TIDMIHP

RNS Number : 7257W

IntegraFin Holdings plc

14 December 2023

LEI Number: 213800CYIZKXK9PQYE87

14 December 2023

IntegraFin Holdings plc

Announcement of full year results for the year ended 30

September 2023

IntegraFin Holdings plc (IHP, or the Group), operator of the

UK's premium investment platform - Transact - for clients and UK

financial advisers, is pleased to report its full year results.

The Group displayed solid financial performance and operational

progress in a challenging macro-economic environment.

Highlights

-- Record year end Transact investment platform funds under direction ('FUD') of GBP55.0bn.

-- Solid growth of the Transact investment platform business

during FY23 with resilient net inflows of GBP2.7bn, representing

over 5% of opening FUD.

-- Group revenue increase of 1% to GBP134.9m (FY22: GBP133.6m).

-- Underlying Group profit before tax of GBP63.0m (FY22:

GBP65.8m), after adjusting for non-underlying expenses of GBP0.4m,

with IFRS profit before tax up 15% to GBP62.6m (FY22:

GBP54.3m).

-- Underlying Group earnings per share of 15.2p (FY22:16.3p).

IFRS Group earnings per share of 15.1p (FY22: 13.3p).

-- Financial guidance for the year ending 30 September 2024 remains unchanged.

-- Declared second interim dividend of 7.0 pence per ordinary

share, resulting in a total dividend for the year of 10.2 pence per

share in line with prior year (2022: 10.2 pps). The dividend is

payable on 26 January 2024 to ordinary shareholders on the register

on 22 December 2023. The ex-dividend date will be 21 December

2023.

Commenting on the Full Year results, Alexander Scott, IHP Group

Chief Executive said:

"I am pleased with the solid performance shown by the Group

during the past financial year. We have grown Group revenue, client

numbers, and adviser numbers, and delivered resilient net inflows

over the period. This is attributable to the dedication of our

staff in delivering a first-class service to our clients and their

advisers.

"While the external market has been volatile, the UK adviser

platform market remains healthy and is expected to grow well over

the coming years. We are well placed to take advantage of this

market growth, and we remain confident in our market position,

despite the uncertainty in the wider economy.

"Above all, we remain focused on our goal of being the number

one provider of software and services for clients and UK financial

advisers."

Operational Highlights

-- Performance of the Transact platform remains strong and growing:

- A 2% increase in the Transact platform's adviser base to

c.7.7k advisers (30 September 2022: 7.5k)

- A 2% increase in the number of clients using the Transact

platform to c.230k (30 September 2022: 225k)

-- Digitalisation programme to deliver operational efficiencies

for the Transact platform is progressing well:

- Recruitment of IT and software professionals advancing despite

competitive IT recruitment market

- Recruitment will continue into FY24 in line with planned total headcount additions

-- Strong growth at Time4Advice including:

- Revenue for FY23 of GBP4.8m, an increase of 22% over the past financial year

- Increase in chargeable users for FY23 of 22%

Financial information

IHP Group

Year to Year to

30 September 30 September

2023 2022

Total Group revenue GBP134.9m GBP133.6m

-------------- --------------

Underlying profit before GBP63.0m GBP65.8m

tax

-------------- --------------

IFRS profit before tax GBP62.6m GBP54.3m

-------------- --------------

Underlying earnings per

share 15.2p 16.3p

-------------- --------------

Total dividend per share 10.2p 10.2p

-------------- --------------

Transact platform:

Year ended Year ended

30 September 30 September

2023 2022

Net new business inflows GBP2.7bn GBP4.4bn

-------------- --------------

Closing funds under direction GBP55.0bn GBP50.1bn

('FUD')

-------------- --------------

GBP53.6bn GBP52.5bn

Average daily FUD

-------------- --------------

Transact platform clients

(as at 30 September) 230,294 224,705

-------------- --------------

Transact platform registered

advisers (as at 30 September) 7,683 7,537

-------------- --------------

Time4Advice:

Year ended Year ended

30 September 30 September

2023 2022

GBP4.8m GBP3.9m

Time4Advice revenue

-------------- --------------

Total number of CURO software

users (as at 30 September) 2.8k 2.3k

-------------- --------------

Enquiries

Investors

Luke Carrivick, IHP Head of Investor

Relations +44 020 7608 5463

Media

FGS Global: Mike Turner +44 7775992415

FGS Global: Chris Sibbald +44 7855955531

2023 Full year results presentation

IHP will be hosting a virtual analyst audio presentation at

09:30am on 14 December 2023. This will be available at

https://brrmedia.news/IHP_FY23.

A recording of the presentation will be available for playback

after the event at https://www.integrafin.co.uk/. Slides

accompanying the analyst presentation will also be available this

morning at https://www.integrafin.co.uk/annual-reports/.

CEO Statement

Overview

The Group has continued its record of resilient growth, with

Transact demonstrating robust performance in increasing funds under

direction (FUD), net inflows and client and adviser numbers. This

financial year has been marked by persistently high inflation and

interest rates, with only modest economic growth.

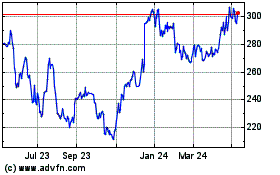

The first half of our financial year saw relatively solid equity

market performance. Global equity markets were volatile but there

was an upward trend during the period from October 2022 to March

2023. The latter two quarters of financial year 2023 saw less

volatility. Slowing inflation towards year end led to a pause in

the rate rises that characterised much of the year but the high

cost of living persisted.

Under these challenging conditions, we support our clients and

their financial advisers through our combination of proprietary

technologies - the Transact investment platform and CURO - and our

industry-leading customer service.

We remain focused on our goal of making financial planning

easier and more efficient and, to this end, we have continued our

programme to deliver organic growth through investment in our

people and our technologies, seeking long-term efficiencies through

scale and ensuring we continue to attract investors to our

platform.

Platform performance - Transact overview

Throughout the period, Transact has steadily grown both its

adviser base and client numbers. In the first half of the year, we

undertook a programme of portfolio rationalisation as part of

preparations for the Consumer Duty regulations, resulting in a

one-time reduction.

Platform inflows fell across the whole advised retail sector due

to the cost-of-living crisis, which diminished the available income

for investment. Consequently, our gross inflows fell during the

year. This nevertheless represents strong performance in a

difficult market, being the third highest level of gross inflows in

the industry which, coupled with high retention, delivered 22% of

net inflows within the advised platform market.

Transact grew its market share as a result of these resilient

net inflows. Nevertheless, owing to both macro-economic and

industry factors, outflows were substantially higher in the year.

In contrast to FY22 - where sharply negative market movements in

the second half reduced otherwise-robust net inflows - market

movements this year were broadly positive.

Financial performance

Driven by the rise in FUD, revenue grew during the year. Annual

commission on client funds remains the main contributor to revenue,

whilst administration fees were the second largest component. T4A's

contribution also increased during this year.

Underlying expenses rose in 2023, with most of the uplift

stemming from our increase in staff costs. This is in line with our

expectations, as the bulk of the IT software hires stipulated in

our growth strategy fell within this year. Other cost increases

were driven by both inflationary and scale-based factors, as the

Group continues to invest in its key competencies.

The Group's IFRS profit before tax has risen by GBP8.3m, a 15%

increase over the prior year. However, there is a decrease in

underlying profit before tax from last year. The underlying figure

excludes exceptional items, which were elevated in FY22 due to the

impact of T4A post-combination remuneration and the VAT decision.

