TIDMHVPE

RNS Number : 8577Q

HarbourVest Global Priv. Equity Ltd

24 June 2020

24 June 2020

RESULTS FOR THE YEARED 31 JANUARY 2020

Another year of strong performance

HarbourVest Global Private Equity Limited ("HVPE" or the

"Company"), today announces its audited results for the year ended

31 January 2020.

Annual results - Eleventh consecutive year of net asset value

("NAV") per share growth

-- NAV per share increase of 14.5% to $27.58 over the 12 months

o Seventh consecutive year of double-digit growth

o Outperformance of FTSE All-World Total Return Index by 2.5%

annually over ten years

o $289.3m net gain on investments (2018: $218.4m)

-- Net investor during the year

o $324.2m cash invested (2019: $396.2m), including $59.3m into

HarbourVest real assets vehicle

o $308.2m distributions received (2019: $306.6m),

o A large portion of proceeds generated from sales of Intelex

Technologies and Press Ganey, and IPO of TeamViewer on Frankfurt

Stock Exchange

-- $570m committed to new HarbourVest funds (2018: $730m)

o Majority weighted towards primary funds (fund-of-funds)

-- Strong cash position at year-end with net cash of $130.6m

Events post year-end - Resilient position in current

environment

-- The impact of COVID-19 has had, and may continue to have, a

material impact on the value and performance of the portfolio

o Estimated NAV per share of $25.62 (GBP20.79) at 31 May 2020

(based predominantly on 31 March 2020 valuations)

o A decline of 6.0% in US dollars from 30 April 2020

-- Commitment plan placed temporarily on hold

o Allowing the Investment Manager to review the Company's

portfolio construction priorities

-- Proactive steps taken by Investment Manager to assess impact on portfolio

o Assessment covers 80% of HVPE's portfolio value

o At this point in time, the great majority of HVPE's portfolio

by value deemed likely to experience a low or moderate impact

o HarbourVest focused on managing the portfolio to weather the

near- and longer-term effects of COVID-19

-- HVPE maintains a well-diversified portfolio, with no single

company exposure representing more than 1.9% of NAV

-- Strong balance sheet

o $200m drawn down from the $600m credit facility in May

2020

-- Deposited in J.P. Morgan AAA-rated US Treasury money market

fund and fully available as at 31 May 2020

o Access to the remaining $400m provides flexibility to react as

required to the evolving situation driven by COVID-19

Sir Michael Bunbury, Chairman of HVPE, said: "I am pleased to

report, in my final year as Chairman of HVPE, that the Company once

again had a very satisfactory twelve months to 31 January,

delivering its eleventh consecutive year of positive NAV

growth.

"Since the end of our financial year, the outbreak of the

COVID-19 pandemic has sent shockwaves through the economy. The

Board and Investment Manager, HarbourVest, acted quickly to assess

the potential impact on HVPE and its portfolio. Several years of

strong growth and careful management have endowed HVPE with a

strong balance sheet, ensuring it is well-placed to capitalise on

the opportunities that may lie ahead.

"The private equity industry is structured with a view to

long-term value creation, and this allows for considerable

flexibility in times like these. Furthermore, HarbourVest has

almost four decades of experience managing through previous global

events and economic crises. The Company's recent commitments have

been weighted towards HarbourVest's primary fund-of-funds vehicles

which seek to deploy capital over a period of several years.

"Before I sign out as Chairman, I would like to thank all

shareholders for their support. I would also like to thank all

those at HarbourVest and our other service providers who have

contributed to the success of HarbourVest Global Private Equity

thus far."

Investor Event

There will be a presentation for institutional and retail

investors on 3 July 2020 at 10am BST. To register for the event,

please contact Liah Zusman: hvpeevents@harbourvest.com .

Annual Report and Accounts

To view the Company's Annual Financial Report and Accounts

please follow this link: Annual Report - Year Ending 31 January

2020 . Page number references in this announcement refer to pages

in this report.

The Annual Financial Report and Accounts will also shortly be

available on the National Storage Mechanism, which is situated

https://data.fca.org.uk/#/nsm/nationalstoragemechanism .

Annual Results Presentation

The Company will publish a new presentation on its website to

supplement the publication of the Annual Results for the twelve

months ended 31 January 2020. The presentation will be publicly

disclosed at 11am today. All stakeholders will be able to view and

download the presentation from HVPE's website www.hvpe.com .

Enquiries:

Shareholders

Richard Hickman Tel: +44 (0)20 7399 9847 rhickman@harbourvest.com

Charlotte Edgar Tel: +44 (0)20 7399 9826 cedgar@harbourvest.com

Media

HarbourVest Partners

Alicia Sweeney Tel: +1 (617) 807 2945

acurransweeney@harbourvest.com

MHP Communications

Charlie Barker / Tim Rowntree / Tel: +44(0)20 3128 8100 hvpe@mhpc.com

Pete Lambie

Notes to Editors:

About HarbourVest Global Private Equity Limited:

HarbourVest Global Private Equity Limited ("HVPE" or the

"Company") is a Guernsey-incorporated, closed-end investment

company which is listed on the Main Market of the London Stock

Exchange and is a constituent of the FTSE 250 index. HVPE is

designed to offer shareholders long-term capital appreciation by

investing in a private equity portfolio diversified by geography,

stage of investment, vintage year, and industry. The Company

invests in and alongside HarbourVest-managed funds which focus on

primary fund commitments, secondary investments and direct

co-investments in operating companies. HVPE's investment manager is

HarbourVest Advisers L.P., an affiliate of HarbourVest Partners,

LLC, an independent, global private markets asset manager with more

than 35 years of experience.

About HarbourVest Partners, LLC:

HarbourVest is an independent, global private markets asset

manager with over 35 years of experience and more than $71 billion

in assets under management, as of March 31, 2020. The Firm's

powerful global platform offers clients investment opportunities

through primary fund investments, secondary investments, and direct

co-investments in commingled funds or separately managed accounts.

HarbourVest has more than 600 employees, including more than 145

investment professionals across Asia, Europe, and the Americas.

This global team has committed more than $39 billion to

newly-formed funds, completed over $22 billion in secondary

purchases, and invested over $16 billion directly in operating

companies. Partnering with HarbourVest, clients have access to

customised solutions, longstanding relationships, actionable

insights, and proven results.

This announcement is for information purposes only and does not

constitute or form part of any offer to issue or sell, or the

solicitation of an offer to acquire, purchase or subscribe for, any

securities in any jurisdiction and should not be relied upon in

connection with any decision to subscribe for or acquire any

Shares. In particular, this announcement does not constitute or

form part of any offer to issue or sell, or the solicitation of an

offer to acquire, purchase or subscribe for, any securities in the

United States or to US Persons (as defined in Regulation S under

the US Securities Act of 1933, as amended ("US Persons")). Neither

this announcement nor any copy of it may be taken, released,

published or distributed, directly or indirectly to US Persons or

in or into the United States (including its territories and

possessions), Canada, Australia or Japan, or any jurisdiction where

such action would be unlawful. Accordingly, recipients represent

that they are able to receive this announcement without

contravention of any applicable legal or regulatory restrictions in

the jurisdiction in which they reside or conduct business. No

recipient may distribute, or make available, this announcement

(directly or indirectly) to any other person. Recipients of this

announcement should inform themselves about and observe any

applicable legal requirements in their jurisdictions.

The Shares have not been and will not be registered under the US

Securities Act of 1933, as amended (the "Securities Act") or with

any securities regulatory authority of any state or other

jurisdiction of the United States and, accordingly, may not be

offered, sold, resold, transferred, delivered or distributed,

directly or indirectly, within the United States or to US Persons.

