The Loan Notes Issue

Key terms and conditions:

- GBP4.5 million issued to certain private investors, with an

option for ESO plc to raise further funds by issuing loan notes

under the same loan note instrument (the "Loan Note Instrument")

(together, the "Loan Notes").

- Final repayment date of 23 July 2022. The Company may (in its

sole discretion) extend the final repayment date to 23 July 2023 by

giving written notice of such extension to the holders of the Loan

Notes on or prior to 31 January 2022, provided that the Company is

in compliance with the terms of the Loan Note Instrument on 23 July

2022.

- The Company may elect to redeem up to 50 per cent of the Loan

Notes at par on or after 31 July 2018 and up to 75 per cent of the

Loan Notes at par on or after 31 July 2020.

- The Loan Notes place restrictions on the Company raising

further debt over pre-agreed levels.

- The Company will pay an annual interest rate of 7.50 per cent

on the outstanding Loan Notes semi-annually in arrears in equal

instalments on 31 January and 31 July. The first interest payment

date in respect of the Loan Notes is 31 January 2016.

- The Loan Notes are freely transferable and the Loan Note

Instrument contains customary mandatory redemption provisions.

- The Loan Note Issue was completed on 23 July 2015.

- The Loan Notes are and will be issued by ESO plc alone.

The Equity Subscription

Key terms and conditions:

- The GBP0.25 million Equity Subscription comprises of 175,895

ordinary shares of 5p each at a price of 142.13p. This price

matches the Company's NAV per share as at 31 January 2015.

- New ordinary shares are being issued under existing allotment authorities.

- An application has been made for 175,895 ordinary shares of 5p

each to be admitted to be traded on AIM (the "Admission"). It is

expected that the Admission will occur at 8:00am on 27 July

2015.

Enquiries:

EPIC Private Equity LLP Alex Leslie

+44 (0) 20 7269 8865

IOMA Fund and Investment Management Philip Scales

Limited +44 (0) 1624 681250

===============================

Cardew Group Richard Spiegelberg

+44 (0) 20 7930 0777

===============================

Numis Securities Ltd +44 (0) 20 7260 1000

===============================

Nominated Advisor: Stuart Skinner / Hugh Jonathan

===============================

Corporate Broker: Charles Farquhar

===============================

This information is provided by RNS

The company news service from the London Stock Exchange

END

ACQLLFLADIIVFIE

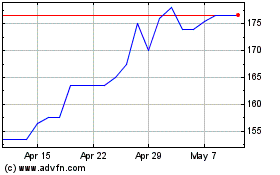

Epe Special Opportunities (LSE:ESO)

Historical Stock Chart

From Jun 2024 to Jul 2024

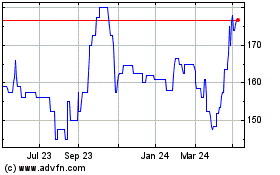

Epe Special Opportunities (LSE:ESO)

Historical Stock Chart

From Jul 2023 to Jul 2024