The reduction in underlying profit before tax is driven by the

increased investment in the business in this year and next year; we

then anticipate the resultant improvements from scale and

efficiency to start to come through from 2025.

The Group maintains its focus on organic platform growth, which

has continued to yield steady increases in both FUD and revenue.

Our aim is to achieve sustainable growth through incremental

improvements to our proposition, thereby allowing us to continue

providing the high quality of service to which we are

committed.

Our people

We have continued with the IT and software professional hiring

plan announced in mid-2022 and since then we have added 27 such

employees. Based on this progress, we anticipate finalising the

plan during 2024. We are already benefitting from the new expertise

and scale, allowing us to accelerate our programme of platform

improvement.

Given the importance of our people to the Group's success, we

have made their wellbeing a priority during the year. Responding to

feedback from the previous employee engagement survey, we have

reworked our remuneration approach. This has led to a tiered pay

rise, changes to the bonus system and enhanced maternity and

paternity benefits.

We have selected a new CFO, Euan Marshall, who will be joining

in January 2024. Euan brings with him significant experience in

listed financial services companies and I look forward to working

with him to execute on our Group strategy.

The Group has made other key senior hires, specifically our

first UK-based Chief Technology Officer (CTO), Damien Francis, and

a new Group Chief Risk Officer (CRO), Emma Vernon, both of whom

joined in January 2023. These new perspectives and skills will

strengthen our strategy as well as helping the Group adapt to key

changes taking place in the industry.

Digitalisation programme

Led by our new CTO, our programme of platform digitalisation has

delivered significant improvements. We have aimed to reduce as many

paper routes as possible on the platform, especially those relating

to account transfers, and we have introduced efficient, intuitive

digital alternatives. The success of these initiatives means that

now all new accounts opened on our platform are paperless and the

majority of wrappers in portfolios are also opened on a paperless

online basis.

Our adviser support team is now well established and has been

making use of new support functionality to promptly address

questions from our clients and advisers; through our live chat

feature we have achieved a 96% query resolution rate. In addition

to the technical improvements to the platform, we have sought also

to expand our service offerings.

Our BlackRock Model Portfolio Service (MPS), launched in

November 2022, has outperformed our expectations in terms of

adviser and client interest. This service offers our clients access

to flexible, diversified model portfolios investing in a broad

range of markets.

Protecting our customers - Consumer Duty

Consumer Duty represented perhaps the largest regulatory change

of the year, with the legislation taking effect in July 2023.

Prioritising good outcomes for our clients and advisers has always

been at the centre of the Group's activities. We were well

positioned to adapt to the new rules and have ensured the necessary

changes have been implemented. This includes mandatory training for

all employees and new joiners.

Our commitment to Consumer Duty is embodied in our approach to

interest on client cash. With interest rates at their highest level

in recent years, greater industry focus has been placed on the

interest generated from client cash. In accordance with our

'customer first' principles, Transact does not take any client cash

interest earned and instead passes it all onto our clients. A t the

time of writing, we are paying the highest interest rate across the

UK platform sector to our clients.

Throughout 2023, we have moved forward with our sustainability

initiatives including significantly increased monitoring of energy

usage and waste, as well as applying tangible initiatives such as

solar panels on our Melbourne office.

Outlook

The market outlook for the coming year is more optimistic than

it was at the start of FY23 but headwinds are anticipated to

persist. Inflation is expected to come down but at a pace that is

as yet unknown, and the Bank of England base rate is predicted to

remain at a higher level than has been seen in the past 10 years.

By investing in the key drivers of our competitive advantage - our

proprietary technology and our industry-leading customer service -

the Group aims to continue to grow our adviser, client and FUD

base.

Throughout FY24, we will continue our work on the platform

digitalisation project. Our digitalisation approach will focus on

further limiting paper-based forms and expanding straight-through

processing. These technological developments will accelerate

processing, making transfers quicker and easier for clients and

advisers. We also seek to add additional data analysis

functionality by making available to advisers more data on the

transactions they perform.

Consumer Duty is expected to remain one of the most prominent

features of the regulatory environment. We put positive consumer

outcomes at the centre of our business model. To secure continued

adherence to the new requirements, we will focus our training and

development to ensure our people are well able to comply with the

objectives of Consumer Duty.

Following the successful beta client test during the year, T4A's

next generation Power Platform CURO software will commence roll out

to the pipeline of adviser firms. We will seek further innovation

including a data interface with the Transact platform.

In this period of ongoing economic and market volatility,

clients rely more than ever on their advisers for high quality,

personalised financial planning and support. As we have always

done, we'll continue to support UK financial advisers and their

clients by providing our combination of in-house technology and

well-trained people delivering high quality service. Our holistic

financial planning solution will serve clients and advisers alike

in managing their portfolios easily and efficiently.

I would like to thank all my colleagues across the Group for

their diligent work over the year. Their commitment and dedication

have been crucial in working towards our strategic objective: to be

the number one provider of software and services for our clients

and their financial advisers. I look forward to continuing to grow

our business and deliver on our strategy throughout FY24 and

beyond.

Alexander Scott

IHP Group CEO

13 December 2023

Financial Review

Headlines

Group revenue remained broadly steady in FY23, increasing by 1%

to GBP134.9 million. This was against another year of economic

volatility, due to elevated inflation and rapidly increasing

interest rates, both of which impacted the financial markets and

client wealth.

Despite ongoing global economic challenges, FY23 ended with a

record 230,294 Transact platform clients (FY22: 224,705) and 7,683

registered advisers (FY22: 7,537).

IHP Group has a strong liquidity profile, largely due to

regulatory capital requirements, and therefore benefited from UK

interest rates rising, with interest received on corporate cash

increasing from GBP0.6 million in FY22 to GBP5.3 million in

FY23.

Headline IFRS profit before tax rose 15% to GBP62.6 million

(FY22: GBP54.3 million), however underlying profit before tax fell

by 4% to GBP63.0 million (FY22: GBP65.8 million). The reduction is

due to an increase in administration expenses, largely driven by

the ongoing strategic programme of investment in software and IT

infrastructure and offset by the increase in corporate interest

income.

Profit after tax rose 13% to GBP49.9 million (FY22: GBP44.0

million).

EPS (earnings per share) is 15.1p (FY22: 13.3p). After removing

all non-underlying expenses in FY23, underlying EPS* is 15.2p,

compared with 16.3p in FY22.

Transact platform operational performance

FY23 FY22

GBPm GBPm

Opening FUD 50,070 52,112

Inflows 6,406 7,275

Outflows (3,753) (2,873)

-------------------- -------- --------

Net flows 2,653 4,402

Market movements 2,272 (6,248)

Other movements(1) (36) (196)

-------------------- -------- --------

Closing FUD 54,959 50,070

(1) Other movements includes fees, tax charges and rebates,

dividends and interest.

Funds Under Direction closed the year up 10% on FY22 at GBP55.0

billion.

FY23 gross inflows of GBP6.4 billion, in a competitive

marketplace and with ongoing economic pressure on our clients, are

due to the reliability and quality of our advised investment

platform.

Whilst outflows have increased to GBP3.8 billion, the annualised

rate is 7% of opening FUD (FY22: 6%) therefore they are still

within the historical banding, as a percentage of FUD, that we

expect. One factor driving outflows is clients withdrawing savings

as the cost of living has increased and also as the world has

returned to normal post lockdown.

Our net flows of GBP2.7 billion are strong for the sector and

represent more than 50% of the increase in FUD in FY23.

*Alternative performance measures (APMs) which are indicated

with an asterisk. APMs are financial measures which are not defined

by IFRS. They are used in order to provide better insight into the

performance of the Group. Further details are provided in the

glossary.

