TIDMKWG

RNS Number : 0878O

Kingswood Holdings Limited

29 September 2023

Kingswood 2023 Half-year Report

Kingswood Holdings Limited (AIM: KWG), the international, fully

integrated wealth and investment management group, is pleased to

announce its unaudited interim financial results for the half year

ended 30 June 2023.

H1 2023 Group Operating Profit was GBP5.0m, GBP0.5m or 10%

higher than H1 2022.

UK & Ireland revenue increased by 41% compared to the same

period last year, of which 86% is recurring in nature. UK & I

Operating Profit was GBP7.7m and in line with expectations.

US revenue decreased by 38% compared to the same period last

year, impacted by a slowdown in capital market activity. Operating

Profits were GBP0.6m, falling short of expectation, though with

recovery expected in H2 2023.

Group Assets under Management and Advice (AuM/A) at June 2023

were GBP12.0bn, having increased by GBP1.5bn compared to December

2022, supported by UK&I acquisitions of Barry Fleming &

Partners (BFP) and Moloney Investments Ltd (MMPI) and in the US by

the on-boarding of an additional 9 registered representatives.

In the UK, migration of AuA into its Discretionary Central

Investment Propositions, notably the IBOSS AM MPS solution has

gathered pace with AuM reaching GBP1.05bn in June 2023, up from

GBP0.65bn on December 2022 - an increase of 62%.

David Lawrence, Kingswood Chief Executive Officer,

commented:

"I am delighted to share our interim financial results for 2023.

Despite continued economic and market uncertainties, the group has

delivered strong growth year over year, and we continue to build

the business into a leading participant in the sector. Our business

fundamentals remain strong, with positive net asset growth, high

levels of recurring revenue and very low adviser and consequently

client attrition.

"We continue to have a clear growth focus across the business

with complementary investment in our People, Technology and Client

Experience to enable and support this. Whilst our focus remains on

inorganic opportunities with which we have a proven integration

model, organic growth has seen an increased focus across our three

drivers of more advice for more clients, migration of AuA into our

investment propositions and growing our IBOSS IFA distribution

channel.

"In the US, whilst market conditions have impacted performance,

the fundamentals across both the investment banking and

alternatives divisions give us confidence that as markets recover

an accelerated growth trajectory will re-appear."

H1'23 - Strategic Highlights:

-- UK & Ireland successfully completed the purchase of Moloney Investments Ltd (MMPI) and Barry Fleming & Partners

(Tax, Trusts and Investment Planning) Limited (BFP):-

--

1. 70% acquisition of MMPI, a leading financial advisory group based in Dublin with EUR0.8bn AuM/A and EBITDA

of c.EUR4.0m

2. BFP, an IFA business based in Berkshire with GBP150m AuA and Operating Profit of c.GBP0.2m.

-- UK & Ireland AuM/A increased by GBP1.4bn to GBP9.5bn in H1'23, driven by acquisitions and encouraging levels of

organic growth:

--

1. Inorganic growth : GBP0.85bn client assets onboarded following the acquisitions of MMPI and BFP

2. Strong levels of growth from vertical integration : GBP1.05bn client assets under our own management, an

increase of GBP0.4bn compared to FY'22

3. Institutional growth : GBP80m AuM net inflows in H1'23, with client assets 17% higher year on year.

-- IBOSS has been ranked by Next Wealth as the sixth fastest growing discretionary fund manager by assets and

percentage of assets over the past 12 months. We have retained our 5 Star and 5 Diamond Defaqto ratings and

gained further recognition from the adviser community by scooping three accolades at the Citywire Wealth Manager

Awards. In 2023, IBOSS hopes to become the only DFM provider to win FTAdviser's 5 Star Award for four consecutive

years.

-- Kingswood was named as one of the UK's 'Best Workplaces for Women' in 2023, by Great Place to Work. We continue

to make progress in addressing diversity imbalances across the organisation and remain committed to increasing

the female representation of our UK adviser population to at least 25% in the medium term, compared to current

levels of 20% (2022: 19%).

-- Kingswood Go, our UK focused digital finance app and portal, is a great success with 3,525 clients registered and

readily using the app. The app also enables us to serve smaller clients in an efficient and cost-effective

manner. Accordingly, we can target clients at an earlier stage of their wealth journey.

-- We strive to maintain the highest level of service for our clients as reflected in our 'Vouchedfor' rating of 4.8

/ 5.0.

-- Kingswood exhibits a strong Consumer Duty culture and pays particular attention to the needs of clients with

characteristics of vulnerability. We successfully delivered in our Consumer Duty requirements by the 31st July

2023 deadline.

-- Inorganic growth continues to see focus with two transactions currently in exclusive discussions. We continue

undertake a highly effective process of integration where the clients sit at the heart of this process.

-- Kingswood US unveiled Kingswood Investments, a comprehensive in-house investment banking and capital markets

division - which is set to contribute to future revenue generation, with its inaugural deal scheduled to close in

September. This addition, along with the business' existing investment banking team in Florida and SPAC Advisory

team, positions Kingswood US as a provider of one of the industry's most extensive investment banking services.

-- Kingswood US has invested in cutting-edge technology within the wealth management sector, ensuring that its

advisors have access to a top-tier technology platform. The integration of Altigo, an industry-leading automated

alternative investment platform, surpassed 1,200 subscriptions, representing $129 million in investments in just

three years.

-- Kingswood US achieved recognition in the USA Today list of Best Financial Advisory Firms, a ranking compiled by

Statista for USA Today. This accolade resulted from assessing over 31,000 RIAs, narrowing it down to the top 500

firms based on their asset under management growth, client and peer recommendations, both in the short and long

term.

-- Our US footprint further expanded in the first half of the year adding nine new registered representatives and

supporting growth in our total AuM/A in Kingswood US.

-- Kingswood US has obtained approval from FINRA (Financial Industry Regulatory Authority) to broaden its authorized

business activities. This development positions the company to continue its natural growth trajectory. The

revised membership agreement grants the opportunity for the potential employment of 325 individuals, the

operation of up to one hundred offices; and engagement in research activities. These approvals mark a significant

milestone for Kingswood US, allowing the company to strengthen its capabilities, extend its reach, and solidify

its standing in the market. This expanded scope of operations aligns seamlessly with Kingswood's strategy for

organic growth and enlarging its market presence.

