Kings Arms Yard VCT PLC: Interim Management Statement

June 07 2023 - 5:41AM

Kings Arms Yard VCT PLC: Interim Management Statement

Kings Arms Yard VCT

PLC Interim Management StatementLEI Code

213800DK8H27QY3J5R45

IntroductionI present Kings

Arms Yard VCT PLC’s (the “Company”) interim management statement

for the period from 1 January 2023 to 31 March 2023.

PerformanceThe Company’s

unaudited net asset value (“NAV”) as at 31 March 2023 was £116.0

million or 21.98 pence per share (excluding treasury shares), an

increase of 1.03 pence per share (4.9%) since 31 December 2022.

On 2 March 2023, a NAV update was announced

following an external fundraising process at Quantexa at a

significantly higher valuation. The NAV at 31 March 2023 has

increased by 0.19 pence per share (0.9%) compared to the 2 March

2023 NAV update. This Series E fundraising round has now completed,

raising $129 million, and was announced by Quantexa on 4 April

2023.

After accounting for the first interim dividend

for the year ending 31 December 2023 of 0.52 pence per share paid

on 28 April 2023 to shareholders on the register on 11 April 2023,

the NAV is 21.46 pence per share.

Albion VCTs’ Top Up OffersA

prospectus Top Up Offer of new Ordinary shares was launched on 10

October 2022. The Board announced on 18 January 2023 that,

following strong demand for the Company’s shares, it had elected to

exercise its over-allotment facility, taking the total Offer to

£12.5 million. The Offer was fully subscribed and closed to further

applications on 16 March 2023.

During the period from 1 January 2023 to 31

March 2023, the Company issued the following new Ordinary shares of

nominal value 1 penny per share under the Albion VCTs Prospectus

Top Up Offers 2022/2023:

|

Date |

Number of shares issued |

Issue price per share (including costs of

issue) |

Net proceeds £’000 |

|

31 March 2023 |

31,071,626 |

22.40p |

6,786 |

Portfolio

The following investments have been made during

the period from 1 January 2023 to 31 March 2023:

|

Further investments |

£’000 |

Activity |

|

Proveca |

533 |

Reformulation of medicines for children |

|

Seldon Technologies |

152 |

Enabling enterprises to deploy Machine Learning models in

production |

|

Symetrica |

150 |

Designer and manufacturer of radiation detection equipment |

|

Brytlyt |

34 |

GPU database software provider |

|

Total further investments |

869 |

|

Top ten holdings as at 31 March

2023:

|

Portfolio company |

Carrying

value£’000 |

% of net asset value |

Activity |

|

Quantexa |

15,274 |

13.2% |

Network analytics platform to detect financial crime |

|

Proveca |

10,445 |

9.0% |

Reformulation of medicines for children |

|

Egress Software Technologies |

6,234 |

5.4% |

Encrypted email and file transfer service provider |

|

Chonais River Hydro |

3,470 |

3.0% |

Owner and operator of a 2 MW hydro-power scheme in the Scottish

Highlands |

|

Oviva |

2,252 |

1.9% |

Technology enabled service business in medical nutritional therapy

(MNT) |

|

The Evewell Group |

2,245 |

1.9% |

Operator of women’s health centres focusing on fertility |

|

Healios |

2,008 |

1.7% |

Provider of an online platform delivering family centric

psychological care primarily to children and adolescents |

|

Gravitee Topco (T/A Gravitee.io) |

1,961 |

1.7% |

API management platform |

|

The Street by Street Solar Programme |

1,859 |

1.6% |

Owner and operator of photovoltaic systems on domestic properties

in the UK |

|

Academia |

1,761 |

1.5% |

Social networking for the academic community |

A full breakdown of the Company’s portfolio can

be found on the Company’s webpage on the Manager’s website at

www.albion.capital/funds/KAY.

Share buy-backsDuring the

period from 1 January 2023 to 31 March 2023, the Company did not

buy back any shares.

It remains the Board’s policy to buy back shares

in the market, subject to the overall constraint that such

purchases are in the Company’s interest, including the maintenance

of sufficient resources for investment in existing and new

portfolio companies and the continued payment of dividends to

shareholders.

It is the Board’s intention for such buy-backs

to be at around a 5% discount to net asset value, so far as market

conditions and liquidity permit.

Material events and transactions after

the period endAfter the period end, the Company issued the

following new Ordinary shares of nominal value 1 penny each were

allotted under the Albion VCTs Prospectus Top Up Offers

2022/23:

|

Date |

Number of shares issued |

Issue price per share (including costs of

issue) |

Net proceeds£’000 |

|

14 April 2023 |

1,377,016 |

21.60p to 21.90p |

294 |

There have been no other material events or

transactions after the period end to the date of this

announcement.

Further informationThe Company

continues to offer a Dividend Reinvestment Scheme to existing

shareholders. Details of this scheme can be found at

www.albion.capital/funds/KAY.

Further information regarding historic and

current financial performance and other useful shareholder

information can be found on the Company’s webpage on the Manager’s

website under www.albion.capital/funds/KAY.

Fiona Wollocombe, Chairman7 June 2023

For further information please contact: Vikash

HansraniOperations PartnerAlbion Capital Group LLP – Tel: 020 7601

1850

Kings Arms Yard Vct (LSE:KAY)

Historical Stock Chart

From Apr 2024 to May 2024

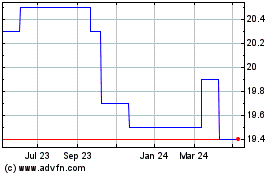

Kings Arms Yard Vct (LSE:KAY)

Historical Stock Chart

From May 2023 to May 2024