TIDMIIP

RNS Number : 5972L

Infrastructure India plc

06 September 2023

6 September 2023

Infrastructure India plc

("IIP" or the "Company" and, together with its subsidiaries, the

"Group")

DLI Transaction Update

Infrastructure India plc, an AIM quoted infrastructure fund

investing directly into assets in India, is pleased to announce the

conditional sale of the Group's interest in 99.99% of Distribution

Logistics Infrastructure Private Limited ("DLI" and, together with

its subsidiaries, the "DLI Group") to Pristine Malwa Logistics Park

Private Limited ("Pristine Malwa"). Pristine Malwa is a wholly

owned subsidiary of Pristine Logistics and Infraprojects Limited

("Pristine" and, along with all Pristine entities, together, the

"Pristine Group").

Transaction Summary

The DLI Group, along with IIP and Distribution and Logistics

Infrastructure India, Mauritius, IIP's wholly-owned subsidiary

("DLI Mauritius"), have entered into a conditional share purchase

and shareholders' agreement (the "Agreement") with the Pristine

Group and certain subsidiaries for the majority acquisition of DLI

by Pristine Malwa (the "Transaction"). The Pristine Group provides

end-to-end multi cargo logistics solutions, and services including

port handling, road and rail transport, warehousing, shipping,

stevedoring, customs handling, and integrated logistics in India

and Nepal.

The Transaction comprises a share swap and upfront cash

consideration, whereby DLI Mauritius, which owns a 99.99% interest

in DLI, will receive, in consideration for selling its entire

shareholding in DLI, a cash payment of approximately US$10 million

on closing, and up to 33% of Pristine Malwa's issued share capital

(the "Merged Group"). The final equity and cash consideration

payable to DLI Mauritius is subject to customary adjustments based

on the net current assets and indebtedness of DLI on the closing

date. The Agreement includes certain conditions precedent to be

satisfied by each of DLI Mauritius and Pristine Malwa prior to

closing of the Transaction, including consent of DLI India's

lenders, certain governmental approvals, mandatory regulatory and

tax filings, and certain limited operational processes. Pristine

Group requires the consent from the investment committee of their

majority shareholder, Global Infrastructure Partners, in order to

proceed with closing of the Transaction. The Transaction is also

subject to consent from the Group's lenders including GGIC, Ltd.,

Cedar Valley Financial and IIP Bridge Facility LLC.

DLI

DLI is a supply chain transportation and container

infrastructure company headquartered in Bangalore and Gurgaon with

a material presence in central, northern and southern India. DLI

provides a broad range of logistics services including rail

freight, trucking, handling, customs clearing and bonded

warehousing with terminals located in the strategic locations of

Nagpur, Bangalore, Palwal in the National Capital Region and

Chennai. DLI is the largest asset in the Group's portfolio. DLI was

valued at GBP176.2 million in IIP's unaudited interim results for

the period ended 30 September 2022, representing 88% of the Group's

portfolio at that date.

Pristine Malwa and Sical

Pristine Malwa is the parent company and c. 95% shareholder of

Sical Logistics Limited ("Sical"), a company listed on the India's

National Stock Exchange and the BSE (formerly named the Bombay

Stock Exchange). Pristine Malwa is also engaged in developing and

managing private freight terminals in India. Sical provides port

handling, road and rail transport, warehousing, shipping,

stevedoring, customs handling, trucking, retail logistics, mining,

and integrated logistics, with expertise in end-to-end bulk

commodity logistics including coal, iron and cement.

Further Information on the Transaction

Following closing of the Transaction, which is expected to occur

during Q4 of 2023, the Group shall become a substantial minority

shareholder of Pristine Malwa, which will be the holding company of

Sical and DLI.

Following the acquisition of DLI, the Pristine Group will own

and control the Merged Group and have a pan-India footprint,

connecting the rail freight across north, south and eastern India,

and would have a presence at all significant rail transport and

logistics hubs in India. The Merged Group would have the ability to

ship both containers and bulk commodities, expanding the scope of

the business.

Sical and DLI have significant synergies, complementary

locations and operational efficiencies, backed by the management

knowhow and railway infrastructure of the Pristine Group.

