Infrastructure India plc Trading Update and Statement re COVID-19 (3653G)

March 17 2020 - 2:00AM

UK Regulatory

TIDMIIP TIDMTTM

RNS Number : 3653G

Infrastructure India plc

17 March 2020

17 March 2020

Infrastructure India plc

("IIP", the "Company and together with its subsidiaries the

"Group")

Trading Update and Statement re COVID-19

Infrastructure India plc, an AIM quoted infrastructure fund

investing directly into assets in India, provides the following

update in relation to IIP's largest asset, Distribution Logistics

Infrastructure Limited ("DLI"), as a result of the global COVID-19

pandemic.

During the first quarter of the calendar year, DLI performed

well, with increased revenue and lower quarter on quarter costs and

timely project completion. Construction at Nagpur, including a

Private Freight Terminal and additional warehousing, is now

complete and operations at the new facilities have been ramping up.

Works are progressing at Bangalore and Palwal with both sites

expecting initial operations to commence in Q2 2020. At Chennai,

DLI is working through regulatory approvals and completion of the

terminal remains on target for the end of 2020.

The primary market impact of the global pandemic at present has

been an overall reduction in the flow of export-import goods

between India and China and changes in the flow of goods has had an

impact on the cycling balance of containers.

Reduced movements of goods and raw materials between China and

India has impacted some of DLI's customers' inventories and

therefore production and shipping. The changes in the balance of

movements of goods, as a result of the global pandemic, are

resulting in bottlenecks as empty containers need to be

repositioned to meet domestic and export shipments. In particular,

a current lack of available empty containers is having an impact on

Indian hinterland exporters.

The Group anticipates that this trend will become more evident

across the Indian domestic market, which imports raw materials from

China, in the near term.

It is too early for the Board to quantify the potential future

impacts of the global pandemic. Despite the progress at its

terminals made during Q1 2020, DLI management anticipate ongoing

volatility with freight volume and container cycles, given the

current and potential future impacts of the global pandemic.

The Company will provide further updates, as appropriate, in due

course.

Enquiries:

Infrastructure India plc www.iiplc.com

Sonny Lulla Via Novella

Cenkos Securities plc

Nominated Adviser & Joint Broker

Ben Jeynes / Katy Birkin +44 (0) 20 7397 8900

Nplus1 Singer Advisory LLP

Joint Broker

James Maxwell - Corporate Finance

James Waterlow - Investment Fund Sales +44 (0) 20 7496 3000

Novella +44 (0) 20 3151 7008

Financial PR

Tim Robertson / Fergus Young

The information communicated within this announcement is deemed

to constitute inside information as stipulated under the Market

Abuse Regulation (EU) No. 596/2014. Upon the publication of this

announcement, this inside information is now considered to be in

the public domain.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

TSTUNUKRROUOAAR

(END) Dow Jones Newswires

March 17, 2020 03:00 ET (07:00 GMT)

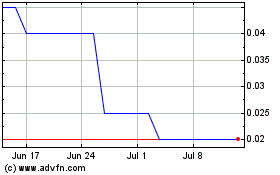

Infrastructure India (LSE:IIP)

Historical Stock Chart

From Apr 2024 to May 2024

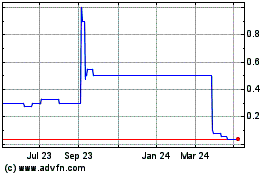

Infrastructure India (LSE:IIP)

Historical Stock Chart

From May 2023 to May 2024