Foxtons Group PLC Trading Update (3252F)

May 17 2017 - 1:00AM

UK Regulatory

TIDMFOXT

RNS Number : 3252F

Foxtons Group PLC

17 May 2017

FOXTONS GROUP PLC

Q1-2017 - Trading Update

17 May 2017

Foxtons plc (LSE: FOXT), London's leading estate agency, issues

the following trading update for the quarter ended 31 March 2017

ahead of its AGM today.

During the first quarter Foxtons performance has been in line

with the Board's expectations. Group revenue was GBP28.7m compared

to GBP38.4m in the first quarter last year and GBP26.4m in the

fourth quarter of 2016. This quarterly performance is set against

the record sales volumes in the first quarter last year when a

number of transactions were brought forward ahead of the stamp duty

surcharge on buy-to-let investments and second homes. Our first

quarter revenues comprised property sales commissions of GBP11.1m

(2016: GBP20.0m), lettings revenues of GBP15.5m (2016: GBP15.8m),

and mortgage broking fees of GBP2.1m (2016: GBP2.6m).

Foxtons holds a net cash position with no debt.

Foxtons will announce its interim results on 27 July 2017.

Contacts

Foxtons Group plc

Jenny Matthews, Investor Relations Manager +44 20 7893 6484

Tulchan Communications LLP

Peter Hewer / Jessica Reid +44 20 7353 4200

Forward Looking Statements

This trading update may include statements that are forward

looking in nature. Forward looking statements involve known and

unknown risks, assumptions, uncertainties and other factors which

may cause the actual results, performance or achievements of the

Group to be materially different from any future results,

performance or achievements expressed or implied by such forward

looking statements. Except as required by the Listing Rules and

applicable law, the Group undertakes no obligation to update,

revise or change any forward looking statements to reflect events

or developments occurring after the date such statements are

published.

About Foxtons Group plc

Foxtons is a multi-award-winning estate agency. It was founded

in 1981 with the first branch opened in Notting Hill Gate. Today

with 67 branches, the Group

focuses on the higher-volume, higher-value property markets in

London.

The Company is able to generate high margins through its

business model, which combines:

-- A strong, single brand;

-- High levels of centralisation allowing low cost expansion of branches;

-- An innovative application of technology; and

-- A powerful culture of sales and service through outstanding training and staff development

The Group has a clear strategy to grow profitability by:

-- Targeting higher-volume, higher-value residential property markets in London;

-- Maintaining a balance between sales and lettings;

-- Providing a premium service which supports premium prices;

-- Expanding organically to maximise return on capital; and

-- Positioning itself for sales volume market growth.

This information is provided by RNS

The company news service from the London Stock Exchange

END

TSTUNSORBBAVAAR

(END) Dow Jones Newswires

May 17, 2017 02:00 ET (06:00 GMT)

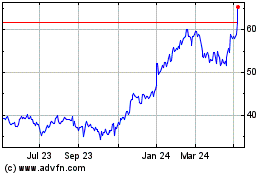

Foxtons (LSE:FOXT)

Historical Stock Chart

From Apr 2024 to May 2024

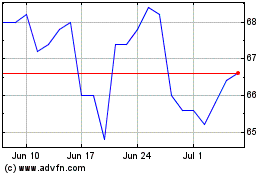

Foxtons (LSE:FOXT)

Historical Stock Chart

From May 2023 to May 2024