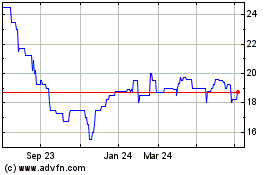

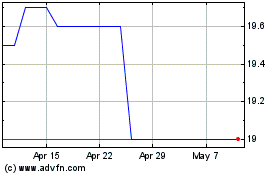

TIDMFPO

RNS Number : 5731D

First Property Group PLC

22 June 2023

On Behalf of: First Property Group plc ("First Property", the "Company" or the "Group")

Embargoed: 0700hrs

First Property Group plc

Preliminary results for the twelve months to 31 March 2023

First Property Group plc (AIM: FPO), the property fund manager

and investor with operations in the United Kingdom and Central

Europe, today announces its preliminary results for the twelve

months ended 31 March 2023.

Highlights since interim results:

-- Sold two directly owned supermarkets in Poland for GBP5.50

million generating a profit of GBP0.68 million.

-- 5th Property Trading Ltd (5PT), a fund in which the Group

gained a controlling interest following the purchase of an

additional 6.57% in shares, has been consolidated into the Group's

accounts.

-- Post the year end, launched a senior debt product for secured

lending against commercial property.

-- Second interim dividend, in lieu of a final dividend, of 0.25

pence per share paid on 5 April 2023, to make a total dividend of

GBP0.50 pence for the year (2022: GBP0.50 pence).

Financial summary:

Restated Percentage

Unaudited Audited change

year to year to

31 March 31 March

2023 2022

-------------------------------- ------------ ----------- -----------

Income Statement:

------------------------------------------------------------------------

Statutory profit before

tax GBP2.49m GBP7.08m -64.83%

Diluted earnings per share 1.70p 6.01p -71.71%

Total dividend per share 0.50p 0.50p -%

Average EUR/GBP exchange

rate 1.1567 1.1754 -

Financial Position at the year-end:

------------------------------------------------------------------------

Investment properties at

book value* GBP47.01m GBP36.20m +29.86%

Investment properties at

market value* GBP53.97m GBP42.24m +27.77%

Associates and investments

at book value GBP22.13m GBP26.58m -16.74%

Associates and investments

at market value GBP25.27m GBP30.60m -17.42%

Cash balances GBP7.65m GBP6.42m +19.16%

Cash per share 6.82p 5.81p +17.38%

Gross debt** GBP29.66m GBP23.66m +25.36%

Net debt** GBP22.00m GBP17.24m +27.61%

Gearing ratio at book value*** 40.57% 35.62%^ -

Gearing ratio at market 36.08% 31.25%^ -

value***

Net assets at book value**** GBP43.44m GBP42.77m^ +1.57%

Net assets at market value GBP52.54m GBP52.05m^ +0.94%

Adjusted net assets per

share (EPRA basis) 46.50p 46.07p^ +0.93%

Year-end EUR/GBP rate 1.1381 1.1834 -

*Investment properties includes properties of 5PT, previously

classed as an associate

**Debt comprises financial liabilities, including those

of 5PT

***Gearing ratio = Gross debt divided by gross

assets

****Attributable to the owners of the parent,

excludes non-controlling interests

^Restated, further details within the basis of

preparation section of the notes to the accounts.

Commenting on the results, Ben Habib, Chief Executive of First

Property Group plc, said:

"These are a creditable set of results in extremely challenging

times.

"The end of lockdowns should have ushered in a more normal

trading environment. Instead, we are experiencing the severe impact

of broken supply chains and labour markets. Together with the war

in Ukraine, the result has been rocketing inflation and a

concomitant increase in interest rates.

"Consequently, investment markets have been hit hard, with a

sharp reduction in debt availability and the volumes of property

being traded.

"Occupational demand is generally holding up better than

investment markets and we are making some inroads in letting the

space available at our office blocks in Warsaw and Gdynia.

"Given the general withdrawal of financing from the market, we

have established a platform for the provision of debt to finance

commercial property investments. It is too early to determine the

likely success of this venture but we believe it to be the right

product, launched at the right time."

A briefing for analysts and shareholders will be held at

11.00hrs today via Investor Meet Company. To participate it is

necessary to register at

https://www.investormeetcompany.com/first-property-group-plc/register-investor

and select to meet the Company. Those who have already registered

and selected to meet the Company will be automatically invited. A

copy of the accompanying investor presentation and a recording of

the call will be posted on the Company's website.

For further information please contact:

First Property Group plc Tel: +44 (20) 7340

0270

Ben Habib (Chief Executive Officer) www.fprop.com

Laura James (Group Finance Director) investor.relations@fprop.com

Jeremy Barkes (Director, Business

Development)

Jill Aubrey (Company Secretary)

Allenby Capital (NOMAD & Broker) Tel: + 44 (0) 20 3328

5656

Nick Naylor / Daniel Dearden-Williams

(Corporate Finance)

Amrit Nahal (Equity Sales)

Notes to Investors and Editors :

First Property Group plc is an award-winning property fund

manager and investor with operations in the United Kingdom and

Central Europe. Its focus is on higher yielding commercial property

with sustainable cash flows. The Company is flexible and takes an

active approach to asset management. Its earnings are derived

from:

-- Fund Management - via its FCA regulated and AIFMD approved

subsidiary, First Property Asset Management Ltd ("FPAM"), which

earns fees from investing for third parties in property. FPAM

currently manages twelve funds which are invested across the United

Kingdom, Poland and Romania.

-- Group Properties - principal investments by the Group, to

earn a return on its own capital, usually in partnership with third

parties. Investments include six directly held properties in

Poland, one in Romania, and non-controlling interests in nine of

the twelve funds.

Quoted on AIM, the Company has offices in London and Warsaw.

Around one third of the shares in the Company are owned by

management, directors and their families. Further information about

the Company and its properties can be found at: www.fprop.com .

CHIEF EXECUTIVE'S STATEMENT

Financial performance

I am pleased to report the Company's preliminary results for the

year ended 31 March 2023.

Revenue earned by the Group during the year amounted to GBP7.25

million (31 March 2022: GBP8.65 million) yielding a profit before

tax of GBP2.49 million (31 March 2022: GBP7.08 million). The profit

for the prior year, as explained in the accounts for that year, was

bolstered by the restructuring of the loan secured on the Group's

property in Gdynia.

The Group's profit was lower than in previous years due to the

sale of income producing properties and the re-investing of some of

these proceeds in the office block in Gdynia and in a further 32%

of Blue Tower in Warsaw. Both investments were largely vacant at

the time the investments were made and are now being leased up.

Further details on these investments are set out below.

The Group ended the year with net assets calculated under the

cost basis of accounting, excluding non-controlling interests, of

GBP43.44 million (2022: restated GBP42.77 million), equating to

39.18 pence per share (2022: restated 38.74 pence per share). It is

the accounting policy of the Group to carry its properties and

interests in associates at the lower of cost or market value.

The net assets of the Group when adjusted to their market value

less any deferred tax liabilities (EPRA basis), amounted to

GBP52.54 million or 46.50 pence per share (31 March 2022: restated

GBP52.05 million or 46.07 pence per share).

Gross debt amounted to GBP29.66 million at the year-end (31

March 2022: GBP23.66 million), GBP17.02 million of which was

non-interest bearing and represents deferred consideration payable

for the purchase of two properties in Poland (in Gdynia and Warsaw,

as referenced above). Net debt stood at GBP22.00 million (31 March

2022: GBP17.24 million). The debt was secured against six

properties in Poland and one in Romania.

The Group's gearing ratio with its properties at their book

value was 40.57% (31 March 2022: restated 35.62%) and with its

properties at their market value was 36.08% (31 March 2022:

restated 31.25%).

Group cash balances at the year-end stood at GBP7.65 million (31

March 2022: GBP6.42 million), equivalent to 6.82 pence per share

(31 March 2022: 5.81 pence per share).

