Hygea VCT plc Hygea Vct Plc : Update For The Quarter Ended 31 March 2017

May 19 2017 - 1:00AM

UK Regulatory

TIDMHYG

FOR IMMEDIATE RELEASE 19 May 2017

HYGEA VCT PLC

("Hygea" or "the Company")

Update for the quarter ended 31 March 2017

Hygea vct plc presents its quarterly update for the period commencing 1

January 2017.

The Directors have recently reviewed the valuation of its portfolio as

at the quarter ended 31 March 2017.

The unaudited Net Asset Value ("NAV") per ordinary share as at 31 March

2017 was 68.8p. This is a rise of 0.5p from the previously published

NAV for the period ended 31 December 2016, due to changes in the value

of the quoted investments, net of running costs. No changes have been

made to the unquoted valuations.

The Company's holding in Scancell Holdings Plc ("Scancell"), listed on

AIM, represents approximately one third of its portfolio at 31 March

2017. The bid price of Scancell's shares used for the calculation of

the Company's net assets on 31 March 2017 was 14.0p, a slight reduction

from 31 December 2016. On 11 May 2017, Scancell announced a placing to

raise GBP5m at 10p per share; the funds raised will be used to initiate

the clinical development of Modi-1, the first product from the

Moditope(R) platform, and to continue to support the ImmunoBody(R)

platform pipeline .Hygea's Net Asset Value per share would have reduced

by 5.2p (net of the reduction in the performance fee provision) had its

Scancell holding been valued at the placing price. Hygea was unable to

subscribe in this funding round due to limitations imposed by HMRC to

maintain VCT qualifying status, and, as a result, we have been further

diluted and now hold 4.2% of Scancell.

At 31 March 2017, the company had used GBP169,424 of its GBP200,000

overdraft facility.

During the period under review, 208,727 shares in EKF Diagnostics plc

were sold for liquidity management purposes (and a further 185,832

shares have been sold since 31 March 2017).

The Directors are not aware of any other events or transactions which

have taken place between 1 April 2017 and the publication of this

statement which have had a material effect on the financial position of

the Company.

Furthermore, in conformity with the Disclosure and Transparency Rules,

the Company notifies the market that the capital of the Company consists

of 8,115,376 Ordinary Shares with a nominal value of GBP0.50 each with

voting rights as at 18 May 2017. The Company does not hold any Ordinary

Shares in Treasury. Therefore, the total number of voting rights in the

Company is 8,115,376 (the 'Figure').

The Figure may be used by shareholders as the denominator for the

calculations by which they will determine if they are required to notify

their interest in, or a change to their interest in the Company under

the FCA's Disclosure and Transparency Rules.

Enquiries:

John Hustler, Hygea vct plc at john.hustler@btconnect.com

Roland Cornish, Beaumont Cornish Limited on 020 7628 3396

This announcement is distributed by Nasdaq Corporate Solutions on behalf

of Nasdaq Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the information

contained therein.

Source: Hygea VCT plc via Globenewswire

(END) Dow Jones Newswires

May 19, 2017 02:00 ET (06:00 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

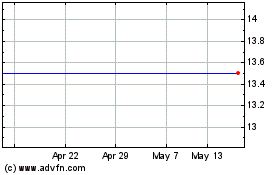

Seneca Growth Capital Vct (LSE:HYG)

Historical Stock Chart

From Apr 2024 to May 2024

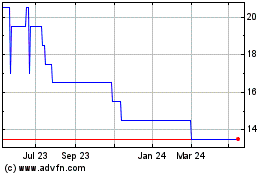

Seneca Growth Capital Vct (LSE:HYG)

Historical Stock Chart

From May 2023 to May 2024