In addition, the Company is not registered under the US Investment

Company Act of 1940, as amended (the "Investment Company Act") and

shareholders of the Company will not have the protections of that

act. There will be no public offer of the Shares in the United

States or to US Persons.

This announcement has been prepared by the Company and its

investment manager, HarbourVest Advisers L.P. (the "Investment

Manager"). No liability whatsoever (whether in negligence or

otherwise) arising directly or indirectly from the use of this

announcement is accepted and no representation, warranty or

undertaking, express or implied, is or will be made by the Company,

the Investment Manager or any of their respective directors,

officers, employees, advisers, representatives or other agents

("Agents") for any information or any of the opinions contained

herein or for any errors, omissions or misstatements. None of the

Investment Manager nor any of their respective Agents makes or has

been authorised to make any representation or warranties (express

or implied) in relation to the Company or as to the truth, accuracy

or completeness of this announcement, or any other written or oral

statement provided. In particular, no representation or warranty is

given as to the achievement or reasonableness of, and no reliance

should be placed on any projections, targets, estimates or

forecasts contained in this announcement and nothing in this

announcement is or should be relied on as a promise or

representation as to the future.

Epidemics, Pandemics and Other Health Risks - Many countries

have experienced infectious illnesses in recent decades, including

swine flu, avian influenza, SARS and 2019-nCoV (the "Coronavirus").

In December 2019, an initial outbreak of the Coronavirus was

reported in Hubei, China. Since then, a large and growing number of

cases have been confirmed around the world. The Coronavirus

outbreak has resulted in numerous deaths and the imposition of both

local and more widespread "work from home" and other quarantine

measures, border closures and other travel restrictions causing

social unrest and commercial disruption on a global scale. The

World Health Organization has declared the Coronavirus outbreak a

pandemic. The ongoing spread of the Coronavirus has had and will

continue to have a material adverse impact on local economies in

the affected jurisdictions and also on the global economy as

cross-border commercial activity and market sentiment are

increasingly impacted by the outbreak and government and other

measures seeking to contain its spread. In addition to these

developments having potentially adverse consequences for underlying

portfolio investments of the HarbourVest funds and the value of the

investments therein, the operations of HVPE, the Investment

Manager, and HVPE's portfolio of HarbourVest funds have been, and

could continue to be, adversely impacted, including through

quarantine measures and travel restrictions imposed on personnel or

service providers based around the world, and any related health

issues of such personnel or service providers. Any of the foregoing

events could materially and adversely affect the Investment

Manager's ability to source, manage and divest its investments and

its ability to fulfil its investment objectives. Similar

consequences could arise with respect to other comparable

infectious diseases.

Other than as required by applicable laws, the Company gives no

undertaking to update this announcement or any additional

information, or to correct any inaccuracies in it which may become

apparent and the distribution of this announcement. The information

contained in this announcement is given at the date of its

publication and is subject to updating, revision and amendment. The

contents of this announcement have not been approved by any

competent regulatory or supervisory authority.

This announcement includes statements that are, or may be deemed

to be, "forward looking statements". These forward looking

statements can be identified by the use of forward looking

terminology, including the terms "believes", "projects",

"estimates", "anticipates", "expects", "intends", "plans", "goal",

"target", "aim", "may", "will", "would", "could", "should" or

"continue" or, in each case, their negative or other variations or

comparable terminology. These forward looking statements include

all matters that are not historical facts and include statements

regarding the intentions, beliefs or current expectations of the

Company. By their nature, forward looking statements involve risks

and uncertainties because they relate to events and depend on

circumstances that may or may not occur in the future and may be

beyond the Company's ability to control or predict. Forward looking

statements are not guarantees of future performance. More detailed

information on the potential factors which could affect the

financial results of the Company is contained in the Company's

public filings and reports.

All investments are subject to risk. Past performance is no

guarantee of future returns. Prospective investors are advised to

seek expert legal, financial, tax and other professional advice

before making any investment decision. The value of investments may

fluctuate. Results achieved in the past are no guarantee of future

results.

This announcement is issued by the Company, whose registered

address is BNP Paribas House, St Julian's Avenue, St Peter Port,

Guernsey, GY1 1WA

(c) 2020 HarbourVest Global Private Equity Limited. All rights

reserved.

Chairman's Statement

Dear Shareholder,

This Statement is the thirteenth and last Annual Chairman's

Statement that I shall write as Chairman of HarbourVest Global

Private Equity ("HVPE" or the "Company") and the circumstances

under which I write it vie with the Global Financial Crisis of

2008/09 as the most challenging that your Company has faced since

its creation in 2007.

This Statement is divided into three sections. First, routine

reporting on the affairs of the Company for the year to 31 January

2020. Second, considering the profound changes for HVPE, for all

companies, individuals, and societies brought about by the shock of

COVID-19 which hit the world in the Spring of 2020, the

consequences of which have a long way to go before they are fully

apparent. Third, a look back at the development of HVPE over the

twelve and a half years since the inception of the Company, the

Board of which I have had the privilege to Chair.

The Year to 31 January 2020

Performance and Asset Values

Once again, HVPE had a very satisfactory year. The Company's

functional currency is the US dollar and the year to 31 January

2020 saw the seventh consecutive year of double-digit growth in Net

Asset Value per share and eleventh consecutive year of positive NAV

per share returns. Over the twelve months the NAV per share

increased by 14.5% to $27.58. At the year end, the Company had net

assets of $2.20 billion based on the 31 January 2020 valuations of

its assets which consist almost entirely of investments in funds

managed by the Company's Investment Manager, HarbourVest Partners

("HarbourVest"). The Investment Manager's Report, which follows

this Statement, sets out in detail the performance of the Company's

assets during the year.

I have written on previous occasions of the lag that occurs

between the movements of listed markets and the valuation of

private assets. Unlike the previous financial year, on this

occasion the Company's public market benchmark, the FTSE All World

Total Return Index, outpaced HVPE's NAV growth, rising in US dollar

terms by 16.7%. Nevertheless, the NAV per share of HVPE continued

to meet its goal of materially outperforming public markets over

the long term by increasing by 2.5% per annum in excess of the FTSE

AW TR Index over the ten years to 31 January 2020.

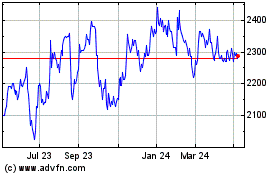

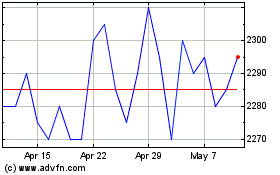

Share Price Performance and Discount

The sterling class is the most actively traded class of shares

and the majority of the Company's shareholders are based in the

United Kingdom. At 31 January 2020 the share price was GBP18.36, up

from GBP14.26 a year earlier, an increase of 28.8%. This very

satisfactory result was a product of the NAV per share growth and a

significant narrowing of the notional discount at which the

Company's shares were trading in the stock market. Over the 12

months to 31 January 2020 the discount narrowed from 22.4% a year

earlier to end the year at 12.1%. At the year end HVPE's market

capitalisation was GBP1.47 billion and was ranked at number 110 in

the FTSE 250 index. There was active trading and regular liquidity

in the Company's shares with 22% of the Company's issued share

capital traded during the year to 31 January 2020.

Assets and Balance Sheet

At 31 January 2020 HVPE had net assets of $2.2 billion, an

increase of $278.7 million over the year. Included in the net

assets were the Company's cash balances which declined over the

year by $26.0 million to $130.6 million as HarbourVest funds called

cash to fund investments at a faster rate than distributions were

received. This was wholly expected and indeed for some years I have

been flagging that the cash balance would be drawn down over time.