T4A operational performance

In the 12 months to September 2022, T4A has increased CURO

licence users by 22%, from 2,253 at 30 September 2022, to 2,752 at

September 2023.

Group financial performance

There are two streams of Group revenue: investment platform

revenue (96% of total revenue) and T4A revenue (4% of total

revenue).

Investment platform revenue

Investment platform revenue has increased by GBP0.4 million

year-on-year to GBP130.1 million and comprises three elements, 99%

(FY22: 98%) of which is from a recurring source.

Annual commission income (an annual, ad valorem tiered fee on

FUD) and wrapper administration fee income (quarterly fixed wrapper

fees for each of the tax wrapper types available) are recurring.

Other income is composed of buy commission and dealing charges.

FY23 FY22

Investment platform GBPm GBPm

revenue

Annual commission income

(recurring) 116.1 115.9

Wrapper fee income (recurring) 12.3 11.6

Other income 1.7 2.2

-------------------------------- ------ ------

Total platform revenue 130.1 129.7

Average daily FUD for the year, arising from the performance of

the assets in client portfolios, increased by 2% in FY23 to GBP53.6

billion. Annual commission income increased to GBP116.1 million in

FY23. The increase in annual commission revenue was moderated by

the reduction in the annual commission rate from 0.27% to 0.26%,

with effect from 1 July 2022, therefore only three months of the

reduction impacted FY22, but a full 12 months impacted FY23.

Recurring wrapper administration fee income increased by GBP0.7

million (6%) year-on-year, reflecting the increase in the number of

open tax wrappers for both existing and new clients.

Buy commission, included in other income, has been deliberately

reduced as a component of revenue each year. Buy commission was

GBP0.7 million in FY23 (FY22: GBP1.5 million), falling due to the

threshold at which clients receive a rebate of buy commission being

reduced from GBP0.2 million which was the threshold from 1 March

2022, to GBP0.1 million with effect from 1 March 2023. The

reduction in the buy commission threshold is another positive step

in our responsible pricing strategy, as we seek to remove an

increasing proportion of clients from the buy commission charge and

simplify our fee structure.

T4A revenue

T4A's revenue was GBP4.8 million for FY23, compared with GBP3.9

million for FY22, an increase of 23%. This was driven by an

increase in recurring revenue from additional CURO user

licences.

Interest income on corporate cash

Interest income rose from GBP0.8 million in FY22 to GBP6.4

million in FY23. The average Group corporate cash balance was

GBP186.3 million over the year and the Bank of England base rate

rose 3% over the course of the financial year, ending the financial

year at 5.25%.

This resulted in interest income on corporate cash balances

rising GBP4.7 million, to GBP5.3 million. We also received another

GBP0.8 million, being a combination of interest due from the Vertus

loan facility and interest received from HMRC.

Operating expenses

FY23 FY22

GBPm GBPm

Employee costs 53.9 47.1

Occupancy 2.8 2.4

Regulatory and professional fees 9.8 9.8

Other income - tax relief due

to shareholders (1.6) (2.4)

Other costs 6.8 6.3

Non-underlying expenses - backdated

VAT and interest - 8.8

Non-underlying expenses - other 0.4 2.7

------------------------------------- ------ ------

Total expenses 72.1 74.7

Depreciation and amortisation 2.5 3.0

------------------------------------- ------ ------

Total operating expenses 74.6 77.7

Operating expenses on a statutory IFRS basis have reduced by

GBP2.6 million, or 3%.

Underlying expenses

Employee costs GBP53.9 million (+GBP6.8 million, +14%)

Costs have increased due to increased headcount and pay

rises.

Group employee numbers through the year increased by 6% (FY22:

8%) from an average of 594 in FY22 to an average of 631 in FY23,

this accounted for GBP2.7 million of the increase in costs. Notable

senior additions are a CTO and CRO. We have also recruited a

further 26 people in IT through the year, as we continue to

implement plans announced in FY22 to significantly increase system

development capacity across the Group and drive future

efficiencies.

We continued to enhance salaries to reflect the inflationary

environment, recognising the pressures being placed on our people

due to the rise in the cost of living. We also want to ensure we

retain talent and we monitor the market with regard to inflationary

pressures and market-competitive salary levels. Inflationary pay

rises, including resultant impact on share scheme costs and company

pension contributions, increased costs by GBP3.7 million in

FY23.

Current year VAT, included in Other costs (GBP3.6 million

(+GBP0.4 million (+13%))

Current year VAT has increased by GBP0.4 million, largely due to

increased investment platform development software fees, charged by

IHP's wholly owned software development company and now subject to

reverse charge VAT.

Occupancy costs GBP2.8 million (+GBP0.4 million, +17%),

depreciation and amortisation costs GBP2.5 million (-GBP0.5

million, -17%)

Occupancy costs increased by GBP0.4 million, and depreciation

and amortisation reduced by GBP0.5 million. The increase in

occupancy costs is due to the head office lease ending in June 2023

and the accounting impact of IFRS 16, the Leases accounting

standard, no longer applying. This means depreciation of the right

of use asset has been replaced by rent expense for the final three

months of the financial year. The lease is being renewed for a

limited period.

Regulatory and professional fees GBP9.8 million (no change)

Regulatory and professional fees did not increase in FY23, due

to an uplift in professional fees being partially offset by

regulatory fees that were lower than expected.

Other income - tax relief due to shareholders GBP1.6 million

(-GBP0.8 million, -33%)

Tax relief due to shareholders relates to life insurance company

tax requirements and thus is subject to valuations at year-end,

which are inherently dependent on market valuations at that

date.

Non-underlying expenses

Non-underlying expenses - other GBP0.4 million (-GBP2.3 million,

-85%)

In FY22, within non-underlying expenses, we recognised GBP3.0

million of ongoing expenses. This was attributable to the IFRS

requirement that we recognise the post combination deferred and

additional consideration payable to the original T4A shareholders

in respect of the acquisition of T4A, as remuneration over the four

years from January 2021 to December 2024.

However, T4A has not met the minimum threshold for highly

stretching targets to earn the additional consideration element of

post combination remuneration. Therefore, the post combination

expense in respect of the additional consideration element that was

recognised in FY21 and FY22 of GBP1.6 million has been released,

and we have not recognised any cost in FY23. This has led to the

reduction in non-underlying post combination remuneration expense

for FY23 from GBP3.0 million to GBP0.4 million.

Moreover, the post combination consideration cost in respect of

FY24 and FY25 is expected to reduce to GBP2.1 million and GBP0.5

million respectively, as only the deferred consideration element

will now be recognised.

Tax

The Group has operations in three tax jurisdictions: UK,

Australia and the Isle of Man. This results in profits being

subject to tax at three different rates. However, 96% of the

Group's income is earned in the UK.

Shareholder tax on ordinary activities for the year increased by

GBP2.5 million, or 24%, to GBP12.8 million (FY22: GBP10.3 million)

due to the increase in taxable profit and the increase in

corporation tax rate from 19% to 25%, with effect from 6 April

2023.

Our effective rate of tax over the period was 20% (FY22: 18%).

The effective rate of tax in FY22 was dampened by the effect of the

backdated, non-recurring VAT expense of GBP8.8 million, incurred in

September 2022, being tax deductible.

