Ground Rents Income Fund PLC CMA - Leasehold Housing Market Investigation (6607E)

March 02 2020 - 3:30AM

UK Regulatory

TIDMGRIO

RNS Number : 6607E

Ground Rents Income Fund PLC

02 March 2020

Ground Rents Income Fund plc

Competition and Markets Authority - Leasehold Housing Market

Investigation

Ground Rents Income Fund PLC ("the Company") notes the update

report published on Friday 28 February 2020 by the Competition and

Markets Authority ("CMA"), which is investigating alleged

misleading selling practices and unfair consumer terms in the

leasehold housing market.

As stated in the Annual Report and Financial Statements for the

year ended 30 September 2019, the Company has openly and

transparently assisted the CMA to develop its understanding of the

leasehold market.

The Company welcomes many of the steps Government, the Law

commission and the CMA intend to take to stamp out poor practice in

the housebuilding industry concerning leasehold houses, to protect

consumers in the home sale process and to improve standards and

transparency in residential property management sector.

The Directors are wholly supportive of reform that delivers an

equitable, transparent and better experience for homeowners. The

Company has therefore been proactive in addressing consumer

concerns regarding onerous ground rents. For example, since

September 2017 the Company has implemented an asset management plan

to offer residential leaseholders with doubling ground rents,

regardless of review cycle, the opportunity to convert their

existing doubling review mechanism to the lesser of inflation, as

measured by the Retail Prices Index (RPI), or doubling, while

retaining their existing review cycle.

In March 2019 the Company signed the Government's 'Public Pledge

for Leaseholders', which we believe is an important step towards

positive change reflecting our desire to bring about sensible,

well-thought-out reform. The Pledge essentially extends the

Company's asset management plan indefinitely.

The Company is committed to working with Government, the Law

Commission and the CMA to appropriately reform the industry and to

support existing leaseholders, working towards meaningful reform

that protects all stakeholders in the sector.

The Company notes that the CMA investigation is ongoing and that

the timescale and specific outcome of the investigation, together

with the resultant impact on the Company and its underlying

portfolio, is uncertain. The Company will consider the CMA report

further with its advisors and keep shareholders advised of

progress. The Board continues to advocate for leasehold reform that

strikes a fair balance for all stakeholders in the sector.

Contacts:

Schroder Real Estate Investment Management Limited

James Agar / Matthew Riley

020 7658 6000

N+1 Singer (Broker)

James Maxwell / Ben Farrow

020 7496 3000

Tavistock (Media)

James Whitmore / Jeremy Carey

020 7920 3150

Appleby Securities (Channel Islands) Limited (Sponsor)

Andrew Weaver

01481 755 600

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCFIFIAVAIFIII

(END) Dow Jones Newswires

March 02, 2020 04:30 ET (09:30 GMT)

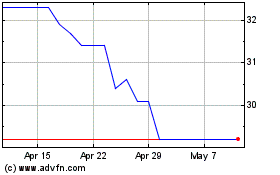

Ground Rents Income (LSE:GRIO)

Historical Stock Chart

From Apr 2024 to May 2024

Ground Rents Income (LSE:GRIO)

Historical Stock Chart

From May 2023 to May 2024