TIDMFBH

RNS Number : 0070J

FBD Holdings PLC

11 August 2023

FBD HOLDINGS PLC

Half yearly Report

For the Six Months ended 30 June 2023

KEY HIGHLIGHTS

-- Profit before tax of EUR39m under IFRS 17 compared to EUR3m in 2022.

-- Combined Operating Ratio (COR) of 81% reflecting continued

underwriting discipline and benefitting from positive prior year

reserve development including that related to Business

Interruption.

-- Special dividend approved of 100 cent per ordinary share.

-- Insurance revenue increased by 4.5% to EUR195m.

-- Written policy count increased by 2.6%.

-- The Covid-19 related Business Interruption best estimate

reduced by EUR15m to EUR27m net of reinsurance since year-end 2022

following conclusion of the test case.

-- Retention levels of existing business increased by 0.2% year on year.

-- Average premium increased by 4.6% across the portfolio.

Private Motor average premium increased by 1.7%.

-- Income statement investment return of 0.7%, reflecting

positive investment returns of EUR8m.

-- Our capital position remains strong with a Solvency capital

ratio (SCR) of 217% (unaudited) after allowing for the special

dividend, compared to 226% at 31 December 2022.

-- Return on equity of 15%.

-- IFRS 17 is effective for insurance contract reporting since 1

January 2023 and all comparatives are Half Year 2022 restated,

unless otherwise specified. IFRS 9 has also been adopted.

Half Year Half Year

FINANCIAL SUMMARY ended ended

30 Jun 30 Jun

2023 2022

(restated)

EUR000s EUR000s

Gross written premium 206,432 192,432

Insurance revenue 194,540 186,142

Insurance service result 65,403 44,052

Profit before taxation 39,477 2,509

Loss ratio 54.0% 60.9%

Expense ratio 27.1% 25.7%

Combined operating ratio 81.1% 86.6%

Cent Cent

Basic earnings per share 91 6

Net asset value per share 1,274 1,179

A reconciliation between IFRS and non-IFRS measures is given in

the Alternative Performance Measures (APMs) on page 62 and 63.

-- The largest element of Insurance revenue is Gross written

premium (GWP) which increased by 7.3% to EUR206m (2022: EUR193m).

Written policy count increased by 2.6% with over 70% of the

increase coming through our local offices.

-- The Insurance service result increased by EUR21m to EUR65m

(2022: EUR44m). This is made up of increased Insurance revenue of

EUR8m, a reduction in the Insurance service expense (ISE) of

EUR35m, largely due to a positive past service benefit including

that related to Business Interruption reserve releases, net of

additional reinsurance contract expenses of EUR22m as expected

reinsurance recoveries on Business Interruption reduced.

-- A positive start to the year for both equity and fixed income

investments has resulted in a profit through the Income Statement

of EUR8m (2022: -EUR15m) and a profit through Other Comprehensive

Income (OCI) of EUR9m (2022: -EUR64m).

-- The expense ratio increased to 27.1% (2022: 25.7%), with the

increase primarily reflecting inflationary increases on staff

costs, IT and utility costs. The expense ratio includes Insurance

acquisition expenses and Non-attributable expenses.

-- Net Asset Value per share of 1,274 cent has reduced from

1,276 cent (restated) at the end of 2022 as the dividend payments

in May were offset by Half Year profit.

Commenting on these results Tomás Ó Midheach, Group Chief

Executive, said:

"I am pleased to announce a strong profit for the first half of

2023 where the business continued to grow and deliver for all

stakeholders. Supported by a disciplined underwriting approach, our

financial and strategic foundations remain solid as we continue to

drive sustainable profitable growth.

Our ongoing focus and commitment to meeting the needs of our

customers and the provision of a personalised service continue to

play a significant role in the performance of the business. As a

consequence, it is most encouraging to see strong retention of

existing customers and continued growth in both customer and policy

count numbers.

Economic conditions remain challenging for businesses and

customers alike. Inflation continues to be experienced in Property

and Motor Damage claims. Injury claims experience has been benign

and there were no significant weather events.

We welcome the final Judgement on the Business Interruption test

case. This ruling allows us to finalise all valid Covid-19 related

claims and State subsidies.

We are supportive of the steps the Government has taken on

insurance reform to reduce claims costs and consequently insurance

premiums. The increased acceptance rates of awards from the

Personal Injuries Resolution Board could indicate the Personal

Injury Guidelines are being adopted, although their ultimate impact

will not be known until the challenges make their way through the

courts.

The business remains strongly capitalised with a capital ratio

above our stated risk appetite. As signalled earlier this year and

following engagement with our stakeholders, a special dividend of

100c per ordinary share was approved by the Board.

I am thankful for the support of the Board and the commitment

and hard work by all the team at FBD. We have demonstrated that our

relationship focus strategy is delivering and our evolving strategy

to firmly position FBD for the future to become a digitally

enabled, data enriched organisation delivering an excellent

customer and employee experience, is firmly on track."

A presentation will be available on our Group website

www.fbdgroup.com from 9.00 am today.

Enquiries Telephone

FBD

Michael Sharpe, Investor Relations +353 87 9152914

Drury Communications

Paddy Hughes +353 87 6167811

About FBD Holdings plc ("FBD")

FBD is one of Ireland's largest property and casualty insurers,

looking after the insurance needs of farmers, consumers and

business owners. Established in the 1960s by farmers for farmers,

FBD has built on those roots in agriculture to become a leading

general insurer serving the needs of its direct agricultural, small

business and consumer customers throughout Ireland. It has a

network of 34 branches nationwide.

Forward Looking Statements

Some statements in this announcement are forward-looking. They

represent expectations for the Group's business, and involve risks

and uncertainties. These forward-looking statements are based on

current expectations and projections about future events. The Group

believes that current expectations and assumptions with respect to

these forward-looking statements are reasonable. However, because

they involve known and unknown risks, uncertainties and other

factors, which are in some cases beyond the Group's control, actual

results or performance may differ materially from those expressed

or implied by such forward-looking statements.

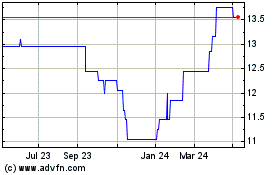

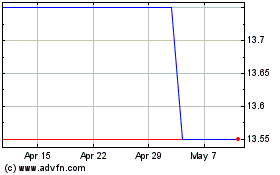

The following details relate to FBD's ordinary shares of EUR0.60

each which are publicly traded:

Listing Euronext Dublin Financial Conduct Authority

Listing Category Premium Premium (Equity)

Trading Venue Euronext Dublin London Stock Exchange

Market Main Securities Market Main Market

ISIN IE0003290289 IE0003290289

Ticker FBD.I or EG7.IR FBH.L

OVERVIEW

The Group reported a profit before tax of EUR39.5m (2022:

EUR2.5m), supported by growth in Insurance revenue of EUR8.4m

primarily in local offices, a reduction in Insurance service

expenses of EUR35.3m mainly related to positive past service

movement including in respect of Covid-19 Business Interruption

(BI) claims, and positive investment returns of EUR8.4m (2022:

-EUR15.3m). This was offset by a EUR7.5m provision for our current

estimate of the cost of a constructive obligation arising from the

deduction of State subsidies under Business Interruption.

The net best estimate in respect of BI reduced by EUR14.9m to

EUR26.6m since December 2022. The reduction reflects the final

Judgement in respect of the BI test case.

INSURANCE SERVICE RESULT

Insurance Revenue

Insurance revenue is 4.5% higher at EUR194.5m (2022: 186.1m).

Gross written premium is the largest part of Insurance revenue and

is 7.3% higher than 2022 at EUR206.4m (2022: EUR192.4m) with strong

increases in Home, Agri and Commercial Business. Written policy

count increased by 2.6% with average premiums increasing by 4.6%

across the portfolio. The retention rate on the portfolio is higher

than the first half of 2022, continuing the trend of multi-year

highs.