Our tax strategy can be found at: https://

www.integrafin.co.uk/legal-and-regulatory-information/

Consolidated statement of financial position

Net assets have grown 10% (FY22: 8%), or GBP16.7 million, in the

year to GBP189.9 million, and the material movements on the

consolidated statement of financial position are as follows:

Cash and significant cash flows

Shareholder cash has decreased by GBP5.1 million year on year to

GBP177.9 million (FY22: GBP183.0 million). This is due to the

strong cash flows generated from operating activities being used to

invest in gilts to maximise returns, whilst maintaining minimal

risk on assets supporting regulatory solvency requirements. The

gilt investments increased by GBP19.3 million from GBP3.1 million

to GBP22.3 million. We also paid dividends of GBP33.7 million in

the year (FY22: GBP33.7 million).

We continue to operate without any need for debt, so have not

incurred an increase in financing costs from the increase in base

rate through the year, rather, we benefited due to our strong

corporate cash reserves.

Deferred tax asset, non-current provisions and non-current

deferred tax liability

The reduction in the deferred tax asset of GBP5.2 million to

GBP0.8 million (FY22: GBP6.0 million) the non-current provisions of

GBP5.6 million to GBP40.5 million (FY22: GBP46.1 million), and the

current provision of GBP3.0 million to GBP7.7 million (FY22: 10.7

million), plus the increase in non-current deferred tax liabilities

of GBP6.4 million to GBP7.3 million (FY22: 0.9 million) are all a

function of the realised and unrealised gains that have arisen on

policyholder assets, as the value of linked funds has risen year on

year.

ILUK holds tax charges deducted from ILUK policyholders in

reserve to meet future tax liabilities and the tax reserve may be

paid back to policyholders if asset values do not recover such that

the tax liability unwinds.

Investments and cash held for the benefit of policyholders and

liabilities for linked investment contracts (notes 17, 18 and

20)

ILUK and ILInt write only unit-linked insurance policies. They

match the assets and liabilities of their linked policies such

that, in their own individual statements of financial position,

these items always net off exactly. These line items are required

to be shown under IFRS in the consolidated statement of

comprehensive income, the consolidated statement of financial

position and the consolidated statement of cash flows but have zero

net effect.

Cash and investments held for the benefit of ILUK and ILInt

policyholders have risen to GBP24.4 billion (FY21: GBP22.2

billion). This increase of 10% is entirely consistent with the rise

in total FUD on the investment platform.

Capital resources and capital management

To enable the investment platform within the Group to offer a

wide range of tax wrappers, there are three regulated entities

within the Group: a UK investment firm, a UK life insurance company

and an Isle of Man life insurance company.

Each regulated entity maintains capital well above the minimum

level of regulatory capital required, ensuring sufficient capital

remains available to fund ongoing trading and future growth. Cash

and investments in short-dated gilts are held to cover regulatory

capital requirements and tax liabilities.

The regulatory capital requirements and resources in ILUK and

ILInt are calculated by reference to economic capital-based

regimes.

IFAL is subject to Investment Firms Prudential Regime (IFPR)

regulatory capital and liquidity rules introduced in January 2022,

following the implementation in the UK of the MiFIDPRU rule

book.

These prudential rules require the calculation of capital

requirements reflecting 'K' factor requirements that cover

potential harms arising from business activities. The K factors are

calculated using formulae for assets and cash under

administration.

Regulatory Capital as at 30 September 2023

Regulatory Regulatory Regulatory

Capital requirements Capital resources cover

GBPm GBPm %

IFAL 33.3 44.4 133

ILUK 201.4 261.6 130

ILInt 23.8 41.1 173

Regulatory Capital as at 30 September 2022

Regulatory Regulatory Regulatory

Capital requirements Capital resources cover

GBPm GBPm %

IFAL 32.6 39.7 122

ILUK 186.9 244.0 131

ILInt 23.7 42.0 177

The Company's regulated subsidiaries continue to hold regulatory

capital resources well in excess of their regulatory capital

requirements. We will maintain sufficient regulatory capital and an

appropriate level of working capital. We will use retained capital

to further invest in the delivery of our service to clients, pay

dividends to shareholders and provide fair rewards to

employees.

The following table shows the surplus capital held by the Group,

after consideration of the Group's risk appetite and future

dividend payments. This is shown on a different basis to the above

table, which is on a regulatory basis while the below shows equity

on an IFRS basis.

Capital as at 30 September 2023

FY23 FY22

GBPm GBPm

Total equity 189.9 173.2

Loans and receivables, intangible assets

and property, plant and equipment (30.6) (30.6)

------------------------------------------ ------- -------

Available capital pre dividend 159.3 142.6

Interim dividend declared (23.2) (23.2)

------------------------------------------ ------- -------

Available capital post dividend 136.1 119.4

Additional risk appetite capital (72.7) (76.2)

------------------------------------------ ------- -------

Surplus 63.4 43.2

Additional risk appetite capital is capital the board considers

to be appropriate for it to hold to ensure the smooth operation of

the business such that it can meet future risks to the business

plan and future changes to regulatory capital requirements without

recourse to additional capital.

The board considers the impact of regulatory capital

requirements and risk appetite levels on prospective dividends from

its regulated subsidiaries.

Our Group's Pillar 3 document contains further details and can

be found on our website at:

https://www.integrafin.co.uk/legal-and-regulatory-information/

Pillar 3 Disclosures.

As stated in the Chair's report, t he board has declared a

second interim dividend for the year of 7.0 pence per ordinary

share, taking the total dividend for the year to 10.2 pence per

share (2022: 10.2p)

Dividends

During the year to 30 September 2023, IHP (the Company) paid a

second interim dividend of GBP23.2 million to shareholders in

respect of financial year 2022 and a first interim dividend of

GBP10.6 million in respect of financial year 2023.

In respect of the second interim dividend for financial year

2023, the board has declared a dividend of 7.0 pence per ordinary

share (FY22: 7.0p).

The financial year 2023 total dividends paid and declared of

GBP33.7 million compares with full year interim dividends of

GBP33.7 million in respect of financial year 2022.

Principal risks and uncertainties

The directors, in conjunction with the board and ARC, have

undertaken a review of the potential risks to the Group that could

undermine the successful achievement of its strategic objectives,

threaten its business model or future performance and considered

non-financial risks that might present operational disruption.

The tables below set out the Group's principal risks and

uncertainties to the achievement of the identified strategic

objectives, risk trend for 2023 together with a summary of how we

manage the risks.

Business and strategic risks

Principal risk and Management of the principal risk and uncertainty

uncertainty

-------------------------------------- ------------------------------------------------------

Service standard failure We manage the risk by providing our client

- our high levels of service teams with extensive initial and ongoing

client and adviser retention training, supported by experienced subject

are dependent upon our matter experts and managers. The challenges

consistent and reliable facing the business and the wider industry,

levels of service. Failure have increased during the year, however monitoring

to maintain these service service metrics has allowed us to identify

levels would affect the areas where there is deviation from expected

our ability to attract service levels or where processing backlogs

and retain business. have arisen and to deliver targeted remediation

There is a potential plans to ensure client outcomes and service

risk of greater outflows standards are maintained. We have substantially

than expected and/or reduced backlogs relative to FY22 and are

a net outflow of FUD better able to address them when they occur.

impacting profitability

and/or the medium/long-term We also conduct satisfaction surveys to ensure

sustainability of the our service levels are still perceived as

platform. excellent by our clients and their advisers.

Service standards are also dependent on resilient

Change over the year operations, both current and forward looking,

Stable ensuring that risk management is in place.

