TIDMLLOY

RNS Number : 5031V

Lloyds Banking Group PLC

13 December 2021

13 December 2021

LLOYDS BANKING GROUP PASSES BANK OF ENGLAND STRESS TEST

Lloyds Banking Group (the Group), together with seven other

financial institutions in the UK, has been subject to the 2021

solvency stress test, conducted by the Bank of England (BoE).

The Group has passed the stress test on both fully-loaded

(non-transitional) and transitional IFRS 9 bases, with the BoE

calculating the Group's CET1 ratio after the application of

management actions as 7.8 per cent, against the reference rate of

7.7 per cent. Despite the hypothetical severity of the stress test

scenario, the Group exceeds the capital reference rate after the

application of management actions and without the conversion of AT1

securities into equity (which contributed 2.1 percentage points of

capital in the 2019 exercise). The fully-loaded capital drawdown of

830 basis points, excluding transitional relief, represents a

significant 3.3 percentage point improvement (i.e. reduction) in

the fully-loaded capital depletion compared to the 2019 stress

test, as a result of the continued improvement in the quality of

the portfolio, capital base and different stress conditions. Given

this performance, the Group is not required to take any capital

actions.

This year's stress test assumes a significant slowdown in

economic activity, on top of the economic impact of the Covid 19

pandemic through 2020. This is one of the most severe stress tests

that the Group has faced, including a significant hypothetical

capital depletion in the first two years, followed by a steep

recovery in most macroeconomic indicators thereafter. Whilst there

is no significant market risk stress, this scenario includes a

severe UK deterioration which particularly impacts the Group as it

combines negative rates, in conjunction with significant falls in

property prices and GDP. In particular, base rates are assumed to

fall below zero in 2021 and remain negative until 2024,

unemployment increases to a peak of 11.9 per cent in the fourth

quarter of 2021, 2.7 percentage points higher than the peak in the

2019 stress test, whilst UK house and commercial property prices

both fall 33 per cent. GDP reduces by 9 per cent in the first year

and, combining the stress scenario with the economic decline in

2020, implies a cumulative three-year loss of 37 per cent of 2019

UK GDP.

In line with previous tests, this year's stress test runs under

the IFRS 9 accounting standard and requires the immediate

recognition of expected losses on a perfect foresight basis, rather

than reflecting incurred losses. The BoE assesses the stress test

results on an IFRS 9 transitional basis, in line with the phased

implementation approach. Results are also shown on an IFRS 9

fully-loaded basis. The low point post-management actions is the

same in both cases given the unwind of the 2020 transitional relief

in the fully-loaded view.

The Group's capital position remains strong, having reported a

CET1 ratio of 17.2 per cent and a UK leverage ratio of 5.8 per

cent, post dividend accrual, at 30 September 2021. The Group also

continues to be strongly capital generative with capital build for

the first nine months of the year of 159 basis points. As indicated

previously, any return of excess capital will be considered at year

end.

Further details

Details of the BoE's approach to the stress test and the

detailed results in relation to all participating financial

institutions are available from the BoE website.

For further information:

Investor Relations

Douglas Radcliffe +44 (0) 20 7356 1571

Group Investor Relations Director

douglas.radcliffe@lloydsbanking.com

Corporate Affairs

Matt Smith +44 (0) 20 7356 3522

Head of Media Relations

matt.smith@lloydsbanking.com

FORWARD LOOKING STATEMENTS

This document contains certain forward-looking statements within

the meaning of Section 21E of the US Securities Exchange Act of

1934, as amended, and section 27A of the US Securities Act of 1933,

as amended, with respect to Lloyds Banking Group plc together with

its subsidiaries (the Group) and its current goals and

expectations. Statements that are not historical or current facts,

including statements about the Group's or its directors' and/or

management's beliefs and expectations, are forward looking

statements. Words such as, without limitation, 'believes',

'achieves', 'anticipates', 'estimates', 'expects', 'targets',

'should', 'intends', 'aims', 'projects', 'plans', 'potential',

'will', 'would', 'could', 'considered', 'likely', 'may', 'seek',

'estimate', 'probability', 'goal', 'objective', 'deliver',

'endeavour', 'prospects', 'optimistic' and similar expressions or

variations on these expressions are intended to identify forward

looking statements. These statements concern or may affect future

matters, including but not limited to: projections or expectations

of the Group's future financial position, including profit

attributable to shareholders, provisions, economic profit,

dividends, capital structure, portfolios, net interest margin,

capital ratios, liquidity, risk-weighted assets (RWAs),

expenditures or any other financial items or ratios; litigation,

regulatory and governmental investigations; the Group's future

financial performance; the level and extent of future impairments

and write-downs; the Group's ESG targets and/or commitments;