The Company's aim is to be fully invested over the private equity

cycle and not to hold substantial cash balances. Indeed the

drawdown would have been more rapid but for the fact that, on a

look-through basis, HVPE's share of borrowing within the

HarbourVest funds in which the Company is invested increased over

the year by $94.2 million to $366.8 million. HVPE has no direct

liability for this fund-level borrowing other than through the

Company's uncalled commitment to the particular HarbourVest fund.

Further details on this can be found in Managing the Balance Sheet

starting on page 26. The effect on the Company of this fund-level

borrowing is carefully monitored and factored into our balance

sheet modelling.

At the financial year end the Company's borrowing facility of

$600.0 million, arranged in 2019 and committed to at least January

2026, and to be provided equally by Credit Suisse and Mitsubishi

UFJ, was undrawn.

As has been the case since the Company's inception in 2007, the

uncalled commitments shown on the Balance Sheet exceeded cash and

available borrowing. This has always been as planned given the

nature of most of the HarbourVest funds in which HVPE is invested.

Those funds take time to commit to underlying managers and it is

even longer before cash is drawn to invest in underlying companies.

Thus the Board is satisfied that, given the particular nature of

the Company's business, the Balance Sheet is strong, and that is

confirmed at the date of signing of this Statement by the Going

Concern and Viability Statements contained within the Annual Report

and Accounts.

Operating Expenses

Over the year management fees to the HarbourVest funds remained

effectively plateaued at 0.86% of NAV whilst net operating expenses

rose slightly from 1.50% to 1.63% driven by a reduction in interest

income on the Company's cash balance. Within the net operating

expenses are commitment fees and other costs relating to the credit

facility shown net of interest earnings. Those expenses are very

different in nature to the normal fees and expenses of running the

Company and are essentially dictated by cash flow requirements and

the terms of the facility agreement in the short term. Both classes

of expenses, be they running costs or finance costs, are keen areas

of focus for the Board and have been the subject of a specific

review during the year.

The Board and Environmental, Social and Governance ("ESG")

The Board recognises the importance of planning the phased

succession of Directors and for ensuring that the Board contains

the necessary skills to direct the affairs of the Company. During

the year both Brooks Zug and Keith Corbin retired from the Board in

July 2019. Carolina Espinal, a Managing Director of HarbourVest,

was elected by shareholders at the AGM in July as Brooks' successor

and, following a search by Trust Associates, Ed Warner was

appointed on 1 August. Ed will succeed me as Chairman at the AGM

due to be held on 22 July 2020.

The heightened importance of ESG matters has been welcomed by

the Board. The Company subscribes to the highest aspirations for

all three, both for itself and for the companies in which it is

indirectly invested. With investments in over 9,500 underlying

companies, we rely on HarbourVest and the underlying managers to

have appropriate protocols to encourage high ESG standards amongst

our investee companies and we have appointed Carolina Espinal as

the Director responsible for ESG at the HVPE Board level

Statement of Purpose

The AIC Code of Corporate Governance requires companies to

carefully consider the company's purpose, values and strategy and,

once documented, to be satisfied that these are aligned with its

culture. HVPE's "Statement of Purpose", detailed on the inside

front cover, was discussed extensively between the Board and the

Investment Manager and the Board endorsed the statement. In

developing this statement, the Board sought to define why this

Company exists for shareholders and all of its stakeholders.

Shareholders and prospective investors are today's and tomorrow's

owners of the Company and therefore at the core of every decision

made by the Board.

The Board has agreed that the Company's Purpose is that "HVPE

exists to provide easy access to a diversified global portfolio of

high-quality private companies by investing in HarbourVest-managed

funds, through which we help support innovation and growth in a

responsible manner, creating value for all our stakeholders."

Events Since 31 January 2020

Despite governments having been warned of the very serious risks

of pandemics, the world, and the Western world particularly, was

woefully unprepared for the onslaught caused by COVID-19. The loss

of life has been tragic. The ongoing effects on individuals,

society, the economy, and way of life are profound and are unlikely

to be fully reversed. Shareholders will be well aware of the

actions taken by governments and central banks to support their

societies and their economies. The shock to all economies is

massive and those of some countries are still in the contraction

phase. Some have begun modest recovery, although that recovery will

be uncertain as to its strength and timescale. Many businesses will

not return to their previous state and some will fail

completely.

Of course, market economies have always had to evolve through

"creative destruction" as described by Joseph Schumpeter, although

the destruction caused by COVID-19 will have been more rapid and

vicious than normal. But the inventiveness of entrepreneurs around

the world will unleash a programme of creative construction and

that has already been seen in the growth of businesses,

particularly in the technology space, addressing a number of trends

accelerated by the pandemic. It has always been a significant core

element of HarbourVest's business, and hence HVPE's underlying

portfolio, to seek out and support managers who are backing those

creative industries and companies.

In terms of the macro overview I will leave shareholders to form

their own views as to the magnitude of the downturn and the speed

of recovery. I do observe that, unlike in 2008/09, the Western

world is facing this maelstrom with the banking sector in much

better shape, thanks to the insistence of central banks and

regulators that balance sheets had to be strengthened after the

Global Financial Crisis. In addition, actions by governments have

generally been aggressively defensive to try and protect jobs. But

there is a long way to go before the success or otherwise of such

measures becomes clear.

The Board and Investment Manager's Response to Events

The Investment Manager's Report carries details of HarbourVest's

response to the crisis and that of the managers with which they are

invested as well as comment on sectors and companies. In this

Statement I will focus on the Board's response. Immediately that

the crisis hit in March the Board requested that HarbourVest update

two pieces of analysis which have been prepared regularly for many

years past. The first was the Investment Manager's best forecast of

the likely progression for the Company for the balance of calendar

2020 and the following four years out to 31 December 2024. The

second was the model, the existence of which I have reported in

earlier Statements, for a downturn more serious than that of

2008/09. As I wrote in my Statement in October 2019, it is

imperative that HVPE is able to weather storms as well as prosper

in a benign environment for equity markets and valuations. I had no

idea of the nature of the next downturn other than to know it would

occur at some point in the future and that HVPE needed to be

prepared.

The Board has now considered the outturn of the very detailed

and thorough work that the Investment Manager has undertaken. In

addition, HVPE has twelve years of detailed historical data and is

managed by an organisation with nearly forty years of experience

and a very settled team of senior private equity professionals. The

Company's first priority must be to ensure that it can meet its

obligations in respect of existing commitments to HarbourVest

funds. On 21 May 2020, the Company announced that the Investment

Manager and Board had agreed that new commitments would be paused

until the outlook was clearer. That continues to be the case in

respect of commitments to new HarbourVest funds. However, volatile

markets throw up opportunities and shareholders will recall that

HVPE took advantage of two such opportunities during and after the

Global Financial Crisis and, as a co-investor, joined HarbourVest

funds in the deals to purchase Absolute Private Equity and the

assets of Conversus. Both of these deals delivered significant

profits for HVPE.

Very recently a new investment opportunity has arisen. HVPE was

invited to join as a co-investor with the HarbourVest funds on a

possible secondary deal and the Board, after carefully considering

the investment case put forward by HarbourVest, decided to take

advantage of that invitation and approve a commitment of $18.9m.

Notwithstanding that commitment I can confirm that the Company is

well positioned to meet all its current obligations and such new

ones as may be entered into in due course. However, as reported in

HVPE's releases accompanying the monthly factsheets for March,

April and May, unless world economies bounce back quickly from the

COVID-19 shock and public markets are strong, shareholders should

expect some reduction in NAV per share to be reported as the year

progresses and as quarterly private equity valuations at 31 March

and 30 June become available. The Company will provide further

guidance in monthly releases as appropriate.