Average premium increased by 4.6% across the portfolio

reflecting the inflationary impacts from the economic environment.

Private Motor average premium increased by 1.7% and Commercial

Motor increased by 0.7% reflecting the increasing cost of Motor

Damage claims, driven by increases in labour, parts and paint costs

with newer, more technologically advanced vehicles costing more to

repair. Home average premium increased by 9.5% reflecting increases

in property sums insured as inflation continues in construction

costs. Commercial Business average premium increased 5.9% driven by

a combination of sums insured increasing due to inflation in

construction costs and customers increasing liability cover,

increasing the exposure and as a result average premium. Farm

average premium increased by 5.0% as a result of increases in

property elements as sums insured increased due to inflation in

construction costs. Average Tractor premium increased by 8.8% due

to a higher proportion of newer tractors, increasing value of

existing tractors and inflation in the cost of Motor Damage

claims.

Insurance Service Expenses

Insurance service expenses (ISE) reduced by EUR35.3m to EUR92.0m

(2022: EUR127.3m). The table below splits the ISE into Gross

incurred claims, Changes that relate to past service and Insurance

acquisition expenses. The Gross incurred claims increase of EUR4.5m

reflects increasing costs due to inflation and increased frequency

in Property and Motor Damage. Changes that relate to past service

of EUR59.4m include prior year reserve movements, gross of

reinsurance, including that related to Business Interruption, as

well as other IFRS 17 specific movements in the Risk Adjustment and

Discounting. Insurance acquisition expenses of EUR36.6m form part

of the ISE and are referenced below under Expenses.

Insurance Service Expenses Half Year ended 30 June 2023 Half Year ended 30 June 2022

EUR000 EUR000

Gross incurred claims (114,744) (110,263)

Changes that relate to past service 59,375 17,005

Insurance acquisition expenses (36,588) (34,064)

Total Insurance service expenses (91,957) (127,322)

----------------------------- -----------------------------

Injury notifications increased 4% year on year largely

reflecting increased policy count with a slight increase in

frequency. The average cost of injury claims settlements are down

5% in the last 12 months and continue to be lower than that

experienced pre-Covid. C ourt backlogs are easing with trial dates

now secured within pre-Covid timeframes . FBD continue to stand

over the Personal Injuries Resolution Board (PIRB) awards made

under the Personal Injury Guidelines.

Claims being settled under the new guidelines continue to be

over 40% lower in value when compared to the previous Book of

Quantum. The level of acceptance of PIRB awards across the market

has improved to 48% which is closer to historic levels. This should

reduce the number of cases through the courts system attracting

higher legal costs. It could take a number of years for the full

impact to be known of the new guidelines on claims settled through

the litigation process.

Motor damage notifications increased by 17% as traffic volumes

have returned to pre-Covid levels and settlement costs also

increased over 11%. The mix is changing within the Motor book as

more policyholders have taken out comprehensive cover and inflation

on parts and labour is increasing the cost of repairs. The

increasing repair costs appear to be encouraging more people to

claim rather than pay outside of their insurance.

The average cost of property claims increased by 7% due to a

change in mix and inflation, with double digit increases in Escape

of Water and Fire costs.

Movement in other provisions increased by EUR7.2m to EUR12.4m

(2022: EUR5.2m), with the increase relating to the provision for

our current estimate of the cost of a constructive obligation

arising from the deduction of State subsidies paid to claimants

under Business Interruption of EUR7.5m. The other elements of the

Movement in other provisions are the Motor Insurers Bureau of

Ireland (MIBI) levy and the Motor Insurers Insolvency Compensation

Fund (MIICF) contribution.

Reinsurance

The reinsurance programme for 2023 was successfully renegotiated

with a similar structure to the expiring programme. The programme

saw an increase in reinsurance rates for property of 8% and

casualty of 2% which was a very positive result in the current

environment of hardening rates in the reinsurance market reflecting

geopolitical and macroeconomic shocks. The net expense from

reinsurance contracts held increased by EUR22.4m as recoverables

from reinsurers reduced by EUR20.1m, primarily due to expected

recoveries on Business Interruption claims reducing, as well as

reinsurance premium increases year on year of EUR2.3m.

Weather, Claims Frequency and Large Claims

No significant weather events of note occurred in the first six

months of 2023.

We observed an increase in the frequency of injury claims in the

first half of 2023 although the frequency of these claims continues

to remain significantly below pre-Covid levels.

Large injury claims, defined as a value greater than EUR250k,

notified to date in 2023 are lower than the average of previous

pre-Covid years.

Expenses

The Group's expense ratio is 27.1% (2022: 25.7%). Insurance

acquisition expenses and Non-attributable expenses are combined to

calculate the total expense cost of EUR52.8m (2022: EUR47.8m). The

increase is made up of inflationary impacts on salary costs, IT

spend and other utility costs with an increase in depreciation

costs as FBD increase capital investment in the business.

Commission also increased as our partnerships with intermediaries

continue to grow.

INDUSTRY ENVIRONMENT

An appeal to the Supreme Court in respect of the Personal Injury

Guidelines was heard at the end of February 2023. We are awaiting

the Judgement, but have no indication as to the timeline for

delivery. There are still a number of challenges over the

constitutionality of the laws underpinning the Guidelines. Court

backlogs have eased, with trial dates secured within pre-Covid

timelines, however, we note Claimants' Solicitors still have a

greater say around the timing of cases being called for trial.

We still await the outcome of the review to determine if the

Judiciary or the Minister of Justice and Equality should be allowed

to determine the discount rate and review it at intervals. The

delay in this decision may raise the potential of a challenge to

the discount rate. The Court & Civil Law (Miscellaneous

Provisions) Bill 2022 was signed into law in July 2023. Part 3 of

the Act sets out that the indexation of periodic payment orders

will no longer be fixed solely on the Consumer Price Index.

Instead, the indexation rate will be set by ministerial regulations

based on a broad range of more flexible factors. We note these

ministerial regulations are yet to be published with no timeline

for introduction indicated.

Amendments to Occupiers Liability Act 1995 were signed into law

in July as part of the Courts and Civil Law (Miscellaneous

Provisions) Bill 2022. An important part of the amendment is the

introduction of the concept of "Voluntary Assumption of Risk",

which seeks to broaden the circumstances in which an occupier may

be relieved of liability. For trespassers and recreational users

the amendment seeks to ensure that for an occupier to be held

liable the appropriate test is one of recklessness and not of

reasonable grounds. The amendment also provides that, apart from

exceptional circumstances, where a person enters onto a premises

for the purpose of committing an offence or while on the premises

commits an offence, the occupier will not be liable.

The following legislative changes impacting insurance have been

enacted in the year to date:

-- Irish Motor Insurance Database (IMID) - The next phase of the

previously named Motor Third Party Liability project (MTPL)

requires sharing of additional data on insured vehicles and drivers

with Regulatory Authorities. FBD is committed to adhering to

industry timelines.

-- The Road Traffic Act (RTA) legislation has been extended to

better regulate the use of scramblers/quads and

e-bike/e-scooters.

-- Assisted Decision Making Act - The Act came into effect on

the 26 April 2023. We are working on a number of changes including

updating our Vulnerable Customer Policy, scenario testing,

reviewing the customer journey and training.

-- Amendments to Occupiers Liability Act - Changes to amend the

"common duty of care" provisions in the Occupiers' Liability Act

1995.

A number of additional changes impacting insurance are

progressing through the legislative process:

-- The Motor Insurance Directive (MID) primarily deals with the

scope of compulsory insurance broadening the potential scenarios

where RTA cover will apply. European council have reached a

provisional agreement on the revision of the MID.

