TIDMKOS

RNS Number : 9942X

Kosmos Energy Limited

10 May 2021

NEWS RELEASE

============

KOSMOS ENERGY ANNOUNCES FIRST QUARTER 2021 RESULTS

DALLAS--(BUSINESS WIRE)-May 10, 2021-- Kosmos Energy Ltd.

("Kosmos" or the "Company") (NYSE: KOS) announced today its

financial and operating results for the first quarter of 2021. For

the quarter, the Company generated a net loss of $91 million, or

$0.22 per diluted share. When adjusted for certain items that

impact the comparability of results, the Company generated an

adjusted net loss(1) of $33 million, or $0.08 per diluted share for

the first quarter of 2021.

FIRST QUARTER 2021 HIGHLIGHTS

-- Net Production(2) - 53,100 barrels of oil equivalent per day

(boepd) with sales of 36,500 boepd, resulting in a material net

underlift position of approximately 1.3 million barrels of oil

-- Phase One of the Greater Tortue LNG project 58% complete at quarter end

-- Completion of an upsized $450 million offering of senior notes due 2028

-- Post-quarter end, successful reserve-based lending (RBL) redetermination and extension

-- Revenues - $176 million, or $53.66 per boe

-- Production expense - $46 million, or $13.91 per boe

-- General and administrative expenses - $22 million, $14

million cash expense and $8 million non-cash

-- Capital expenditures:

-- $44 million Base Business capital expenditures

-- $73 million Mauritania and Senegal

-- Net cash used in operating activities - $47 million

Commenting on the Company's first quarter 2021 performance,

Chairman and Chief Executive Officer Andrew G. Inglis said: "This

month marks the tenth anniversary of Kosmos' listing on the New

York Stock Exchange. In those ten years, Kosmos has evolved from a

frontier explorer to a full-cycle E&P with a diverse reserve

base that has increased nearly seven-fold, building the platform

for continued success over the next ten years. In the first decade

of the company's history, we maintained a strong focus on corporate

responsibility, leading on transparency and positioning the

business to deliver value to our stakeholders through the energy

transition.

2021 is off to a strong start with momentum building across the

business. We have begun infill drilling activities in Ghana and the

Gulf of Mexico, will soon begin drilling in Equatorial Guinea, and

are on track to deliver our production and cash flow targets for

the year. Progress also continues on the Greater Tortue Project in

Mauritania and Senegal, with Phase one 58% complete at the end of

the first quarter. We have taken important steps to create a more

permanent capital structure with the bond offering and the

recently-completed RBL extension, which increased liquidity and

cleared all material near-term debt maturities."

FINANCIAL UPDATE

In the first quarter of 2021, 1.5 cargos were lifted from a

forecast 12.5 cargos for the full year 2021. As a result of the

timing mismatch between production and the lifting of cargos, there

was a material underlift of approximately 1.3 million barrels of

oil in the first quarter.

In March 2021, Kosmos successfully closed a $450 million

offering of senior notes due 2028. The net proceeds from the

offering were used to partially pay down the RBL facility and

revolving credit facility as well as for working capital

purposes.

In May 2021, Kosmos successfully completed an amendment and

restatement of the RBL facility in conjunction with the spring

redetermination. The amendment reduced the facility size to $1.25

billion and extended the facility by two years, with a final

maturity of March 2027. The borrowing base was finalized, with a

more conservative price deck, at $1.24 billion with $1.0 billion

currently outstanding.

The base business net capital expenditure for the first quarter

of 2021 was approximately $44 million, in-line with Company

guidance. Net capital expenditures related to Mauritania and

Senegal in the first quarter were $73 million.

Kosmos exited the first quarter of 2021 with approximately $2.2

billion of net debt(1) and available liquidity of around $0.8

billion. The increase in net debt in the quarter was driven by the

material underlift, Mauritania and Senegal capital expenditures and

the National Oil Company loan payments, as well as working capital.

Kosmos base business free cash flow guidance for 2021 remains

unchanged.

OPERATIONAL UPDATE

Production

Total net production in the first quarter of 2021 averaged

approximately 53,100 boepd(2) , in line with prior guidance.

Ghana

Production in Ghana averaged approximately 22,400 barrels of oil

per day (bopd) net in the first quarter of 2021. As forecasted,

Kosmos lifted one cargo from Ghana during the first quarter.