Turning to the model in the event of an extreme downside

scenario - and I emphasise this is not a scenario that either the

Board or Investment Manager expects to unfold - once again the

Company is forecast to be able to live within its present financial

facilities without having to change its strategy of investing for

the long term in private market assets so as to deliver performance

of NAV per share materially in excess of that of listed

markets.

Share Price and Discount

After reaching an all-time high of GBP18.68 in February 2020,

the share price has fallen back. Once the extremes of mid-March had

passed, it recovered sharply from a low of GBP9.21 and today's

price on 23 June 2020 is GBP15.60. Such volatility was seen widely

elsewhere in the market and could return at any time. In past

Statements I have consistently reminded shareholders that

investment in HVPE should be a long-term enterprise and it is worth

remembering that even at the mid-March low point, the sterling

share price was approximately three times the 31 January 2010 US

dollar share price when converted into sterling.

In part, on account of the lag in reporting private equity

valuations, the share price stands at a notional discount of 34% to

the last reported Net Asset Value at 31 May 2020. As I have already

written, it is probable that there will be a reduction in the

reported NAV per share over the months to come and, until those

adjustments have been worked through, the reported discount needs

to be treated with caution.

Annual General Meeting and Informal Webcast for Shareholders

The Company's AGM will be held in Guernsey on 22 July 2020 and

formal notice will be despatched to registered shareholders in the

week commencing 22 June. Owing to the travel restrictions imposed

on account of COVID-19, the meeting will be legally effective, but

no Director, other than Guernsey resident Andrew Moore, will be

present in person. The Company hopes that all registered

shareholders will exercise their votes by proxy. Save for myself,

all Directors will submit themselves for re-election including my

successor as Chairman, Ed Warner.

In recent years, in advance of the formal AGM, HVPE has held an

informal meeting for shareholders in London. That will obviously

not be possible in 2020, so in its place we will be holding a

webcast on 3 July 2020 at 10.00am British Summer Time. Shareholders

should contact Liah Zusman: lzusman@harbourvest.com should they

wish to attend.

The Last 12 Years and the Future

This is my final Chairman's Statement before I leave the Board.

I have been Chairman since the creation of the Company in 2007 and

have been part of the team that has steered it from a rarely traded

company, with a parentage then almost unknown outside of

professional investors, through to the largest private equity

fund-of-funds company listed in London, with significant liquidity

in the shares and a wide following. The journey has had a number of

interesting milestones along the road; the effects of the Global

Financial Crisis for HVPE; the introduction to the Specialist Funds

Market and the innovative secondary placing, with put options

attached, in London in May 2010; the far-sighted decision of

HarbourVest to give up control of HVPE and allow enfranchisement of

all of the investors' shares; the listing on the Main Market in

London in September 2015 followed by joining the FTSE 250 Index

that December.

I had hoped to leave on a high, having reported on the year to

31 January 2020 at which point the NAV per share had grown from

$10.00 at inception to $27.58 and the sterling share price, or

equivalent in 2007, when the only quote was in US dollars, had

increased from GBP4.93 to GBP18.36. But COVID-19 had different

ideas. Nevertheless, I know I am handing over to Ed Warner with the

Company in good shape under the circumstances and fit to prosper

further once the present crisis has passed.

I end by saying thank you to shareholders for your support, to

my Board colleagues, past and present, to all at HarbourVest and to

all those who have contributed to the success of HarbourVest Global

Private Equity thus far. May it flourish for years to come.

Michael Bunbury

Chairman

23 June 2020

Ten-Year Financial Track Record

------------------------------------------------------------------------------------------------------

At 31 January 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020

---------------- ----- ----- ------- ------- ------- ------- ------- ------- ------- -------

NAV ($ million) 849.7 944.0 1,030.2 1,167.0 1,266.3 1,337.3 1,474.9 1,713.9 1,924.0 2,202.7

---------------- ----- ----- ------- ------- ------- ------- ------- ------- ------- -------

NAV per Share

($) 10.24 11.42 12.46 14.38 15.86 16.75 18.47 21.46 24.09 27.58

---------------- ----- ----- ------- ------- ------- ------- ------- ------- ------- -------

Share Price

($) 6.18 6.37 8.66 10.75 12.73 12.41 15.03 17.77 18.75 24.15

---------------- ----- ----- ------- ------- ------- ------- ------- ------- ------- -------

Share Price

(GBP) 3.86 4.04 5.46 6.54 8.45 8.71 11.95 12.52 14.26 18.36

---------------- ----- ----- ------- ------- ------- ------- ------- ------- ------- -------

Discount to

NAV -40% -44% -30% -25% -20% -26% -19% -17% -22% -12%

---------------- ----- ----- ------- ------- ------- ------- ------- ------- ------- -------

Gearing (%) 9% 16% 15% 8% 0% 0% 0% 0% 0% 0%

---------------- ----- ----- ------- ------- ------- ------- ------- ------- ------- -------

Investment Manager's Report

Introductory Note in Light of Covid-19

This report presents a summary of the Company's performance in

the year to 31 January 2020. However, since the Company's year end,

and at the time of writing, the global outbreak of coronavirus

("COVID-19"), continues to weigh on economies around the world.

While the portfolio remained largely unaffected by COVID-19 during

the financial year, the pandemic has had, and may continue to have,

a material impact on the value and performance of the portfolio

since the reporting date, as described in Note 11 of the Financial

Statements on page 91.

In this report, disclosure is provided regarding the steps taken

by the Board and the Investment Manager to meet the ongoing

challenges arising from these adverse events. More

specifically:

-- In this section, on page 10, we present a summary of the

impact of COVID-19 with a short- to medium-term outlook.

-- Under Recent Events on page 12, the latest developments since

the financial year end, and position of the NAV per share,

following publication of the latest estimate, 31 May 2020, on 19

June 2020 are detailed.

-- Within the Period Since 31 January 2020 section on page 13

the impact on HVPE's share price is considered.

-- The actions taken around balance sheet modelling and stress

testing in response to COVID-19 are covered in Managing the Balance

Sheet on pages 28 to 29.

-- Due to the material impact that the pandemic will have on

society and the economy, and in turn, the Company, the Principal

Risks and Uncertainties section on pages 34 to 35 outline the

additional risks the Board has identified as a result of

COVID-19.

-- The Going Concern and the Viability Statement have both been

updated in light of COVID-19 and can be read in full on pages 65

and 66.

Portfolio Performance

NAV per Share - Year to 31 January 2020

HVPE's portfolio continued to perform well in the year to 31

January 2020, resulting in double-digit NAV per share growth for

the seventh consecutive year. The Company's NAV per share increased

by 14.5% from $24.09 at 31 January 2019 to $27.58 at the financial

year end. Translated into sterling(1) , NAV per share growth was

13.6% as sterling marginally appreciated against the US dollar over

the year. Recent COVID-19-related events, however, have had a

material impact on the NAV per share since 31 January 2020.

Developments following the year end and details of the latest NAV

per share can be found under Recent Events on page 12.

Most major equity market indices performed strongly in 2019 and

the early part of 2020, with some reaching record levels. HVPE's

public market benchmark, the FTSE AW TR Index (in US dollars), rose

by 16.7% in the year to 31 January 2020. Although HVPE's NAV per

share growth of 14.5% lagged this by 2.2 percentage points over the

reporting period, it is important to note that the starting point

captures an interim low for public market indices following a weak

Q4 2018, whilst HVPE's NAV had remained stable through that period.

Longer-term comparisons through the cycle are more indicative of

HVPE's relative performance: measured over the ten years to 31

January 2020, HVPE's NAV per share outperformed the FTSE AW TR

Index by 2.5% on an annualised basis in US dollar terms.