H1'23 - Financial Highlights

-- Group revenue of GBP62.7m decreased by GBP17.6m, or 22%, compared to H1'22. This was due to a decrease of

GBP24.4m in US revenues is reflected in US Investment Banking as macro-economic headwinds and market volatility

led to a slowdown in capital market activity. The increase of GBP6.8m across UK & Ireland revenues has been

achieved through a combination of acquisitions and organic growth.

-- 86% of UK revenue is recurring in nature, providing a strong, annuity-style fee stream. Investment Banking fees

are a larger portion of Kingswood US revenues, and transactional in nature, which means that recurring revenue

for the Group was 33% compared to 28% in 2022.

-- Operating Profit of GBP5.0m was GBP0.5m, or 10%, higher than H1'22 reflecting acquisitions in the UK & Ireland

partly offset by the reduction in profits from lower US Investment Banking revenues in the US business.

-- Within Kingswood US, Investment Banking experienced a 48% decline in revenue compared to the previous year,

delivering $33.5 million, down from $65 million in 2022. This decrease was primarily attributed to lower deal

volumes due to challenging macroeconomic conditions. Despite this decline, the business maintains a strong

recruitment pipeline for new advisers, with a particular focus on developing consistent and recurring revenue

streams through client asset management. During the first half of 2023, Kingswood US expanded its presence in the

U.S. by adding 9 new registered representatives and increasing AUM/A by $0.4 billion, contributing to a 32%

increase in fee-based revenue.

The Kingswood Board believes Operating Profit is the most

appropriate indicator to explain the underlying performance of the

Group. The definition of Operating Profit is profit before finance

costs, amortisation and depreciation, gains and losses, and

exceptional costs (business re-positioning and transaction

costs)

GBP'000 (unless otherwise stated) H1'23 H1'22 Change % Change GBP

----------------------------------- -------- -------- --------- -----------

Wealth Planning 16,715 12,864 30% 3,851

Investment Management 3,917 3,588 9% 329

Kingswood Ireland 2,533 - n/a 2,533

Kingswood US 39,565 63,937 (38)% -24,372

Total Revenue 62,730 80,389 (22)% -17,659

Recurring Revenue 33% 28%

Kingswood UK&I 7,729 5,810 33% 1,919

Kingswood US 591 1,529 (61)% -938

Division Operating Profit 8,320 7,339 13% 981

Central Costs (3,355) (2,834) (18)% (521)

Operating Profit 4,965 4,505 10% 460

GBP'000 (unless otherwise stated) H1'23 FY'22 Change % Change GBP

----------------------------------- -------- -------- --------- -----------

Total Equity 64,806 73,967 12% (9,161)

Total Cash 24,126 19,642 23% 4,484

Key Metrics 0

AUM/A (GBPm) 11,954 10,453 14% 1,501

# of UK&I Advisers 116 100 16% 16

# of US RIA/IBD reps 241 232 4% 9

Outlook

In our 2022 Annual Report we stated that our "near term" target

for the group was to get to GBP12.5bn of AuA. We are delighted

that, despite difficult conditions, we have made strong progress

against this objective and at June 2023 our AuA/M now stands at

GBP12bn (GBP10.5bn at December 2022).

In the first half of the year, we have increased the amount of

assets under our own management in our market leading discretionary

propositions by GBP0.4bn to GBP1.05bn. A strong suite of

initiatives are in place to encourage vertical integration. We

believe there remains a significant further opportunity within our

existing wealth advisory AuA to increase from our current levels of

20.5% to 40%, over a three-year term, subject to client

suitability.

We stated an expectation for a total group proforma operating

profit of GBP14.7m for 2023 in our 2022 annual results. Whilst our

UK and Ireland business is tracking broadly in line with

expectations, difficult conditions in the US lead to us revising

this expectation to GBP13.6m due to lower than expected Investment

Banking / Capital Markets activity and a more cautious approach in

the US to users of our Alternatives division, as investors sought

better returns across a broader range of opportunities .

We remain confident in the success of our ambitious long-term

growth strategy, grounded in supporting our clients to protect and

grow their wealth.

Our new advisory clients, which are historically derived from

professional introducer base and referrals, continue to see strong

inflows into the business, despite volatile market conditions. We

also continue to invest in a range of lead generation and digital

tools to widen reach to new and younger demographics.

In the second half of the year, we expect further organic growth

and positive net inflows, and the business remains well positioned

as financial markets begin to recover.

For further details, please contact:

Kingswood Holdings Limited +44 (0)20 7293 0730

David Lawrence www.kingswood-group.com

Cavendish Capital Markets Limited Ltd (Nomad & Broker)

Simon Hicks / Abigail Kelly +44 (0)20 7220 0500

GreenTarget (for Kingswood media) +44 (0)20 7324 5498

Jamie Brownlee / Ellie Basle Jamie.Brownlee@greentarget.co.uk

The Group's Nominated Adviser and Broker, finnCap Ltd, has now

changed its name to Cavendish Capital Markets Limited following

completion of its own corporate merger.

Company Registration No. 42316 (Guernsey)

KINGSWOOD HOLDINGS LIMITED

CONSOLIDATED INTERIM UNAUDITED FINANCIAL STATEMENTS

FOR THE SIX MONTH PERIODED 30 JUNE 2023

Page

KINGSWOOD HOLDINGS LIMITED

CONTENTS

Financial and Operational Review 1 - 2

Interim Consolidated Statement of Comprehensive Income 3 - 4

Interim Consolidated Statement of Financial Position 5 - 6

Interim Consolidated Statement of Changes in Equity 7 - 8

Interim Consolidated Statement of Cash Flows 9

Notes to the Interim Consolidated Financial Statements 10 - 26

Group Review:

The Group has continued to build momentum in 2023 and revenue

and operating profit have grown despite unfavourable market

conditions. Our business continues to grow organically in both the

UK and US and our acquisition activity is slowing down, as planned.

We have a strong leadership team that is driving tangible results

and realising our ambition to become a leading fully integrated

International wealth & investment management business.

Finance Review:

We have maintained both cost and balance sheet discipline in the

first half of 2023. Our focus is to maximise shareholder returns

through Operating Profit growth combined with minimising our

weighted average cost of capital. We also continue to maintain a

strong discipline in how we think about the businesses we acquire,

ensuring that the multiples we pay are within our risk appetite and

funding profile.

Kingswood's financial performance remained resilient in H1'23

against a continued backdrop of market volatility. Group Assets

under Management and Advice (AuM/A) of GBP12.0bn at FY'23

represents a GBP1.5bn, or 14%, increase compared to FY'22.