Diluted earnings per share was 1.70 pence (2022: 6.01

pence).

As set out in previous accounts, the profit share earned by

Fprop Offices LP is subject to clawback. As a result of reductions

in the value of commercial property, an adjustment has been made to

the net assets of the Group as at 31 March 2022 to reflect the

likelihood of this clawback. No cash repayment has yet been made

but the Directors consider it prudent to make this adjustment. In

addition, the results for the year to 31 March 2023 include a

provision of GBP0.59 million which represents the balance of any

potential clawback.

Dividend

Instead of a final dividend (usually paid in September), a

second interim dividend of 0.25 pence per share was paid on 5 April

2023 (2022: Final dividend 0.25 pence per share), which together

with the first interim dividend of 0.25 pence per share equates to

a dividend for the year of 0.50 pence per share (2022: 0.50 pence

per share).

REVIEW OF OPERATIONS

PROPERTY FUND MANAGEMENT

Third party assets under management ended the year at GBP400.4

million (31 March 2022: GBP516.5 million).

The decrease was attributable to:

1. The sale by three funds of seven properties in the United

Kingdom valued at GBP69.0 million offset by the purchase by another

fund of one property, also in the United Kingdom, for GBP6.2

million;

2. A decrease in the value of the remainder of the portfolio of

some GBP52.4 million offset by foreign exchange gains of GBP4.8

million; and

3. The consolidation of 5PT into the Group's accounts, a fund

invested in three commercial properties in Poland with a value at

the date of acquisition of GBP7.62 million.

Fund management fees are generally levied monthly by reference

to the value of properties. In the case of Fprop Offices LP, the

Group is entitled to a share of total profits in lieu of fund

management fees and to receive annual payments on account

equivalent to 10% of total cumulative income profits and capital

gains. These payments are adjusted annually.

Revenue earned by this division decreased by 38% to GBP2.52

million (2022: GBP4.04 million), resulting in profit before

unallocated central overheads and tax decreasing by GBP1.32 million

to GBP0.12 million (2022: GBP1.44 million). The decrease was due to

the sale of properties held by three funds invested in the United

Kingdom, a reduction in value of properties generally, and a

provision for the possible clawback by Fprop Offices LP of GBP0.59

million in profit share.

At the year end fund management fee income, excluding

performance fees, was being earned at an annualised rate of GBP2.55

million (31 March 2022: GBP2.66 million).

The weighted average unexpired fund management contract term at

the year-end was 2 years, 9 months (31 March 2022: 3 years, 7

months).

The reconciliation of movement in third party funds managed by

FPAM during the year is shown below:

Funds managed for third parties (including

funds in which the Group is a minority

shareholder)

----------------------- -------------------------------------------------

UK CEE Total No. of

GBPm GBPm GBPm properties

----------------------- ---------- --------- --------- ---------------

As at 1 April 2022 345.5 171.0 516.5 62

----------------------- ---------- --------- --------- ---------------

Purchases 6.2 - 6.2 1

Property sa les (69.0) - (69.0) (7)

Reclassified as Group

properties - (7.6) (7.6) (3)

Capital expenditure 0.3 1.6 1.9 -

Property revaluation (41.6) (10.8) (52.4) -

FX revaluation - 4.8 4.8 -

----------------------- ---------- --------- --------- ---------------

As at 31 March 2023 241.4 159.0 400.4 53

----------------------- ---------- --------- --------- ---------------

An overview of the value of assets and maturity of each of the

funds managed by FPAM is set out below:

Fund Country Fund Assets No. of % of total Assets

of investment expiry under properties third-party under

management assets management

at market under at market

value at management value at

31 March 31 March

2023 2022

--------------- --------------- ------------- ------------- ------------ -------------- ----------------

GBPm. GBPm.

-------------------------------- ------------ -------------- ------------ -------------- --------------

SAM & DHOW UK Rolling * * * *

5PT** Poland Dec 2025 - - - 7.7

OFFICES UK Jun 2024 84.9 4 21.2 136.4

SIPS UK Jan 2025 104.7 21 26.1 140.6

FOP Poland Oct 2025 64.5 5 16.1 64.5

FGC Poland Mar 2026 22.0 1 5.5 21.3

UK PPP UK Jan 2027 28.1 10 7.0 41.5

SPEC OPPS UK Jan 2027 14.9 4 3.7 17.0

FKR Poland Mar 2027 16.8 1 4.2 19.4

FCL Romania Jun 2028 8.7 1 2.2 8.5

FPL Poland Jun 2028 47.0 4 11.8 49.6

FULCRUM UK Indefinite 8.8 2 2.2 10.0

--------------- --------------- ------------- ------------- ------------ -------------- ----------------

Total Third-Party

AUM 400.4 53 100.0 516.5

----------------------------------------------- ------------- ------------ -------------- ----------------

* Not subject to recent revaluation.

** The Group gained control of this fund in May 2022,

consolidating its Net Assets into the Group.

The sub sector weightings of investments in FPAM funds is set

out in the table below:

UK Poland Romania Total % of Total

------------------------ ------ ------- -------- ------ -----------

GBPm. GBPm. GBPm. GBPm.

------------------------ ------ ------- -------- ------ -----------

Offices 150.5 85.9 8.7 245.1 61.2%

Retail warehousing 62.3 - - 62.3 15.6%

Supermarkets 28.6 12.6 - 41.2 10.3%

Shopping centres - 51.8 - 51.8 12.9%

Total 241.4 150.3 8.7 400.4 100.0%

------------------------ ------ ------- -------- ------ -----------

% of Total Third-Party

AUM 60.3% 37.5% 2.2% 100%

------------------------ ------ ------- -------- ------ -----------

GROUP PROPERTIES

At 31 March 2023, Group Properties comprised seven directly

owned commercial properties in Poland and Romania valued at

GBP53.97 million (31 March 2022: seven valued at GBP42.24 million)

and interests in nine of the twelve funds managed by FPAM

(classified as Associates and Investments) in which the Group's

share is valued at GBP25.27 million (31 March 2022: GBP30.60

million).

The contribution to Group profit before tax and unallocated

central overheads from the Group Properties division was GBP3.43

million (31 March 2022: GBP8.60 million), representing 97% of Group

profit before unallocated central overheads and tax. The profit in

the prior year included the benefit of a GBP7.81 million debt

restructuring. In addition, the Group's investments in largely

vacant office property in Gdynia and Blue Tower with the proceeds

from the sale of income producing property have not yet turned

cashflow positive, though reasonable leasing progress is being

made.

The contribution to Group profit before tax and unallocated

central overheads from directly owned properties was GBP2.56

million (31 March 2022: GBP7.48 million) and the Associates and

Investments contributed GBP0.87 million (31 March 2022: GBP1.12

million).

1. Directly owned Group Properties (all accounted for under the cost model):

The book value of the Group's seven directly owned properties

was GBP47.01 million (31 March 2022: seven properties with a book

value of GBP36.20 million). The increase was mainly due to an

additional investment of GBP7.44 million in Blue Tower, Warsaw and

the consolidation of 5PT, which owns three properties in Poland

valued at GBP8.45 million, into the Group's accounts. Their market

value, based on valuations at 31 March 2023, was GBP53.97 million

(31 March 2022: seven properties valued at GBP42.24 million).

Country Sector Property/ No. Book Market *Contribution *Contribution

Fund Name of props value value to Group to Group

31 March 31 31 March profit profit

2023 March 2023 before before

2023 tax tax

31 March 31 March

2023 2022

--------- ------------- ------------ ---------- ------- ---------- -------------- --------------

GBPm. GBPm. GBPm. GBPm.