During the 12 months ended 31 January 2020 there was a $289.3

million net gain on investments, contributing to an overall

increase in net assets of $278.7 million. This compares with a

$218.4 million net gain on investments and overall increase in net

assets of $210.1 million for the year to 31 January 2019. The

$289.3 million net gain in this financial period was driven by an

almost equal mix of realised and unrealised gains at 49% and 51%,

respectively.

In percentage terms, the Primary portfolio was the

best-performing strategy, delivering value growth of 16.0%.

Geographically, the strongest gains came from the European

portfolio, which generated a value increase of 15.8%; this was

followed closely by the US assets, which returned 15.0%. In terms

of stage, Venture and Growth Equity was the strongest performer,

growing 17.8% over the 12 months ended 31 January 2020. This was

followed by Buyouts, which returned 14.7%. More information on the

growth drivers can be found on page 41.

As at 31 January 2020, HVPE held investments in 49 HarbourVest

funds and seven secondary co--investments(2) (compared with 46 and

seven, respectively, at 31 January 2019). Of these, the largest

drivers of NAV per share growth during the 12 months to 31 January

2020 are described below:

Fund X Venture was the largest contributor, adding $0.40 to

HVPE's NAV per share. This fund is a 2015 vintage US-focused

vehicle now entering the growth phase. As might be expected at this

stage in the fund's life, most of this gain came from unrealised

value growth.

Fund X Buyout, a 2015 vintage US-focused buyout fund, was the

second largest contributor, adding $0.29 per share. As with Fund X

Venture, most of this growth was derived from unrealised gains.

Following closely behind this was Global Annual Fund, a 2014

vintage multi-strategy fund-of-funds, which added $0.28 per share.

This came from an almost equal mix of realised and unrealised

gains.

Fund IX Venture, a 2011 vintage US-focused venture fund, added

$0.25 to NAV per share.

Dover IX, a 2016 vintage global secondary fund, was the fifth

largest contributor, adding $0.24 to NAV per share over the

period.

Portfolio Cash Flows

HVPE was a net investor in the 12 months to 31 January 2020,

with a net $16.0 million invested following capital calls of $324.2

million into HarbourVest funds (year to 31 January 2019: $396.2

million) and cash distributions of $308.2 million (year to 31

January 2019: $306.6 million). Overall, net negative cash flow

including operating expenses in the period resulted in HVPE's cash

balance declining from $156.6 million to $130.6 million.

HVPE has indirect exposure, on a look-through basis, to a pro

rata share of borrowing carried on the balance sheets of some of

the HarbourVest funds in which HVPE is a Limited Partner (referred

to as HarbourVest Partners ("HVP") fund-level borrowing; described

in previous reports as "embedded leverage"). It is important to

note that HVPE has no additional liability for these borrowings

beyond its uncalled commitments to each fund. The majority of this

fund-level borrowing represents delayed capital calls, as a portion

of the unfunded commitments has been invested through the use of

subscription credit lines at the fund level, but the capital has

not yet been called from HVPE.

At 31 January 2020, HVPE's share of HVP fund-level borrowing on

a look-through basis was $366.8 million, a net increase of $94.2

million from $272.6 million at 31 January 2019. Expressed as a

percentage of NAV, the figure increased from 14.2% to 16.7% over

the 12-month period. The increase was driven by the changing mix of

current fund exposures in the portfolio, and in particular the most

recent US fund-of-funds programme, HarbourVest Partners XI, which

has used a credit line to smooth early capital calls from its

investors. More detail on the HVP fund-level borrowing, and how we

factor this into our balance sheet management, can be found under

Managing the Balance Sheet on pages 26 to 29.

In the reporting period, the largest HarbourVest fund capital

call ($59.3 million) came from the real assets vehicle which HVPE

seeded in June 2018. This was used to fund an investment into a

global portfolio of high-quality infrastructure assets, which

includes an Australian shipping ports business, a Spanish toll road

operator and a US airport manager and developer. This "net" amount

funded is less than the $101.3 million reported in the interim

results to 31 July 2019 as it reflects the returned capital

contribution of $42.0 million received by HVPE in November 2019,

following additional subscriptions to the vehicle from other

investors. Other large capital calls originated from Fund X Buyout

($35.3 million) and Fund XI Buyout ($31.5 million), 2015 and 2018

vintage funds, respectively. Following these were calls from Fund X

Venture ($19.2 million), Fund XI Venture ($19.0 million), and Dover

IX ($19.0 million). These are all funds currently in the investment

phase and building out their portfolios.

Distributions in the HVPE portfolio were driven by a mix of

HarbourVest funds across all strategies, with the largest total

amount in the period ($49.1 million) received from HarbourVest 2013

Direct Fund, a global direct co-investment fund in its growth

phase. A large portion of these proceeds came from the sales of two

portfolio companies: Toronto-based environmental, safety, and

quality management software provider Intelex Technologies; and

patient satisfaction survey provider Press Ganey, HVPE's largest

underlying portfolio company at 31 January 2019. Strong

distributions also came from Fund X Buyout (a US-focused buyout

fund-of-funds) and 2016 Global Fund (a multi-strategy

fund-of-funds) with proceeds of $20.7 million and $18.7 million,

respectively. The 2014 vintage Global Annual Fund (a global

multi-strategy fund-of-funds) followed closely with distributions

totalling $18.0 million, which included proceeds received from the

sale of TeamViewer shares following the software solutions

provider's September IPO on the Frankfurt Stock Exchange.

Details of other notable company exits and performance drivers

within the portfolio during the reporting period are provided in

this year's Deep Dive section on pages 18 to 21.

Focus on ESG

HVPE

In November 2019, the HVPE Board named Carolina Espinal as

HVPE's Director responsible for ESG, with the remit to help

coordinate activity between the Investment Manager and the Board on

ESG matters, to promote closer monitoring and further development

in this area for HVPE. Further ESG-related information can be found

in the Directors' Report on page 53.

HarbourVest Partners

Strengthening its ESG programme is an ongoing strategic priority

for HarbourVest Partners (referred to hereafter as "HarbourVest" or

the "firm"). On 4 March 2020, HarbourVest released its first ever

digital-only ESG Report, detailing the initiatives and activities

it undertook in 2019 to support its longstanding commitment to

responsible investing and engaged corporate citizenship. Among

other highlights, the report details how the firm integrates ESG

into its investment processes, the proactive work the firm does to

drive increased awareness and adoption externally, HarbourVest's

commitment to backing managers led by diverse teams, itself being a

diverse and inclusive organisation, and how HarbourVest plans to

address the issue of climate change. It also features the community

and charitable activities that the firm undertakes, including its

two annual Global Volunteer Weeks. In 2019 these supported 28

organisations globally, tackling worthy causes such as youth

mentoring, child and adult special education, gender diversity,

poverty and homelessness, women's leadership, the arts, and various

health causes. The full list of charities supported can be found in

the 2019 report (link on page 9).

HarbourVest reported material progress on ESG integration

practices over 2019. On the investment side, it provided deeper

training and strengthened its post-investment monitoring protocols.

It also used its proprietary "scorecard", which assesses managers'

ESG programmes on more than 20 metrics, to proactively rank the

programmes of 178 General Partners ("GPs") over the year. In

addition, as a signatory of the United Nations-supported Principles

for Responsible Investment ("PRI"), HarbourVest is graded in three

core areas and this year it achieved strong results, with one A+,

and two As, placing the firm above the industry 2019 median.