At Jubilee, production averaged approximately 70,400 bopd gross

during the quarter. Kosmos and its partners continue to focus on

higher reliability in Ghana as demonstrated by floating production,

storage and offloading (FPSO) vessel uptime at Jubilee of around

98% in the first quarter and consistent water injection at the

highest levels since 2012. Gas offtake to the government of Ghana

of around 110 million standard cubic feet per day in the quarter is

almost double the level seen in 2019. At TEN, production averaged

approximately 38,800 bopd gross for the first quarter with FPSO

uptime of 99%.

In early 2021, the Jubilee Catenary Anchor Leg Mooring (CALM)

buoy was commissioned with the first offloading taking place in

February. The CALM buoy will replace the need for shuttle tankers

and is expected to reduce operating expenses going forward.

Infill drilling has resumed in the second quarter with drilling

planned for three wells on Jubilee and one on TEN in 2021. A

long-term rig contract has been entered into for the Maersk

Venturer, which arrived on location early in the second quarter. A

Jubilee producer well has finished drilling and the rig has now

moved to drill a water injector well at Jubilee, after which we

expect to complete both wells. The expected impact of these two

wells is to increase production by 15,000-20,000 barrels of oil per

day gross.

U.S. Gulf of Mexico

Production in the U.S. Gulf of Mexico averaged approximately

20,500 boepd net (81% oil) during the first quarter.

In late-February, the Kodiak-2 well was brought back online

after successful remediation of the subsea infrastructure issue

identified in the fourth quarter of 2020. In April, the Kodiak-3

infill well was also brought online.

After the encouraging results from the Tornado-4 water injection

well last year, drilling of the Tornado-5 infill well is now

planned by the operator in the second quarter and expected online

in the third quarter.

In January 2021, Kosmos announced an oil discovery at the

Winterfell infrastructure-led exploration (ILX) well (drilled at a

Kosmos working interest 17.5%), which encountered approximately 26

meters (85 feet) of net oil pay in two intervals. During the first

quarter, Kosmos worked with partners on an appraisal plan for

Winterfell, which is expected to begin with a well in the third

quarter. This appraisal well is expected to drill the fault block

to the northwest of the discovery, which has the same seismic

signature as Winterfell, with an exploration tail into a deeper

horizon. The Winterfell discovery is located within tie back

distance to several existing and planned host facilities.

Kosmos plans to drill a second ILX well at Zora with a 37.5%

operated working interest in the third quarter. The Zora prospect

is a Miocene target in the same play as nearby analogous fields

such as Odd Job, Horn Mountain and Marmalard. The permits to drill

the well have all been received and a rig has been contracted. The

Zora prospect is located near multiple other prospects where Kosmos

has built a material interest and is in close proximity to several

potential host facilities, which could facilitate a low cost and

lower carbon development in the event of success.

Equatorial Guinea

Production in Equatorial Guinea averaged approximately 30,200

bopd gross and 10,200 bopd net in the first quarter of 2021. As

forecasted, Kosmos lifted 0.5 cargos from Equatorial Guinea during

the quarter.

The Okume upgrade project is nearing completion, adding

additional power, water injection and gas lift capacity necessary

for further facilities de-bottlenecking and additional electrical

submersible pumps (ESPs). In April, partners commenced the second

phase of the planned ESP program and upgraded the G-19 flowline,

which has significantly enhanced production from that well.

A rig has also been contracted for the upcoming infill drilling

campaign, which is expected to arrive in country later this quarter

to drill the three wells planned this year.

Mauritania & Senegal

The momentum in Kosmos' production activities in the first

quarter can also be seen in the Company's development project.

Phase one of the Greater Tortue Ahmeyim LNG project ended the first

quarter around 58% complete with material progress across all of

the major workstreams, including the FPSO, Floating LNG vessel, hub

terminal (concrete breakwater) and subsea infrastructure. The

partnership is targeting Phase one to be around 80% complete by

year end.

Kosmos expects completion of the FPSO sale and lease-back in the

second quarter of 2021 as previously communicated. The process

remains on track with documentation being finalized and the

government approval process well underway.

(1) A Non-GAAP measure, see attached reconciliation of non-GAAP

measure

(2) Production means net entitlement volumes. In Ghana and

Equatorial Guinea, this means those volumes net to Kosmos' working

interest or participating interest and net of royalty or production

sharing contract effect. In the Gulf of Mexico, this means those

volumes net to Kosmos' working interest and net of royalty.

Conference Call and Webcast Information

Kosmos will host a conference call and webcast to discuss first

quarter 2021 financial and operating results today at 10:00 a.m.