-- Flood Insurance Bill - This is a private member bill at early

stage of debate, the purpose of the bill is to provide for fairness

in the market for property insurance, which will force insurers to

offer flood cover to homes and businesses in flood affected

areas.

-- Protection of the Collective Interests of Consumers Bill 2023

- Proposed legislation transposes an EU directive and gives

designated "Qualified Entities" the power to take enforcement

action on behalf of a group of consumers whose rights have been

breached in Ireland or in another EU country. This Bill is

currently before the Seanad at the 3(rd) stage of debate.

-- Consumer Insurance Contracts (Amendment) Bill 2023 - This

Bill is currently at the second stage of debate in the Seanad and

proposes to ban the use of "clauses of average" in non-life

insurance contracts. FBD has provided its response to Insurance

Ireland on the proposed Bill, with the immediate concerns being

this legislation at present does not state the ban is only

applicable to new policies, and should not apply in entirety to

commercial policies. Introduction of a change in legislation in the

middle of a policy term as proposed would have an immediate impact

on Insurer reserving and pricing. A timed amendment has been passed

and the Bill will have to be reintroduced in June 2024 for

discussion.

We recently passed the anniversary of the Differential Pricing

regulations, meaning all policies have been through a cycle under

the new regulations. We continue to support the Central Bank of

Ireland with their data requests in this area, and we continue to

actively monitor the impact of the changes on our portfolio.

GENERAL

FBD's Combined Operating Ratio (COR) was 81.1% (2022: 86.6%).

The calculation of COR has changed under IFRS 17 (see APMs).

Investment Return

FBD's actual investment return for the first six months of 2023

was 1.5% (2022: -6.6%). 0.7% (2022: -1.3%) is recognised in the

Consolidated Income Statement and 0.8% (2022: -5.3%) in the

Consolidated Statement of Other Comprehensive Income (OCI).

Interest rates stabilised in the first half of 2023 after

extraordinary rate increases in 2022. Although the ECB continued to

raise its benchmark deposit rate during the first 6 months of 2023,

these rises were largely priced into FBD's 5 year benchmark

interest rate which remained largely unchanged over the half year.

The pull-to-par effect on the bond portfolios was the main

contributor to OCI returns, also aided with some spread narrowing

for corporate bonds. Bond maturities continue to be reinvested at

higher interest rates, which is gradually increasing the income

earned on these portfolios through the Income Statement.

Risk assets in general posted positive returns for the first six

months of the year. This was despite rising interest rates

threatening to cause a recession in many developed countries. The

bankruptcy of Silicon Valley Bank in the US and the forced takeover

of Credit Suisse in Europe threatened to cause a wider banking

crisis, however the situation was very much confined to US regional

banks. Rising interest rates did result in one of the Company's

corporate bonds being downgraded below investment grade. The

Company decided to sell the bond resulting in a realised loss of

EUR0.9m. The Company also wrote down the value of its investment

property by 5% (EUR0.75m), on advice from its valuation agent.

Financial Services and Other Group activities

The Group's financial services operations returned a loss before

tax of EUR0.1m for the period (2022 profit: EUR0.2m). Other Group

activities includes Holding Company costs which increased by

EUR0.3m to EUR1.8m due to inflation as well as additional costs

incurred for new reporting requirements.

Profit per share

The diluted profit per share is 89 cent per ordinary share,

compared to a profit of 6 cent per ordinary share in 2022.

Dividend

The Board has approved a special dividend of 100 cent per

ordinary share returning a portion of the excess capital to

shareholders. We will continue to monitor our capital position with

the intention of moving closer to our target capital based on risk

appetite.

The special dividend approved by the Board on 10 August 2023

will be paid on 20 October 2023 to the holders of shares on the

register on 15 September 2023. The dividend is subject to

withholding tax ("DWT") except for shareholders who are exempt from

DWT and who have furnished a properly completed declaration of

exemption to the Company's Registrar from whom further details may

be obtained.

STATEMENT OF FINANCIAL POSITION

Capital position

Ordinary shareholders' funds at 30 June 2023 amounted to

EUR456.9m (31 December 2022: EUR454.0m restated). The increase in

shareholders' funds is driven by the following:

-- Profit after tax for the half year of EUR33.3m;

-- An increase of EUR1.4m due to share based payments;

-- Mark to market gains on investments in debt securities

measured at FVOCI of EUR7.6m after tax;

-- Net of a decrease in the defined benefit pension scheme surplus of EUR0.9m after tax;

-- Insurance finance expense for insurance and reinsurance contracts of EUR2.3m after tax; and

-- Dividend payments of EUR36.2m in respect of 2022 financial year.

Net asset value per ordinary share is 1,274 cent, compared to

1,276 cent per share at 31 December 2022.

Investment Allocation

The Group has a conservative investment strategy that ensures

that its technical reserves are matched by cash and fixed interest

securities of similar nature and duration. The Company's deposits

and cash reduced as the 2022 dividend was paid and EUR10m was

invested in risk assets in the first six months of the year. The

average credit quality of the corporate bond portfolio has remained

at A- and has seen a reduction in allocation to BBB rated bonds

(40% vs 42% at 31 December 2022).

The allocation of the Group's investment assets is as

follows:

30 June 2023 31 December 2022

(restated)

EURm % EURm %

Corporate bonds 575 51% 563 49%

Government bonds 276 24% 271 24%

Deposits and cash 124 11% 175 15%

Other risk assets 92 8% 83 7%

Equities 56 5% 50 4%

Investment property 14 1% 15 1%

1,137 100% 1,157 100%

--------- ------ ----------- --------

Solvency

The Half Year Solvency Capital Ratio (SCR) is 217% (unaudited).

The audited SCR at 31 December 2022 was 226%. The Group is

committed to maintaining a strong solvency position.

RISKS AND UNCERTAINTIES

The principal risks and uncertainties faced by the Group are

outlined on pages 21 to 28 of the Group's Annual Report for the

year ended 31 December 2022 and continue to apply to the six month

period ended 30 June 2023. Inflation is expected to moderate due to

falling energy prices although price levels are still higher since

the Russian invasion of Ukraine, which is difficult for businesses

to afford and poses cost of living challenges for consumers.

The Personal Injury Guidelines are positively impacting the

claims environment although continuing challenges have resulted in

delayed settlements that may result in increased legal costs. A

higher degree of uncertainty still exists in the environment as the

claims payment patterns and average settlement costs of more recent

years are a less reliable future indicator and must be carefully

considered by the Actuarial function when arriving at claims

projections. The delays in claim settlements are likely to increase

legal costs further as well as additional inflation.

Substantial inflation in materials and labour continue to impact

the Motor and the Construction industries which has a knock on

effect on claims costs. There is a risk of continually increasing

settlement costs in future years and potentially higher injury

claims costs in the near future as pressure mounts on salary

inflation.

FBD model forward looking projections of key financial metrics

on a periodic basis based on an assessment of the likely operating

environment over the next number of years. The projections reflect

changes of which we are aware and other uncertainties that may

impact future business plans and includes assumptions on the

potential impact on revenue, expenses, claims frequency, claims

severity, investment market movements and in turn solvency. The

output of the modelling demonstrates that the Group is projected to

be profitable and remain in a strong capital position. However, the

situation can change and unforeseen challenges and events could

occur. The solvency of the Group remains solid and is currently at

217% (31 December 2022: 226%).

Central banks have continued to raise interest rates in an

effort to reduce stubbornly high inflation. Developed economies

have remained surprisingly resilient to higher interest rates,

however, there are real fears that continued higher rates will push

economies into recession and will increase default rates. Whether

monetary policy is sufficient to bring inflation under control

remains a risk. Also, whether the policy response will push

economies into a recession with consequent impact on asset

valuations continues to be a risk. Future financial market

movements and their impact on balance sheet valuations, pension

surplus and investment income are unknown and market risk is

expected to remain high for the foreseeable future.