Group revenue was GBP62.7m, a 22% decrease year on year. US

Investment Banking revenues are lower as macro-economic headwinds

and market volatility led to a slowdown in capital market activity.

In the UK and Ireland a 41% revenue increase was achieved through a

combination of acquisitions and organic growth.

Operating Profit of GBP5.0m is 10% higher than 2022, driven by a

GBP1m reduction in US profits and continued acquisition and organic

growth. C entral costs have increased by reflecting an increase in

the central resources required to support a larger business.

The overall result for H1'23 was a loss before tax of GBP8.6m

reflecting GBP0.3m of acquisition-related deferred consideration

expenses, GBP3.0m amortisation and depreciation, GBP5.8m finance

costs and GBP5.0m business re-positioning and transaction

costs.

The Group had GBP24.1m of cash as at H1'23, an increase of

GBP4.5m since 31 December 2022 with a positive cashflow from

operating activities.

Highlights -- UK & Ireland:

We have continued to build momentum on our strategic growth

plans over the first half of the year, following the acquisition of

Moloney Investments Ltd (MMPI) and Barry Fleming & Partners

(BFP). The 70% acquisition of MMPI, a leading advisory group based

in Dublin with EUR0.8bn AuM/A and annual Operating Profit of

c.EUR4.0m, is a highly strategic acquisition for the Group

providing access to the attractive Irish wealth management market

whilst also offering diverse new avenues for growth. The purchase

of BFP, an IFA business based in Berkshire has added GBP150m AuA

contributing c.GBP0.2m annual Operating Profit.

The hard work and dedication of our staff enables us to

continually deliver against our buy, build and grow strategy at

pace whilst maintaining the highest levels of service and

experience for our clients, as reflected in our 'Vouchedfor' rating

of 4.8 / 5.0. We expect organic growth in both initial and ongoing

fees post integration through accretive assets under influence and,

despite continued economic uncertainty, the UK business generated

healthy net client asset inflows over the first half of the

year.

The business delivered double-digit revenue and operating profit

growth in H1'23. Revenue of GBP23.2m was GBP6.7m (41%) higher and

over 80% of revenues are recurring in nature, providing the strong,

annuity style revenue stream required to deliver sustainable, long

term returns to our shareholders.

AuM/A increased by GBP1.4bn to GBP9.5bn over H1'23, driven by

acquisitions and encouraging levels of organic growth. There were

strong levels of vertical integration over the period, with client

retail Assets under our own Management (AuM) in IBOSS AM MPS and

Personal DFM now totalling GBP1.05bn, an increase from GBP0.65bn at

FY'22. Institutional net asset inflows were GBP80m in the first six

months of the year, with total AuM 17% higher year on year.

US Highlights:

The US business continues to place a strong emphasis on

maintaining a robust recruitment pipeline for new advisers, with a

specific focus on cultivating reliable and recurring revenue

streams through the management of client assets. In the first half

of 2023, we extended our presence in the US by adding 9 new

registered representatives and increasing our assets under

management and advisement (AUM/A) by $0.2bn.

In the first half of the year (H1), operating profit saw a

decrease of 69% on a YoY basis, delivering $0.7m (2022: $2.3m). The

decrease in operating profit was primarily driven within revenue,

which saw a decline of 41% resulting in Group revenues of $48.4

million (2022: $82.2m). T he escalating geopolitical tensions, the

conflict in Ukraine, rising inflation rates, and the looming

spectre of a global recession are collectively exerting additional

stress on wealth management firms. These factors are especially

challenging because they are contributing to lower growth in assets

under management (AuM), which, in turn, is putting a strain on

profitability.

Investment Banking: Revenue in our Investment Banking division

declined by 48% compared to the previous year, amounting to $33.5

million (compared to $65 million in 2022). This decrease was

primarily due to subdued deal volumes resulting from unfavourable

macroeconomic conditions. The situation was exacerbated by

challenges in the banking and financial services sectors,

compounded by the collapse of Silicon Valley Bank. However, we

anticipate a rebound in deal volumes towards historical levels in

the second half of the year as market conditions improve.

Additionally, H1 marked the establishment of Kingswood Investments

(KWUS' internal investment banking team), which is set to

contribute to revenue generation in H2, with its inaugural deal

scheduled to close in September.

Our Alternatives division experienced a revenue decline of 47%

resulting in $2.3 million in revenue (compared to $4.4 million in

2022) This decline was attributed to shifting investment dynamics,

as investors sought better returns across a broader range of

opportunities, reducing reliance on riskier investments. Although

there were concerns about asset value markdowns in private markets,

the demand remains robust and is anticipated to align with

historical performance in H2.

On a positive note, Advisor Fees category recorded a 32% revenue

increase, delivering $5.3 million in revenue (compared to $3.9

million in 2022). This growth was fuelled by a 20 year-on-year

increase in the number of advisors, contributing an additional $450

million in AuM.

These results reflect our ability to adapt to changing market

conditions, seize growth opportunities, and maintain a strong

footing in our core revenue-generating sectors. While challenges

persist, we are optimistic about the prospects for the remainder of

the fiscal year.

KINGSWOOD HOLDINGS LIMITED

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE PERIODED 30 JUNE 2023

Six months Six months to Year ended

to

30 June 30 June 2022 31 Dec 2022

2023

(unaudited) (unaudited) (audited)

Notes GBP'000 GBP'000 GBP'000

Revenue 3 62,730 80,389 145,998

Direct expenses (37,314) (60,330) (103,878)

Gross profit 25,416 20,059 42,120

Operating staff costs (14,034) (10,283) (23,720)

Other operating costs (6,417) (5,271) (9,704)

Total operating costs (20,451) (15,554) (33,424)

Operating profit 4,965 4,505 8,696

Non-operating costs:

Business re-positioning

costs (369) (1,202) (1,964)

Finance costs (7,138) (1,455) (6,398)

Amortisation and

depreciation (2,957) (1,863) (4,507)

Acquisition-related

items:

Other (losses) / gains 4 - - (23)

Remuneration charge

(deferred consideration) 10 (259) 6,309 (1,852)

Goodwill adjustment 8 - (6,364) -

Restructuring and

integration costs (4,161) (1,621) (4,924)

Loss before tax (9,919) (1,691) (10,972)

Tax (175) (139) (4,480)

Loss after tax (10,094) (1,830) (6,492)

Other comprehensive

income / (loss)

Items that may not be reclassified to profit

or loss

Exchange differences on

translation of foreign

operations - (417) -

Total comprehensive loss (10,094) (2,247) (6,492)

Six months to Six months to Year ended

30 June 2023 30 June 2022 31 Dec 2022

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

- Owners of the parent company (10,537) (2,545) (7,797)

- Non-controlling interests 443 715 1,305

Total comprehensive loss is attributable to:

- Owners of the parent company (10,537) (2,962) (7,797)

- Non-controlling interests 443 715 1,305

Loss per share:

- Basic loss per share 5 GBP (0.05) GBP (0.01) GBP (0.04)

- Diluted loss per share 5 GBP (0.01) GBP (0.00) GBP (0.01)

The notes on pages 10 - 26 form an integral part of the financial statements.