Central time (11:00 a.m. Eastern time). The live webcast of the

event can be accessed on the Investors page of Kosmos' website at

http://investors.kosmosenergy.com/investor-events. The dial-in

telephone number for the call is +1-877-407-3982. Callers in the

United Kingdom should call 0800 756 3429. Callers outside the

United States should dial 1-201-493-6780. A replay of the webcast

will be available on the Investors page of Kosmos' website for

approximately 90 days following the event.

About Kosmos Energy

Kosmos is a full-cycle deepwater independent oil and gas

exploration and production company focused along the Atlantic

Margins. Our key assets include production offshore Ghana,

Equatorial Guinea and the U.S. Gulf of Mexico, as well as a

world-class gas development offshore Mauritania and Senegal. We

also maintain a sustainable proven basin exploration program in

Equatorial Guinea, Ghana and the U.S. Gulf of Mexico. Kosmos is

listed on the New York Stock Exchange and London Stock Exchange and

is traded under the ticker symbol KOS. As an ethical and

transparent company, Kosmos is committed to doing things the right

way. The Company's Business Principles articulate our commitment to

transparency, ethics, human rights, safety and the environment.

Read more about this commitment in the Kosmos Sustainability

Report. For additional information, visit www.kosmosenergy.com.

Non-GAAP Financial Measures

EBITDAX, Adjusted net income (loss), Adjusted net income (loss)

per share, free cash flow, and net debt are supplemental non-GAAP

financial measures used by management and external users of the

Company's consolidated financial statements, such as industry

analysts, investors, lenders and rating agencies. The Company

defines EBITDAX as Net income (loss) plus (i) exploration expense,

(ii) depletion, depreciation and amortization expense, (iii) equity

based compensation expense, (iv) unrealized (gain) loss on

commodity derivatives (realized losses are deducted and realized

gains are added back), (v) (gain) loss on sale of oil and gas

properties, (vi) interest (income) expense, (vii) income taxes,

(viii) loss on extinguishment of debt, (ix) doubtful accounts

expense and (x) similar other material items which management

believes affect the comparability of operating results. The Company

defines Adjusted net income (loss) as Net income (loss) adjusted

for certain items that impact the comparability of results. The

Company defines free cash flow as net cash provided by operating

activities less Oil and gas assets, Other property, and certain

other items that may affect the comparability of results. The

Company defines net debt as the sum of notes outstanding issued at

par and borrowings on the RBL Facility and Corporate revolver less

cash and cash equivalents and restricted cash.

We believe that EBITDAX, Adjusted net income (loss), Adjusted

net income (loss) per share, free cash flow, Net debt and other

similar measures are useful to investors because they are

frequently used by securities analysts, investors and other

interested parties in the evaluation of companies in the oil and

gas sector and will provide investors with a useful tool for

assessing the comparability between periods, among securities

analysts, as well as company by company. EBITDAX, Adjusted net

income (loss), Adjusted net income (loss) per share, free cash

flow, and net debt as presented by us may not be comparable to

similarly titled measures of other companies.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933 and

Section 21E of the Securities Exchange Act of 1934. All statements,

other than statements of historical facts, included in this press

release that address activities, events or developments that Kosmos

expects, believes or anticipates will or may occur in the future

are forward-looking statements. Kosmos' estimates and

forward-looking statements are mainly based on its current

expectations and estimates of future events and trends, which

affect or may affect its businesses and operations. Although Kosmos

believes that these estimates and forward-looking statements are

based upon reasonable assumptions, they are subject to several

risks and uncertainties and are made in light of information

currently available to Kosmos. When used in this press release, the

words "anticipate," "believe," "intend," "expect," "plan," "will"

or other similar words are intended to identify forward-looking

statements. Such statements are subject to a number of assumptions,

risks and uncertainties, many of which are beyond the control of

Kosmos (including, but not limited to, the impact of the COVID-19

pandemic), which may cause actual results to differ materially from

those implied or expressed by the forward-looking statements.

Further information on such assumptions, risks and uncertainties is

available in Kosmos' Securities and Exchange Commission ("SEC")

filings. Kosmos undertakes no obligation and does not intend to

update or correct these forward-looking statements to reflect

events or circumstances occurring after the date of this press

release, except as required by applicable law. You are cautioned

not to place undue reliance on these forward-looking statements,

which speak only as of the date of this press release. All

forward-looking statements are qualified in their entirety by this

cautionary statement.

###

Kosmos Energy Ltd.