Poland Office Gdynia 1 14.20 14.50 (0.39) (0.86)

Poland Office Blue Tower 1 20.50 24.20 1.13 1.20

Poland Supermarket Praga 1 1.98 2.95 0.12 0.20

Romania Office Dr Felix 1 2.36 3.87 0.27 0.37

Poland Multi use 5PT*** 3 7.97 8.45 0.28 -

--------- ------------- ------------ ---------- ------- ---------- -------------- --------------

Total* 7 47.01 53.97 1.41 0.91

-------------------------------------- ---------- ------- ---------- -------------- --------------

Profit from the sale of three investment 1.78 -

properties

Debt restructuring on

finance lease** - 7.81

Other overhead costs allocated to the

Group Property division (0.63) (1.24)

----------------------------------------------------------------------- -------------- --------------

Total contributions to PBT from Group

Properties 2.56 7.48

----------------------------------------------------------------------- -------------- --------------

* Prior to the deduction of direct overhead and unallocated

central overhead expenses.

**Includes EUR9.00 million (GBP7.81 million) debt reduction

following restructuring of the finance lease at Gdynia.

***5PT, a fund in which the Group gained a controlling interest

(previously recognised as an associate).

Two of the Group's seven directly owned properties account for

72% (GBP38.70 million) of their total market value. Both are office

buildings in Poland of which one is Blue Tower (in which the

Group's 80.3% share totals circa 18,000 square metres) and the

other is in Gdynia (circa 13,500 square metres).

On 12 August 2022 the Group acquired some 7,171 square meters in

Blue Tower in Warsaw at a price of GBP7.20 million. The purchase

resulted in the Group's interest in the building increasing from

48.2% to 80.3%. Some 5,159 square metres of the newly acquired

space was vacant at purchase.

The Group's office property in Gdynia is now 28% leased, up from

20% at 31 March 2022. When fully let it is anticipated that the

building should generate net operating income of over GBP1.90

million per annum.

The Group's other directly owned properties include an office

block in Bucharest, Romania valued at GBP3.87 million, and four

properties in Poland held by consolidated undertakings valued at

GBP11.40 million. These comprise a mini-supermarket in Warsaw held

by E and S Estates Sp. Zo.o (E&S) (in which the Group owns an

aggregate 88.5% interest), and two retail units in Warsaw, a

mixed-use building in Warsaw, and an office block in Poznan all

held by 5PT (in which the Group owns 47.2% but is deemed to have

control).

In August 2022 the Group sold a warehouse in Tureni, Romania for

GBP3.11 million which realised a profit of GBP1.10 million.

In December 2022 the Group sold two supermarkets in Poland held

by E&S for GBP5.50 million which realised a profit of GBP0.68

million. The Group also refinanced the last remaining property held

by E&S, a supermarket valued at GBP2.95 million, releasing some

GBP1.50 million in cash.

The debt secured against these seven properties totalled

GBP29.66 million (31 March 2022: GBP23.66 million), of which only

GBP12.64 million was interest bearing. The remainder (GBP17.02

million) represents deferred consideration in respect of the

Group's purchase of its additional share in Blue Tower and for the

office block in Gdynia.

Interest costs on the Group's debt amounted to GBP0.53 million

(2022: GBP0.33 million). This equates to an average borrowing cost

of 1.8% per annum when expressed as a percentage of total

outstanding Group debt of GBP29.66 million, or 4.2% per annum if

the deferred consideration of GBP17.02 million, on which no

interest is payable, is excluded.

31 March 2023 31 March 2022

GBPm. GBPm.

Book value of directly owned

properties 47.01 36.20

Market value of directly owned

properties 53.97 42.24

Gross debt undiscounted (all

non-recourse to Group) 29.66 23.66

LTV at book value 63.09% 65.35%

LTV at market value 54.96% 56.01%

Average borrowing cost 1.8% 1.4%

-------------------------------- -------------- --------------

The average vacancy rate across all seven properties is

23.60%.

The weighted average unexpired lease term (WAULT) as at 31 March

2023 was 5 years, 2 months (2022: 5 years, 7 months).

2. Associates and Investments

These comprise non-controlling interests in nine of the twelve

funds managed by FPAM and are valued at GBP25.27 million (31 March

2022: GBP30.60 million). Of these, five are accounted for as

Associates and held at the lower of cost or fair value (the "cost

model"), and four are accounted for as Investments in funds and

held at fair value.

The contribution to Group profit before tax and unallocated

central overheads from its Associates and Investments decreased by

22.3% to GBP0.87 million (31 March 2022: GBP1.12 million). The

contribution was impacted by aggregate impairment provisions of

GBP0.90 million in the value of Fprop Krakow Ltd (FKR) and Fprop

Opportunities plc (FOP). In addition, another Associate, Fprop

Phoenix Ltd (FPL), made a loss after tax of which the Group's share

amounted to GBP0.85 million (2022: loss of GBP0.62 million).

An overview of the Group's Associates and Investments is set out

in the table below:

Fund % owned Book value Current Group's Group's

by of First market share share

First Property's value of of post-tax of post-tax

Property share in holdings profits profits

Group fund earned by earned by

fund fund

31 March 31 March

2023 2022

------ ---------- ------------ ---------- ------------- --------------

% GBP'000 GBP'000 GBP'000 GBP'000

------ ---------- ------------ ---------- ------------- --------------

a) Associates (all invested in Poland and Romania)

5PT * - - - 97

FRS ** - - - 47

FOP 45.7 12,679 12,679 293 1,044

FGC 29.1 3,058 3,303 289 221

FKR 18.1 1,155 1,155 (426) (12)

FPL 23.4 60 2,682 (848) (617)

FCL 21.2 636 908 64 67

------ ---------- ------------ ---------- ------------- --------------

Sub Total 17,588 20,727 (628) 847

------------------ ------------ ---------- ------------- --------------

*Consolidated into the Group from May 2022

**In liquidation

b) Investments (all invested in the United Kingdom)

UK PPP 0.9 272 272 40 100

FULCRUM 2.5 185 185 9 -

SPEC OPPS 11.1 2,624 2,624 1,353 23

OFFICES 1.6 1,463 1,463 95 148

---------------- -------- -------- -------- -------- -----

Sub Total 4,544 4,544 1,497 271

-------------------------- -------- -------- -------- -----

Total 22,132 25,271 869 1,118

------- ------- ------- ---- ------

3. New product: secured lending against commercial property

Post the year end the Group launched a senior debt product for

secured lending against commercial property.

With interest rates increasing and banks retreating from lending

to commercial property, the returns available in making relatively

safe loans are potentially more attractive than investing in the

underlying property.

The loans will likely be up to GBP20 million in value; 65% of

loan to value (LTV); and interest only.

No new employees will, initially, be required to be employed to

roll out this product and the Group does not intend to use its own

cash to make such loans. It may, however, invest alongside third

parties in any fund structures set up to make such loans.

Commercial Property Markets Outlook

Poland:

The rate of growth in Poland's GDP is expected to slow from a

rate of 5.1% in 2022 to 1.5% in 2023, compared to a pre-pandemic

10-year average of 3.6% per annum, amidst high inflation, which

peaked at over 17% per annum, and tighter monetary conditions. The

rate of inflation has, since its peak, reduced to some 13% per

annum.

The National Bank of Poland's key policy interest rate is

currently at 6.75% per annum.

Commercial property markets in Poland have slowed dramatically

as interest rates have increased and banks have withdrawn from

lending to the sector. The development of new buildings has

similarly reduced.

However, continued economic growth and the influx of refugees

and businesses from Ukraine is sustaining occupational demand.

Rent review provisions in Polish leases are mostly contractually

linked either to the rate of inflation in Poland or the Eurozone.

This offers landlords some protection from inflation as long as the

economy remains buoyant.

United Kingdom:

Economic growth in the United Kingdom is barely perceptible,

compared to growth rates of 1-3% per annum in the years leading up

to the pandemic. Inflation is the highest in the G7 group of

developed nations, running at over 8% on an annualised basis. This

in turn has led to successive increases in the Bank of England base

interest rate to 4.5% at the date of these results with further

rises forecast.