30 Jun 2023 30 Jun 2022 31 Dec 2022

(unaudited) (unaudited) (audited)

Notes GBP'000 GBP'000 GBP'000

Non-current assets

Property, plant and equipment 6 916 916 832

Right-of-use assets 7 3,298 3,071 3,553

Goodwill and other intangible assets 8 148,658 97,231 123,469

Deferred tax asset 4,492 - 4,492

157,364 101,218 132,346

Current assets

Short term investments 49 72 52

Trade and other receivables 10,380 7,207 9,274

Cash and cash equivalents 24,126 20,693 19,624

34,555 27,972 28,950

Total assets 191,919 129,190 161,296

Current liabilities

Trade and other payables 13,892 18,515 17,597

Deferred consideration payable 10 15,513 14,286 20,771

29,405 32,801 38,368

Non-current liabilities

Deferred consideration payable 10 12,559 10,304 9,228

Other non-current liabilities 2,519 2,956 2,806

Loans and borrowings 64,984 - 24,343

Deferred tax liability 17,646 7,521 12,584

Total liabilities 97,708 53,582 87,329

Net assets 64,806 75,608 73,967

Equity

Share capital 11 10,846 10,846 10,846

Share premium 11 8,224 8,224 8,224

Preference share capital 12 70,150 70,150 70,150

Other reserves 16,168 11,597 14,373

Foreign exchange reserve (1,087) 417 (422)

Retained (loss) (42,132) (27,638) (31,595)

Equity attributable to the owners of the Parent Company 62,169 73,596 71,576

Non-controlling interests (NCI) 2,637 2,012 2,391

Total equity 64,806 75,608 73,967

The notes on pages 10 - 26 form an integral part of the financial statements.

The financial statements of Kingswood Holdings Limited (registered number 42316) were approved

and authorised for issue by the Board of Directors, and signed on its behalf by:

David Hudd

Chairman

Date: 29(th) September 2023

KINGSWOOD HOLDINGS LIMITED

INTERIM CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

(CONTINUED)

FOR THE PERIODED 30 JUNE 2023

Share Preference Other Foreign Retained Equity attributable NCI Total

capital and share reserves exchange earnings to the owners of

share capital reserve the parent Company

premium

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1

January 2022 19,070 70,150 11,041 (488) (23,800) 75,973 925 76,898

Loss for the

period - - - - (2,545) (2,545) 715 (1,830)

Movement on NCI - - - - - - 372 372

Consolidation

adjustment - - - - (1,293) (1,293) - (1,293)

Foreign exchange

gain - - - 905 - 905 - 905

Share based

remuneration - - 556 - - 556 - 556

Balance at 30

June 2022

(unaudited) 19,070 70,150 11,597 417 (27,638) 73,596 2,012 75,608

(Loss) / profit

for the period - - - - (5,252) (5,252) 590 (4,662)

Movement on NCI - - - - - - (351) (351)

Other adjustment - - - - 1,293 1,293 - 1,293

Share based

remuneration - - 296 - - 296 - 296

Preference share

capital reserve - - 2,480 - - 2,480 - 2,480

Foreign exchange

loss - - - (839) 2 (837) 140 (697)

Balance at 31

December 2022

(audited) 19,070 70,150 14,373 (422) (31,595) 71,576 2,391 73,967

(Loss) / profit for

the period - - - - (10,537) (10,537) 443 (10,094)

Movement on NCI - - - - - - (197) (197)

Consolidation

adjustment - - - - - - - -

Foreign exchange

movement - - - (665) - (665) - (665)

Share based

remuneration - - 498 - - 498 - 498

Preference share

capital - - 1,297 - - 1,297 - 1,297

Foreign exchange

gain - - - - - - - -

Balance at 30 June

2023 (unaudited) 19,070 70,150 16,168 (1,087) (40,835) 62,169 2,637 66,806

Period Period Year ended

30 Jun 2023 30 Jun 2022 31 Dec 2022

(unaudited) (unaudited) (audited)

Notes GBP'000 GBP'000 GBP'000

Net cash generated from / (used in) operating

activities 13 3,852 (8,989) (2,704)

Investing activities

Property, plant and equipment purchased (99) (50) (113)

Acquisition of investments (28,458) (13,180) (32,272)

Remuneration charge (deferred consideration) (6,953) (173) (10,774)

Net cash used in investing activities (35,510) (13,403) (43,159)

Financing activities

Interest paid (3,565) (11) (21)

Lease payments (430) (454) (852)

Dividends paid to non-controlling interests - - (811)

New loans (repaid) / loans received 40,607 (156) 23,784

Net cash (used in)/generated from financing

activities 36,612 (621) 22,100

Net (decrease)/increase in cash and cash

equivalents 4,954 (23,013) (23,763)

Cash and cash equivalents at beginning of Period 19,624 42,933 42,933

Effect of foreign exchange rates (452) 771 454

Cash and cash equivalents at end of Period 24,126 20,691 19,624

The notes on pages 10 - 26 form an integral part of the financial statements.

1 Accounting policies

General information

Kingswood Holdings Limited is a company incorporated in Guernsey under The Companies (Guernsey)

Law, 2008. The shares of the Company are traded on the AIM market of the London Stock Exchange

(ticker symbol: KWG). The nature of the Group's operations and its principal activities are

set out in the Strategic Report. Certain subsidiaries in the Group are subject to the FCA's

regulatory capital requirements and therefore required to monitor their compliance with credit,

market and operational risk requirements, in addition to performing their own assessment of

capital requirements as part of the ICAAP.