T4A continues to develop the delivery of next

Aligned to strategic generation CURO.

financial objectives

Sustainable growth

Increase earnings

------------------------------------------------------

Diversion of platform The risk of reduced investment in the platform

development resources is managed through a disciplined approach

- maintaining our quality to expense management and forecasting. We

and relevance requires horizon scan for upcoming regulatory and taxation

ongoing investment. regime changes and maintain contingency to

Any reduction in investment allow for unexpected expenses e.g. UK Financial

due to diversion of Services Compensation Scheme (FSCS) levies,

resources to other non-discretionary which ensures we do not need to compromise

expenditure (for example, on investment in our platform to a degree

regulatory developments) that affects our offering.

may affect our competitive

position. The risk has increased over the year driven

in large part due to preparation for, and

the implementation of, the Consumer Duty regime

Change over the year for our regulated entities, both as manufacturers

Increase and/or distributors.

We remain proactive in embedding all mandatory

changes (e.g. Consumer Duty, Operational Resilience,

Aligned to strategic HMRC changes to lifetime allowances) through

financial objectives our business-as-usual model. Our platform

Sustainable growth developers remain responsive to the business

Invest needs and have increased developer resources

Increase earnings over the year.

------------------------------------------------------

Increased competition: The advised market remains our key target

cheaper and/or more and competitor risk is mitigated by focusing

sophisticated propositions on providing exceptionally high levels of

- we operate in an increasingly service and being responsive to client and

competitive market, financial adviser feedback and demands through

both for clients and an efficient process and operational base.

their advisers. Consolidation

in the adviser market We also keep close to the landscape of our

makes it more challenging platform competitors, as well as the trends

to attract and retain impacting the financial adviser market. Our

business. The consequences platform service and developments remain award

may be that greater winning. We release a monthly update to our

outflows are experienced proprietary platform technology, incorporating

than expected and/or improvements and new functionality. We continue

a net outflow of FUD to develop our digital strategy, expanding

impacting profitability our Transact Online interface allowing advisers

and/or the medium/long-term direct processing onto the platform. This

sustainability of the is essential to remain relevant and competitive,

platform. improving both functionality and service efficiency

and allows us to continue to increase the

Change over the year value-for-money of our service by reducing

Increase client charges, subject to profit and capital

parameters when deemed appropriate.

The Group continues to review its business

Aligned to strategic strategy and growth potential. In this regard,

financial objectives it primarily considers organic opportunities

Sustainable growth that will enhance or complement its current

Increase earnings service offerings to the adviser market.

T4A continues to broaden our service offering

to advisers. We also continue to support the

diversification of the adviser market through

the Vertus scheme which continues to be successful.

------------------------------------------------------

Financial risks

Principal risk and Management of the principal risk and uncertainty

uncertainty

Stock and bond market The risk of depressed stock and bond market

value volatility (Market values, and the impact on revenue, has been

Risk) - our core business and remains high. External economic, political

revenue is derived from and geopolitical factors continue to influence

our platform business markets in 2023. The risk is mitigated through

which has a fee structure a wide asset offering which ensures we are

based, in large part, not wholly correlated with one market, and

upon a percentage of which enables clients to switch assets in

the FUD. Depressed equity times of uncertainty. In particular, clients

and bond values have are able to switch into cash assets, which

an impact on the revenue remain on our platform supported by our top

streams of the platform quartile interest rates. In addition, our

business. wrapper fees are not impacted by market volatility

as they are based on a fixed quarterly charge.

Change over the year

Increase We can closely monitor and control expenses

by continually driving efficiency improvements

in our business processes including increasing

Aligned to strategic online and digital processing. Strong investment

financial objectives platform service and sales and marketing activity

Sustainable growth ensures we attract new advisers and clients.

Increase earnings Sustaining positive net inflows during turbulent

Generate cash times presents the potential for longer-term

Retain strong balance profitability.

sheet

Deliver on dividend This value volatility is not expected to ease

policy in the foreseeable future and while hedging

options have been explored, they have been

deemed expensive in terms of the revenue protection

they afford.

-------------------------------------------------------

Uncontrolled expense The risk has increased over the year as a

risk - higher expenses direct result of sustained inflationary pressures

than expected and budgeted on the UK and global economy.

for would adversely

impact cash profits. The most significant element of our expense

base is employee costs. These are controlled

Change over the year through modelling employee requirements against

Increase forecast business volumes. The Group has made

sustainable salary increases to employees

over the year and built out its capability

Aligned to strategic in several key areas across all three lines

financial objectives of risk governance to support the business.

Generate cash

Deliver on dividend Planned investment in IT and software development

policy deliver enhancements to our proprietary platform

enabling us to implement enhanced straight

through processing of operational activities.

A robust multi-year costing plan is produced

which reflects the strategic initiatives of

the business. This captures planned investment

expenditure required to build our operational

capability and cost-effective scalability

of the business. Cost base variance analysis

is completed monthly with any expenditure

that deviates unexpectedly from plan being

rigorously reviewed to assess the likely trend

with reforecasts completed accordingly.

Occupancy and utility costs have also increased.

Regulatory fees decreased slightly while professional

fees have increased in line with expectations,

as a result of the broad regulatory agenda.

Also notable, and a growing issue, is that

suppliers are wrestling with the requirements

of climate initiatives in terms of disclosures,

and with unit costs for sustainable or green

energy and supplies likely to attract a premium

as organisations stride toward a net zero

carbon footprint. Such costs are difficult

to control directly and may unexpectedly impact

the base case budget.

-------------------------------------------------------

Capital strain (including We continuously monitor the current and expected

liquidity) - unexpected, future regulatory environment and ensure that

additional capital or all regulatory obligations are or will be

liquidity requirements met. This provides a proactive control to

imposed by regulators mitigate this risk. Additionally, we carry

may negatively impact out an assessment of our capital requirements,

our solvency coverage which includes assessing the regulatory capital

ratio. required. We retain a capital buffer over

and above the regulatory minimum solvency

Change over the year capital requirements.

Stable

We await the detail of corporate tax changes

resulting from the OECD Base Erosion and Profit

Aligned to strategic Shifting project relating to our Isle of Man

financial objectives life company, ILInt. We anticipate that there

Retain strong balance will be a reduced level of retained income,

sheet which will impact the future coverage levels

Deliver on dividend of regulatory capital.

policy

-------------------------------------------------------

Credit risk - loss The Group seeks to invest its shareholder

due to defaults from assets in high quality, highly liquid, short-dated

holdings of cash and investments. For the banks holding corporate

cash equivalents, deposits, cash, maximum counterparty limits are set

formal loans and reinsurance in addition to minimum credit quality steps.

treaties with banks

and financial institutions. The Vertus loan scheme has an agreed commitment

level and the value of the drawn and undrawn

Change over the year balances are monitored regularly. Loans are

Stable made on approved business cases.

Aligned to strategic

financial objectives

Retain strong balance

sheet

-------------------------------------------------------

Non-financial risks

Principal risk and Management of the principal risk and uncertainty

uncertainty

Reputational risk - The Risk Management Framework provides the

the risk that current monitoring mechanisms to ensure that reputational

and potential clients' damage controls operate effectively and reputational

and their advisers desire risk is mitigated.

to do business with

the Group reduces due Mitigation includes a focus on internal operational

to a lower perception risk controls, error management and complaints

in the marketplace of handling processes as well as root cause analysis

the Group's offered investigations. Additionally, controls include

services covering the training for key company staff on how to manage

Transact platform and company reputation internally; regular management

T4A adviser support and monitoring of the company websites and

software. social media; and engaging the services of

an external PR firm to consult on reputational

matters.