On the subject of diversity and inclusion, HarbourVest continued

to be a leading industry voice in 2019, participating in several

forums and, where appropriate, leveraging its advisory board

presence to deepen awareness and share insights and best practices

at a portfolio company level. During the year the firm formed a

Diversity & Inclusion Council to accelerate progress and

results. Due to the energy of the Council in its first year, the

firm introduced a new Flexible Work Program, expanded its global

parental leave policy, and established a new global

anti-discrimination and anti-harassment policy. The firm also

worked with Korn Ferry to provide conscious inclusion and anti-bias

training to all employees. This commitment to diversity and

inclusion extends to how HarbourVest invests. HarbourVest has

historically provided capital support to diverse and emerging funds

and managers (diversity defined as 25% or greater of a senior-level

team identifying as female, belonging to an under-represented

minority, or both) and sources more than 150 opportunities each

year focused within this market. Since 2009, HarbourVest's US

buyout and venture data shows that diverse GPs have generally

outperformed non-diverse GPs during this time, and that the

outperformance delta has grown over time.

The firm has historically embraced diversity and inclusion

across the organisation - one-third of HarbourVest's senior-level

professionals are female, more than triple the industry average(3)

and 27% of its workforce are ethnic minorities (as at 31 March

2020). As an initial further step HarbourVest has signed the

Diverse Alternative Investment Industry Statement, put forward by

the National Association of Investment Companies ("NAIC") to

promote America's largest investment managers of colour call for

action. HarbourVest also closed on Friday 19 June, in recognition

of "Juneteenth". In the US, Juneteenth is the oldest nationally

celebrated commemoration of the ending of slavery. The firm will

observe this holiday annually as a reminder of its diversity and

inclusion goals.

HarbourVest launched a major, cross-company transformation

initiative in 2019 that will allow it to examine all aspects of its

programme and make enhancements. The firm also hired its first

full-time, ESG-focused staff member with the addition of Natasha

Buckley, who joined HarbourVest from the PRI. Natasha sits on

HarbourVest's Global ESG Committee, which is responsible for

overseeing the firm's ESG Policy, recommending modifications, and

ensuring overall implementation across the organisation. The

Committee meets monthly to discuss the ongoing integration of ESG

principles into all aspects of business, including investments,

operations, and community engagement. One of the top areas of focus

for Natasha is the climate crisis, which the firm knows is foremost

among investors' top ESG concerns. The goal is to develop a

meaningful understanding of how the effects of climate change may

impact the firm's investments, and what it can do to build

portfolio resiliency on behalf of clients. As such, and in

adherence to the principle of industry collaboration, HarbourVest

plans to organise its strategy in line with the recommendations of

the Task Force on Climate-related Financial Disclosures ("TCFD"),

and will engage with GPs on the adoption of the TCFD framework to

assess and manage climate-related risks. As of March 2020,

HarbourVest became an official supporter of the TCFD and will

report on its progress in the 2020 ESG Report and through the PRI

Reporting Framework.

The full report can be found under Viewpoints in the Insights

section of the HarbourVest website:

www.harbourvest.com/insights/viewpoints.

Company Activity

New Fund Commitments

In the 12 months ended 31 January 2020, HVPE made total

commitments of $570.0 million across eight HarbourVest funds (12

months to 31 January 2019: $730.0 million). These cover all the

main strategies offered by HarbourVest in the period, as detailed

on page 40; however, by value, the majority of commitments were

weighted towards primary funds (i.e. fund-of-funds).

Of the total capital committed, the largest commitment ($120.0

million) was made to HarbourVest Partners XI Buyout, a US-focused

buyout fund-of-funds. This brings the total amount committed by

HVPE to this fund to $350.0 million. The capital drawdown profile

of such a programme typically extends over a period of several

years, which helps to drive an even allocation across vintage

years, thereby reducing the risk of exposure to a single

poor-performing year. Other large commitments during the period

included $100.0 million each to a global secondary fund (Dover

Street X), and the latest annual global multi-strategy

fund-of-funds (HarbourVest's 2019 Global Fund).

These commitments are all in line with the Company's Strategic

Asset Allocation ("SAA") targets and reflect the Investment

Manager's and Board's current perspective on the most appropriate

portfolio composition required to optimise long-term NAV growth for

shareholders.

Strategic Asset Allocation

The Company's SAA targets (see pages 32 and 33 for more details)

are reviewed annually and were revised in November 2019, as

communicated in the Company's December 2019 Regulatory Newswire

Service ("RNS") announcement for the estimated November NAV update.

The adjustments by strategy were an increase in allocation to

Secondary investments from 25% to 30%, with a decrease in Primary

investments from 55% to 50%. The changes by geography were an

increase in Asia Pacific from 12% to 17%, with a decrease in US

from 65% to 60%. All other targets remain unchanged. The increase

in targeted Secondary exposure was driven by a desire to balance

cash flows more evenly over the medium term, and to enable the

Company to take advantage of the attractive opportunities that

HarbourVest anticipates will arise in the secondary market in the

months and years ahead. The heightened focus on Asia reflects the

Board's and Investment Manager's belief in the increasing

importance of the region for private markets investors, and will

help to ensure that HVPE's portfolio keeps pace with what is

expected to be a continuing shift in the centre of economic gravity

from

West to East.

Market Environment in 2019 (4)

Private equity fundraising hit record highs in the US and Europe

in 2019, totalling $301.3 billion (2018: $197.8 billion) and

EUR86.4 billion (2018: EUR69.7 billion), respectively, across a

total of 291 funds (2018: 294). This reflected strong demand from

investors and increased recognition of private markets as an

attractive means by which to access diversified global growth and

outperform public markets.

These record totals were achieved despite a slightly lower fund

count than in the previous year, indicating that investor capital

has been chasing fewer but larger funds. Fundraising in Asia

Pacific fell 48% year-on-year to $53.0 billion, led by declines in

China-focused and pan-regional funds. It is important to note,

however, that 2018 was a record year for fundraising in this

region, and 2019 was still the second strongest year

historically.

US and European private equity investment activity remained

robust in 2019, totalling $627.3 billion (2018: $730.3 billion) and

EUR453.5 billion (2018: EUR464.5 billion), respectively, across

8,329 deals (2018: 9,340). This fell short of 2018's record-setting

pace as deal-makers focused on limiting risk as rhetoric escalated

around a possible cyclical peak and imminent downturn, fuelled by

ongoing trade disputes and geopolitical ambiguity creating an

uncertain market backdrop. However, average deal sizes remained

high across these regions as the dynamics around a favourable

financing environment and heightened competition for deals

continued, as well as the growth in demand for well-established,

recession-resilient companies. Company valuations in these regions

ended the year above their pre-Global Financial Crisis ("GFC")

levels, requiring managers to be disciplined in selection. Software

deals, which typically attract higher valuations, grew as a

proportion of total transacted deal value in both the US and Europe

at 17% (2018: 13%) and 24% (2018: 17%), respectively. Investment

volumes in Asia Pacific were 21% lower year-on-year, largely due to

a slowdown in large late--stage technology financing rounds in

China.

Exit value and volume were materially lower across all regions

in 2019. Estimated exits in the US totalled $318.2 billion in value

and 1,035 in count representing declines of 28% and 17%,

respectively, compared to 2018. The Europe and Asia Pacific regions

were also subdued; European exits declined 22% in value and 24% in

count whilst Asia Pacific exit value fell 29% year-on-year. Market

anxiety due to recession risk, geopolitical issues, and a desire by

GPs to hold assets for longer as well as participate in add-on

deals all contributed to the slowdown.

