Keller Group PLC s430(2B) Companies Act 2006

January 03 2017 - 1:00AM

UK Regulatory

TIDMKLR

3 January 2017

SECTION 430(2B) COMPANIES ACT 2006 STATEMENT

Wolfgang Sondermann

Further to the announcement made on 14 December 2016, the Company announces

that Wolfgang Sondermann has stepped down as a Director of the Company with

effect from 31 December 2016.

In accordance with Section 430(2B) of the Companies Act 2006, the following

arrangements will apply in respect of Wolfgang's remuneration which are in

accordance with the Remuneration Policy approved by the Company's shareholders

at its 2014 Annual General Meeting.

1. Wolfgang will remain an employee of Keller Holding GmbH until 30 April 2017

when he will retire.

2. Until 30 April 2017, he will continue to receive his contractual salary,

benefits in kind and pension contributions. Wolfgang will use all of his

outstanding leave before his employment contract terminates.

3. Following his retirement from Keller Holding GmbH, Wolfgang will serve in

an advisory capacity for two days per month representing Keller Holding

GmbH as Chairman of the Board of the German Geotechnical Society. He will

be paid EUR1,000 per day of service by Keller Holding GmbH.

4. Wolfgang will be treated as a "Good Leaver" under the Group's Performance

Share Plan ("PSP"). His 2014 and 20161 awards under the PSP will vest based

to the extent the applicable performance conditions have been achieved over

the full performance period and the proportion of the performance period

worked.

5. Any bonus payable for the 2016 performance year will be determined by the

Remuneration Committee following Company's results announcement in February

2017.

6. Other than the amounts disclosed above, Wolfgang will not be eligible for

any pay in lieu of notice or severance as a result of his retirement.

Details of the above payments will be disclosed in the Directors'

Remuneration Report for the year ending 31 December 2016.

Venu Raju

Also, further to the Company's announcement on 14 December 2016 regarding the

appointment of Venu Raju as Executive Director (Engineering & Operations) with

effect from 1 January 2017, Venu's remuneration is set out below. Venu will

continue to be based in Singapore during 2017 employed by his current employer,

Keller Foundations (SE Asia) PTE Ltd, and is expected to relocate to Europe

during 2018 at which point he will be employed by Keller Group plc.

Base pay

* Salary: GBP280,000 per annum.

* Pension: 18% of salary per annum. While based in Singapore, Venu will

remain in the Central Provident Fund (CPF), which is the statutory

authority that administers Singapore's public pension system.

* Benefits: Venu will receive a car allowance of GBP12,000 per annum, private

health care, life assurance and long-term disability insurance.

Performance related pay

* Annual Bonus: up to 150% of salary (max)

* Long term incentive plan: normal maximum annual awards of 75% of base

salary

The remuneration package meets the criteria set out in the Company's approved

2014 Remuneration Policy.

For further information, please contact:

Kerry Porritt

Company Secretary

Tel: 020 7616 7575

Notes to Editors:

Keller is the world's largest geotechnical contractor, providing technically

advanced geotechnical solutions to the construction industry. With annual

revenue of around GBP1.8bn, Keller has approximately 10,000 staff world-wide.

Keller is the clear market leader in the US, Canada, Australia and South

Africa; it has prime positions in most established European markets and a

strong profile in many developing markets.

1 As announced in the 2015 Directors Remuneration Report, the Committee

approved an award of shares to Wolfgang under the PSP in 2016 in lieu of an

award in 2015. An award was not made in 2015 due to his then announced

retirement. Wolfgang's retirement date was subsequently postponed to April

2017 at the request of the Board and the Committee made an award in 2016 on the

basis of an award received in 2015: the 2016 award was based on a lower number

of shares with a performance period of 1 January 2015 to 31 December 2017 (the

same as for other participants in the 2015-17 cycle). The award will vest three

years from grant, i.e. not before 2019, and will be pro-rated over the period

from the date of grant to the date of Wolfgang's retirement.

END

(END) Dow Jones Newswires

January 03, 2017 02:00 ET (07:00 GMT)

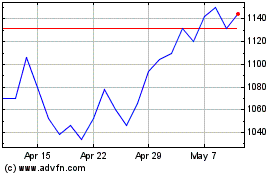

Keller (LSE:KLR)

Historical Stock Chart

From Apr 2024 to May 2024

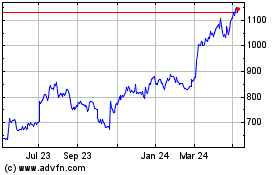

Keller (LSE:KLR)

Historical Stock Chart

From May 2023 to May 2024