Change over the year

Stable

Aligned to strategic

financial objectives

Sustainable growth

---------------------------------- ------------------------------------------------------

Political and Geopolitical Political and Geopolitical risk cannot be

risk - the risk of changes directly mitigated by the Group. However,

in the political landscape by closely monitoring developments through

within the UK and between its risk horizon scanning process, potential

countries or geographies, impacts are taken into consideration as part

disrupting the operations of the business planning process.

of the business or resulting

in significant development The external geopolitical environment in 2023

costs. has built on 2022 and become increasingly

uncertain through a series of significant

Change over the year global events, including the continuing Russian

Increase invasion of Ukraine, the escalating conflict

in the Middle East, trade tensions between

USA and China, the global energy crisis and

Aligned to strategic supply chain issues. Furthermore, domestic

financial objectives political instability exists within both the

Sustainable growth UK and the USA with elections due within the

Invest next 24 months. These dynamics and related

Increase earnings events can cause disruption to markets and

Generate cash macroeconomics with a direct impact on FUD

Retain strong balance for the Group.

sheet

Deliver on dividend

policy

---------------------------------- ------------------------------------------------------

Operational risk (including The Group aims to minimise operational risks

operational resilience at all times, through a strong and well-resourced

and the sustainability control and operational structure. Note that

agenda) - the risk of operations form an integral part of the ESG

loss arising from inadequate and sustainability agenda.

or failed internal processes,

people and systems, We note the principal types of operational

or from external events. risk below and provide the change over the

year for each.

Change over the year

Increase

Aligned to strategic

financial objectives

Sustainable growth

Invest

Increase earnings

Generate cash

---------------------------------- ------------------------------------------------------

People - the inability The business operates both performance management

to attract, retain and and talent recognition programmes to reward

motivate performing high performing employee members, identify

and values-aligned employees future leaders, and retain and attract talent

within the business. within the business.

Significant attrition We maintain a comprehensive career and training

rates of such employees development programme and provide a flexible

or an inability to attract working environment that meets our employees'

such new employees can and business needs. These are supported by

have a detrimental impact robust Group HR policies and practices. Our

on the service provided benefits package is competitive.

as well as poor adherence

to regulatory procedures No less than annually, the Group undertakes

and requirements resulting a staff engagement survey and addresses any

in reputational damage identified areas for improvement to drive

and potential compliance high engagement.

breaches. Since the "great resignation" of 21/22 difficulties

with the retention of employees and the ability

Change over the year to attract new recruits in our UK and Australian

Decrease operations have significantly improved.

---------------------------------- ------------------------------------------------------

IT Infrastructure and The continuous and evolving sophistication

software - a geing and of the cyber threat to our IT infrastructure

underinvested IT infrastructure environment means risk within this space remains

and software has the high.

potential to cause the

Group disruption through Wars and conflict contribute to a global technology

systems outages, a failure environment that is constantly under attack.

to plan and maintain Protecting our services against this continues

operational capacity to be a core focus. We continue to carry out

and create vulnerabilities cyber penetration testing and evolve our cyber

to operational resilience security capabilities. Awareness training

and loss of a competitive is provided to ensure employees understand

market share as newer and recognise threats to our business systems.

technology emerges.

Investment in IT and software development

Change over the year continues, with modernisation of our digital

Stable workplace capabilities presenting opportunity

for improved security controls.

There is a full programme of digitalisation

work to be delivered over the business planning

period for our proprietary investment platform,

focussing on the provision of online, straight

through processes for common financial planning

practices, which will benefit our UK advisers

and their clients. This will also significantly

increase the scalability of our investment

platform.

Integration between adviser software applications

is paramount, with data access and synchronisation

between systems being key requirements. Our

Application Programming Interfaces (APIs)

are already integrated with many third-party

software providers, and we will continue to

enhance our data services to meet the demands

of our clients in a secure manner.

---------------------------------- ------------------------------------------------------

IT Resilience and Information Data and continuity of services are critical

Security - the Group focus areas for us given the increase of risk

creates, obtains, stores, in channels like cybersecurity. Ensuring that

processes and retrieve our core services are resilient and that are

significant volumes controls around business and client data are

of commercial and corporate robust is a constantly evolving focus area.

matters, some of which Resilience testing of the Transact platform,

is highly sensitive. for example, takes place every two months.

Change over the year In particular, the Group has a dedicated financial

Increasing crime team and an on-going fraud and cyber

risk awareness programme. Additionally, the

Group carries out regular IT system vulnerability

testing. The crisis management team (CMT)

reviews the Group's business continuity plans

during the course of the year.

Key changes in the last year are the establishment

of dedicated first and second line Cyber Security

teams, the heads of which are due to start

in early 2024. This will provide an improved

governance and operational framework for Cyber

Security.

Beyond IT and cyber security, the Company

also has a function led by the Company's Data

Protection Officer (DPO) to manage information

security risk and compliance with UK GDPR.

The DPO carries out monitoring and works with

the business to ensure the risks from its

evolving physical and digital workplace and

business operations are managed.

---------------------------------- ------------------------------------------------------

Regulatory risk - the The Group has an established compliance function

financial services regulated that analyses regulation and advises on and

entities within the monitors how our financial services regulatory

Group have a full and standards are met.

stretching regulatory

agenda. Expanding law, The financial services regulated entities

regulation and guidance in the group ensure regulatory standards are

need analysing and transitioning met through a framework of policies, procedures,

effectively into business governance, training, horizon scanning, monitoring

as usual to avoid failing and engagement with our regulators.

to comply with regulatory

rules or standards. Cross-departmental projects are established

to deliver for significant regulatory changes,

Change over the year with Group internal audit undertaking reviews

Increasing during the project phases and/or post-implementation

thematic reviews. During the period such projects

included preparation and implementation of

the FCA's Consumer Duty, which requires ongoing

work to ensure it is embedded within operations,

and work to meet FCA PS21/3 Operational Resilience

requirements.

Meeting the regulatory agenda is an imperative

for the operation of our core platform business.

The regulatory agenda remains challenging,

particularly in light of the demands of the

new consumer duty.

---------------------------------- ------------------------------------------------------

Emerging risk focus

Through regular conversations and more formal quarterly risk

review meetings with risk owners and other business stakeholders,

attending industry events and reviewing external sources, emerging

risks are identified. These emerging risks by their nature have

uncertainty of likelihood and impact on the business. Emerging

risks are categorised as near- (next 12 months), medium- and

longer-term (more than 3 years) and are regularly reported and

assessed, both at the executive level and, no less than quarterly,

at ARCs and boards where appropriate.

Emerging risks discussed during 2023 have included:

-- Changing expectations of the UK and Isle of Man

regulators.

-- Increasing regulatory scrutiny or focus impacting our

platform business model.

-- Shift in tax regime which may alter the tax benefits of

pensions and ISAs including the abolition of inheritance tax.

-- The aging population of the UK, the platform client base and

the advisers using our platform and/or the CURO software and the

generational shift in wealth to different generations with

differing preferences and needs.

The directors have carried out a robust assessment of the

principal and emerging risks facing the Group, including those that

would threaten its business model, future performance, solvency or

liquidity, and have concluded that the Group is well positioned to

manage these risks.

Statement of Directors' Responsibilities

The directors are responsible for preparing the Annual report

and financial statements in accordance with applicable United

Kingdom law and regulations.

Company law requires the directors to prepare financial

statements for each financial year. Under that law the directors

have elected to prepare the Group and parent Company financial

statements in accordance with UK-adopted international accounting

standards (IFRSs). Under Company law the directors must not approve

the financial statements unless they are satisfied that they give a

true and fair view of the state of affairs of the Group and the

Company and of the profit or loss of the Group and the Company for

that period.