The Group's Investment Policy, which defines investment limits

and rules and ensures there is an optimum allocation of

investments, is being continuously monitored. Regular review of the

Group's reinsurers' credit ratings, term deposits and outstanding

debtor balances is in place. All of the Group's reinsurers have a

credit rating of A- or better. All of the Group's fixed term

deposits are with financial institutions which have a minimum A-

rating. Customer defaults are at pre-pandemic levels and support is

provided to customers when required.

The Group continues to manage liquidity risk through ongoing

monitoring of forecast and actual cash flows. The Group's cash flow

projections from its financial assets are well matched to the cash

flow projections of its liabilities and it maintains a minimum

amount available on term deposit at all times. The Group's asset

allocation is outlined on page 8.

Businesses are refocusing on costs due to the ongoing energy and

cost of living crisis impacted by the war in Ukraine. There is a

risk that delaying the transition to a green economy due to

affordability may accelerate the already evident effects of climate

change, with more immediate impacts on insurers globally such as

reinsurance becoming increasingly more expensive and a reassessment

may be required of insurable risks.

The labour market is constantly evolving and changing with

certain skills in high demand making attracting and retaining

employees challenging. FBD continue to embed pandemic-based

learnings in the workplace culture including hybrid working,

flexibility, well-being initiatives and are committed to investing

in our employees' on-going skills development to meet future

needs.

OUTLOOK

The economic outlook for 2023 is projected to continue on a

solid growth path. Inflation is expected to reduce although high

prices and rising interest rates are still expected to impact

growth. Unemployment is expected to remain low while labour

shortages may hold back growth expectations.

The increased acceptance rates of awards from the PIRB could

indicate the Personal Injury Guidelines are gaining more

acceptance, although their ultimate impact will not be known until

the challenges make their way through the courts and experience

develops of how the guidelines are implemented.

The Differential Pricing requirements have been in place for

over a year and all policies have gone through a renewal cycle. It

will take time to see the full effects of the changes on pricing in

the market as the insurance industry adapts, creating potential

opportunities and challenges.

Income projections on our bond portfolios have increased in the

years ahead due to the impact of higher reinvestment rates as

existing bonds mature.

Our sustainability journey continues as we focus our ESG

approach on where we can have a meaningful impact as we embed and

engage the broader company through the integration of ESG across

the business. We are currently assessing the gaps to delivering the

multiple reporting and disclosure requirements and putting plans

and processes in place to address. We are investigating Science

Based Targets in order to provide a benchmark for future

decarbonisation improvements and we have submitted an application

to sign up to the UN Principles for Sustainable Insurance.

FBD offers a valuable proposition to all our customers and they

continue to stay with us in ever increasing numbers which is

testament to our committed employees keeping the customer at the

heart of what we do. We will continue to strengthen our

relationship focus and extend our digital enablement as our

strategy evolves. Despite the headwinds of inflation and increasing

interest rates affecting all businesses, customers and employees,

FBD is profitable and growing and continuing to deliver for all our

stakeholders.

FBD HOLDINGS PLC

CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

CONDENSED CONSOLIDATED INCOME STATEMENT (UNAUDITED)

For the half year ended 30 June 2023

Half Half year Year

year

ended ended ended

30/06/23 30/06/22 31/12/22

Notes (restated)(1) (restated)(1)

EUR000s EUR000s EUR000s

Insurance revenue 6(a) 194,540 186,142 379,697

Insurance service expenses 6(c) (91,957) (127,322) (201,838)

Reinsurance expense (19,540) (17,232) (34,814)

Change in amounts recoverable from reinsurers

for incurred claims (17,640) 2,464 (11,941)

----------- --------------- ---------------

Net expense from reinsurance contracts

held 6(a) (37,180) (14,768) (46,755)

Insurance service result 6(a) 65,403 44,052 131,104

----------- --------------- ---------------

Total investment return 7 8,389 (15,281) (10,753)

----------- --------------- ---------------

Finance expense from insurance contracts

issued 5 (1,823) (6,213) (8,731)

Finance (expense)/income from reinsurance

contracts held 5 (281) 1,431 1,389

Net insurance finance expenses (2,104) (4,782) (7,342)

----------- --------------- ---------------

Net insurance and investment result 71,688 23,989 113,009

----------- --------------- ---------------

Other finance costs (1,272) (1,272) (2,559)

Non-attributable expenses 6(c) (16,165) (13,780) (33,048)

Movement in other provisions 16 (12,439) (5,241) (8,403)

Revenue from contracts with customers 6(a) 1,592 1,753 3,173

Financial services income and expenses (3,381) (2,940) (6,045)

Revaluation of property, plant and equipment 6(a) (546) - (287)

Profit before taxation 39,477 2,509 65,840

Income taxation charge 8 (6,170) (327) (8,284)

Profit for the period 33,307 2,182 57,556

----------- --------------- ---------------

Attributable to:

Equity holders of the parent 33,307 2,182 57,556

----------- --------------- ---------------

Half Half year Year

year

ended ended ended

30/06/23 30/06/22 31/12/22

Notes (restated) (restated)

Earnings per share Cent Cent Cent

Basic 9 91 6 161

----------- ------------ ------------

Diluted (2) 9 89 6 157

----------- ------------ ------------

(1) On 1 January 2023, IFRS 17 'Insurance Contracts' became

effective, replacing IFRS 4 'Insurance Contacts'. The Group

elected, as it met the criteria for a temporary exemption, to defer

the application of IFRS 9 'Financial Instruments' (replacing IAS

39) until 1 January 2023. See note 3 for updated accounting

policies and note 4 for transitional impact.

(2) Diluted earnings per share reflects the potential vesting of

share based payments.

FBD HOLDINGS PLC

CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

Condensed Consolidated Statement of Comprehensive Income

(UNAUDITED)

For the half year ended 30 June 2023

Half Half year Year

year

ended ended ended

30/06/23 30/06/22 31/12/22

Notes (restated)(1) (restated)(1)

EUR000s EUR000s EUR000s

Profit for the period 33,307 2,182 57,556

------------------ --------------- ---------------

Items that will or may be reclassified

to profit or loss in subsequent periods:

Movement on investments in debt securities

measured at FVOCI 7 7,720 (63,842) (89,761)

Movement transferred to the Consolidated

Income Statement on disposal during

the period 7 965 (11) (41)

Finance (expense)/income from insurance

contracts issued 5 (5,096) 35,670 42,388

Finance income/(expense) from reinsurance

contracts held 5 2,400 (7,832) (8,202)

Income tax relating to these items (749) 4,500 6,951

Items that will not be reclassified

to profit or loss:

Re-measurements of post-employment benefit

obligations, before tax (999) 3,899 (2,272)

Revaluation of owner occupied property - - 5

Income tax relating to these items 125 (485) 282

------------------ --------------- ---------------

Other comprehensive income/(expense)

after taxation 4,366 (28,101) (50,650)

------------------ --------------- ---------------

Total comprehensive income/(expense)

for the period 37,673 (25,919) 6,906

------------------ --------------- ---------------

Attributable to:

Equity holders of the parent 37,673 (25,919) 6,906

------------------ --------------- ---------------

(1) On 1 January 2023, IFRS 17 'Insurance Contracts' became

effective, replacing IFRS 4 'Insurance Contacts'. The Group

elected, as it met the criteria for a temporary exemption, to defer

the application of IFRS 9 'Financial Instruments' (replacing IAS

39) until 1 January 2023. See note 3 for updated accounting

policies and note 4 for transitional impact.