The investment market for commercial property has weakened in

the face of these headwinds. Offices have been particularly hard

hit due to lockdowns and the development of a work from home

culture. The cost of ensuring that buildings comply with net zero

legislation is exacerbating the situation and is resulting in wide

value dispersion between those buildings which do comply, those

that can be made to comply and those for which compliance is too

costly.

Rental values should over time be sustained by inflation and a

reduction in the supply of property in sectors which are over

supplied, such as offices.

Current Trading and Prospects

These are a creditable set of results in extremely challenging

times.

The end of lockdowns should have ushered in a more normal

trading environment. Instead, we are experiencing the severe impact

of broken supply chains and labour markets. Together with the war

in Ukraine, the result has been rocketing inflation and a

concomitant increase in interest rates.

Consequently, investment markets have been hit hard, with a

sharp reduction in debt availability and the volumes of property

being traded.

Occupational demand is generally holding up better than

investment markets and we are making some inroads in letting the

space available at our office blocks in Warsaw and Gdynia.

Given the general withdrawal of financing from the market, we

have established a platform for the provision of debt to finance

commercial property investments. It is too early to determine the

likely success of this venture but we believe it to be the right

product, launched at the right time.

Ben Habib

Chief Executive

22 June 2023

GROUP FINANCE DIRECTOR'S REVIEW

Profit before tax for the year was GBP2.49 million (2022:

GBP7.08 million) largely driven by 'one off' sales of properties

owned directly by the Group which generated a profit of GBP1.78

million.

The profit in the prior year was bolstered due to an exceptional

gain of EUR9.00 million (GBP7.81 million) from the restructuring of

the finance lease secured against the Group's office block in

Gdynia, Poland.

Group net assets excluding non-controlling interests increased

to GBP43.44 million (31 March 2022 Restated: GBP42.77 million)

.

During the year the Group gained control of 5PT, a fund managed

by FPAM in which it owns a 47.2% share but is considered to have

control in accordance with the provisions of IFRS 10, resulting in

its consolidation into these accounts. The Group's share of its net

assets at consolidation was GBP1.54 million. Previously, the

Group's investment in this fund was accounted for as an associate

(31 March 2022: GBP1.34 million).

On 31 March 2023, the Group granted to employees the option to

subscribe to 10,450,000 new ordinary shares in the Company at an

exercise price of 23.5 pence per Ordinary Share, being the

mid-market closing price on 30 March 2023. The options granted

resulted in an increase to 12,560,000 in the number of outstanding

options over Ordinary Shares, representing approximately 11.33% of

the Company's issued share capital. See note 6 of the financial

statements for further information on the terms of the options

granted.

Gross debt, excluding lease liabilities, increased to GBP29.66

million (31 March 2022: GBP23.66 million) mainly due to the

purchase of additional space in Blue Tower, Warsaw . Of this gross

debt, GBP17.02 million is deferred consideration on which no

interest is payable. Net debt, excluding lease liabilities, reduced

to GBP22.00 million (31 March 2022: GBP17.24 million).

GOING CONCERN

Information on our approach and the result of our assessment is

included in note 1 of the Financial Statements.

FPROP OFFICES LP CLAWBACK

The Group is entitled to a share of total profits in Fprop

Offices LP in lieu of fund management fees and to receive annual

payments on account equivalent to 10% of total cumulative income

profits and capital gains. These payments are adjusted annually, if

necessary, for any overpayments made in previous years up to a

maximum of total past cumulative payments received. A s at 31 March

2022, the Group had recognised a cumulative total of GBP1.97

million as revenue in 2022 and prior years.

The combination of inflationary pressures, higher interest

rates, a cost of living crisis in the UK and an increase in

employees working from home has caused severe disruption to

economic activity and a reduction in the value of commercial

property. During the period between 1 April 2022 and 31 March 2023,

the properties held by Fprop Offices LP reduced in value by 18%. As

a result, the Group considers that GBP1.97 million of revenue

previously recognised will need to be clawed back, with GBP1.38

million being the cumulative amount of revenue recognised to 31

March 2021, being shown as a restatement of the Financial Year 2022

and GBP0.59 million being reflected as a reduction to revenue for

the year to 31 March 2023.

See further information on the impact of this adjustment in the

notes to the financial statements.

INCOME STATEMENT

A review of the operating and financial performance of the two

trading divisions are included in the Chief Executive's

Statement.

Revenue and Gross Profit

Revenue for the year decreased by GBP1.40 million or 16% to

GBP7.25 million (2022: GBP8.65 million).

Gross profit (revenue less the cost of sales) reduced by GBP0.73

million or 13% to GBP4.99 million (2022: GBP5.72 million).

Performance fee income

Performance fees totalled a negative GBP0.37 million (2022:

positive GBP0.58 million). It comprised GBP0.22 million earned from

the sale of two properties by two of the UK funds managed by FPAM

and a provision for the clawback of revenue of GBP0.59 million by

Fprop Offices LP.

Operating expenses

Operating expenses decreased by GBP2.69 million or 36% to

GBP4.77 million (2022: GBP7.46 million) mainly due to a reduction

in incentives paid to employees to GBP0.11 million (2022: GBP2.03

million).

Share of results in associates

The contribution from the Group's associates amounted to a loss

of GBP0.63 million (2022: profit GBP0.85 million) mainly due to an

impairment provision of GBP0.43 million in respect of the Group's

18.1% holding in Fprop Krakow Ltd (FKR) and an impairment provision

of GBP0.47 million in respect of the Group's 45.7% holding in Fprop

Opportunities plc (FOP) .

Fprop Phoenix Ltd (FPL), in which the Group owns 23.4%, made a

loss after tax of which the Group's share amounted to GBP0.85

million (2022: loss of GBP0.62 million).

Investment income (from other financial assets and

investments)

Investment income from the Group's four investments in five of

the UK funds managed by FPAM increased by 455% to GBP1.50 million

(2022: GBP0.27 million), of which GBP1.35 million represented

distributions from Fprop UK Special Opportunities LP (Spec

Opps).

Financing costs

Finance costs increased to GBP0.53 million (2022: GBP0.33

million) mainly due to higher interest rates payable on our

floating rate loans. All bank loans are denominated in Euros, and

all are used to finance properties valued in Euros.

Taxation

The tax charge increased to GBP0.45 million (2022: GBP0.25

million) of which GBP0.38 million was in respect of the profit from

the sale of two directly held properties by E&S, a consolidated

undertaking (2022: GBPNil).

The charge includes Polish and Romanian corporation tax where

headline rates remain at 19% and 16% respectively.

STATEMENT OF FINANCIAL POSITION

Investment Properties (held using the cost model)

The Group has adopted the "cost model" of valuation whereby

investment properties are accounted for at the lower of cost less

accumulated depreciation and impairments or fair market value.

During the year the Group acquired an additional 7,171 square

metres of office space in Blue Tower for a consideration of GBP7.20

million, which is payable in seven instalments over a six year

period. Following this purchase, the Group's interest in Blue Tower

now amounts to 80.3% (2022: 48.2%) of the building. As a result of

this acquisition the Group reclassified the building from Inventory

to Investment Property. Following this reclassification, no

properties were held under inventory.

Following the Group's purchase of 6.57% of the shares in issue

of 5PT during the year, its interest in 5PT increased to 47.2%. The

Group is now considered to have a controlling interest in this fund

(previously held as an associate). As a result, the three

commercial properties held by the fund were added to Investment

Properties with a fair value at the date of consolidation of

GBP7.62 million.

The Group also disposed of three properties during the year. In

August 2022 it sold a warehouse in Tureni, Romania for GBP3.11

million which generated a profit of GBP1.10 million after

accounting for disposal costs.