In preparing these financial statements the directors are

required to:

-- select suitable accounting policies in accordance with IAS 8

Accounting Policies, Changes in Accounting Estimates and Errors and

then apply them consistently;

-- make judgements and accounting estimates that are reasonable and prudent;

-- present information, including accounting policies, in a

manner that provides relevant, reliable, comparable and

understandable information;

-- provide additional disclosures when compliance with the

specific requirements in IFRSs is insufficient to enable users to

understand the impact of particular transactions, other events and

conditions on the Group and Company financial position and

financial performance;

-- in respect of the Group financial statements, state whether

IFRSs have been followed, subject to any material departures

disclosed and explained in the financial statements;

-- in respect of the parent Company financial statements, state

whether IFRSs have been followed, subject to any material

departures disclosed and explained in the financial statements;

and

-- prepare the financial statements on the going concern basis

unless it is inappropriate to presume that the Company and/ or the

Group will continue in business.

The directors are responsible for keeping adequate accounting

records that are sufficient to show and explain the Company's and

Group's transactions and disclose with reasonable accuracy, at any

time, the financial position of the Company and the Group and

enable them to ensure that the Company and the Group financial

statements comply with the Companies Act 2006. They are also

responsible for safeguarding the assets of the Group and parent

Company and hence for taking reasonable steps for the prevention

and detection of fraud and other irregularities.

Under applicable law and regulations, the directors are also

responsible for preparing a strategic report, directors' report,

directors' remuneration report and corporate governance statement

that comply with that law and those regulations. The directors are

responsible for the maintenance and integrity of the corporate and

financial information included on the Company's website.

Directors' responsibilities pursuant to DTR4

The directors confirm, to the best of their knowledge:

-- that the consolidated financial statements, prepared in

accordance with IFRSs give a true and fair view of the assets,

liabilities, financial position and profit of the parent Company

and undertakings included in the consolidation taken as a

whole;

-- that the annual report, including the strategic report,

includes a fair review of the development and performance of the

business and the position of the Company and undertakings included

in the consolidation taken as a whole, together with a description

of the principal risks and uncertainties that they face; and

-- that they consider the annual report, taken as a whole, is

fair, balanced and understandable and provides the information

necessary for shareholders to assess the Company's position,

performance, business model and strategy.

By order of the board,

Helen Wakeford

Company Secretary

13 December 2023

Consolidated Statement of Comprehensive Income

Note 2023 2022

GBPm GBPm

Revenue 5 134.9 133.6

Cost of sales (3.9) (2.1)

Gross profit 131.0 131.5

Expenses

Administrative expenses 8 (74.6) (77.7)

16,

Expected credit losses on financial assets 22 (0.1) (0.2)

Operating profit 56.3 53.6

------------------------------------------------ ----- ---------- ----------

Interest income 9 6.4 0.8

Interest expense 25 (0.1) (0.1)

Net policyholder returns

Net income/(loss) attributable to policyholder

returns 12.1 (38.5)

Change in investment contract liabilities (1,056.0) 2,770.3

Fee and commission expenses 18 (193.3) (192.6)

Policyholder investment returns 10 1,249.3 (2,577.7)

------------------------------------------------ ----- ---------- ----------

Net policyholder returns 12.1 (38.5)

Profit on ordinary activities before taxation

attributable to policyholders and shareholders 74.7 15.8

Policyholder tax (charge)/credit (12.1) 38.5

Profit on ordinary activities before taxation

attributable to shareholders 62.6 54.3

Total tax attributable to shareholder

and policyholder returns 11 (24.8) 28.2

Less: tax attributable to policyholder

returns 12.1 (38.5)

------------------------------------------------ ----- ---------- ----------

Shareholder tax on profit on ordinary

activities (12.7) (10.3)

Profit for the financial year 49.9 44.0

Other comprehensive (loss)/income

Exchange (losses)/gains arising on translation

of foreign operations (0.1) 0.1

Total other comprehensive (losses)/income

for the financial year (0.1) 0.1

Total comprehensive income for the financial

year 49.8 44.1

------------------------------------------------ ----- ---------- ----------

Earnings per share

------------------------------------------------ ----- ---------- ----------

Earnings per share - basic 7 15.1p 13.3p

Earnings per share - diluted 7 15.1p 13.3p

All activities of the Group are classed as continuing.

Notes 1 to 36 form part of these Financial Statements.

Consolidated Statement of Financial Position

Note 2023 2022

GBPm GBPm

Non-current assets

Loans receivable 16 6.3 5.5

Intangible assets 12 21.4 21.8

Property, plant and equipment 13 1.1 1.2

Right-of-use assets 14 1.0 2.1

Deferred tax asset 26 0.7 6.0

30.5 36.6

Current assets

Investments 21 22.4 3.1

Prepayments and accrued income 22 17.2 17.2

Trade and other receivables 23 3.6 2.0

Current tax asset 14.3 15.0

Cash and cash equivalents 19 177.9 183.0

235.4 220.3

Current liabilities

Trade and other payables 24 19.5 21.5

Provisions 27 7.7 10.7

Lease liabilities 25 0.3 1.9

27.5 34.1

Non-current liabilities

Provisions 27 40.5 46.1

Contingent consideration 28 - 1.7

Lease liabilities 25 0.8 0.9

Deferred tax liabilities 26 7.2 0.9

----------------------------------- ----- ------------- -------------

48.5 49.6

Policyholder assets and

liabilities

Cash held for the benefit

of policyholders 20 1,419.2 1,458.6

Investments held for the

benefit of policyholders 17 23,021.7 20,715.8

Liabilities for linked investment

contracts 18 (24,440.9) (22,174.4)

- -

Net assets 189.9 173.2

----------------------------------- ----- ------------- -------------

Equity

Called up equity share capital 3.3 3.3

Share-based payment reserve 29 3.4 2.6

Employee Benefit Trust reserve 30 (2.6) (2.4)

Foreign exchange reserve 31 (0.1) -

Non-distributable reserves 31 5.7 5.7

Retained earnings 180.2 164.0

----------------------------------- ----- ------------- -------------

Total equity 189.9 173.2

----------------------------------- ----- ------------- -------------

These Financial Statements were approved by the Board of

Directors on 13 December 2023 and are signed on their behalf

by:

Alexander Scott

Director

Company Registration Number: 08860879

Notes 1 to 36 form part of these Financial Statements.

Company Statement of Financial Position

Note 2023 2022

GBPm GBPm

Non-current assets

Investment in subsidiaries 15 35.3 33.3

Loans receivable 16 6.3 5.5

41.6 38.8

Current assets

Prepayments 22 - 0.1

Trade and other receivables 23 0.1 0.2

Cash and cash equivalents 26.0 33.1

----------------------------------- ----- ------- -------

26.1 33.4

Current liabilities

Trade and other payables 24 2.5 2.4

Loans payable 16 1.0 1.0

----------------------------------- ----- ------- -------

3.5 3.4

Non-current liabilities

Contingent consideration 28 - 1.7

Loans payable 16 6.0 7.0

----------------------------------- ----- ------- -------

6.0 8.7

Net assets 58.2 60.1

----------------------------------- ----- ------- -------

Equity

Called up equity share capital 3.3 3.3

Share-based payment reserve 29 2.7 2.2

Employee Benefit Trust reserve 30 (2.4) (2.1)

Profit or loss account

Brought forward retained earnings 56.7 50.7

Profit for the year 31.6 39.8

Dividends paid in the year (33.7) (33.8)

----------------------------------- ----- ------- -------

Profit or loss account 54.6 56.7

Total equity 58.2 60.1

----------------------------------- ----- ------- -------

The Company has taken advantage of the exemption in section 408

(3) of the Companies Act 2006 not to present its own income

statement in these financial statements.