FBD HOLDINGS PLC

CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

Condensed Consolidated Statement of Financial Position

(UNAUDITED)

At 30 June 2023

Assets Half Half year Year

year

Notes ended ended ended

30/06/23 30/06/22 31/12/22

(restated)(1) (restated)(1)

EUR000s EUR000s EUR000s

Cash and cash equivalents 12 113,833 148,771 165,240

Equity and debt instruments at fair

value through profit or loss 10 149,147 131,583 134,094

Debt instruments at fair value through

other comprehensive income 10 851,124 851,805 833,865

Deposits 10 10,000 20,000 10,000

Investment assets 1,010,271 1,003,388 977,959

----------- --------------- ---------------

Other receivables 11 23,689 20,161 15,148

Loans 10 506 520 568

Reinsurance contract assets 15 120,234 158,069 136,657

Retirement benefit surplus 20 7,500 14,800 8,499

Intangible assets 19,083 10,074 14,082

Policy administration system 21,530 27,081 23,683

Investment property 14,304 16,053 15,052

Right of use assets 3,896 4,683 4,290

Property, plant and equipment 22,442 23,439 22,745

Deferred taxation asset 17 2,924 2,174 3,629

Total assets 1,360,212 1,429,213 1,387,552

----------- --------------- ---------------

(1) On 1 January 2023, IFRS 17 'Insurance Contracts' became

effective, replacing IFRS 4 'Insurance Contacts'. The Group

elected, as it met the criteria for a temporary exemption, to defer

the application of IFRS 9 'Financial Instruments' (replacing IAS

39) until 1 January 2023. See note 3 for updated accounting

policies and note 4 for transitional impact.

FBD HOLDINGS PLC

CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

Condensed Consolidated Statement of Financial Position

(UNAUDITED) ( continued)

At 30 June 2023

Liabilities and equity Half Half year Year

year

ended ended ended

30/06/23 30/06/22 31/12/22

(restated)(1) (restated)(1)

Notes EUR000s EUR000s EUR000s

Liabilities

Current taxation liabilities 1,650 13,520 2,399

Other payables 18 39,875 30,805 35,628

Other provisions 16 16,750 10,062 11,103

Reinsurance contract liabilities 15 656 458 610

Insurance contract liabilities 15 787,522 897,112 826,621

Lease liabilities 4,214 4,974 4,600

Subordinated debt 49,690 49,632 49,662

Total liabilities 900,357 1,006,563 930,623

----------- --------------- ---------------

Equity

Called up share capital presented

as equity 13 21,745 21,583 21,583

Capital reserves 33,257 28,738 30,192

Retained earnings 444,777 400,346 450,318

Other reserves 14 (42,847) (30,940) (48,087)

Shareholders' funds equity interests 456,932 419,727 454,006

----------- --------------- ---------------

Preference share capital 2,923 2,923 2,923

Total equity 459,855 422,650 456,929

----------- --------------- ---------------

Total liabilities and equity 1,360,212 1,429,213 1,387,552

----------- --------------- ---------------

(1) On 1 January 2023, IFRS 17 'Insurance Contracts' became

effective, replacing IFRS 4 'Insurance Contacts'. The Group

elected, as it met the criteria for a temporary exemption, to defer

the application of IFRS 9 'Financial Instruments' (replacing IAS

39) until 1 January 2023. See note 3 for updated accounting

policies and note 4 for transitional impact.

FBD HOLDINGS PLC

CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

Condensed Consolidated Statement of Cash Flows (UNAUDITED)

For the half year ended 30 June 2023

Half year Half year Year

ended 30/06/22

ended (restated)(1) ended

31/12/22

(restated)(1)

30/06/23

EUR000s EUR000s EUR000s

Cash flows from operating activities

Profit before taxation 39,477 2,509 65,840

Adjustments for:

Movement on investments classified as fair

value (3,096) 20,663 19,616

Interest and dividend income (8,809) (5,895) (11,510)

Depreciation/amortisation of property, plant

and equipment, intangible assets and policy

administration system 5,648 4,943 13,239

Depreciation on right of use assets 394 395 788

Share based payment expense 1,419 1,227 2,681

Fair value movement on investment property 748 1 1,003

Revaluation of property, plant and equipment 546 - 287

----------- ---------------- ----------------

Operating cash flows before movement in working

capital 36,327 23,843 91,944

----------- ---------------- ----------------

Movement on insurance and reinsurance contract

liabilities/assets (25,326) 45,459 2,879

Movement on other provisions 5,397 (2,209) (1,168)

Movement on other receivables (6,429) (4,266) 1,274

Movement on other payables 5,773 2,797 9,023

Interest on lease liabilities 92 106 216

Cash generated from operations 15,834 65,730 104,168

----------- ---------------- ----------------

Interest and dividend income received 6,694 5,909 10,998

Income taxes (paid)/refunded (6,836) 4,706 (12,603)

----------- ---------------- ----------------

Net cash generated from operating activities 15,692 76,345 102,563

----------- ---------------- ----------------

Cash flows from investing activities

Purchase of investments classified as fair

value through other comprehensive income (92,658) (166,911) (238,126)

Sale of investments classified as fair value

through other comprehensive income 82,127 142,007 203,750

Purchase of investments classified as fair

value through profit or loss (24,503) (16,154) (25,312)

Sale of investments classified as fair value

through profit or loss 14,503 4,415 13,573

Purchase of property, plant and equipment (1,383) (453) (1,288)

Additions to policy administration system (1,297) (2,021) (4,566)

Purchase of intangible assets (6,056) (1,873) (6,987)

Movement on loans 62 40 (8)

Additional deposits invested with banks - (20,000) (10,000)

----------- ---------------- ----------------

Net cash used in investing activities (29,205) (60,950) (68,964)

----------- ---------------- ----------------

Cash flows from financing activities

Ordinary and preference dividends paid (36,166) (35,870) (35,870)

Interest payment on subordinated debt (1,250) (1,250) (2,500)

Principal elements of lease payments (478) (480) (965)

----------- ---------------- ----------------

Net cash used in financing activities (37,894) (37,600) (39,335)

----------- ---------------- ----------------

Net decrease in cash and cash equivalents (51,407) (22,205) (5,736)

Cash and cash equivalents at the beginning

of the period 165,240 170,976 170,976

----------- ---------------- ----------------

Cash and cash equivalents at the end of the

period 113,833 148,771 165,240

----------- ---------------- ----------------

(1) On 1 January 2023, IFRS 17 'Insurance Contracts' became

effective, replacing IFRS 4 'Insurance Contacts'. The Group

elected, as it met the criteria for a temporary exemption, to defer

the application of IFRS 9 'Financial Instruments' (replacing IAS

39) until 1 January 2023. See note 3 for updated accounting

policies and note 4 for transitional impact.

FBD HOLDINGS PLC

CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

Condensed Consolidated Statement of Changes in Equity

(UNAUDITED)

For the half year ended 30 June 2023

Call up Capital Retained Other Attributable Preference Total

share capital reserve earnings reserves to ordinary share capital equity

presented shareholders

as equity

EUR000s EUR000s EUR000s EUR000s EUR000s EUR000s EUR000s

--------------- --------- ---------- ---------- -------------- --------------- ---------

As at 31 December

2022, as previously

reported 21,583 30,192 370,258 755 422,788 2,923 425,711

--------------- --------- ---------- ---------- -------------- --------------- ---------

Impact of application

of IFRS 17 (Note 4) - - 10,518 20,984 31,502 - 31,502

Impact of application

IFRS 9 (Note 4) - - 69,542 (69,826) (284) - (284)

--------------- --------- ---------- ---------- -------------- --------------- ---------

Restated balance at 1

January 2023 21,583 30,192 450,318 (48,087) 454,006 2,923 456,929

--------------- --------- ---------- ---------- -------------- --------------- ---------

Profit after taxation - - 33,307 - 33,307 - 33,307

Other comprehensive

(expense)/income for

the period - - (874) 5,240 4,366 - 4,366

--------------- --------- ---------- ---------- -------------- --------------- ---------