In December 2022 E&S sold two supermarkets in Poland for

GBP5.50 million (EUR6.20 million) generating a profit after sale of

GBP0.68 million.

At the year end the Group held seven properties. Their book

value was GBP47.01 million (31 March 2022: seven properties valued

at GBP36.20 million). Their fair market value was GBP53.97 million

(31 March 2022: GBP42.24 million).

Capital expenditure incurred on the Group's seven directly owned

properties amounted to GBP1.02 million (2022: seven properties,

GBP1.76 million).

Foreign exchange revaluations amounted to a debit of GBP1.32

million (2022: credit GBP0.22 million).

Borrowings

Bank and other borrowings (including deferred consideration)

increased to GBP29.66 million (31 March 2022: GBP23.66 million)

mainly due to the purchase of the additional space at Blue Tower

but also due to the consolidation of 5PT (GBP3.60 million) into

these financial statements.

The ratio of debt to gross assets at their market value (the

gearing ratio) increased to 36.08% (31 March 2022: 31.25%).

All bank loans are denominated in Euros and are non-recourse to

the Group's assets.

Deposits of GBP0.64 million (31 March 2022: GBP0.55 million) are

held by lending banks in respect of four bank loans (31 March 2022:

four) as security for Debt Service Cover Ratio (DSCR) covenants and

consequently this amount of cash and cash equivalents was

restricted as at 31 March 2023.

Trade and Other Receivables

Trade and other receivables decreased by GBP0.60 million to

GBP3.73 million (31 March 2022: GBP4.33 million).

Provisions

Provisions decreased to GBP0.16 million (31 March 2022: GBP0.92

million) and are entirely in respect of the space at Chalubinskiego

(CH8), Warsaw, over which commitments in respect of fit-out and

rent guarantees were granted at its sale in the Financial Year

2021. Payments of GBP0.37 million (2022: GBP1.93 million) pursuant

to this were made in the year. The reduction in the provision is

due to some 85% (2022: 73%) of the office space which is subject to

the guarantee having been leased. The provision represents our best

estimate of the Group's remaining liability over the life of the

rent guarantee (until April 2025).

Non-controlling Interests

The value of the Group's three non-controlling interests

increased to GBP2.03 million (31 March 2022: GBP0.23 million).

Non-controlling interests consist of:

1. 10% of the share capital of Corp Sp. z o. o., the property

management company to Blue Tower, Warsaw;

2. 23% of the share capital of E and S Estates Ltd, a fund

invested in one property in Poland; and

3. 52.80% of the share capital of 5th Property Trading Ltd, a

fund invested in three commercial properties in Poland.

Investment Revaluation Reserve

The investment revaluation reserve decreased by GBP1.41 million

(2022: increased by GBP1.04 million) to a debit balance of GBP0.73

million mainly due to a decrease in the value of the Group's

investment in Fprop UK Special Opportunities LP (Spec Opps)

resulting from property sales by the UK Pension Property Portfolio

LP (UKPPP), a fund in which it holds an investment.

Foreign Exchange Translation Reserve

A strengthening of the Polish Zloty against Sterling to PLN

5.3267/ GBP (31 March 2022: PLN 5.4868/ GBP) resulted in a

reduction in the deficit in the foreign exchange translation

reserve to GBP2.35 million (31 March 2022: GBP3.30 million).

Cash and cash equivalents

The Group's cash balance increased to GBP7.65 million (31 March

2022: GBP6.42 million) mainly as a result of investing and

financing activities.

Laura James

Group Finance Director

22 June 2023

CONSOLIDATED INCOME STATEMENT

for the year ended 31 March 2023

Year ended Year ended

31 March 31 March

Notes 2023 2022

Total results Total results

GBP'000 GBP'000

---------------------------------------- -------- ---------------- ----------------

Revenue 2 7,249 8,645

Cost of sales (2,257) (2,928)

---------------------------------------- -------- ---------------- ----------------

Gross profit 4,992 5,717

Debt reduction following restructuring

of finance lease 3 - 7,809

Profit on sale of investment 1,779 -

properties

Operating expenses (4,767) (7,464)

---------------------------------------- -------- ---------------- ----------------

Operating profit 2,004 6,062

---------------------------------------- -------- ---------------- ----------------

Share of associates' profit/(loss)

after tax 9 273 (29)

Share of associates' revaluation

(losses)gains 9 (901) 876

Investment income 1,497 271

Interest income 4 145 230

Interest expense 4 (530) (330)

---------------------------------------- -------- ---------------- ----------------

Profit before tax 2,488 7,080

Tax charge 5 (449) (245)

---------------------------------------- -------- ---------------- ----------------

Profit for the year 2,039 6,835

---------------------------------------- -------- ---------------- ----------------

Attributable to:

Owners of the parent 1,919 6,779

Non-controlling interests 120 56

---------------------------------------- -------- ---------------- ----------------

2,039 6,835

---------------------------------------- -------- ---------------- ----------------

Earnings per share:

Basic 6 1.73p 6.14p

Diluted 6 1.70p 6.01p

---------------------------------------- -------- ---------------- ----------------

All operations are continuing.

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

for the year ended 31 March 2023

Year ended Year ended

31 March 31 March

2023 2022 Total

Total results results

GBP'000 GBP'000

Profit for the year 2,039 6,835

-------------------------------------------- ---------------- -------------

Other comprehensive income

Items that may subsequently be

reclassified to profit or loss

Exchange differences on retranslation

of foreign subsidiaries 944 (189)

Net(loss)/ profit on financial assets

at fair value through other comprehensive

income (1,412) 1,039

Taxation - -

-------------------------------------------- ---------------- -------------

Total comprehensive income for

the year 1,571 7,685

Total comprehensive income for

the year attributable to:

Owners of the parent 1,324 7,623

Non-controlling interests 247 62

-------------------------------------------- ---------------- -------------

1,571 7,685

-------------------------------------------- ---------------- -------------

All operations are continuing.

STATEMENT OF FINANCIAL POSITION

First Property Group plc

Registered No. 02967020

As at 31 March 2023

2023 2022

Notes Group Group

GBP'000 GBP'000

------------------------------ -------- --------- ---------

Non-current assets

Investment properties 7 47,009 23,849

Right of use assets 8 197 1,018

Property, plant and

equipment 80 128

Investment in Group - -

undertakings

Investment in associates 9a) 17,588 19,135

Other financial assets

at fair value through

OCI 9b) 4,544 7,445

Other receivables 14 - 95

Goodwill 11 153 153

Deferred tax assets 12 930 1,599

------------------------------ -------- --------- ---------

Total non-current assets 70,501 53,422

------------------------------ -------- --------- ---------

Current assets

Inventories - land and

buildings 13 - 12,352

Current tax assets 79 14

Right of use assets 8 457 446

Trade and other receivables 14 3,729 4,329

Cash and cash equivalents 7,647 6,419

------------------------------ -------- --------- ---------

Total current assets 11,912 23,560

------------------------------ -------- --------- ---------

Current liabilities

Trade and other payables 15 (3,310) (4,764)

Provisions 16 (158) (922)

Lease Liabilities 8 (469) (410)

Financial liabilities 17 (1,116) (4,212)

Other financial liabilities 18 (939) -

Current tax liabilities (28) (20)

------------------------------ -------- --------- ---------

Total current liabilities (6,020) (10,328)

------------------------------ -------- --------- ---------

Net current assets 5,892 13,232

------------------------------ -------- --------- ---------

Total assets less current

liabilities 76,393 66,654

------------------------------ -------- --------- ---------

Non-current liabilities

Financial liabilities 17 (11,519) (9,309)

Other financial liabilities 18 (16,082) (10,141)

Lease Liabilities 8 (267) (1,098)

Deferred tax liabilities 12 (3,050) (3,112)

