National Grid to Buy Largest UK Power Distribution Company for $10.89 Billion -- Update

March 18 2021 - 4:24AM

Dow Jones News

--National Grid is to acquire Western Power Distribution for

$10.89 Bln

--The deal with U.S. owner PPL also includes the sale of a Rhode

Island utility for $3.8 billion

--National Grid plans to sell a majority stake in the U.K. gas

transmission system as it pivots toward electricity

By Jaime Llinares Taboada

National Grid PLC said Thursday that it has agreed to acquire

Western Power Distribution and sell the Narragansett Electric Co.

in a deal with PPL Corp., and that it plans to sell a majority

stake in the British gas transmission system.

The FTSE 100 energy networks company said WPD, the largest U.K.

electricity distribution business, is being acquired from PPL for

an equity value of 7.8 billion pounds ($10.89 billion). WPD owns

four distribution networks in the U.K., delivering power to around

7.9 million customers.

Meanwhile, the Narragansett Electric Co., a Rhode Island

utility, is being sold to PPL for an equity value of $3.8 billion,

it said.

In addition, National Grid said it will start a process later in

2021 to sell a majority stake in National Grid Gas PLC, the owner

of the British gas transmission system. This business had

contributed adjusted operating profit of GBP348 million to the

group's total of GBP3.31 billion in the year to March 31, 2020.

National Grid said that as a result of these transactions, the

proportion of its assets in electricity will increase to around 70%

from 60%.

"These transactions will be transformational for our U.K.

portfolio. The acquisition of WPD is a one-off opportunity to

acquire a significant scale position in U.K. electricity

distribution," Chief Executive John Pettigrew said.

"With increased exposure to the U.K.'s electricity sector, these

transactions enhance our role in the progress towards net zero,

underpinning our core ambition which is to enable the energy

transition for all," he said.

National Grid will fund the acquisition of WPD with a GBP8.25

billion bridge financing facility. This will be repaid with the

proceeds from the NECO and NGG sales and the issue of new senior

debt and hybrid capital securities, the company said.

The acquisition of WPD is expected to close in four months and

the sale of NECO is expected to occur by the first quarter of 2022.

As for NGG, the group is targeting to launch the sale process in

the second half of 2021 and complete it a year later.

Shares at 0853 GMT were down 22.4 pence, or 2.7%, at 809.0

pence.

Write to Jaime Llinares Taboada at jaime.llinares@wsj.com;

@JaimeLlinaresT

(END) Dow Jones Newswires

March 18, 2021 05:09 ET (09:09 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

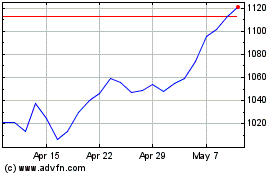

National Grid (LSE:NG.)

Historical Stock Chart

From Apr 2024 to May 2024

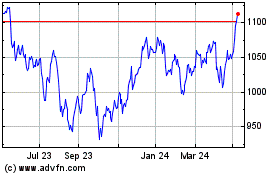

National Grid (LSE:NG.)

Historical Stock Chart

From May 2023 to May 2024