Total comprehensive

income for the

period - - 32,433 5,240 37,673 - 37,673

Dividends paid and

approved on ordinary

and

preference shares - - (36,166) - (36,166) - (36,166)

Issue of ordinary

shares* 162 1,646 (1,808) - - - -

Recognition of share

based payments - 1,419 - - 1,419 - 1,419

--------------- --------- ---------- ---------- -------------- --------------- ---------

Balance at 30 June

2023 21,745 33,257 444,777 (42,847) 456,932 2,923 459,855

--------------- --------- ---------- ---------- -------------- --------------- ---------

As at 31 December

2021, as previously

reported 21,409 27,406 422,815 752 472,382 2,923 475,305

--------------- --------- ---------- ---------- -------------- --------------- ---------

Impact of initial

application of IFRS

17

(Note 4) - - 17,190 (8,928) 8,262 - 8,262

Impact of initial

application IFRS 9

(Note

4) - - (9,106) 8,751 (355) - (355)

--------------- --------- ---------- ---------- -------------- --------------- ---------

Restated balance at 1

January 2022 21,409 27,406 430,899 575 480,289 2,923 483,212

--------------- --------- ---------- ---------- -------------- --------------- ---------

Profit after taxation - - 2,182 - 2,182 - 2,182

Other comprehensive

income/(expense) for

the period - - 3,414 (31,515) (28,101) - (28,101)

Total comprehensive

income/(expense) for

the period - - 5,596 (31,515) (25,919) - (25,919)

Dividends paid and

approved on ordinary

and

preference shares - - (35,870) - (35,870) - (35,870)

Issue of ordinary

shares* 174 105 (279) - - - -

Recognition of share

based payments - 1,227 - - 1,227 - 1,227

Balance at 30 June

2022 21,583 28,738 400,346 (30,940) 419,727 2,923 422,650

--------------- --------- ---------- ---------- -------------- --------------- ---------

* In 2022 and 2023 new ordinary shares were allotted to

employees of FBD Holdings plc as part of the performance share

awards scheme.

FBD HOLDINGS PLC

CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

Condensed Consolidated Statement of Changes in Equity

(UNAUDITED) ( continued)

For the half year ended 30 June 2023

Call up Capital Retained Other Attributable Preference Total

share capital reserve earnings reserves to ordinary share capital equity

presented shareholders

as equity

EUR000s EUR000s EUR000s EUR000s EUR000s EUR000s EUR000s

As at 31 December

2021, as previously

reported 21,409 27,406 422,815 752 472,382 2,923 475,305

--------------- --------- ---------- ---------- -------------- --------------- ---------

Impact of initial

application of IFRS

17

(Note 4) - - 17,190 (8,928) 8,262 - 8,262

Impact of initial

application IFRS 9

(Note

4) - - (9,106) 8,751 (355) - (355)

--------------- --------- ---------- ---------- -------------- --------------- ---------

Restated balance at 1

January 2022 21,409 27,406 430,899 575 480,289 2,923 483,212

Profit after taxation - - 57,556 - 57,556 - 57,556

Other comprehensive

expense for the year - - (1,988) (48,662) (50,650) - (50,650)

Total comprehensive

income/(expense) for

the year - - 55,568 (48,662) 6,906 - 6,906

Dividends paid and

approved on ordinary

and

preference shares - - (35,870) - (35,870) - (35,870)

Issue of ordinary

shares* 174 105 (279) - - - -

Recognition of share

based payments - 2,681 - - 2,681 - 2,681

Balance at 31

December 2022 21,583 30,192 450,318 (48,087) 454,006 2,923 456,929

--------------- --------- ---------- ---------- -------------- --------------- ---------

* In 2022 new ordinary shares were allotted to employees of FBD

Holdings plc as part of the performance share awards scheme.

FBD HOLDINGS PLC

NOTES TO THE CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

(UNAUDITED)

For the half year ended 30 June 2023

Note 1 Statutory information

The half yearly financial information is considered

non-statutory financial statements for the purposes of the

Companies Act 2014 and in compliance with section 340(4) of that

Act we state that:

-- the financial information for the half year to 30 June 2023

does not constitute the statutory financial statements of the

Company;

-- the statutory financial statements for the financial year

ended 31 December 2022 have been annexed to the annual return and

delivered to the Registrar;

-- the statutory auditors of the Company have made a report

under section 391 Companies Act 2014 in respect of the statutory

financial statements for year ended 31 December 2022; and

-- the matters referred to in the statutory auditors' report

were unqualified, and did not include a reference to any matters to

which the statutory auditors drew attention by way of emphasis

without qualifying the report.

PricewaterhouseCoopers, Chartered Accountants and Statutory

Audit Firm, have performed an interim review in accordance with

International Standard on Review Engagements (Ireland) 2410,

'Review of Interim Financial Information Performed by the

Independent Auditor of the Entity' ("ISRE (Ireland) 2410") issued

for use in Ireland' on the interim financial information for the

period ended 30 June 2023. As part of this review they also

reviewed the IFRS 17 and IFRS 9 transition impacts on the

comparative information.

Note 2 Going concern

The Directors have, at the time of approving the interim

financial statements, a reasonable expectation that the Company and

the Group have adequate resources to continue in operational

existence for the foreseeable future being a period of not less

than 12 months from the date of this report.

In making this assessment the Directors considered up to date

solvency, liquidity and profitability projections for the Group.

The basis of this assessment was the latest quarterly forecast for

2023 and projections for 2024 which reflect the latest assumptions

used by the business. The economic environment may impact on

premiums including exposures, new business and retention levels.

Expense assumptions can change depending on the level of premiums

as discretionary spend and resources are adjusted and inflationary

pressures are taken into account.

A number of scenario projections were also run as part of the

Own Risk Solvency Assessment (ORSA) process, including a number of

more extreme stress events, and in all scenarios the Group's

capital ratio remained in excess of the Solvency Capital

Requirement and in compliance with liquidity policies.

The Directors considered the liquidity requirements of the

business to ensure it is projected to have cash resources available

to pay claims and other expenditures as they fall due. The business

is expected to have adequate cash resources available to support

business requirements. In addition the Group has a highly liquid

investment portfolio with over 50% of the portfolio invested in

corporate and sovereign bonds with a minimum A- rating. In the

worst case scenario run the Group's Capital Ratio remained in

excess of the Solvency Capital Requirement and in compliance with

liquidity policies.

Note 3 Summary of significant accounting policies

Basis of preparation

The annual financial statements of FBD Holdings plc are prepared

in accordance with International Financial Reporting Standards

("IFRSs") as adopted by the European Union. The condensed set of

financial statements included in this half-yearly financial report

has been prepared in accordance with IAS 34 'Interim Financial

Reporting', as adopted by the European Union.

On the basis of the projections for the Group, the Directors are

satisfied that there are no material uncertainties which cast

significant doubt on the ability of the Group or Company to

continue as a going concern over the period of assessment being not

less than 12 months from the date of this report. Therefore the

Directors continue to adopt the going concern basis of accounting

in preparing the financial statements.

Consistency of accounting policies

The below accounting policies have been updated for the

application of IFRS 17 and IFRS 9 (see note 4). Apart from the

updated accounting policies included hereafter to address IFRS 17

and IFRS 9, the methods of computation used by the Group to prepare

the interim financial statements for the six month period ended 30

June 2023 are the same as those used to prepare the Group Annual

Report for the year ended 31 December 2022 (reference Note 3 of FBD

Holdings plc Annual Report 2022). Other than the adoption of IFRS

17 and IFRS 9 there are no other impacts from the adoption of other

standards and amendments.

