Results - Jaipur Rough Emerald and Beryl Auction

June 20 2012 - 1:00AM

UK Regulatory

TIDMGEM

Gemfields plc

("Gemfields" or the "Company")

Results - Jaipur Rough Emerald and Beryl Auction

20 June 2012

Gemfields plc (AIM: "GEM") is pleased to announce the results of the auction

of predominantly lower quality rough emerald and beryl held in Jaipur, India

from 9-13 June 2012.

Highlights

- Healthy Jaipur auction revenues of USD 9.0 million

- The auction saw 10.85 million carats of emerald and beryl mined

by Gemfields placed on offer, with 3.47 million carats being sold

- Solid overall demand for Gemfields ethical Zambian emeralds

continues, with some weakness apparent only in the lowest quality grades

- Four auctions held in the current financial year total USD 77.9

million in revenue

- Ten auctions held since July 2009 total USD 133.7 million in

revenue

Gemfields held an auction of predominantly lower quality rough emeralds in

Jaipur, India from 9 to 13 June 2012. Twenty five companies attended the

auction, with twenty of these placing bids. The auction saw 10.85 million

carats of emerald and beryl mined by Gemfields placed on offer, with the 3.47

million carats sold generating auction sales of USD 9.0 million.

Last week's auction was the fourth and final auction of the current financial

year (which ends on 30 June 2012). The four auctions, two of which were for

lower quality material, have generated aggregate sales of USD 77.9 million

while the 10 auctions held since July 2009 have generated USD 133.7 million in

aggregate revenues.

The overall quality characteristics of the gems placed on offer at

last week's auction were broadly similar to those offered at the previous

lower quality emerald auction held in November 2011 in Jaipur (which achieved

an average of USD 1.12 per carat for the lots sold). While last week's auction

yielded an average of USD 2.61 per carat for the lots sold, in the Company's

opinion, this figure is artificially inflated by the number of lowest quality

lots that remained un-sold due to the weaker demand experienced at these value

points with the current per carat value of this quality material having been

largely stable over the past six months.

Given the Company's strong cash position and its belief in the long

term fundamentals of the emerald market, Gemfields does not sell lots where

the bids do not meet its pre-determined minimum reserve prices. Between

November 2011 and June 2012, the Indian Rupee weakened against the US Dollar

by 13%, which further negatively affected pricing at this particular auction

on account of the large percentage of finished goods produced from this

material that is likely to be consumed directly within the Indian domestic

retail market.

The results of the four lower quality auctions held to date are summarised

below:

AUCTION RESULTS MARCH '10 MARCH '11 NOVEMBER '11 JUNE '12

(LOWER QUALITY) AUCTION AUCTION AUCTION AUCTION

Dates 11-15 March 10-14 March 21-25 November 9-13 June

2010 2011 2011 2012

Location Jaipur, India Jaipur, India Jaipur, India Jaipur, India

Type Lower Quality Lower Quality Lower Quality Lower Quality

Carats offered* 28.90 million 16.83 million 10.83 million 10.85 million

Carats Sold 22.80 million 12.98 million 9.82 million 3.47 million

No. of companies 25 44 27 20

placing bids

Average no. of bids 8 14 9 3

per lot

No. of lots offered 56 35 26 33

No. of lots sold 49 34 19 17

Percentage of lots 88% 97% 73% 52%

sold

Percentage of lots 79% 77% 91% 32%

sold by weight

Percentage of lots 89% 99% 80% 60%

sold by value

Total sales realised USD 7.2 USD 9.9 USD 11.0 USD 9.0

at auction million million million million

Average per carat USD 0.31/carat USD 0.77/carat USD 1.12/carat USD 2.61/carat

sales value

* A larger volume of material was placed on offer in March 2010

following Gemfields extensive inventory building exercise during 2008 and

2009.

The Jaipur auction was again used as a platform to further test levels of

demand for rough emerald and beryl made available from other sources of supply

(i.e. not certified as having been mined by Gemfields). None of this material

is included in the data presented above. The most recent trial comprised of

other rough emerald from Zambia and approximately one quarter of this material

(by value) was sold. The present net income accruing to Gemfields from traded

material remains immaterial in the context of Gemfields' own production, and

the Company will continue to refine and evolve the opportunities of selling

rough from other sources of supply.