1.1 Basis of accounting

The Group's interim condensed consolidated financial statements are prepared and presented

in accordance with IAS 34 'Interim Financial Reporting'. The accounting policies adopted by

the Group in the preparation of its 2022 interim report are consistent with those disclosed

in the annual financial statements for the year ended 31 December 2021.

The information relating to the six months ended 30 June 2022 and the six months ended 30

June 2021 do not constitute statutory financial statements and has not been audited. The interim

condensed consolidated financial statements do not include all the information and disclosures

required in the annual financial statements and should be read in conjunction with the Group's

most recent annual financial statements for the year ended 31 December 2021.

1.2 Changes in significant accounting policies

The Group has applied the same accounting policies and methods of computation in its interim

consolidated financial statements as in its 2022 annual financial statements.

1.3 Significant accounting policies

Going concern

The Directors review the going concern position of the Group on a regular basis as part of

the monthly reporting process which includes consolidated management accounts and cash flow

projections and have, at the time of approving the financial statements, a reasonable expectation

that the Group has adequate resources to continue in operational existence for the foreseeable

future. Accordingly, the Directors continue to adopt the going concern basis of accounting

in preparing the financial statements.

Revenue recognition

Performance obligations and timing of revenue recognition

The majority of the Group's UK revenue, being investment management fees and ongoing wealth

advisory, is derived from the value of funds under management / advice, with revenue recognised

over the period in which the related service is rendered. This method reflects the ongoing

portfolio servicing required to ensure the Group's contractual obligations to its clients

are met. This also applies to the Group's US Registered Investment Advisor ("RIA") business.

For certain commission, fee-based and initial wealth advisory income, revenue is recognised

at the point the service is completed. This applies in particular to the Group's US Independent

Broker Dealer ("IBD") services, and its execution-only UK investment management. There is

limited judgement needed in identifying the point such a service has been provided, owing

to the necessity of evidencing, typically via third-party support, a discharge of pre-agreed

duties.

1 Accounting policies

The US division also has significant Investment Banking operations, where commission is recognised

on successful completion of the underlying transaction.

Determining the transaction price

Most of the Group's UK revenue is charged as a percentage of the total value of assets under

management or advice. For revenue earned on a commission basis, such as the US broker dealing

business, a set percentage of the trade value will be charged. In the case of one-off or ad

hoc engagements, a fixed fee may be agreed.

Allocating amounts to performance obligations

Owing to the way in which the Group earns its revenue, which is largely either percentage-based

or fixed for discrete services rendered, there is no judgement required in determining the

allocation of amounts received. Where clients benefit from the provision of both investment

management and wealth advisory services, the Group is able to separately determine the quantum

of fees payable for each business stream.

Further details on revenue, including disaggregation by operating segment and the timing of

transfer of service(s), are provided in note 3 below.

2 Critical accounting judgements and key sources of estimation uncertainty

In the application of the Group's accounting policies, which are described in note 1, the

Directors are required to make judgements, estimates and assumptions about the carrying amounts

of assets and liabilities that are not readily apparent from other sources. The estimates

and associated assumptions are based on historical experience and other factors that are considered

to be relevant. Actual results may differ from these estimates.

Critical judgements in applying the Group's accounting policies

The following are the critical judgements that the Directors have made in the process of applying

the Group's accounting policies that had the most significant effect on the amounts recognised

in the financial statements.

Assessment of control

Control is considered to exist where an investor has power over an investee, or else is exposed,

and has rights, to variable returns. The Group determines control to exist where its own direct

and implicit voting rights relative to other investors afford the Group -- via its board and

senior management -- the practical ability to direct, or as the case may be veto, the actions

of its investees.

The company holds 50.1% of voting rights in Kingswood US, LLC, parent company of the US and

its subsidiaries, as well as a majority stake in the US division's advisory board when grouped

with affiliated entities. The Group has thus determined that the Company has rights, to variable

returns from involvement with Kingswood US, LLC and its subsidiaries; and the ability to use

power over the US Group to affect the amount of those returns, as such the Company has consolidated

the sub-group as subsidiaries with a 49.9% non-controlling interest.

The company holds 70% of voting rights in Moloney Investments Limited, parent company of Ireland

and its subsidiaries, as well as a majority stake in the Ireland division's advisory board

when grouped with affiliated entities. The Group has thus determined that the Company has

the practical ability to direct the relevant activities of Moloney Investments Limited and

its subsidiaries and has consolidated the sub-group as subsidiaries with a 30% non-controlling

interest.

2 Critical accounting judgements and key sources of estimation uncertainty

Estimates and Assumptions

Intangible assets:

Expected duration of client relationships

The Group makes estimates as to the expected duration of client relationships to determine

the period over which related intangible assets are amortised. The amortisation period is

estimated with reference to historical data on account closure rates and expectations for

the future. During the period, client relationships were amortised over a 10-20 year period.

Goodwill

The amount of goodwill initially recognised as a result of a business combination is dependent

on the allocation of the purchase price to the fair value of the identifiable assets acquired

and the liabilities assumed. The determination of the fair value of the assets and liabilities

is based, to a considerable extent, on management's judgement. Goodwill is reviewed annually

for impairment by comparing the carrying amount of the Cash Generating Units (CGU) to their

expected recoverable amount, estimated on a value-in-use basis. The CGUs are based on the

business segments as outlined in note 3.

Share-based remuneration:

Share based payments

The calculation of the fair value of share-based payments requires assumptions to be made

regarding market conditions and future events. These assumptions are based on historic knowledge

and industry standards. Changes to the assumptions used would materially impact the charge

to the Statement of Comprehensive Income.

Deferred tax:

Recoverability of deferred tax assets

The amount of deferred tax assets recognised requires assumptions to be made to the financial

forecasts that probable sufficient taxable profits will be available to allow all or part

of the asset to be recovered.

Leases:

Estimating the incremental borrowing rate

The Group cannot readily determine the interest rate implicit in leases where it is the lessee,

therefore, it uses its incremental borrowing rate to measure lease liabilities. This is the

rate of interest that the Group would have to pay to borrow over a similar term, and with

a similar security, the funds necessary to obtain an asset of a similar value to the right-of-use

asset in a similar economic environment.

The incremental borrowing rate therefore reflects what the Group 'would have to pay', which

requires estimation when no observable rates are available or when they need to be adjusted

to reflect the terms and conditions of the lease (for example, when leases are not in the

subsidiary's functional currency). The Group estimates the incremental borrowing rate using

observable inputs (such as market interest rates) when available and is required to make certain

entity-specific estimates (such as the subsidiary's stand-alone credit rating).

