Glencore Maintains Trading Earnings Guidance, Despite Market Turmoil

April 30 2020 - 5:00AM

Dow Jones News

By Alistair MacDonald

Glencore PLC said it will stick to its closely watched earnings

guidance for its trading operations, saying a "volatile and complex

commodity trading environment has provided opportunities."

Glencore, a mining and commodities trading giant, said trading

is generating annualized earnings within its $2.2 billion to $3.2

billion long-term guidance range.

The coronavirus pandemic has sent commodity prices sharply lower

and closed mines around the world. But costs have also come down,

as sharply lower oil prices make fuel cheaper. The current crisis

has also boosted the price of gold, which can be a byproduct of the

mining of other metals and can help lower overall costs of mining

those other metals. Zinc unit costs, for instance, are now 39%

lower. Thermal coal costs are $3 a metric ton lower, at $42 a

metric ton, Glencore said.

The miner also said it expects a $1 billion to $1.5 billion

reduction in capital expenditure this year, compared with original

guidance of $5.5 billion.

Write to Alistair MacDonald at alistair.macdonald@wsj.com

(END) Dow Jones Newswires

April 30, 2020 05:45 ET (09:45 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

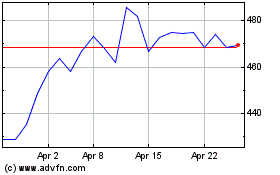

Glencore (LSE:GLEN)

Historical Stock Chart

From Apr 2024 to May 2024

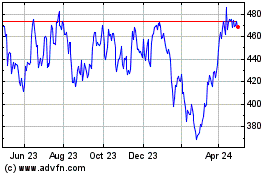

Glencore (LSE:GLEN)

Historical Stock Chart

From May 2023 to May 2024