Following the onset of the COVID-19 pandemic in the early part

of 2020, we have begun to see the impact, with lower deal volumes

across all regions. The pandemic has highlighted how the health of

the global economy is deeply reliant on the continued day-to-day

functioning of society at the micro level. The profound effects of

social distancing measures have delivered an exogenous shock to the

global economy and financial markets. Companies operating within

certain sectors, particularly those considered "non-essential",

have been adversely affected by restrictions enforced by

governments around the world as they attempt to limit the spread of

the virus. As a consequence, it is likely that new investment

activity and exits will be markedly down on 2019 levels in the

months ahead as the industry adjusts to a heightened level of

uncertainty over the economic outlook and its potential impact

across a broad range of businesses, both private and public.

Update in light of COVID-19

The World Health Organization classified COVID-19 as a pandemic

on 11 March 2020 - approximately six weeks after HVPE's financial

year end. The full impact of this on HVPE's portfolio is difficult

to forecast, given the complex interplay between unprecedented

top-down actions from governments and central banks on the one

hand, and myriad specific responses from businesses and consumers

on the other. However, the Investment Manager and Board have sought

to provide guidance and updates to stakeholders in recent months,

the latest of which can be found under Recent Events on page 12.

Indeed, our Estimated NAV Update at 31 May 2020, published on 19

June 2020 and based predominantly on Q1 2020 valuations, reported a

NAV decline of 6.0% in US dollars from the previous month end. In

this section we aim to collate and summarise all the developments

since the year end, to date.

Share Price and Portfolio Valuations

As the pandemic triggered an indiscriminate sell-off across

financial markets in early March, the immediate impact was a sharp

decline in HVPE's share price, as reviewed in the Share Price

Trading and Liquidity section on page 13. Consequently, the

discount to NAV at which the shares currently trade has increased

materially from the levels at the start of this calendar year.

Although the share price has made a partial recovery from the

trough on 19 March, the consequences of the declines in public

markets and the broader impact of COVID-19 on the real economy are

expected to weigh materially on HVPE's NAV in the months ahead. A

portion of the NAV decline has come through in the underlying Q1

2020 valuations, driven by public market declines and a decrease in

mark-to-market earnings multiples. The latest estimated NAV, which

includes 91% of 31 March valuations, can be found in the Recent

Events section on page 12.

Investment Manager Actions

HarbourVest's investment team has been focused on managing the

portfolio to weather the near- and longer-term effects of COVID-19.

For existing investments, the primary, secondary, and direct

co-investment strategy teams are in continuous dialogue with

General Partners ("GPs") to maintain a portfolio risk analysis heat

map, which gauges the level of exposure to distressed or high-risk

companies. Where appropriate, this then includes identification of

strategies and mechanisms to soften the revenue impact.

There are many potential areas where higher-risk companies can

be supported and guided by their investors, helping to protect all

stakeholders and limit the extent of any permanent value

destruction. Meanwhile, new investment opportunities are being

evaluated carefully and selectively, considering current and

prospective market conditions.

The private equity industry is structured with a view to

long-term value creation, and this allows for considerable

flexibility in times like these. Furthermore, the Investment

Manager has almost four decades of experience managing through

previous global events and economic crises. With the benefit of

hindsight, previous crisis-era vintages such as 2008 and 2009 were

among the best performing in HarbourVest's history. However, past

performance cannot be relied on as an indicator of future

performance.

Portfolio Assessment

As reported on 20 April 2020, the Investment Manager had

embarked on an ongoing bottom-up assessment of the likely impact of

COVID-19 on HVPE's portfolio. As at 31 May 2020, approximately 80%

of the portfolio by value had been reviewed as part of this

exercise. Companies were assessed directly or with the help of the

applicable GP, taking into consideration HQ location, employee

dislocation risk, end user/consumer sentiment sensitivity,

person-to-person exposure, business model travel requirements,

potential for supply side disruption, and liquidity and leverage

profile, among other factors.

The great majority of HVPE's portfolio by value has been deemed

likely to experience a low or moderate impact across these areas of

assessment, with only a relatively small proportion expected to be

materially impacted, as shown in the chart on the left. The

Investment Manager is continuously refining the risk profiles based

on regular communication with GPs and company management. Should

there be any substantive change in the output of this ongoing

impact assessment, a further update will be provided in due

course.

Cash Flows, Credit Facility, and Balance Sheet

There is some evidence that GPs have been issuing capital calls

to pay down their subscription lines, with pre-emptive calls

providing liquidity to take advantage of specific short-term market

opportunities and in certain instances to support impacted

companies. Importantly, HVPE benefits from a strong balance sheet

supported by a $600.0 million credit facility committed until at

least January 2026. As a prudent measure, in April 2020, HVPE

provided notice to its lenders to draw down $200.0 million from the

credit facility. Details of this transaction and cash flows in the

months subsequent to the financial year end are outlined in the

Recent Events section on page 12.

HVPE's cash flows are closely monitored for reasons which are

outlined in more detail later in this report. As discussed in the

Chairman's Statement, HVPE has revised its cash flow projections to

reflect recent developments together with insights from the

portfolio risk analysis exercise mentioned above. Current forecasts

indicate that the Company is able to accommodate a considerable

period of cash outflows even while distributions remain low. For

further information on this and the Company's approach to cash flow

management and balance sheet stress testing, see the Managing the

Balance Sheet section on pages 26 to 29.

Market Perspectives and Outlook

Challenging times like these are another reminder of the virtues

of a well-diversified, global private markets investment programme

in helping to mitigate downside risk. No single investment is

sufficiently material on its own to cause serious concern; at 31

January 2020, the largest single exposure represents 1.9% of NAV.

Furthermore, HVPE's diversification by sector as well as by

strategy, stage, geography, and vintage year should help to ensure

that any potential negative developments in one part of the

portfolio are offset, at least partially, by favourable outcomes

elsewhere. See pages 32 to 33 for detail on portfolio

diversification.

Continued, steady pacing of investment through the cycle is

critical to achieve superior long-term risk-adjusted returns.

HarbourVest funds are managed by experienced teams, and the

Investment Manager will continue to seek opportunities for HVPE

provided that forecast returns are suitably attractive on a

risk-adjusted basis. HVPE's ability to maintain a steady pace of

investment allows it to participate in such opportunities as they

arise, so that it not only navigates the current turbulence

successfully but emerges even more strongly positioned in the long

term.

1 USD/GBP exchange rate: 0.7572.

2 These include five Secondary Overflow III investments and Absolute, referred to as "HVPE Avalon Co-Investment L.P.", and Conversus, referred to as "HVPE Charlotte Co-Investment L.P.", in the Audited Consolidated Schedule of Investments. Absolute has been fully realised; however, $480,180 remains in escrow.

3 Preqin, "Women in Private Equity", 2019

4 Source: Pitchbook data

Recent Events

Credit Facility

On 9 April 2020, HVPE provided notice to its lenders Credit

Suisse and Mitsubishi UFJ to draw down $200.0 million of the $600.0

million credit facility. This decision was based on a revised

outlook for cash requirements informed by updated forecasts

presented by the Investment Manager. The cash amount, deposited in

May, is being held in a AAA-rated US Treasury money market fund

managed by J.P. Morgan.

Following the initiation of this draw on the facility, HVPE has

access to the remaining $400.0 million available and therefore

retains the flexibility to react as required to the evolving

situation driven by COVID-19. In utilising HVPE's credit facility,

the Board is confident that HVPE will be well-placed to continue

investing as planned through the difficult times ahead, supporting

its underlying managers and portfolio companies, and to capitalise

on new opportunities during the recovery phase.

New Commitments

On 21 May 2020, it was announced that the Board and the

Investment Manager had placed HVPE's commitment plan temporarily on

hold, in order to allow for the Investment Manager to review the

Company's portfolio construction priorities during these uncertain

times. A further assessment will be made in due course, with the

potential to re-start new commitments in Q4 2020. In the meantime,

the HarbourVest funds to which HVPE has already made commitments

will continue to call capital for new investments, so enabling the

Company to take advantage of the attractive opportunities that the

Investment Manager anticipates will arise during this period.