Deferred consideration:

Payment of deferred consideration

The Group structures acquisitions such that consideration is split between initial cash or

equity settlements and deferred payments. The initial value of the contingent consideration

is determined by EBITDA and/or revenue targets agreed on the acquisition of each asset. It

is subsequently remeasured at its fair value through the Statement of Comprehensive Income,

based on the Directors' best estimate of amounts payable at a future point in time, as determined

with reference to expected future performance. Forecasts are used to assist in the assumed

settlement amount.

3 Business and geographical segments

Information reported to the Group's Non-Executive Chairman for the purposes of resource

allocation

and assessment of segment performance is focused on the category of customer for each type

of activity.

The Group's reportable segments under IFRS 8 are as follows: investment management, wealth

planning and US operations.

The Group has disaggregated revenue into various categories in the following table which is

intended to depict how the nature, amount, timing and uncertainty of revenue and cash flows

are affected by economic date and enable users to understand the relationship with revenue

segment information provided below.

The following is an analysis of the Group's revenue and results by reportable segment for

the year to 31 December 2021. The table below details a full year's worth of revenue and results

for the principal business and geographical divisions, which has then reconciled to the results

included in the Statement of Comprehensive Income:

Investment Wealth US IRE Group Total

management planning operations operations

Perioded Ended 30 June 2023

Continuing operations: GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Revenue (disaggregate

by timing):

Non-recurring 452 2,053 37,514 1,743 - 41,762

Recurring 3,465 14,662 2,051 790 - 20,968

External sales 3,917 16,715 39,565 2,533 - 62,730

Direct expenses (569) (793) (35,952) - - (37,314)

Gross profit 3,348 15,922 3,613 2,533 - 25,416

Operating profit / (loss) 1,379 5,589 591 761 (3,355) 4,965

Business re-positioning

costs (76) (104) (124) - (64) (368)

Finance costs (7) (87) (8) (1) (7,035) (7,138)

Amortisation and

depreciation (9) (823) - (18) (2,107) (2,957)

Remuneration charge

(deferred consideration) - - - (259) (259)

Transaction costs (61) (272) - (3,828) (4,161)

Goodwill adjustment - - - - -

Profit / (loss) before tax

from continuing operations 1,226 4,303 459 742 (16,649) (9,919)

Tax - (157) (14) (4) - (175)

Profit / (loss) after tax

from continuing operations 1,226 4,146 445 738 (16,649) (10,094)

3 Business and geographical segments

Perioded Ended 30 June Investment Wealth planning US Group Total

2022 management operations

Continuing operations: GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Revenue (disaggregated by timing):

Non-recurring 465 1,776 55,944 - 58,185

Recurring 3,123 11,088 7,993 - 22,204

External sales 3,588 12,864 63,937 - 80,389

Direct expenses (717) (519) (59,094) - (60,330)

Gross profit 2,871 12,345 4,843 - 20,059

Operating (loss) / profit 685 5,125 1,529 (2,834) 4,505

Business re-positioning

costs (140) (336) (397) (329) (1,202)

Finance costs (1) (70) (3) (1,381) (1,455)

Amortisation and

depreciation - (687) 42 (1,218) (1,863)

Remuneration charge

(deferred consideration) - (42) - 6,351 6,309

Transaction costs - - - (1,621) (1,621)

Goodwill adjustment - - - (6,364) (6,364)

Profit / (loss) before tax

from continuing operations 544 3,990 1,171 (7,396) (1,691)

Tax - (129) 11 (21) (139)

Profit / (loss) after tax

from continuing operations 544 3,861 1,182 (7,417) (1,830)

3 Business and geographical segments

Year Ended 31 December Investment Wealth US Group Total

2022 management planning operations

(audited)

Continuing operations: GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Revenue (disaggregated by timing):

Non-recurring 931 2,045 118,396 - 121,322

Recurring 6,252 15,169 9,431 23 28,394

External sales 7,183 17,214 127,827 23 149,716

Direct expenses (1,476) (913) (118,108) - (120,497)

Gross profit 3,176 16,301 9,719 23 29,219

Operating (loss) / profit 365 5,779 5,123 (4,940) 6,327

Business re-positioning

costs (177) (239) (263) (885) (1,564)

Finance costs - (72) 2 (4,857) (4,927)

Amortisation and

depreciation - (1,197) (212) (990) (2,399)

Other gains - - - (3,056) (3,056)

Remuneration charge

(deferred consideration) - (3,691) - (3,318) (7,009)

Transaction costs - (4) - (1,832) (1,836)

(Loss) / profit before tax

from continuing

operations 188 576 4,650 (19,878) (14,464)

Tax - (16) (317) (428) (761)

(Loss) / profit after tax

from continuing

operations 188 560 4,333 (20,306) (15,225)

4 Other (losses) / gains

Six months to Six months to Year Ended

30 June 2023 30 June 2022 31 December

2022

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Additional payments due on acquired businesses - - -

Unrealised gain/(loss) on investment - - (23)

- - (23)

5 Earnings per share

Six months to Six months to Year ended

30 Jun 2023 30 Jun 2022 31 Dec 2022

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Loss from continuing operations for the purposes

of basic loss per share, being net loss

attributable

to owners of the Group (10,537) (2,545) (7,797)

Number of shares

Weighted average number of ordinary shares for the

purposes of basic loss per share 216,920,719 216,920,719 216,920,724

Effect of dilutive potential ordinary shares:

Share options 6,624,664 8,580,094 5,897,018

Convertible preference shares in issue 525,217,205 469,263,291 512,407,029

Weighted average number of ordinary shares for the

purposes of diluted loss per share 748,762,592 694,764,104 735,224,771

Continuous operations:

Basic loss per share GBP(0.05) GBP(0.01) GBP(0.04)

Diluted loss per share GBP(0.01) GBP(0.00) GBP(0.01)

Total loss:

Basic loss per share GBP(0.05) GBP(0.01) GBP(0.04)

Diluted loss per share GBP(0.01) GBP(0.00) GBP(0.01)

6 Tangible Assets

Fixtures and equipment

GBP'000

Cost

At 1 January 2022 1,655

Additions 86

Acquisitions NBV 61

At 30 June 2022 1,802

Additions 27

Acquisitions NBV 19

Reclassifications 1,438

FX on opening 17

At 31 December 2022 3,303

Additions 99

Acquisitions NBV 160

Reclassifications 39

FX on opening (7)