FBD HOLDINGS PLC

NOTES TO THE CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

(UNAUDITED)

For the half year ended 30 June 2023

Note 3 Summary of significant accounting policies (continued)

E) Insurance contracts

I. Definition and classification

The Group issues insurance contracts in the normal course of

business, under which it accepts significant insurance risk from

its policyholders. As a general guideline, the Group determines

whether it has significant insurance risk by comparing benefits

payable after an insured event with benefits payable if the insured

event did not occur. Insurance contracts can also transfer

financial risk. The Group issues non-life insurance to individuals

and businesses. Non-life insurance products offered include Motor,

Property, Liability and Personal Accident which are segmented into

Motor and Non-Motor for reporting. These products offer protection

of policyholder's assets and indemnification of other parties that

have suffered damage as a result of an insured event occurring.

In the normal course of business, the Group uses reinsurance to

mitigate its risk exposures. A reinsurance contract transfers

significant risk if it transfers substantially all the insurance

risk resulting from the insured portion of the underlying insurance

contracts, even if it does not expose the reinsurer to the

possibility of a significant loss.

II. Insurance and reinsurance contracts accounting treatment

Separating components from insurance and reinsurance

contract

Before the Group accounts for an insurance contract based on the

guidance of IFRS 17, it assesses whether the contract contains

distinct components which must be accounted for under another IFRS

instead of under IFRS 17. After separating any distinct components,

the Group applies IFRS 17 to all remaining components of the

insurance contract. Currently, engineering inspection risk, which

is not material, is the only non-insurance component which forms

part of any insurance contracts that requires unbundling.

Level of aggregation/Unit of account

The Group manages insurance contracts issued by product lines

within an operating segment, where each product line includes

contracts that are subject to similar risks. All insurance

contracts within a product line represent a portfolio of contracts.

Each portfolio is further disaggregated into groups of contracts

that are issued within a calendar year (annual cohorts) and are (i)

contracts that are onerous at initial recognition; (ii) contracts

that at initial recognition have no significant possibility of

becoming onerous subsequently; or (iii) a group of remaining

contracts. These groups represent the level of aggregation at which

insurance contracts are initially recognised and measured.

The profitability of groups of contracts is assessed by

actuarial valuation models that take into consideration existing

and new business. FBD assumes that no contracts in the portfolio

are onerous at initial recognition unless facts and circumstances

indicate otherwise. By the nature of the insurance risks covered by

the Group, all of the contracts issued have a maximum claim pay-out

potential that is greater than the premium received. On this basis

there are currently no contracts grouped into 'no significant

possibility of becoming onerous'.

Recognition, modification and de-recognition

The Group recognises groups of insurance contracts it issues

from the earliest of the following:

-- the beginning of the coverage period of the group of contracts;

-- the date when the first payment from a policyholder in the

group is due or when the first payment is received if there is no

due date; and

-- when the Group determines that a group of contracts becomes onerous.

Only contracts that meet the recognition criteria by the end of

the reporting period are included in the groups. When contracts

meet the recognition criteria in the groups after the reporting

date, they are added to the groups in the reporting period in which

they meet the recognition criteria, subject to the annual cohorts'

restriction. Composition of the groups is not reassessed in

subsequent periods.

The Group derecognises insurance contracts when:

-- the rights and obligations relating to the contract are

extinguished (i.e. discharged, cancelled or expired)

or

-- the contract is modified such that the modification results

in a change in the measurement model or the applicable standard for

measuring a component of the contract, substantially changes the

contract boundary, or requires the

FBD HOLDINGS PLC

NOTES TO THE CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

(UNAUDITED)

For the half year ended 30 June 2023

Note 3 Summary of significant accounting policies (continued)

E) Insurance contracts (continued)

II. Insurance and reinsurance contracts accounting treatment (continued)

Recognition, modification and de-recognition (continued)

modified contract to be included in a different group. In such

cases, the Group derecognises the initial contract and recognises

the modified contract as a new contract.

When a modification is not treated as a derecognition, the Group

recognises amounts paid or received for the modification with the

contract as an adjustment to the relevant liability for remaining

coverage (LRC).

Contract boundary

The Group includes in the measurement of a group of insurance

contracts all the future cash flows within the boundary of each

contract in the group. Cash flows are within the boundary of an

insurance contract if they arise from substantive rights and

obligations that exist during the reporting period in which the

Group can compel the policyholder to pay the premiums, or in which

the Group has a substantive obligation to provide the policyholder

with insurance contract services. A substantive obligation to

provide insurance contract services ends when the Group has the

practical ability to reassess the risks of the particular

policyholder and, as a result, can set a price or level of benefits

that fully reflects those risks.

Cash flows outside the insurance contracts boundary relate to

future insurance contracts and are recognised when those contracts

meet the recognition criteria.

Initial and subsequent measurement - groups of contracts

measured under the PAA

The Group applies the premium allocation approach (PAA) to all

the insurance contracts that it issues and reinsurance contracts

that it holds. The PAA is an optional simplified measurement model

in IFRS 17 that is available for insurance and reinsurance

contracts that meet the eligibility criteria.

The Group is eligible to apply the PAA because the following

criteria are met at initial recognition:

-- insurance contracts and losses-occurring reinsurance

contracts: The coverage period of each contract in the group is one

year or less.

-- risk-attaching reinsurance contracts: The Group reasonably

expects that the resulting measurement of the asset for remaining

coverage would not differ materially from the measurement that

would be produced applying the general measurement model (GMM).

The estimates of future cash flows:

-- are based on a probability weighted mean of the full range of possible outcomes;

-- are determined from the perspective of the Group, provided

the estimates are consistent with observable market prices for

market variables; and

-- reflect conditions existing at the measurement date.

The ultimate cost of outstanding claims is estimated by using a

range of standard actuarial claims projection techniques, such as,

but not limited to, Chain Ladder, Bornheutter-Ferguson, Initial

Expected Loss Ratio and frequency-severity methods.

The main assumption underlying these techniques is that a

group's past claims development experience can be used to project

future claims development and hence ultimate claims costs. These

methods extrapolate the development of paid and incurred losses,

average costs per claim (including claims handling costs), and

claim numbers based on the observed development of earlier years

and expected loss ratios. Historical claims development is mainly

analysed by accident years, but can also be further analysed by

significant business lines and claim types. Large claims are

separately addressed, separately projected in order to reflect

their future development. Explicit assumptions are made regarding

future rates of claims inflation or loss ratios. Additional

qualitative judgement is used to assess the extent to which past

trends may not apply in future, (e.g., to reflect one-off

occurrences, changes in external or market factors such as public

attitudes to claiming, economic conditions, levels of claims

inflation, judicial decisions and legislation, as well as internal

factors such as portfolio mix, policy features and claims handling

procedures) in order to arrive at the estimated ultimate cost of

claims that present the probability weighted expected value outcome

from the range of possible outcomes, taking account of all the

uncertainties involved.

In its claims incurred assessments, the Group uses internal and

market data. Internal data is derived mostly from the Group's

claims reports. This information is used to develop scenarios

related to the latency of claims that are used for the projections

of the ultimate number of claims.

FBD HOLDINGS PLC

NOTES TO THE CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

(UNAUDITED)

For the half year ended 30 June 2023

Note 3 Summary of significant accounting policies (continued)

E) Insurance contracts (continued)

II. Insurance and reinsurance contracts accounting treatment (continued)

Initial and subsequent measurement - groups of contracts

measured under the PAA (continued)

Some of the insurance contracts that have been written in the

property line of business permit the Group to sell property

acquired in settling a claim. The Group also has the right to

pursue third parties for payment of some or all costs. Estimates of

salvage recoveries and subrogation reimbursements are considered as

an allowance in the measurement of ultimate claims costs.

Other key circumstances affecting the reliability of assumptions

include delays in settlement and inflation rates.