Consolidated Statements of Operations

(In thousands, except per share amounts, unaudited)

Three Months Ended

March 31,

---------------------

2021 2020

--------- ----------

Revenues and other income:

Oil and gas revenue $ 176,474 $ 177,780

Gain on sale of assets 26 -

Other income, net 70 1

--------- ----------

Total revenues and other income 176,570 177,781

Costs and expenses:

Oil and gas production 45,752 61,603

Facilities insurance modifications, net 671 8,038

Exploration expenses 8,181 44,605

General and administrative 22,441 20,911

Depletion, depreciation and amortization 76,541 93,302

Impairment of long-lived assets - 150,820

Interest and other financing costs, net 24,528 27,835

Derivatives, net 102,461 (136,038)

Other expenses, net 3,468 23,929

--------- ----------

Total costs and expenses 284,043 295,005

--------- ----------

Loss before income taxes (107,473) (117,224)

Income tax expense (benefit) (16,705) 65,543

--------- ----------

Net loss $(90,768) $(182,767)

======== =========

Net loss per share:

Basic $ (0.22) $ (0.45)

======== =========

Diluted $ (0.22) $ (0.45)

======== =========

Weighted average number of shares used

to compute net loss per share:

Basic 407,365 404,759

========= ==========

Diluted 407,365 404,759

========= ==========

Dividends declared per common share $ - $ 0.0452

======== =========

Kosmos Energy Ltd.

Condensed Consolidated Balance Sheets

(In thousands, unaudited)

March 31, December 31,

2021 2020

---------- ----------------

Assets

Current assets:

Cash and cash equivalents $ 95,242 $ 149,027

Receivables, net 92,407 78,813

Other current assets 232,578 172,451

---------- --------------

Total current assets 420,227 400,291

Property and equipment, net 3,369,448 3,320,913

Other non-current assets 169,411 146,389

---------- --------------

Total assets $3,959,086 $ 3,867,593

========= ==========

Liabilities and stockholders' equity

Current liabilities:

Accounts payable $ 188,704 $ 221,430

Accrued liabilities 174,147 203,260

Current maturities of long-term debt 35,000 7,500

Other current liabilities 83,293 28,009

---------- --------------

Total current liabilities 481,144 460,199

Long-term liabilities:

Long-term debt, net 2,271,112 2,103,931

Deferred tax liabilities 551,540 573,619

Other non-current liabilities 298,505 289,690

---------- --------------

Total long-term liabilities 3,121,157 2,967,240

Total stockholders' equity 356,785 440,154

---------- --------------

Total liabilities and stockholders' equity $3,959,086 $ 3,867,593

========= ==========

Kosmos Energy Ltd.

Condensed Consolidated Statements of Cash Flow

(In thousands, unaudited)

Three Months Ended

March 31,

---------------------

2021 2020

--------- ----------

Operating activities:

Net loss $(90,768) $(182,767)

Adjustments to reconcile net loss to net

cash used in operating activities:

Depletion, depreciation and amortization

(including deferred financing costs) 79,112 95,585

Deferred income taxes (22,079) 72,177

Unsuccessful well costs and leasehold impairments 1,469 19,228

Impairment of long-lived assets - 150,820

Change in fair value of derivatives 106,158 (136,322)

Cash settlements on derivatives, net(1) (32,998) 9,016

Equity-based compensation 8,281 9,346

Gain on sale of assets (26) -

Loss on extinguishment of debt - -

Other (890) 3,974

Changes in assets and liabilities:

Net changes in working capital (94,885) (58,020)

--------- ----------

Net cash used in operating activities (46,626) (16,963)

Investing activities

Oil and gas assets (128,448) (83,716)

Other property (354) (1,537)

Acquisition of oil and gas properties, net

of cash acquired - -

Proceeds on sale of assets 631 1,713

Notes receivable from partners (22,416) (23,983)

--------- ----------

Net cash used in investing activities (150,587) (107,523)

Financing activities:

Borrowings on long-term debt 100,000 50,000

Payments on long-term debt (350,000) -

Advances under production prepayment agreement - -

Net proceeds from issuance of senior notes 444,375 -

Redemption of senior secured notes - -

Purchase of treasury stock / tax withholdings (1,018) (4,947)

Dividends (430) (19,156)

Deferred financing costs (1,034) -

--------- ----------

Net cash provided by financing activities 191,893 25,897

--------- ----------

Net decrease in cash, cash equivalents and

restricted cash (5,320) (98,589)

Cash, cash equivalents and restricted cash

at beginning of period 149,764 229,346

--------- ----------

Cash, cash equivalents and restricted cash

at end of period $ 144,444 $ 130,757

======== =========

(1) Cash settlements on commodity hedges were $(28.6) million

and $12.0 million for the three ended March 31, 2021 and 2020,

respectively.