Subsequently, on 17 June 2020, the HVPE Board approved a

commitment of $18.9 million to a potential transaction made

available to HVPE as a result of the Company's existing commitments

to HarbourVest funds.

HVPE Committed Capital to Newly-Formed HarbourVest Funds

Between 1 February 2020 and 23 June 2020, HVPE committed $50

million to the HarbourVest funds outlined below.

HarbourVest Date Commitment

Fund Committed ($m)

------------ ------------- ----------

Dover X 9 March 2020 $50.0

------------ ------------- ----------

Total $50.0

--------------------------- ----------

HVPE PUBLISHED ESTIMATED NAV AT 31 MAY 2020

HVPE publishes its estimated NAV on a monthly basis. These

reports are available on the Company's website, generally within 20

calendar days of the month end.

On 19 June, HVPE published an estimated NAV per share at 31 May

2020 of $25.62 (GBP20.79), a decrease of $1.96 from the final NAV

(US GAAP) figure of $27.58. This latest NAV per share is based

predominantly on 31 March 2020 valuations, and therefore reflects

the majority of the decline expected from Q1 2020 marks.

The Investment Pipeline of unfunded commitments decreased from

$1,807.0 million at 31 January 2020 to $1,693.7 million at 31 May

2020, based on capital funded and foreign exchange movements.

At the end of May HVPE's borrowing was $200.0 million. Due to

the draw down, the Company's cash balance had increased by $84.1

million to $214.7 million. HVPE's look-through exposure to

borrowing at the HarbourVest fund level had decreased by $12.2

million to $354.6 million.

Key Ratios at 31 May 2020

Total Commitment Ratio

(Total exposure to private markets investments as a percentage

of NAV)

Investment Portfolio

+ Investment Pipeline $3,720.0m

----------------------- ---------

Divided by the NAV $2,046.3m

----------------------- ---------

182%

----------------------- ---------

Commitment Coverage Ratio

(Short-term liquidity as a percentage of total Investment

Pipeline)

Cash + available credit

facility $614.7m

-------------------------- ---------

Divided by the Investment

Pipeline $1,693.7m

-------------------------- ---------

36%

-------------------------- ---------

Rolling Coverage Ratio

(A measure of medium-term commitment coverage)

Cash + available credit

facility (total $614.7m)

+ current year estimated

distributions ($180.9m) $795.6m

-------------------------- ---------

Divided by the next

three years' estimated

investments $1,264.8m

-------------------------- ---------

63%

-------------------------- ---------

Managing the Balance Sheet

Effective and prudent balance sheet management is critical when

running a closed-ended vehicle investing into a portfolio of

private market funds with varying cash flow profiles. This is

particularly true for a company such as HVPE which maintains a

large pipeline of unfunded commitments (the "Investment Pipeline"),

i.e. the portion of capital pledged to an underlying fund, but not

yet drawn down for investments. This section aims to outline HVPE's

approach to managing its balance sheet and explain the steps it

takes to ensure that the Company is sufficiently resourced in

preparation for periods of significant market stress.

The Importance of the Credit Facility

HVPE makes commitments to HarbourVest funds, which typically

call capital over a period of several years. This long-duration

cash flow profile necessitates a large pipeline of unfunded

commitments in order to ensure that the Company remains

approximately fully invested over time - this is known as an

over-commitment strategy and is critical to optimising long-term

NAV per share growth. In most years, the capital called from HVPE

by the HarbourVest funds is taken from the cash distributions

flowing from liquidity events within the portfolio. Occasionally,

however, capital calls will exceed distributions, potentially by a

meaningful amount, and it may be necessary to draw on the credit

facility to fund the difference. A subsequent year may see the

reverse situation, with net positive cash flow used to repay the

borrowing. In this way, the credit facility acts as a working

capital buffer and enables HVPE to manage its commitments to the

level required in order to optimise returns through the cycle.

At 31 January 2020, HVPE had a $600.0 million multi-currency

credit facility (the "Facility"), with Mitsubishi UFJ Trust Banking

Corporation ("Mitsubishi") acting through its New York Branch, and

Credit Suisse AG London Branch ("Credit Suisse"). The Facility,

details of which were announced on 4 January 2019, is a five-year

evergreen structure, with an initial two-year no-notice provision,

giving it an initial term of seven years to January 2026. From

January 2021, the lenders have the option to serve notice, but the

notice given must be a minimum of five years. HVPE believes this is

one of the leading finance packages within its peer group and that

it appropriately underpins the activities of the Company,

supporting its unfunded commitments and future investment plans. As

a pre-emptive measure, in April 2020, HVPE initiated a draw of

$200.0 million on the Facility to ensure that it had sufficient

liquid resources to meet its near-term obligations; for more

details on this, please visit Recent Events on page 12.

Understanding HVPE's Investment Pipeline (Unfunded

Commitments)

At 31 January 2020, HVPE's total pipeline of unfunded

commitments stood at $1.81 billion. This total pipeline comprised

"allocated" investments of $1.29 billion and "unallocated"

investments of $521.7 million. It is important to note that, of the

allocated pipeline, approximately 70% of commitments are to primary

funds, which have a longer drawdown profile, whilst secondary and

direct co-investment funds represent approximately 20% and 10%,

respectively. Further detail on the age breakdown of the allocated

pipeline is provided on page 40.

Since 2010, annual capital calls have been in the range 18% to

32% of the total pipeline, while distributions have been 16% to 32%

of NAV. However, in an adverse macroeconomic environment comparable

to the GFC of 2008/09, it is conceivable that HVPE could suffer

prolonged negative cash flow as these figures move to the more

extreme levels seen in that period. In 2009, for example,

distributions fell to only 6% of NAV while capital calls that year

also fell to a low level (11% of the total pipeline).

We cannot be sure that this pattern will be repeated and must

consider the possibility that capital calls could remain elevated

even during a period of suppressed distribution activity. A large

credit facility committed for an extended period (currently five

and a half years) provides reassurance that the Company would be

able to remain operational under such conditions, with the

additional flexibility to continue to take advantage of attractive

investment opportunities as they arise. This is a model that has

worked well in the past, as shown in the chart on page 26. HVPE's

large credit facility meant that it was able to be a net investor

through the period 2008 to 2011, which has helped the Company to

deliver very attractive long-term returns for shareholders. For

some time, extensive modelling has been conducted to ensure that

the Company's balance sheet can withstand a crisis more prolonged

than the GFC. This modelling has also been updated in light of

COVID-19. Please see "REVISIONS TO THE MODELLING IN LIGHT OF

COVID-19" overleaf for more on this.

HarbourVest Fund Level Borrowing

HarbourVest funds employ credit lines for two main purposes:

bridging capital calls and distributions; and financing specific

investment projects where the use of debt may be advantageous. HVPE

is exposed to this fund-level borrowing on a look-through basis as

a result of its investments in the HarbourVest funds. This

borrowing does not represent an additional liability above and

beyond the commitments that HVPE has made to the HarbourVest funds.

The debt is provided to the HarbourVest funds on attractive terms

by multiple institutions and carries a relatively low rate of

interest as it is secured on the commitments made by investors

(including HVPE) to those funds.

The HVPE team monitors the HarbourVest fund-level borrowing in

absolute terms, and as a percentage of NAV. This borrowing is also

considered when evaluating the key balance sheet ratios: The Total

Commitment Ratio within the Investment Pipeline (unfunded

commitments), and the Rolling Coverage Ratio within the three-year

capital call projections. HarbourVest fund-level borrowing is also

included when assessing the credit facility's loan-to-value ratios,