JZ Capital Ptnrs Ltd JZCP Announces Exit of Factor Energia for EUR69.7 Million

November 06 2017 - 1:00AM

UK Regulatory

TIDMJZCP TIDMJZCC TIDMJZCN

JZ CAPITAL PARTNERS LIMITED

JZ CAPITAL PARTNERS ANNOUNCES FACTOR ENERGIA EXIT FOR GROSS PROCEEDS OF EUR69.7

MILLION

Transaction represents a gross 9.2x multiple of invested capital and 42.4%

internal rate of return

06 November 2017

JZ Capital Partners Limited (LSE:JZCP.L "JZCP" or the "Company"), the London

listed fund that invests in US and European micro-cap companies and US real

estate, today announces the realization at net asset value ("NAV") of its

majority equity interest in Factor Energia S.A. ("Factor"), held through the

EuroMicrocap Fund 2010, L.P. ("EMC 2010"). The transaction enterprise value was

approximately EUR120 million.

Factor is being acquired by a public-sector asset manager, on behalf of a major

Canadian pension fund. As part of this transaction, JZI Fund III, L.P. ("Fund

III"), in which JZCP is an approximately 18.8% limited partner, has agreed to

invest EUR20 million alongside the majority owner and Factor management,

representing approximately 25% of the business' fully diluted equity

ownership.

Founded in 1999, Factor is a leading independent supplier of electricity to

small and mid-sized companies in Spain. Taking advantage of distressed

valuations at the height of the financial crisis, JZCP entered the Spanish

market through its investment in Factor in July 2010 and has since worked with

Factor's Founder and CEO, Emilio Rousaud, to significantly scale the business.

Supported by the deregulation of Spain's electricity supply market and the

recovery of the domestic economy, Factor has experienced a period of

significant transformation under JZCP's ownership, growing its customer base

from approximately 4,000 to 45,000 and reported revenues from approximately EUR68

million to more than EUR370 million.

JZCP invested a total of approximately EUR7.6 million in Factor and is expected

to receive total gross proceeds (before carry) of approximately EUR69.7 million

from the sale (including deferred payments and interim distributions received

over the course of the investment), representing a gross multiple of invested

capital ("MOIC") of approximately 9.2x and a gross internal rate of return

("IRR") of approximately 42.3%.

Across the six Spanish portfolio companies it has sold to date (including

Factor), JZCP has realized approximately EUR144.9 million on an investment of

approximately EUR60 million. These six transactions represent a gross MOIC of

2.4x and a gross IRR of 23.2%. JZCP is still highly committed to the Spanish

region, holding four Spanish portfolio companies through its limited partner

interest in Fund III (including Factor), which continue to perform in line with

expectations.

David Zalaznick, JZCP's Founder and Investment Adviser, commented: "We're

delighted to announce the successful realization of Factor Energia. As we

continue to focus on narrowing the discount to NAV at which JZCP's ordinary

shares trade, our ongoing ability to realize key assets at NAV further

validates the true value of the Company's portfolio. We are excited about

Factor's future and the next chapter of its history through JZCP's investment

in JZI Fund III, L.P. We continue to see exciting micro-cap investment

opportunities in Spain and look forward to deploying further capital in the

region."

Miguel Rueda, Senior Partner of JZAI's London office, commented: "A lot has

been achieved over the seven years we have owned Factor Energia. During this

time, we have strengthened the company's market position and grown revenues and

profits substantially. We believe Factor still has considerable upside

potential and look forward to continue working closely with management via our

minority investment in Factor through JZI Fund III, L.P."

Ends

For further information:

Ed Berry / Kit Dunford +44 (0) 20

3727 1143

FTI Consulting

David Zalaznick +1 212 485

9410

Jordan/Zalaznick Advisers, Inc.

Rebecca Booth +44 (0)

1481 745189

JZ Capital Partners

About JZCP

JZ Capital Partners ("JZCP") is one of the oldest closed-end investment

companies listed on the London Stock Exchange. It seeks to provide shareholders

with a return by investing selectively in US and European microcap companies

and US real estate. JZCP receives investment advice from Jordan/Zalaznick

Advisers, Inc. ("JZAI") which is led by David Zalaznick and Jay Jordan. They

have worked together for more than 35 years and are supported by teams of

investment professionals in New York, Chicago, London and Madrid. JZAI's

experts work with the existing management of micro-cap companies to help build

better businesses, create value and deliver strong returns for investors. For

more information please visit www.jzcp.com.

END

(END) Dow Jones Newswires

November 06, 2017 02:00 ET (07:00 GMT)

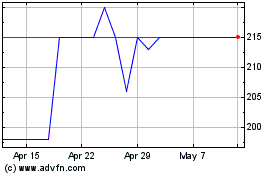

Jz Capital Partners (LSE:JZCP)

Historical Stock Chart

From Apr 2024 to May 2024

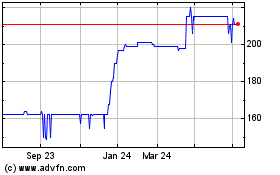

Jz Capital Partners (LSE:JZCP)

Historical Stock Chart

From May 2023 to May 2024