Kosmos Energy Ltd.

EBITDAX

(In thousands, unaudited)

Twelve Months

Three months ended Ended

--------------------- ---------------

March 31, March 31, March 31,

2021 2020 2021

--------- ---------- ---------------

Net loss $(90,768) $(182,767) $ (319,587)

Exploration expenses 8,181 44,605 48,192

Facilities insurance modifications,

net 671 8,038 5,794

Depletion, depreciation and

amortization 76,541 93,302 469,101

Impairment of long-lived

assets - 150,820 3,139

Equity-based compensation 8,281 9,346 31,641

Derivatives, net 102,461 (136,038) 255,679

Cash settlements on commodity

derivatives (28,623) 12,018 (43,356)

Restructuring and other 1,186 18,023 12,330

Other, net 2,282 3,091 9,406

Gain on sale of assets (26) - (92,189)

Interest and other financing

costs, net 24,528 27,835 106,487

Income tax expense (benefit) (16,705) 65,543 (87,457)

--------- ---------- ---------------

EBITDAX $ 88,009 $ 113,816 $ 399,180

======== ========= ===========

Kosmos Energy Ltd.

Adjusted Net Income

(In thousands, except per share amounts, unaudited)

Three Months Ended

March 31,

---------------------

2021 2020

--------- ----------

Net loss $(90,768) $(182,767)

Derivatives, net 102,461 (136,038)

Cash settlements on commodity derivatives (28,623) 12,018

Gain on sale of assets (26) -

Facilities insurance modifications,

net 671 8,038

Impairment of long-lived assets - 150,820

Restructuring and other 1,186 18,023

Other, net 2,323 3,091

Total selected items before tax 77,992 55,952

--------- ----------

Income tax expense (benefit) on adjustments(1) (20,198) 34,464

Impact of valuation adjustments and

U.S. tax law changes - 26,001

--------- ----------

Adjusted net loss $(32,974) $ (66,350)

======== =========

Net loss per diluted share $ (0.22) $ (0.45)

Derivatives, net 0.25 (0.34)

Cash settlements on commodity derivatives (0.07) 0.03

Gain on sale of assets - -

Facilities insurance modifications,

net - 0.02

Impairment of long-lived assets - 0.37

Restructuring and other - 0.04

Other, net 0.01 0.01

Total selected items before tax 0.19 0.13

--------- ----------

Income tax expense (benefit) on adjustments(1) (0.05) 0.09

Impact of valuation adjustments and

U.S. tax law changes - 0.07

--------- ----------

Adjusted net loss per diluted share $ (0.08) $ (0.16)

======== =========

Weighted average number of diluted

shares 407,365 404,759

(1) Income tax expense is calculated at the statutory rate in

which such item(s) reside. Statutory rates for the U.S. and

Ghana/Equatorial Guinea are 21% and 35%, respectively.

Kosmos Energy Ltd.

Free Cash Flow

(In thousands, unaudited)

Three Months Ended

March 31,

2021 2020

---------- ----------

Reconciliation of net cash provided by

operating activities to free cash flow:

Net cash used in operating activities $ (46,626) $ (16,963)

Net cash used in investing activities -

base business (47,883) (75,794)

Net cash used in investing activities -

Mauritania/Senegal (102,704) (31,729)

---------- ----------

Free cash flow(1) $(197,213) $(124,486)

========= =========

(1) Commencing in the second quarter of 2020, the Company no

longer included restricted cash and other cash used in financing

activities (deferred financing costs, the purchase of treasury

stock and costs related to the redemption of the senior secured

notes and issuance of senior notes) in its calculation of free cash

flow to better reflect cash flow of the underlying business,

consistent with general industry practice.

