Hammerson PLC Acquisition of Cergy 3 shopping centre, France (0960U)

October 19 2017 - 6:00AM

UK Regulatory

TIDMHMSO

RNS Number : 0960U

Hammerson PLC

19 October 2017

Hammerson plc

Acquisition

19 October 2017

Acquisition of Cergy 3 shopping centre, France

Hammerson plc ("Hammerson") announces that it has completed the

acquisition of the 11,000m(2) shopping centre Cergy 3 adjoining its

centre Les Trois Fontaines, Cergy Pontoise, Paris for EUR 81

million (GBP72 million) from a private vendor.

Les Trois Fontaines is established as the leading shopping

destination for the Val d'Oise region of Paris and is one of

Hammerson's flagship assets in France. This acquisition of the

adjoining Cergy 3 centre strengthens Hammerson's investment by

increasing the scale of the retail platform and growing catchment

share. It also supports an enhanced customer experience by

providing the opportunity to manage leasing and consumer

initiatives across both adjoining sites.

Les Trois Fontaines is trading well, in particular benefiting

from a recent refurbishment. Hammerson is progressing with plans

for a 33,000m(2) extension of its centre alongside a wider project

by the city authorities in Cergy Pontoise. The proposed extension

would take the total retail space to over 95,000m(2) with 3,700 car

park spaces, 230 stores and an attractive restaurant and leisure

offer to create one of the leading retail centres in the Paris

region. The extension plans are supported by the co-owners, Auchan

hypermarket, and the city authorities. Building permits and retail

consents have been obtained, a contractor has been selected and

pre-letting is progressing well to be in a position to start in

2018.

Cergy 3 is anchored by FNAC and has 46 units let to retailers

and restaurants including Grande Récré and Foot Locker producing

EUR 3.2 million (GBP2.8 million) of rental income. Asset management

initiatives have been identified as part of the extension project

to create additional value.

David Atkins, Hammerson CEO, commented:

"The purchase of Cergy 3 strengthens our retail presence in the

affluent Western catchment of Paris adding to the scale of Les

Trois Fontaines, which trades amongst the top French shopping

centres. It allows us to manage all leasing and ensure a consistent

quality across the whole centre. The future development of Les

Trois Fontaines provides the opportunity to further enhance one of

Hammerson's flagship retail schemes in France adding new

international fashion operators and increased dining and

leisure."

ENDS

For further information:

Hammerson

David Atkins, CEO

Tel: 020 7887 1000

Rebecca Patton, Head of Investor Relations

Tel: 020 7887 1109

Lindsay Dunford, Head of Corporate Communications

Tel: 020 7887 1115

Note: the announcement above has also been released on the SENS

system of the Johannesburg Stock Exchange.

Notes to Editors

Hammerson is a FTSE 100 owner, manager and developer of retail

destinations in Europe. Our portfolio of high-quality retail

property has a value of around GBP10.5 billion and includes 23

prime shopping centres, 17 convenient retail parks and investments

in 20 premium outlet villages, through our partnership with Value

Retail and the VIA Outlets joint venture. Key investments include

Bullring, Birmingham, Bicester Village, Dundrum Town Centre, Dublin

and Les Terrasses du Port, Marseille.

This information is provided by RNS

The company news service from the London Stock Exchange

END

ACQEAEENFSEXFFF

(END) Dow Jones Newswires

October 19, 2017 07:00 ET (11:00 GMT)

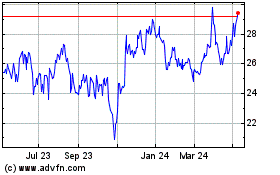

Hammerson (LSE:HMSO)

Historical Stock Chart

From Apr 2024 to May 2024

Hammerson (LSE:HMSO)

Historical Stock Chart

From May 2023 to May 2024