HICL Infrastructure PLC Completion of Hornsea II OFTO transaction (6999G)

July 21 2023 - 1:00AM

UK Regulatory

TIDMHICL

RNS Number : 6999G

HICL Infrastructure PLC

21 July 2023

21 July 2023

HICL Infrastructure PLC

"HICL" or "the Company" and, together with its subsidiaries,

"the Group", the London-listed infrastructure investment company

managed by InfraRed Capital Partners Limited ("InfraRed" or "the

Investment Manager".)

Completion of announced Hornsea II OFTO transaction

Further to earlier announcements, the Board of HICL

Infrastructure PLC is pleased to confirm that the Company has now

completed the acquisition of a 75% shareholding in the offshore

transmission assets associated with the Hornsea II Windfarm

(Hornsea II OFTO). This availability-based and inflation-linked

investment in critical UK electricity transmission represents

HICL's fifth OFTO investment in partnership with Diamond

Transmission Corporation.

The investment will represent approximately 3% of HICL's

portfolio by value(1) and will be funded by the Company's GBP650m

revolving credit facility ("RCF"). Following this transaction and

the receipt of proceeds from the partial disposal of Northwest

Parkway, the RCF is expected to be c.GBP370m drawn. The Company

intends to continue its strategy of selectively realising assets to

reduce the RCF balance and optimise portfolio construction.

(1) As at 31 March 2023, using the Directors' Valuation of

GBP3,772.8m

-ends-

Enquiries

InfraRed Capital Partners Limited +44 (0) 20 7484 1800 / info@hicl.com

Edward Hunt

Helen Price

Mohammed Zaheer

Brunswick +44 (0) 20 7404 5959 / hicl@brunswickgroup.com

Sofie Brewis

Investec Bank plc +44(0) 20 7597 4952

David Yovichic

RBC Capital Markets +44 (0) 20 7653 4000

Matthew Coakes

Elizabeth Evans

Aztec Financial Services (UK) Limited +44(0) 203 818 0246

Chris Copperwaite

Sarah Felmingham

HICL Infrastructure PLC

HICL Infrastructure PLC ("HICL") is a long-term investor in

infrastructure assets which are predominantly operational and

yielding steady returns. It was the first infrastructure investment

company to be listed on the London Stock Exchange.

With a current portfolio of over 100 infrastructure investments,

HICL is seeking further suitable opportunities in core

infrastructure, which are inherently positioned at the lower end of

the risk spectrum.

Further details can be found on the HICL website www.hicl.com

.

Investment Manager (InfraRed Capital Partners)

InfraRed Capital Partners is an international infrastructure

investment manager, with more than 180 professionals operating

worldwide from offices in London, New York, Sydney and Seoul. Over

the past 25 years, InfraRed has established itself as a highly

successful developer and custodian of infrastructure assets that

play a vital role in supporting communities. InfraRed manages

US$14bn+ of equity capital (1) for investors around the globe, in

listed and private funds across both income and capital gain

strategies.

A long-term sustainability-led mindset is integral to how

InfraRed operates as it aims to achieve lasting, positive impacts

and deliver on its vision of Creating Better Futures. InfraRed has

been a signatory of the Principles of Responsible Investment since

2011 and has achieved the highest possible PRI rating (2) for its

infrastructure business for seven consecutive assessments, having

secured a 5 stars rating for the 2021 period. It is also a member

of the Net Zero Asset Manager's Initiative and is a TCFD

supporter.

InfraRed is part of SLC Management, the institutional

alternatives and traditional asset management business of Sun Life.

InfraRed represents the infrastructure equity arm of SLC

Management, which also incorporates BentallGreenOak, a global real

estate investment management adviser, and Crescent Capital, a

global alternative credit investment asset manager.

www.ircp.com

(1) Data as at Q3 2022. Equity Capital is calculated using a

5-year average FX rate

(2) Principles for Responsible Investment ("PRI") ratings are

based on observation of the PRI Association's Principles, including

incorporating ESG issues into investment analysis, decision-making

processes and ownership policies. More information is available at

https://www.unpri.org/about-the-pri

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQRMMITMTATBTJ

(END) Dow Jones Newswires

July 21, 2023 02:00 ET (06:00 GMT)

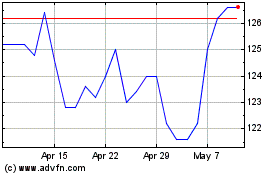

Hicl Infrastructure (LSE:HICL)

Historical Stock Chart

From Apr 2024 to May 2024

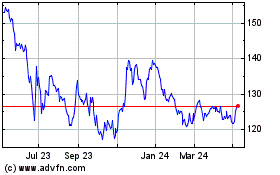

Hicl Infrastructure (LSE:HICL)

Historical Stock Chart

From May 2023 to May 2024