An explicit risk adjustment for non-financial risk is estimated

separately from the other estimates. For contracts measured under

the PAA, unless the contracts are onerous, the explicit risk

adjustment for non-financial risk is only estimated for the

measurement of the liability for incurred claims (LIC).

The risk adjustment for non-financial risk is applied to the

present value of the estimated future cash flows and reflects the

compensation the Group requires for bearing the uncertainty about

the amount and timing of the cash flows from non-financial risk as

the Group fulfils insurance contracts. The Group does not

disaggregate the change in risk adjustment for non-financial risk

between a financial and non-financial portion and includes the

entire change as part of the insurance service result. Methods and

assumptions used to determine the risk adjustment for non-financial

risk are discussed in accounting policy U.

The Group does not adjust the LRC for insurance contracts issued

and the remaining coverage for reinsurance contracts held for the

effect of the time value of money as insurance premiums are due

within the coverage period of contracts, which is one year or less.

The estimates of future cash flows related to incurred claims are

adjusted using the current discount rates to reflect the time value

of money and the financial risks related to those cash flows, to

the extent not included in the estimates of cash flows. The

discount rates reflect the characteristics of the cash flows

arising from the groups of insurance contracts, including timing,

currency and liquidity characteristics of the insurance contracts.

The determination of the discount rate that reflects the

characteristics of the cash flows and liquidity characteristics of

the insurance contracts requires significant judgement and

estimation.

The Group estimates certain fulfilment cash flows (FCF) at the

portfolio level or higher and then allocates such estimates to

groups of contracts.

Insurance acquisition cash flows

The Group includes the following acquisition cash flows within

the insurance contract boundary that arise from selling,

underwriting and starting a group of insurance contracts and that

are:

-- costs directly attributable to individual contracts and groups of contracts; and

-- costs directly attributable to the portfolio of insurance

contracts to which the group belongs, which are allocated on a

reasonable and consistent basis to measure the group of insurance

contracts.

For all groups, insurance acquisition cash flows will be

allocated to related groups of insurance contracts and amortised

over the coverage period of the related group.

Cash flows that are not directly attributable to a portfolio of

insurance contracts, such as some product development and training

costs, are recognised in non-attributable expenses as incurred.

Initial measurement

The carrying amount of a group of insurance contracts issued at

the end of each reporting period is the sum of:

-- the LRC; and

-- the LIC, comprising the FCF related to past service allocated

to the group at the reporting date.

For insurance contracts issued, on initial recognition, the

Group measures the LRC at the amount of premiums received, less any

acquisition cash flows paid and any amounts arising from the

derecognition of the prepaid acquisition cash flows asset.

The Group estimates the LIC as the FCF related to incurred

claims.

Where facts and circumstances indicate that contracts are

onerous at initial recognition, the Group performs additional

analysis to determine if a net outflow is expected from the

contract. Such onerous contracts are separately grouped from other

contracts

FBD HOLDINGS PLC

NOTES TO THE CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

(UNAUDITED)

For the half year ended 30 June 2023

Note 3 Summary of significant accounting policies (continued)

E) Insurance contracts (continued)

II. Insurance and reinsurance contracts accounting treatment (continued)

Initial and subsequent measurement - groups of contracts

measured under the PAA (continued)

and the Group recognises a loss in the income statement for the

net outflow, resulting in the carrying amount of the liability for

the group being equal to the FCF. A loss component is established

by the Group for the LRC for such onerous groups depicting the

losses recognised and included in the LRC.

Subsequent measurement

For insurance contracts issued, at each of the subsequent

reporting dates, the LRC is:

-- increased for premiums received in the period;

-- decreased for insurance acquisition cash flows paid in the period;

-- decreased for the amounts recognised as insurance revenue for

the services provided in the period; and

-- increased for the amortisation of insurance acquisition cash

flows in the period recognised as insurance service expenses.

The FCF relating to incurred claims, therefore the LIC, is

updated by the Group for current assumptions at the end of every

reporting period, using the current estimates of the amount, timing

and uncertainty of future cash flows and of discount rates.

If a group of contracts becomes onerous, the Group increases the

carrying amount of the LRC to the amounts of the FCF determined

under the GMM with the amount of such an increase recognised in

insurance service expenses. Subsequently, the Group amortises the

amount of the loss component within the LRC by decreasing insurance

service expenses. The loss component amortisation is based on the

passage of time over the remaining coverage period of contracts

within an onerous group. If facts and circumstances indicate that

the expected profitability of the onerous group during the

remaining coverage has changed, then the Group remeasures the FCF

by applying the GMM and reflects changes in the FCF by adjusting

the loss component as required until the loss component is reduced

to zero.

Reinsurance contracts held

Reinsurance contracts held are measured on the same basis as

insurance contracts, except:

-- They are adapted to reflect the features of reinsurance

contracts that differ from insurance contracts;

-- That references to onerous contracts refer to contracts on

which there is a net gain on initial recognition. For some groups

of reinsurance contracts held, a group can comprise a single

contract. By the nature of the Group's reinsurance treaties

currently in effect, there are no reinsurance contracts held that

are a net gain on initial recognition nor that are deemed as having

no significant risk of being a gain.

-- The Group recognises a group of reinsurance contracts held it

has entered into from the earlier of the following:

o the beginning of the coverage period of the group of

reinsurance contracts held. (However, the Group delays the

recognition of a group of reinsurance contracts held that provide

proportionate coverage until the date any underlying insurance

contract is initially recognised, if that date is later than the

beginning of the coverage period of the group of reinsurance

contracts held); and

o the date the Group recognises an onerous group of underlying

insurance contracts if the Group entered into the related

reinsurance contract held in the group of reinsurance contracts

held at or before that date.

-- The risk adjustment represents the amount of risk being

transferred by the Group to the reinsurer.

-- That cash flows are within the contract boundary if they

arise from substantive rights and obligations of the Group that

exist during the reporting period in which the Group is compelled

to pay amounts to the reinsurer or in which the Group has a

substantive right to receive services from the reinsurer.

-- The excess of loss reinsurance contracts held provides

coverage for claims incurred during an accident year.

-- All cash flows arising from claims incurred and expected to

be incurred in the accident year are included in the measurement of

the reinsurance contracts held. Some of these contracts may include

reinstatement reinsurance premiums, which are guaranteed per the

contractual arrangements and are thus within the respective

reinsurance contracts' boundaries.

-- In the measurement of reinsurance contracts held, the

probability weighted estimates of the present value of future cash

flows include the potential credit losses and other disputes of the

reinsurer to reflect the non-performance risk of the reinsurer.

-- On initial recognition, the Group measures the remaining

coverage at the amount of ceding premiums paid. The carrying amount

of a group of reinsurance contracts held at the end of each

reporting period is the sum of:

o the remaining coverage; and

o the incurred claims, comprising the FCF related to past

service allocated to the group at the reporting date.

FBD HOLDINGS PLC

NOTES TO THE CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

(UNAUDITED)

For the half year ended 30 June 2023

Note 3 Summary of significant accounting policies (continued)

E) Insurance contracts (continued)

II. Insurance and reinsurance contracts accounting treatment (continued)

Reinsurance contracts held (continued)

-- Instead of at initial recognition, where the Group recognises

a loss on initial recognition of an onerous group of underlying

insurance contracts or when further onerous underlying insurance

contracts are added to a group, the Group establishes a

loss-recovery component of the asset for remaining coverage for a

group of reinsurance contracts held depicting the recovery of

losses. The loss-recovery component adjusts the carrying amount of

the asset for remaining coverage.

-- At each of the subsequent reporting dates, the remaining coverage is:

o increased for ceding premiums paid in the period; and

o decreased for the amounts of ceding premiums recognised as

reinsurance expenses for the services received in the period.

-- Instead of a loss component, the loss-recovery component

adjusts the carrying amount of the asset for remaining coverage.

Where a loss-recovery component has been established, the Group