TIDMMIDW

RNS Number : 2050T

Midwich Group PLC

13 November 2023

13 November 2023

Midwich Group plc

("Midwich", the "Midwich Group" or "the Group")

Acquisition of prodyTel Distribution Gmbh

Midwich Group (AIM: MIDW), a global specialist audio visual

distributor is pleased to announce that it has entered a binding

agreement to acquire prodyTel Distribution Gmbh ("prodyTel" or "the

Company"), a distributor of professional audio and technical

solutions products based near Nuremberg, Germany.

Through its German subsidiary Kern & Stelly Medientechnik

GmbH ("Kern & Stelly"), Midwich will acquire 51% of the

Company's share capital for initial cash consideration of EUR8.5

million (approximately GBP7.4 million). Put/ call options are in

place to facilitate the purchase of the remaining 49% of the share

capital in June 2024 for a fixed cash consideration of EUR8.1

million (approximately GBP7.1 million). An additional performance

linked amount of up to EUR5.5 million (approximately GBP4.8

million) will be payable in cash in 2026.

Based in Stein, on the outskirts of Nuremberg, prodyTel was

founded in 2003, originally as a manufacturer of audio codecs

before switching its focus to distribution in 2014. From there, it

has developed a strong vendor portfolio, including premium brands

Biamp, Aver and Jabra, with a particular focus on the corporate and

education market. The Company operates across Germany and employs

thirty staff.

prodyTel supplements its core distribution services with a suite

of value-add services for its trade customers throughout Germany.

These services include the prodyTel Academy, offering technology

seminars, training courses and product demonstrations to customers

from a dedicated 230 sq m space within the Stein facility.

In its latest financial statements, for the year ended 31

December 2022, the Company generated revenues of EUR22.0 million

(approx. GBP19.2 million) and profit before tax of EUR4.0 million

(approx. GBP3.5 million). Gross assets at 31 December 2022 were

EUR6.3 million (approx. GBP5.6 million).

prodyTel's net cash at signing was around EUR0.7 million (GBP0.6

million). Completion of the transaction is subject to merger

control clearance from the German Federal Cartel Office.

Stephen Fenby, Midwich Group Managing Director, commented:

"We are delighted to have reached an agreement to acquire

prodyTel, which will strengthen our technology offering in the DACH

region. prodyTel has a strong reputation in the market which has

enabled it to attract top tier brands. Customers greatly value the

expertise the Company is able to offer, and will now be able to

benefit from the combined portfolio of prodyTel and Kern &

Stelly. We look forward to working with Christian and his team to

build on the success the business has experienced in recent

years."

Christian Carrero, Managing Director of ProdyTel commented:

"Not only have I developed a lot of personal relationships over

the last 20 years with many people within the Midwich family, but

prodyTel has often found itself working alongside Kern & Stelly

on common projects. From these interactions, I had already

developed a positive feeling about the corporate culture in Kern

& Stelly.

I had quite a few offers to sell my company over the years, but

based upon these past interactions, when the opportunity presented

itself to join the Midwich family, it seemed only logical. I

believe this deal can bring prodyTel and its people to the next

level in distribution and equally will allow us to share our

expertise in audio and AV project management to support Kern &

Stelly to further grow its business in Germany.

Personally, I am really excited to contribute to the Group with

my 25 years of knowledge in the global AV market and am already

looking forward to many new and exciting projects and ideas within

Kern & Stelly and Midwich."

Further Details of the Transaction

The deal will be funded from Midwich's existing facilities and

is expected to be earnings enhancing in the first full year

following completion.

The maximum aggregate consideration (including

performance-linked consideration and net of cash at signing) for

the purchase of 100% of the Company is EUR21.4 million (approx.

GBP18.7 million) payable in cash.

Midwich Group plc

Stephen Fenby, Managing Director

Stephen Lamb, Finance Director +44 (0) 1379 649200

Investec Bank plc (NOMAD and Joint Broker

to Midwich)

Carlton Nelson / Ben Griffiths / Cameron +44 (0) 20 7597

MacRitchie 5970

Berenberg (Joint Broker to Midwich) +44 (0) 20 3207

Ben Wright / Richard Andrews 7800

FTI Consulting

Alex Beagley / Tom Hufton / Rafaella de +44 (0) 20 3727

Freitas 1000

About Midwich Group

Midwich Group is a specialist AV distributor, with operations in

the UK and Ireland, EMEA, Asia Pacific and North America. The

Group's long-standing relationships with over 600 vendors,

including blue-chip organisations, support a comprehensive product

portfolio across major audio visual categories such as displays,

projectors, technical AV, broadcast, professional audio, lighting

and unified communications. The Group operates as the sole or

largest in-country distributor for a number of its vendors in their

respective product sets.

The Directors attribute this position to the Group's technical

expertise, extensive product knowledge and strong customer service

offering built up over a number of years. The Group has a large and

diverse base of over 22,000 trade customers, most of which are

professional AV integrators and IT resellers serving sectors such

as corporate, education, retail, residential and hospitality.

Initially a UK only distributor, the Group now has over 1,800

employees across the UK and Ireland, EMEA, North America and Asia

Pacific. A core component of the Group's growth strategy is further

expansion of its international operations and footprint into

strategically targeted jurisdictions.

For further information, please visit

www.midwichgroupplc.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQGPGAPGUPWPWP

(END) Dow Jones Newswires

November 13, 2023 02:00 ET (07:00 GMT)

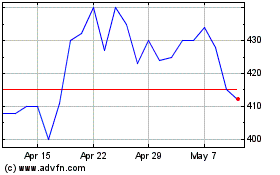

Midwich (LSE:MIDW)

Historical Stock Chart

From Apr 2024 to May 2024

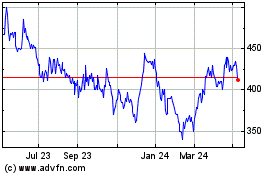

Midwich (LSE:MIDW)

Historical Stock Chart

From May 2023 to May 2024