Operational Summary

(In thousands, except barrel and per barrel data, unaudited)

Three Months Ended

March 31,

----------------------

2021 2020

------------ --------

Net Volume Sold

Oil (MMBbl) 2.941 3.450

Gas (MMcf) 1.325 1.982

NGL (MMBbl) 0.127 0.193

------------ --------

Total (MMBoe) 3.289 3.973

============ ========

Total (Boepd) 36.543 43.659

============ ========

Revenue

Oil sales $ 169,150 $171,916

Gas sales 4,540 3,719

NGL sales 2,784 2,145

------------ --------

Total sales 176,474 177,780

Cash settlements on commodity derivatives (28,623) 12,018

------------ --------

Realized revenue $ 147,851 $189,798

======== =======

Oil and Gas Production Costs $ 45,752 $ 61,603

Sales per Bbl/Mcf/Boe

Oil sales per Bbl $ 57.51 $ 49.83

Gas sales per Mcf 3.43 1.88

NGL sales per Bbl 21.92 11.11

Total sales per Boe 53.66 44.74

Cash settlements on commodity derivatives

per oil Bbl(1) (9.73) 3.48

Realized revenue per Boe 44.96 47.77

Oil and gas production costs per Boe $ 13.91 $ 15.50

(1) Cash settlements on commodity derivatives are only related

to Kosmos and are calculated on a per barrel basis using Kosmos'

Net Oil Volumes Sold.

Kosmos was underlifted by approximately 1,316 thousand barrels

as of March 31, 2021.

Hedging Summary

As of March 31, 2021(1)

(Unaudited)

Weighted Average Price per

Bbl

-------------------------------------------

Index MBbl Floor(2) Sold Put Ceiling

------------ ----- ---------------- ------------ ---------

2021:

Swaps with sold puts Dated Brent 4,500 $ 53.96 $ 42.92 $ -

Swaps with sold puts NYMEX WTI 500 47.75 37.50 -

Three-way collars Dated Brent 2,750 40.45 32.95 52.84

Three-way collars NYMEX WTI 750 45.00 37.50 55.00

2022:

Three-way collars Dated Brent 1,500 50.00 40.00 70.00

(1) Please see the Company's filed 10-K for full disclosure on

hedging material. Includes hedging position as of March 31, 2021

and hedges added since quarter-end.

(2) "Floor" represents floor price for collars or swaps and strike price for purchased puts.

Note: Excludes 5.3 MMBbls of sold (short) calls with a strike

price of $70.09 per Bbl in 2021 and 1.6 MMBbls of sold (short)

calls with a strike price of $60.00 per Bbl in 2022.

2021 Guidance

2Q 2021 FY 2021

------------------- -------------------

52,500 - 54,000 boe 53,000 - 57,000 boe

Production(1,2) per day per day

$16.00 - $18.00 per $14.50 - $16.50 per

Opex boe boe

$23.00 - $25.00 per $21.00 - $23.00 per

DD&A boe boe

G&A(3) $22 - $24 million $85 - $95 million

Exploration Expense(4) $20 million $35 - $45 million

Net Interest(5) $30 million per quarter

Tax $1.00 - $3.00 per boe

Base Business Capex(6) $225 - $275 million in FY 2021

Note: Ghana / Equatorial Guinea revenue calculated by number of

cargos.

(1) 2Q 2021 cargos forecast - Ghana: 3 cargos / Equatorial

Guinea: 1.5 cargos. FY 2021 Ghana: 8 cargos / Equatorial Guinea 4.5

cargos. Average cargo sizes 950,000 barrels of oil.

(2) U.S. Gulf of Mexico Production - 2Q 2021 forecast

20,500-22,000 boe per day. FY 2021: 21,000-23,000 boe per day.

Oil/Gas/NGL split for 2021: 80%/15%/5%.

(3) G&A - Approximately 60% cash.

(4) Excludes dry hole costs. 2Q includes Gulf of Mexico seismic acquisition.

(5) Excludes one-off loss on extinguishment of debt of

approximately $15 million in the second quarter 2021 associated

with the amendment and restatement of the RBL.

(6) Excludes Mauritania and Senegal capital expenditures.

Source: Kosmos Energy Ltd.

Investor Relations

Jamie Buckland

+44 (0) 203 954 2831

jbuckland@kosmosenergy.com

Media Relations

Thomas Golembeski

+1-214-445-9674

tgolembeski@kosmosenergy.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

QRFDGGDUXGGDGBR

(END) Dow Jones Newswires

May 10, 2021 02:00 ET (06:00 GMT)

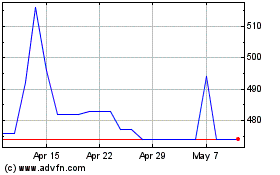

Kosmos Energy (LSE:KOS)

Historical Stock Chart

From Apr 2024 to May 2024

Kosmos Energy (LSE:KOS)

Historical Stock Chart

From May 2023 to May 2024