Completion of the Transaction would enable the Pristine Group,

together with Sical and DLI, to take advantage of several

macro-changes in the logistics industry, including:

-- A shift towards a multimodal freight system from a road-based

one, in line with India's goal to reduce logistics costs from 14.4%

of its GDP to 10%, and the mission of the Indian railway board to

ship 3,000 million tonnes by rail by 2027 (up from 1,418 million

tonnes in 2022).

-- Heavy investments in railways by the Indian Government,

expanding India's overburdened rail freight infrastructure and

establishing dedicated freight corridors.

The Transaction allows the Company to remain invested in the

Indian logistics sector through its substantial interest in the

Merged Group and realise better value for the Company's

shareholders at the time of exit, which is contemplated to be

within 24 to 36 months from the date of closing of the Transaction.

It also allows the Company to retain a significant indirect

interest in DLI, whilst also benefitting from asset diversification

through its significant indirect interest in Sical. In addition,

the Board expects that by DLI being part of a larger group, it will

benefit from economies of scale.

Following the closing of the Transaction, DLI Mauritius will

appoint a nominee director to the boards of Pristine Malwa and DLI

India. In addition, IIP will have customary minority protection

rights, such as operational inputs relating to business plans,

information parity rights, pre-emptive rights in respect of future

equity issuances, tag-along rights and change of control covenants

in relation to Pristine Malwa and its subsidiaries. Similarly, DLI

Mauritius' shareholding in Pristine Malwa shall be subject to

certain contractual and statutory transfer restrictions, right of

first refusal exercisable by Pristine Group and drag-along rights

applicable in limited circumstances. Each of Pristine Malwa and DLI

Mauritius will also provide customary indemnities to each other in

relation to the Transaction.

The Board believes that the Transaction presents an exciting

prospect for DLI with clear synergies and a business combination

with considerable reach and scale. Having considered the funding

options currently available to the Company and the immediate

funding needs of the Group, the Board believe that the Transaction

is in the best interests of the Company and its shareholders.

The Board looks forward to providing shareholders with further

updates, as appropriate, in due course.

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulation (EU) No. 596/2014 as it forms part of

United Kingdom domestic law by virtue of the European Union

(Withdrawal) Act 2018 (as amended).

- Ends -

Enquiries:

Infrastructure India plc www.iiplc.com

Sonny Lulla Via Novella

Strand Hanson Limited

Nominated Adviser

Richard Johnson / James Dance +44 (0) 20 7409 3494

Singer Capital Markets

Broker

James Maxwell - Corporate Finance

James Waterlow - Investment Fund Sales +44 (0) 20 7496 3000

Novella

Financial PR

Tim Robertson / Safia Colebrook +44 (0) 20 3151 7008

About the Pristine Group :

Pristine Group, headquartered in Delhi, is engaged in the

business of providing end-to-end multi-cargo logistics solutions

pivoted around rail terminals and is backed by Global

Infrastructure Partners and British International Investment.

The Pristine Group currently operates six Inland Container

Depots and Private Freight Terminals, with warehousing area of

approximately 905,000 square feet. Additional assets include

approximately 2,624 domestic standard containers and 395 dwarf

containers. Sical operates three container freight stations in

southern India, with capacity to handle more than 1.5 million TEUs

(20-foot equivalent unit cargo containers).

The Pristine Group has been expanding its presence in India

through acquisitions, in the course of which it acquired Sical and

has now agreed to acquire DLI.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDSSWFEMEDSEFU

(END) Dow Jones Newswires

September 06, 2023 08:20 ET (12:20 GMT)

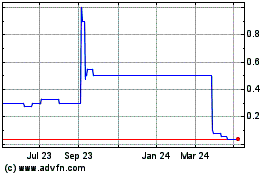

Infrastructure India (LSE:IIP)

Historical Stock Chart

From Mar 2024 to Apr 2024

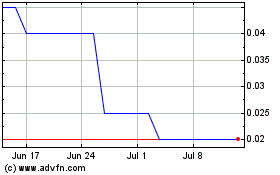

Infrastructure India (LSE:IIP)

Historical Stock Chart

From Apr 2023 to Apr 2024