At 30 June 2023 3,594

Accumulated depreciation

At 1 January 2022 714

Depreciation charged in the Period 172

At 30 June 2022 886

Depreciation charged in the Period 138

Reclassifications 1,438

FX on opening 9

At 31 December 2022 2,471

Depreciation charged in the Period 153

Reclassifications 39

FX on opening 15

At 30 June 2023 2678

Net book value

At 30 June 2023 916

At 31 December 2022 832

At 30 June 2022 916

7 Right-of-use assets

Land and buildings

GBP'000

Cost

At 1 January 2022 4,089

Movement due to FX 8

Additions 742

At 30 June 2022 4,839

Current year adjustment (137)

Movement due to FX (8)

Additions 963

At 31 December 2022 5,657

Current year adjustment 137

Additions 66

At 30 June 2023 5,860

Accumulated depreciation

At 1 January 2022 1,370

Depreciation charged in the Period 398

At 30 June 2022 1,768

Current year adjustment (25)

Depreciation charged in the Period 361

At 31 December 2022 2,104

Current year adjustment 25

Depreciation charged in the Period 433

At 30 June 2023 2,562

Net book value

At 30 June 2023 3,298

At 31 December 2022 3,553

At 30 June 2022 3,071

8 Goodwill and other intangible assets

Goodwill Other intangible assets Total

GBP'000 GBP'000 GBP'000

Cost

At 1 January 2022 45,150 42,615 87,765

Additions 11,226 13,449 24,675

Revaluation of acquisition (6,364) - (6,364)

At 30 June 2022 50,012 56,064 106,076

Additions 7,176 20,042 27,218

Exchange adjustments 629 - 629

At 30 December 2022 57,817 76,106 133,923

Additions 7,306 20,554 27,860

Movement due to FX (315) 14 (301)

Disposals - - -

At 30 June 2023 64,808 96,674 161,482

Accumulated amortisation

At 1 January 2022 2,279 5,231 7,510

Charge for period - 1,335 1,335

At 30 June 2022 2,279 6,566 8,845

Disposals

Charge for period - 1,609 1,609

At 31 December 2022 2,279 8,175 10,454

Disposals

Charge for period - 2,370 2,370

At 30 June 2023 2,279 10,545 12,824

8 Goodwill and other intangible assets (continued)

Net book value

As at 30 June 2023 62,529 86,129 148,658

As at 31 December 2022 55,538 67,931 123,469

As at 30 June 2022 47,733 49,498 97,231

9 Lease liabilities

The lease liabilities are included in trade and other payables and other non-current

liabilities

in the statement of financial position.

Land and buildings

GBP'000

At 1 January 2022 3,274

Additions 735

Interest expense 95

Lease payments (451)

At 30 June 2022 3,653

Additions 920

Interest expense 52

Lease payments (401)

At 31 December 2022 4,274

Additions 66

Interest expense 71

Lease payments (430)

At 30 June 2023 3,981

The Group recognises a right-of-use asset and a lease liability at the lease commencement

date. The right-of-use asset is initially measured at cost, and subsequently at cost less

any accumulated depreciation and impairment losses and adjusted for certain re-measurements

of the lease liability.

9 Lease liabilities (continued)

The lease liability is initially measured at the present value of the lease payments

that

are not paid at the commencement date, discounted using the Group's incremental

borrowing

rate.

The lease liability is subsequently increased by the interest cost on the lease

liability

and decreased by lease payment made.

The Group has applied judgement to determine the lease term for some lease contracts

in which

it is a lessee that includes renewal options. The assessment of whether the Group is

reasonably

certain to exercise such options impacts the lease term, which significantly affects

the amount

of lease liabilities and right-of-use assets recognised.

10 Deferred consideration payable

Six Months to Six Months to Year Ended

30 June 2023 30 June 2022 31 December 2022

GBP'000 GBP'000 GBP'000

Deferred consideration payable on acquisitions: 28,072 24,590 29,999

- falling due within one year 15,513 14,286 20,771

- due after more than one year 12,559 10,304 9,228

The deferred consideration payable on acquisitions is due to be paid in cash.

The deferred consideration liability is contingent on performance requirements during

the

deferred consideration period. The value of the contingent consideration is determined

by

EBITDA and/or revenue targets agreed on the acquisition of each asset, as defined under

the

respective Share or Business Purchase Agreement. As at the reporting date, the Group is

expecting

to pay the full value of its deferred consideration as all acquisitions are on target to

meet

the requirements.

Previously all deferred consideration payable on acquisitions was recorded as a deferred

liability

and included in the fair value of assets. However, in circumstances where the payment of

deferred

consideration is contingent on the seller remaining within the employment of the Group

during

the deferred period, the contingent portion of deferred consideration is not included in

the

fair value of consideration paid, rather is treated as remuneration and accounted for as

a

charge against profits over the deferred period.

11 Share capital

Six months Six months Year ended Six months Six months to Year ended

to to to

30 June 30 June 31 Dec 2022 30 June 30 June 2022 31 Dec 2022

2023 2022 2023

(unaudited) (unaudited) (audited) (unaudited) (unaudited) (audited)

Shares Shares Shares GBP'000 GBP'000 GBP'000

Ordinary

shares

issued:

Fully paid 216,920,719 216,920,719 216,920,719 10,846 10,846 10,846

216,920,719 216,920,719 216,920,719 10,846 10,846 10,846

Share capital and share premium

Number of Par value Share premium Total

ordinary

shares

'000 GBP'000 GBP'000 GBP'000

At 1 January 2022 216,921 10,846 8,224 19,070

Issued during year - - - -

As at 30 June 2022 216,921 10,846 8,224 19,070

At 31 December 2022 216,921 10,846 8,224 19,070

Issued during year - - - -

At 30 June 2023 216,921 10,846 8,224 19,070

Ordinary shares have a par value of GBP0.05 per share. They entitle the holder to

participate

in dividends, and to share in the proceeds of winding up the company in proportion

to the

number of, and amounts paid on, shares held. On a show of hands, every holder of

ordinary

shares present at a meeting in person or by proxy, is entitled to one vote and upon

a poll

each share is entitled to one vote.

Kingswood Holdings Limited does not have a limit on the amount of authorised

capital.