------------------------------ -------- --------- ---------

Net assets 45,475 42,994

------------------------------ -------- --------- ---------

Equity

Called up share capital 1,166 1,166

Share premium 5,635 5,791

Share-based payment

reserve 179 179

Foreign exchange translation

reserve (2,353) (3,297)

Purchase of own shares

reserve (2,440) (2,653)

Investment revaluation

reserve (728) 684

Retained earnings 41,983 40,895

------------------------------ -------- --------- ---------

Equity attributable

to the owners of the

parent 43,442 42,765

Non-controlling interests 2,033 229

------------------------------ -------- --------- ---------

Total equity 45,475 42,994

------------------------------ -------- --------- ---------

Net assets per share 6 39.18p 38.74p

------------------------------ -------- --------- ---------

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

for the year ended 31 March 2023

Group Share Share Share-based Foreign Purchase Investment Retained Non-controlling Total

capital premium payment exchange of own revaluation earnings interests

reserve translation shares reserve

reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------- -------- -------- ------------ ------------ --------- ------------ --------- ---------------- --------

At 1 April

2022 1,166 5,791 179 (3,297) (2,653) 684 40,895 229 42,994

Profit for

the year - - - - - - 2,039 - 2,039

Net loss on

financial

assets at

fair value

through other

comprehensive

income - - - - - (1,412) - - (1,412)

Purchase from

treasury shares - (156) - - 213 - - - 57

Exchange

differences

arising on

translation

of foreign

subsidiaries - - - 944 - - - 127 1,071

Transfer 5PT

to subsidiary

undertaking - - - - - - - 1,606 1,606

Total

comprehensive

income - (156) - 944 213 (1,412) 2,039 1,733 3,361

Non-controlling

interests - - - - - - (120) 120 -

Dividends

paid - - - - - - (831) (49) (880)

----------------- -------- -------- ------------ ------------ --------- ------------ --------- ---------------- --------

At 31 March

2023 1,166 5,635 179 (2,353) (2,440) (728) 41,983 2,033 45,475

----------------- -------- -------- ------------ ------------ --------- ------------ --------- ---------------- --------

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY (Restated)

for the year ended 31 March 2022

Group Share Share Share-based Foreign Purchase Investment Retained Non-controlling Total

capital premium payment exchange of own revaluation earnings interests

reserve translation shares reserve

reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------- -------- -------- ------------ ------------ --------- ------------ --------- ---------------- --------

At 1 April

2021 1,166 5,791 179 (3,108) (2,653) (355) 34,392 201 35,613

Profit for

the year - - - - - - 6,835 - 6,835

Net gain on

financial

assets at

fair value

through other

comprehensive

income - - - - - 1,039 - - 1,039

Exchange

differences

arising on

translation

of foreign

subsidiaries - - - (189) - - - 6 (183)

Total

comprehensive

income - - - (189) - 1,039 6,835 6 7,691

Non-controlling

interests - - - - - - (56) 56 -

Dividends

paid - - - - - - (276) (34) (310)

----------------- -------- -------- ------------ ------------ --------- ------------ --------- ---------------- --------

At 31 March

2022 1,166 5,791 179 (3,297) (2,653) 684 40,895 229 42,994

----------------- -------- -------- ------------ ------------ --------- ------------ --------- ---------------- --------

Foreign Exchange Translation Reserve

The translation reserve comprises all foreign exchange

differences arising from the translation of the financial

statements of foreign Group companies. This reserve is non

distributable.

Share Based Payment Reserve

The Group grants certain of its employees' rights to its equity

instruments as part of its share-based payment incentive plans. The

value of these rights has been charged to the Income Statement and

has been credited to the share-based payment reserve (which is a

distributable reserve).

Purchase of Own Ordinary Shares

The cost of the Company's Ordinary Shares purchased by the

Company for treasury purposes is held in this reserve. The reserve

is non distributable.

Investment Revaluation Reserve

The change in fair value of the Group's financial assets

measured at fair value through Other Comprehensive Income is held

in this reserve and is non distributable.

CASH FLOW STATEMENTS

for the year ended 31 March 2023

Restated

2023 2022

Notes Group Group

GBP'000 GBP'000

---------------------------------------- ------- --------- ---------

Cash flows from operating activities

Operating profit/(loss) 2,004 6,062

Adjustments for:

Depreciation of investment property

and property, plant & equipment 99 90

Debt reduction following restructuring

of finance lease 3 - (7,809)

Profit on the sale of investment (1,779) -

properties

Impairment loss on an investment - -

property

Decrease/(increase) in inventories - 38

Decrease/ (increase) in trade

and other receivables 777 1,208

(Decrease)/ increase in trade

and other payables 4,189 (1,213)

Other non-cash adjustments 215 65

---------------------------------------- ------- --------- ---------

Cash generated from operations 5,505 (1,559)

---------------------------------------- ------- --------- ---------

Taxes paid (616) 118

---------------------------------------- ------- --------- ---------

Net cash flow from/(used in)

operating activities 4,889 (1,441)

---------------------------------------- ------- --------- ---------

Cash flow (used in)/ from investing

activities

Capital expenditure on investment

properties 7 (1,017) (1,642)

Purchase of property, plant &

equipment 2 (10) (33)

Proceeds from the sale of investment

property 7 8,612 -

Purchase of investment property 13 (7,443) -

Investment in shares of new associates (606) -

Investment in funds 9b) (3) (3,633)

Proceeds from funds 9b) 1,492 290

Proceeds from investments in

associates 9a) 176 48

Interest received 145 187

Dividends from associates 9a) - 241

Distributions received - 266

---------------------------------------- ------- --------- ---------

Net cash flow from/(used in)

investing activities 1,346 (4,276)

---------------------------------------- ------- --------- ---------

Cash flow (used in)/ from financing

activities

---------------------------------------- ------- --------- ---------

Proceeds from bank loan 1,474 1,289

Repayment of bank loans (5,215) (1,297)

Repayment of finance lease - (3,434)

Sale of shares held in Treasury 58 -

Interest paid 4 (530) (330)

Dividends paid (831) (276)

Dividends paid to non-controlling

interests (49) (34)

---------------------------------------- ------- --------- ---------

Net cash flow (used in)/ from

financing activities (5,093) (4,082)

Net /increase/decrease in cash

and cash equivalents 1,142 (9,799)

---------------------------------------- ------- --------- ---------

Cash and cash equivalents at

the beginning of the year 6,419 16,244

---------------------------------------- ------- --------- ---------

Currency translation gains/(losses)

on cash and cash equivalents 86 (26)

---------------------------------------- ------- --------- ---------

Cash and cash equivalents at

the year end 7,647 6,419

---------------------------------------- ------- --------- ---------

Basis of Preparation

These preliminary financial statements have not been audited and

are derived from the statutory accounts within the meaning of

section 434 of the Companies Act 2006. They have been prepared in

accordance with the Group's accounting policies that will be

applied in the Group's annual financial statements for the

year-ended 31 March 2023. The policies have been consistently

applied to all years presented unless otherwise stated below. These

accounting policies are drawn up in accordance with UK-adopted

International Accounting Standards ('IFRS'). Whilst the financial

information included in this preliminary statement has been

prepared in accordance with IFRS, this announcement does not itself

contain sufficient information to fully comply with IFRS. The

comparative figures for the financial year ended 31 March 2022 have

been restated as set out below under prior year adjustment and are

not the statutory accounts for the financial year but are derived

from those accounts prepared under IFRS which have been reported on

by the Group's auditors and delivered to the Registrar of

Companies. The report of the auditors was unqualified, did not

include references to any matter to which the auditors drew

attention by way of emphasis without qualifying their report and

did not contain a statement under section 498 (2) or (3) of the

Companies Act 2006.

Going Concern

The Directors have carried out an analysis to support their view

that the Group is a going concern and under which basis these

financial statements have been prepared.