statements of plans, objectives or goals of the Group or its

management and other statements that are not historical fact;

expectations about the impact of COVID-19; and statements of

assumptions underlying such statements. By their nature, forward

looking statements involve risk and uncertainty because they relate

to events and depend upon circumstances that will or may occur in

the future. Factors that could cause actual business, strategy,

plans and/or results (including but not limited to the payment of

dividends) to differ materially from forward looking statements

include, but are not limited to: general economic and business

conditions in the UK and internationally; market related risks,

trends and developments; fluctuations in interest rates, inflation,

exchange rates, stock markets and currencies; volatility in credit

markets; any impact of the transition from IBORs to alternative

reference rates; the ability to access sufficient sources of

capital, liquidity and funding when required; changes to the

Group's credit ratings; the ability to derive cost savings and

other benefits including, but without limitation, as a result of

any acquisitions, disposals and other strategic transactions;

potential changes in dividend policy; the ability to achieve

strategic objectives; management and monitoring of conduct risk;

exposure to counterparty risk; credit rating risk; instability in

the global financial markets, including within the Eurozone, and as

a result of uncertainty surrounding the exit by the UK from the

European Union (EU) and the effects of the EU-UK Trade and

Cooperation Agreement; political instability including as a result

of any UK general election and any further possible referendum on

Scottish independence; technological changes and risks to the

security of IT and operational infrastructure, systems, data and

information resulting from increased threat of cyber and other

attacks; natural pandemic (including but not limited to the

COVID-19 pandemic) and other disasters; inadequate or failed

internal or external processes or systems; acts of hostility or

terrorism and responses to those acts, or other such events;

geopolitical unpredictability; risks relating to sustainability and

climate change (and achieving climate change ambitions), including

the Group's ability along with the government and other

stakeholders to measure, manage and mitigate the impacts of climate

change effectively; changes in laws, regulations, practices and

accounting standards or taxation; changes to regulatory capital or

liquidity requirements and similar contingencies; the policies and

actions of governmental or regulatory authorities or courts

together with any resulting impact on the future structure of the

Group; projected employee numbers and key person risk; the impact

of competitive conditions; and exposure to legal, regulatory or

competition proceedings, investigations or complaints. A number of

these influences and factors are beyond the Group's control. Please

refer to the latest Annual Report on Form 20-F filed by Lloyds

Banking Group plc with the US Securities and Exchange Commission

(the SEC), which is available on the SEC's website at www.sec.gov,

for a discussion of certain factors and risks. Lloyds Banking Group

plc may also make or disclose written and/or oral forward-looking

statements in other written materials and in oral statements made

by the directors, officers or employees of Lloyds Banking Group plc

to third parties, including financial analysts. Except as required

by any applicable law or regulation, the forward-looking statements

contained in this document are made as of today's date, and the

Group expressly disclaims any obligation or undertaking to release

publicly any updates or revisions to any forward looking statements

contained in this document whether as a result of new information,

future events or otherwise. The information, statements and

opinions contained in this document do not constitute a public

offer under any applicable law or an offer to sell any securities

or financial instruments or any advice or recommendation with

respect to such securities or financial instruments.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCFLFEDFTLVLIL

(END) Dow Jones Newswires

December 13, 2021 13:03 ET (18:03 GMT)

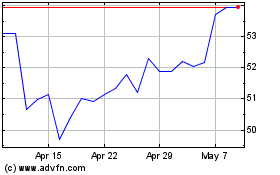

Lloyds Banking (LSE:LLOY)

Historical Stock Chart

From Oct 2024 to Nov 2024

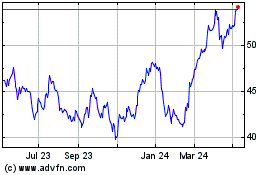

Lloyds Banking (LSE:LLOY)

Historical Stock Chart

From Nov 2023 to Nov 2024