For ease of reference, the results of the six higher quality rough emerald

auctions held to date are summarised below:

AUCTION RESULTS JUL '09 NOV '09 JUL '10 DEC '10 JUL '11 MAR ` 12

(HIGHER QUALITY) AUCTION AUCTION AUCTION AUCTION AUCTION AUCTION

Dates 20-24 Jul 23-27 Nov 19-23 Jul 6-10 Dec 11-15 Jul 19-23 Mar

`09 `09 `10 `10 `11 `12

Location London, UK Johannesburg, London, UK Johannesburg, Singapore Singapore

SA SA

Type Higher Higher Higher Higher Higher Higher

Quality Quality Quality Quality Quality Quality

Carats offered 1.36 million 1.12 million 0.85 million 0.87 million 1.07 million 0.77 million

Carats Sold 1.36 million 1.09 million 0.80 million 0.75 million 0.74 million 0.69 million

No. of companies 23 19 37 32 38 29

placing bids

Average no. of 10 13 18 16 16 11

bids per lot

No. of lots 27 19 27 19 25 23

offered

No. of lots sold 26 14 24 18 18 20

Percentage of lots 96% 74% 89% 95% 72% 87%

sold

Percentage of lots 99.8% 97% 94% 86% 69% 89%

sold by weight

Percentage of lots 82% 76% 87% 99% 91% 94%

sold by value

Total sales USD 5.9 USD 5.6 USD 7.5 USD 19.6 USD 31.6 USD 26.2

realised at million million million million million million

auction

Average per carat USD USD USD USD USD USD

sales value 4.40/carat 5.10/carat 9.35/carat 26.20/carat 42.71/carat 38.25/carat

The specific auction mix and the exact quality of the lots offered at each

auction can vary in characteristics such as colour and clarity on account of

mined production and market circumstances. Each auction is thus made up of

differing overall quality compositions.

Ian Harebottle, CEO of Gemfields, commented:

"Gemfields is pleased to announce robust results from the recent lower quality

emerald auction in Jaipur considering the backdrop of global economic unease

and the substantially weaker Indian Rupee against the US dollar. General

economic instability typically has a greater negative impact on the lower

quality grades than it does on the higher quality material, the latter often

being seen as a store of value in times of uncertainty. This effect was

clearly seen at this auction, where demand for the lowest quality grades was

indeed weaker than it has been for some time. However, due to the Company's

strong cash position and operational performance, Gemfields was not obliged to

sell lots at sub-optimal prices and is confident in the long term value of

these gems.

Overall, the on-going appetite for better grades remains firm and ensured that

Gemfields was able to deliver another set of encouraging auction results

thanks to our positive momentum, the success of our marketing initiatives and

the consistency of the emeralds produced at our Kagem mine. In addition, the

results are particularly pleasing given that a large supply of rough emeralds

recently entered the Indian market from other sources, creating an isolated

period of considerable supply which is not sustainable and which bodes well

for future auctions"

Enquiries:

Gemfields dev.shetty@gemfields.co.uk

Dev Shetty, CFO +44 (0)20 7518 3402

Canaccord Genuity Limited +44 (0)20 7523 8000

Nominated Adviser and Joint Broker to Gemfields

Tarica Mpinga/Andrew Chubb

JP Morgan Cazenove +44 (0)20 7155 8630

Neil Passmore

Tavistock Communications +44 (0)20 7920 3150

Jos Simson/Lydia Eades

Notes to Editors:

Gemfields plc is a leading gemstone miner listed on the AIM market of the

London Stock Exchange (ticker: `GEM'). The Company's principal asset is the

75% owned Kagem emerald mine in Zambia, the world's single largest emerald

mine. In addition to the Kagem emerald mine, Gemfields has a 50% interest in

the Kariba amethyst mine in Zambia.

The Company also owns controlling stakes in a highly prospective ruby deposit

in Mozambique and licences in Madagascar including ruby, emerald and sapphires

deposits.

In July 2009 Gemfields commenced a formal auction programme for its Zambian

emeralds. To date, the Company has held ten auctions which have generated

revenues totalling USD 133.7 million.

END

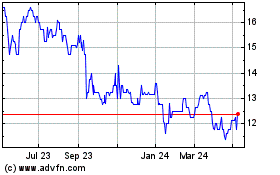

Gemfields (LSE:GEM)

Historical Stock Chart

From Dec 2024 to Jan 2025

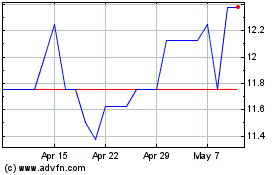

Gemfields (LSE:GEM)

Historical Stock Chart

From Jan 2024 to Jan 2025