These Financial Statements were approved by the Board of

Directors on 13 December 2023 and are signed on their behalf

by:

Alexander Scott

Director

Company Registration Number: 08860879

Notes 1 to 36 form part of these Financial Statements.

Consolidated Statement of Cash Flows

2023 Restated

2022

GBPm GBPm

Cash flows from operating activities

Profit on ordinary activities before

taxation attributable to policyholders

and shareholders 74.7 15.8

Adjustments for non-cash movements:

Amortisation and depreciation 2.5 3.0

Share-based payment charge 2.1 2.0

Interest charged on lease 0.1 0.1

(Decrease)/increase in contingent consideration (1.7) 0.9

(Decrease)/increase in provisions (8.6) 38.5

Adjustments for cash effecting investing

and financing activities:

Interest on cash and loans (6.4) (0.8)

Adjustments for statement of financial

position movements:

(Increase)/decrease in trade and other

receivables, and prepayments and accrued

income (1.6) 0.5

(Decrease)/increase in trade and other

payables (2.0) 4.0

Adjustments for policyholder balances:

(Increase)/decrease in investments

held for the benefit of policyholders (2,305.9) 1,071.3

Increase/(decrease) in liabilities

for linked investment contracts 2,266.5 (879.0)

Increase/(decrease) in policyholder

tax recoverable 10.0 (6.0)

Cash generated from operations 29.7 250.3

Income taxes paid (22.4) (13.5)

Interest paid on lease liabilities (0.1) (0.1)

--------------------------------------------------------------- ------------ --------------

Net cash flows (used in)/generated

from operating activities 7.2 236.7

Investing activities

Acquisition of property, plant and

equipment (0.7) (0.3)

Purchase of financial instruments (22.3) (3.0)

Redemption of financial instruments 3.0 5.0

Increase in loans (0.8) (2.1)

Interest on cash and loans 6.4 0.8

--------------------------------------------------------------- ------------ --------------

Net cash generated from/(used in)investing

activities (14.4) 0.4

Consolidated Statement of Cash Flows (continued)

2023 Restated

2022

GBPm GBPm

Financing activities

Purchase of own shares in Employee

Benefit Trust (0.4) (0.5)

Purchase of shares for share scheme

awards (1.1) (1.3)

Equity dividends paid (33.7) (33.7)

Payment of principal portion of lease

liabilities (1.9) (2.4)

-------- ---------

Net cash used in financing activities (37.1) (37.9)

Net (decrease)/increase in cash and

cash equivalents (44.3) 199.2

Cash and cash equivalents at beginning

of year 1,641.6 1,442.4

Exchange losses on cash and cash equivalents (0.1) -

Cash and cash equivalents at end of

year 1,597.1 1,641.6

------------------------------------------------ -------- ---------

Cash and cash equivalents consist

of:

---------------------------------------------- -------- ---------

Cash and cash equivalents 177.9 183.0

------------------------------------------------ -------- ---------

Cash held for the benefit of policyholders 1,419.2 1,458.6

------------------------------------------------ -------- ---------

Cash and cash equivalents 1,597.1 1,641.6

------------------------------------------------ -------- ---------

Notes 1 to 36 form part of these Financial Statements.

See note 36 for details on 2022 restated balances.

Company Statement of Cash Flows

2023 Restated

2022

GBPm GBPm

Cash flows from operating activities

Loss before interest and dividends (2.0) (4.9)

Adjustments for non-cash movements:

(Decrease)/increase in contingent

consideration (1.7) 0.9

Adjustment for statement of financial

position movements:

Decrease/(increase) in trade and other

receivables 0.2 (0.2)

Increase in trade and other payables 0.1 -

Net cash flows used in operating

activities (3.4) (4.2)

Investing activities

Dividends received 33.3 45.0

Interest received 0.9 0.2

Increase in loans receivable (0.8) (2.0)

----------------------------------------- ------- ---------------------

Net cash generated from investing

activities 33.4 43.2

Financing activities

Purchase of own shares in Employee

Benefit Trust (0.3) (0.5)

Purchase of shares for share scheme

awards (1.3) (1.3)

Repayment of loans (1.0) (1.0)

Interest expense on loans (0.6) (0.2)

Equity dividends paid (33.7) (33.8)

---------------------

Net cash used in financing activities (37.1) (36.8)

Net (decrease)/increase in cash and

cash equivalents (7.1) 2.2

Cash and cash equivalents at beginning

of year 33.1 30.9

Cash and cash equivalents at end

of year 26.0 33.1

----------------------------------------- ------- ---------------------

Notes 1 to 36 form part of these Financial Statements.

See note 36 for details on 2022 restated balances.

Consolidated Statement of Changes in Equity

Non-distributable

Called insurance

up equity and foreign Share-based Employee

share exchange payment Benefit Retained

capital reserves reserve Trust reserve earnings Total equity

GBPm GBPm GBPm GBPm GBPm GBPm

Balance at

1 October 2021 3.3 6.2 2.4 (2.1) 153.5 163.3

Comprehensive

income for

the year:

Profit for

the year - - - - 44.0 44.0

Movement in

currency translation - 0.1 - - - 0.1

----------------------- ------------ ------------------ ------------ --------------- ---------- -------------

Total comprehensive

income for

the year - 0.1 - - 44.0 44.1

Share-based

payment expense - - 2.0 - - 2.0

Settlement

of share based

payment - - (1.5) - - (1.5)

Purchase of

own shares

in EBT - - - (0.5) - (0.5)

Excess tax

relief charged

to equity - - (0.3) - - (0.3)

Exercised share

options - - - 0.2 (0.2) -

Release of

actuarial reserve - (0.5) - - 0.5 -

Other movement - (0.1) - - (0.1) (0.2)

Distributions

to owners -

Dividends paid - - - - (33.7) (33.7)

Balance at

30 September

2022 3.3 5.7 2.6 (2.4) 164.0 173.2

----------------------- ------------ ------------------ ------------ --------------- ---------- -------------

Balance at

1 October 2022

Comprehensive

income for

the year: 3.3 5.7 2.6 (2.4) 164.0 173.2

Profit for

the year - - - - 49.9 49.5

Movement in

currency translation - (0.1) - - - (0.1)

----------------------- ------------ ------------------ ------------ --------------- ---------- -------------

Total comprehensive

income for

the year - (0.1) - - 49.9 49.4

Share-based

payment expense - - 2.1 - - 2.1

Settlement

of share based

payment - - (1.5) - - (1.5)

Purchase of

own shares

in EBT - - - (0.4) - (0.4)

Excess tax

relief charged

to equity - - 0.2 - - 0.2

Exercised share

options - - - 0.2 - 0.2

Distributions

to owners -

Dividends paid - - - - (33.7) (33.7)

Balance at

30 September

2023 3.3 5.6 3.4 (2.6) 180.2 189.9

----------------------- ------------ ------------------ ------------ --------------- ---------- -------------

Notes 1 to 36 form part of these Financial Statements.

Company Statement of Changes in Equity

Called Employee

up equity Share-based Benefit

share payment Trust Retained Total

capital reserve reserve earnings equity

GBPm GBPm GBPm GBPm GBPm

Balance at 1 October

2021

Comprehensive income

for the year: 3.3 1.7 (1.8) 50.7 53.9

Profit for the year - - - 39.8 39.8