As at 31 December 2022 KPI (Nominees) Limited held 144,125,262 Ordinary Shares,

representing

66.4 per cent of ordinary shares in issue at year end.

12 Preference share capital

Six Months to Six Months to Year Ended Six Months to Six Months to Year Ended

30 June 2023 30 June 2022 31 Dec 2022 30 June 2023 30 June 2022 31 Dec 2022

(unaudited) (unaudited) (audited) (unaudited) (unaudited) (audited)

Shares Shares Shares GBP'000 GBP'000 GBP'000

Convertible preference shares issued:

Fully paid 77,428,443 77,428,443 77,428,443 77,428 77,428 77,428

77,428,443 77,428,443 77,428,443 77,428 77,428 77,428

Six Months to Six Months to Year Ended

30 June 2023 30 June 2022 31 Dec 2022

(unaudited) (unaudited) (audited)

Equity component 70,150 70,150 70,150

Liability component - - -

70,150 70,150 70,150

On 12 September 2019, Kingswood Holdings Limited entered into a

subscription agreement with HSQ Investment Limited, a wholly owned

indirect subsidiary of funds managed and/or advised by Pollen

Street Capital, to subscribe for up to 80 million irredeemable

convertible preference shares, at a subscription price of GBP1 each

(the Subscription). Pollen Street Capital is a global, independent

alternative asset investment management company, established in

2013 with currently GBP3.2 billion gross AUM across private equity

and credit strategies, focused on the financial and business

services sectors, with significant experience in speciality

finance.

All irredeemable convertible preference shares convert into new

ordinary shares at Pollen Street Capital's option at any time from

the earlier of an early conversion trigger or a fundraising, or

automatically on 31 December 2023. Preferential dividends on the

irredeemable convertible preference shares accrue daily at a fixed

rate of five per cent per annum from the date of issue. Effective

17 December 2021 onwards, these will be settled via the issue of

additional ordinary shares, thereby extinguishing the liability

component.

13 Notes to the cash flow statement

Cash and cash equivalents comprise cash and cash equivalents with an original

maturity of

three months or less. The carrying amount of these assets is approximately equal to

their

fair value.

Six Months to Six Months to Year Ended

30 June 2023 30 June 2022 31 Dec 2022

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Loss before tax (9,919) (1,691) (10,972)

Depreciation and amortisation 2,957 1,863 4,507

Goodwill adjustment - 6,364 -

Finance costs 6,639 1,455 6,398

Remuneration charge (deferred consideration) 259 (7,399) 1,852

Acquisition of investments - - 586

Share-based payment expense 499 556 878

Other losses / (gains) - - 23

Foreign exchange gain - 12 -

Tax paid (175) (139) (22)

Operating cash flows before movements in working capital 260 1,021 (3,250)

(Increase)/decrease in receivables 6,318 786 1,821

Increase/(decrease) in payables (2,726) (10,796) (7,775)

Net cash inflow / (outflow) from operating activities 3,852 (8,989) (2,704)

14 Financial instruments

The following table states the classification of financial instruments and is

reconciled to

the Statement of Financial Position:

30 Jun 2023 30 Jun 2022 31 Dec 2022

Carrying amount Carrying amount Carrying amount

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Financial assets measured at amortised cost

Trade and other receivables 10,181 5,846 9,273

Cash and cash equivalents 24,126 20,693 19,624

Financial liabilities measured at amortised

cost

Trade and other payables (11,316) (16,530) (16,130)

Other non-current liabilities (2,519) (222) (2,806)

Lease liability (1,462) (3,653) (1,467)

Financial liabilities measured at fair value

through profit and loss

Deferred consideration payable (28,072) (24,590) (29,999)

(9,060) (18,456) (21,505)

Financial instruments not measured at fair value includes cash and cash equivalents,

trade

and other receivables, trade and other payables, and other non-current liabilities.

Due to their short-term nature, the carrying value of cash and cash equivalents,

trade and

other receivables, and trade and other payables approximates fair value.

Item Fair value Valuation technique Fair value

hierarchy level

GBP'000

Deferred 28,072 Fair value of Level 3

consideration deferred

payable consideration

payable is

estimated by

discounting the

future cash flows

using the IRR

inherent in the

company's

acquisition price.

15 Related party transactions

Remuneration of key management personnel

The remuneration of the Directors, who are the key management personnel of the Group, is set

out below in aggregate for each of the categories specified in IAS 24 Related Party Disclosures.

Six months to Six months to Year ended

30 June 2023 30 June 2022 31 Dec 2022

(unaudited) (unaudited) (audited)

2023 2022 2022

GBP'000 GBP'000 GBP'000

Salaries and other short-term employee benefits 665 103 678

Other related parties

During the period, KHL incurred fees of GBP50,000 (30 June 2022: GBP58,333; 31 December 2022:

GBP116,000) from KPI (Nominees) Limited in relation to Non-Executive Director remuneration.

At 30 June 2023, GBPnil of these fees remained unpaid (30 June 2022: GBPnil; 31 December 2022:

GBPnil).

Fees received from Moor Park Capital Partners LLP, in which Gary Wilder holds a beneficial

interest, relating to property related services provided by KHL totalled GBPnil for the period

ended 30 June 2023 (30 June 2022: GBP23,708; 31 December 2022: GBP23,708), of which GBPnil

(30 June 2022: GBPnil; 31 December 2022: GBPnil) was outstanding at 30 June 2023.

Fees paid for financial and due diligence services to Kingswood LLP, in which Gary Wilder

and Jonathan Massing hold a beneficial interest, totalled GBP69,469 for the period to 30 June

2023 (30 June 2022: GBP420,807; 31 December 2022: GBP479,955), of which GBPnil (30 June 2022:

GBPnil; 31 December 2022: GBPnil) was outstanding at 30 June 2023.

16 Ultimate controlling party

As at the date of approving the financial statements, the ultimate controlling party of the

Group was KPI (Nominees) Limited.

17 Events after the reporting date

There were no significant events after the reporting period.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR EAANPASKDEAA

(END) Dow Jones Newswires

September 29, 2023 02:00 ET (06:00 GMT)

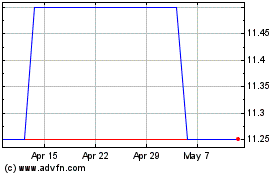

Kingswood (LSE:KWG)

Historical Stock Chart

From Apr 2024 to May 2024

Kingswood (LSE:KWG)

Historical Stock Chart

From May 2023 to May 2024