Analysis and scenario testing, was carried out on the Group's

main divisional income streams, being asset management fees from

the asset management division, rental income from its seven

directly owned group properties and cash returns from its

associates and investments.

a) Asset Management Fee Income

Asset management fee income is primarily derived from its UK

funds (52%), four of which are limited partnerships whose limited

partners are a mix of pension funds and registered charities. With

one exception, fees are invoiced monthly and are calculated based

on a percentage of the latest valuation, which for the UK funds is

performed quarterly.

In the one fund from which fees are not levied by reference to

the properties valuation (Fprop Offices LP) a clawback of income

can be triggered. As at 31 March 2022, a performance fee totalling

of GBP1.97 million had been recognised of which GBP1.41 million has

been received in cash. As a result of falls in the value of the

properties held in this fund, the Group considers that GBP1.97

million will be clawed back in line with the contract. This is

reflected in the financial statements in the following manner;

-- GBP1.38 million, being the cumulative amount of income

recognised to 31 March 2021. This amount is shown as a restatement

of the 31 March 2022 Statement of Financial Position as set out in

the Prior Year Adjustment note below

-- GBP0.59 million clawed back as a reduction in the performance

fee revenue included as part of the asset management revenue in the

year ended 31 March 2023

-- The Group will repay GBP0.25 million to Fprop Offices LP. At

the year end this amount was recognised in Trade and Other

payables

Asset management fees on the Group's Polish and Romanian managed

funds are also levied as a percentage of funds under management,

with reference to the most recent valuations, again with one

exception where the fee is fixed (Fprop Phoenix Ltd (FPL)). These

funds are set up under the ownership of a UK limited company which

in turn owns the company domiciled in the country that owns the

property. Each of these local companies has borrowing secured on

the property and is therefore ring fenced from the Group.

The longevity of this asset management fee income is determined

by the fund's life which is fixed by agreement when each fund is

first established. The weighted average unexpired fund management

contract term is 2 years, 9 months.

b) Rental Income from Group Properties

All seven Group Properties are located in Poland or Romania.

These properties consist of four office blocks, a mini-supermarket,

one multi-let property and ground-floor retail property. All were

independently valued on 31 March 2023 at GBP53.97 million (31 March

2022: seven properties GBP42.24 million).

The rental income has been reviewed and evaluated and no

significant falls in collection rates are expected. The tenants are

of good quality, as proven by excellent cash collection rates

through and after the lockdown periods. Any renegotiation of rental

payment terms that have been agreed are reflected in the

analysis.

On 12 August 2022 the Group acquired some 7,171 square meters in

Blue Tower in Warsaw at a price of GBP7.20 million. The purchase

resulted in the Group's interest in the building increasing from

48.2% to 80.3%. Some 5,159 square metres of the newly acquired

space was vacant at purchase.

The Group's office property in Gdynia is now 28% leased, up from

20% at 31 March 2022. A further 72% of the office space in the

building remains to be leased. When fully let it is anticipated the

building should generate net operating income of over GBP1.90

million per annum.

c) Income from Associates and Investments

Analysis was also conducted on the returns from the Group's

investment in its four (2022: five) Associates.

All bank loan covenants were reviewed and tested against future

decreases in valuation and net operating income.

Dividend income from the Group's UK investments was also stress

tested and found not to have a significant impact.

Going Concern Statement

Based on the results of the analysis conducted as outlined above

the Board believes that the Group has the ability to continue its

business for at least twelve months from the date of approval of

the financial statements and therefore has adopted the going

concern basis in the preparation of this financial information.

Prior year adjustment

Fund management fees are generally levied monthly by reference

to the value of properties. In the case of Fprop Offices LP, the

Group is entitled to a share of total profits in lieu of fund

management fees and to receive annual payments on account

equivalent to 10% of total cumulative income profits and capital

gains. These payments are adjusted annually, if necessary, for any

overpayments made in previous years up to a maximum of total past

cumulative payments received.

As at 31 March 2022, the Group had reflected cumulative revenue

of GBP1.97 million. The Group recognised its share of the total

profits of Fprop Offices LP as performance fee income within asset

management revenue.

The combination of inflationary pressures, higher interest

rates, a cost of living crisis in the UK and an increase in

employees working from home has caused severe disruption to

economic activity and a reduction in the value of commercial

property. During the period between 1 April 2022 and 31 March 2023,

there was a 18% fall in the value of the properties held by Fprop

Offices LP. As a result, the Group considers that GBP1.38 million

of the previously recognised revenue should be reversed as a prior

year adjustment to the 31 March 2022 financial statements and

GBP0.59 million should be reflected as a reduction to revenue for

the year to 31 March 2023.

For the purposes of revenue recognition under IFRS 15, the

profit share due to the Group is a "variable consideration".

Paragraph 56 of IFRS 15 places a constraint upon the recognition of

variable consideration, requiring that it should only be recognised

to the extent that it is highly probable that a significant

reversal in the amount of cumulative revenue recognised will not

occur when the uncertainty associated with the variable

consideration is subsequently resolved.

The IFRS rules require that the reduction in previously

recognised variable consideration should be presented as a prior

period adjustment.

The following line items in the Statement of Financial Position

in the financial statements were impacted.

Year ended

31 March

2022

Retained Earnings

-----------

Retained Earnings as reported in the 2022

financial statements. 42,271

-----------

Prior year restatement due to IFRS 15 accounting

treatment (1,376)

-----------

Retained Earnings as restated 40,895

-----------

Trade and other payables

-----------

Trade and other payables as reported in

the 2022 financial statements. (3,388)

-----------

Prior year restatement due to IFRS 15 accounting

treatment (1,376)

-----------

Trade and other payables (4,764)

-----------

Net Assets

-----------

Net assets excluding non-controlling interests

as reported in the 2022 financial statements 44,141

-----------

Prior year restatement due to IFRS 15 accounting

treatment (1,376)

-----------

Net assets as restated 42,765

-----------

Net Assets per share

-----------

Net assets per share as reported in the

2022 financial statements 40.00p

-----------

Prior year restatement due to IFRS 15 accounting

treatment (1.26p)

-----------

Net assets per share as restated 38.74p

-----------

New Standards and Interpretations

New standards impacting the Group have been adopted in the

preliminary financial statements for the year-ended 31 March 2023,

none of which have had a significant impact to the financial

statements:

-- Annual Improvements to IFRS Standards 2018-2020 Cycle

-- Amendments to IFRS 3 - Reference to the Conceptual Framework

-- Amendments to IAS 16 - Property, Plant and Equipment: Proceeds before Intended Use

-- Amendment to IAS 37 - Onerous Contracts: Cost of Fulfilling a Contract

The Group has not adopted any new IFRSs that are issued but not

yet effective and it does not expect any of these changes to impact

the group.

These preliminary financial statements were approved by the

Board of Directors on 21 June 2023.

1. Revenue

Revenue from continuing operations consists of revenue arising

in the United Kingdom 12% (2022: 27%), Poland 75% (2022: 59%) and

Romania 13% (2022: 14%). All revenue relates solely to the Group's

principal activities.

2. Segment Reporting 2023

Fund Group Properties

Management Division

Division

---------------------------------------------

Property Group Associates Unallocated Total

fund properties and central

management investments overheads

----------------------- --------------------

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------------------- ---------------------- -------------------------- ----------------------- ----------------------- --------------------

Rental income - 3,614 - - 3,614

---------------------- -------------------------- ----------------------- ----------------------- --------------------

Service charge

income - 1,115 - - 1,115

---------------------- -------------------------- ----------------------- ----------------------- --------------------

Sale of a - - - - -

property

held in

inventory

---------------------- -------------------------- ----------------------- ----------------------- --------------------

Asset

management

fees 2,892 - - - 2,892

---------------------- -------------------------- ----------------------- ----------------------- --------------------

Performance

related

fee income (372) - - - (372)

---------------------- -------------------------- ----------------------- ----------------------- --------------------

Total revenue 2,520 4,729 - - 7,249

---------------------- -------------------------- ----------------------- ----------------------- --------------------

Depreciation

and

amortisation (36) (24) - - (60)

---------------------- -------------------------- ----------------------- ----------------------- --------------------

Operating

profit 120 3,069 - (1,185) 2,004

---------------------- -------------------------- ----------------------- ----------------------- --------------------

Share of

results

in associates - - 273 - 273

---------------------- -------------------------- ----------------------- ----------------------- --------------------

Fair value

adjustment

on associates - - (901) - (901)

---------------------- -------------------------- ----------------------- ----------------------- --------------------

Investment

income - - 1,497 - 1,497

---------------------- -------------------------- ----------------------- ----------------------- --------------------

Interest income - 20 - 125 145

---------------------- -------------------------- ----------------------- ----------------------- --------------------

Interest

payable - (530) - - (530)

---------------------- -------------------------- ----------------------- ----------------------- --------------------

Profit/(loss)

before

tax 120 2,559 869 (1,060) 2,488

---------------------- -------------------------- ----------------------- ----------------------- --------------------

Analysed as:

Underlying

profit/(loss)

before tax

before

adjusting for

the

following

items: 513 752 273 (1,089) 449

---------------------- -------------------------- ----------------------- ----------------------- --------------------

Provision in

respect

of rent

guarantee - 511 - - 511

---------------------- -------------------------- ----------------------- ----------------------- --------------------

Profit on the

sale

of investment

properties - 1,779 - - 1,779

---------------------- -------------------------- ----------------------- ----------------------- --------------------

Interest

received

on loan to FOP

@12% - 125 - - 125

---------------------- -------------------------- ----------------------- ----------------------- --------------------

Fair value

adjustment

on associates - - (901) - (901)

---------------------- -------------------------- ----------------------- ----------------------- --------------------

UK fund

distributions

following

sales of

properties - - 1,497 - 1,497

---------------------- -------------------------- ----------------------- ----------------------- --------------------

Performance

related

fee income 222 - - - 222

---------------------- -------------------------- ----------------------- ----------------------- --------------------

Clawback of

Office

income (594) (594)

---------------------- -------------------------- ----------------------- ----------------------- --------------------

Staff

incentives (44) (65) - - (109)

---------------------- -------------------------- ----------------------- ----------------------- --------------------

Realised

foreign

currency

(losses)/gains 23 (543) - 29 (491)

---------------------- -------------------------- ----------------------- ----------------------- --------------------

Total 120 2,559 869 (1,060) 2,488

---------------------- -------------------------- ----------------------- ----------------------- --------------------

Assets - Group 795 54,525 4,544 4,727 64,591

---------------------- -------------------------- ----------------------- ----------------------- --------------------

Share of net

assets

of associates - - 17,588 - 17,588

---------------------- -------------------------- ----------------------- ----------------------- --------------------

Liabilities (71) (36,574) - (59) (36,704)

---------------------- -------------------------- ----------------------- ----------------------- --------------------

Net assets 724 17,951 22,132 4,668 45,475

---------------------- -------------------------- ----------------------- ----------------------- --------------------

Additions to non-current assets

Property, plant

and

equipment 8 2 - - 10

---------------------- -------------------------- ----------------------- ----------------------- --------------------

Investment

properties - 1,017 - - 1,017

---------------------- -------------------------- ----------------------- ----------------------- --------------------

Trading stock - 7,443 - - 7,443

---------------------- -------------------------- ----------------------- ----------------------- --------------------

Segment Reporting 2022

Fund Group Properties

Management Division

Division

---------------------------------------------

Property Group Associates Unallocated Total

fund properties and central

management investments overheads

----------------------- --------------------

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------------------- ---------------------- ---------------------- ----------------------- ----------------------- --------------------

Rental income - 2,926 - - 2,926

---------------------- ---------------------- ----------------------- ----------------------- --------------------

Service charge

income - 1,678 - - 1,678

---------------------- ---------------------- ----------------------- ----------------------- --------------------

Asset

management

fees 3,463 - - - 3,463

---------------------- ---------------------- ----------------------- ----------------------- --------------------

Performance

related

fee income 578 - - - 578

---------------------- ---------------------- ----------------------- ----------------------- --------------------

Total revenue 4,041 4,604 - - 8,645

---------------------- ---------------------- ----------------------- ----------------------- --------------------

Depreciation

and

amortisation (36) (24) - - (60)

---------------------- ---------------------- ----------------------- ----------------------- --------------------

Operating

profit 1,437 7,781 - (3,156) 6,062

---------------------- ---------------------- ----------------------- ----------------------- --------------------

Share of

results

in associates - - (29) - (29)

---------------------- ---------------------- ----------------------- ----------------------- --------------------

Fair value

adjustment

on associates - - 876 - 876

---------------------- ---------------------- ----------------------- ----------------------- --------------------

Investment

income - - 271 - 271

---------------------- ---------------------- ----------------------- ----------------------- --------------------

Interest income - 29 - 201 230

---------------------- ---------------------- ----------------------- ----------------------- --------------------

Interest

payable - (330) - - (330)

---------------------- ---------------------- ----------------------- ----------------------- --------------------

Profit/(loss)

before

tax 1,437 7,480 1,118 (2,955) 7,080

---------------------- ---------------------- ----------------------- ----------------------- --------------------

Analysed as:

Underlying

profit/(loss)

before tax

before

adjusting for

the

following

items: 1,182 401 242 (1,449) 376

---------------------- ---------------------- ----------------------- ----------------------- --------------------

Provision in

respect

of rent

guarantee - (629) - - (629)

---------------------- ---------------------- ----------------------- ----------------------- --------------------

Debt reduction

following

restructuring

of finance

lease - 7,809 - - 7,809

---------------------- ---------------------- ----------------------- ----------------------- --------------------

Interest

received

on loan to

FOP @12% - 202 - - 202

---------------------- ---------------------- ----------------------- ----------------------- --------------------

Fair value

adjustments

on associates - - 876 - 876

---------------------- ---------------------- ----------------------- ----------------------- --------------------

Performance

related

fee income 578 - - - 578

---------------------- ---------------------- ----------------------- ----------------------- --------------------

Staff

incentives (305) (251) - (1,472) (2,028)

---------------------- ---------------------- ----------------------- ----------------------- --------------------

Realised

foreign

currency

(losses)/gains (18) (52) - (34) (104)

---------------------- ---------------------- ----------------------- ----------------------- --------------------

Total 1,437 7,480 1,118 (2,955) 7,080

---------------------- ---------------------- ----------------------- ----------------------- --------------------

Assets - Group 891 44,693 7,445 4,818 57,847

---------------------- ---------------------- ----------------------- ----------------------- --------------------

Share of net

assets

of associates - - 19,135 - 19,135

---------------------- ---------------------- ----------------------- ----------------------- --------------------

Liabilities (143) (33,348) - (547) (34,038)

---------------------- ---------------------- ----------------------- ----------------------- --------------------

Net assets 748 11,345 26,580 4,271 42,994

---------------------- ---------------------- ----------------------- ----------------------- --------------------

Additions to non-current assets

Property, plant

and equipment 5 28 - - 33

---------------------- ---------------------- ----------------------- ----------------------- --------------------

Investment

properties - 1,642 - - 1,642

---------------------- ---------------------- ----------------------- ----------------------- --------------------

Trading stock - 119 - - 119

---------------------- ---------------------- ----------------------- ----------------------- --------------------

3. Debt Reduction following Restructuring of Finance Lease

The prior year results reflect the reduction of EUR9.00 million

(GBP7.81 million) in the amount owed to ING Bank ( from EUR25

million to EUR16 million) in final settlement of the finance lease

secured against the Group's directly held property in Gdynia. As

part of the transaction ING was paid EUR4.00 million in June 2021.

The remainder of the finance lease liability was replaced by