TIDMNWOR

RNS Number : 4231A

National World PLC

24 May 2023

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF REGULATION 2014/596/EU (WHICH FORMS PART OF

DOMESTIC UK LAW PURSUANT TO THE EUROPEAN UNION (WITHDRAWAL) ACT

2018 (THE "EUWA")) ("UK MAR"). UPON THE PUBLICATION OF THIS

ANNOUNCEMENT, THIS INSIDE INFORMATION (AS DEFINED IN UK MAR) IS NOW

CONSIDERED TO BE IN THE PUBLIC DOMAIN.

National World plc

("National World," "the Company" or "the Group")

Trading update for the 21 weeks to 27 May 2023

National World plc issues the following trading update for the

21 weeks to 27 May 2023, ("the period") ahead of its Annual General

meeting on 24 May 2023.

Highlights

-- 7% digital growth in challenging economic conditions

-- Overall revenue decline mitigated by digital growth and acquisitions

-- Continued pivoting towards more diverse and sustainable revenue streams

-- Maintaining profit expectations for the full year

-- Maiden dividend proposed, payable 5 July to shareholders on the register on 2 June

National World's Chairman, David Montgomery, said:

"We have continued to reposition the business towards our new,

digital-only operating model - meaning full automation of all

content resourcing and production processes across all platforms,

including print. We already lead the local publishing sector in

video exploitation and are in the process of relaunching the

majority of our brands deploying the new model.

"Our five recent acquisitions focus on original content serving

key communities, by sector and locality, and expected to add

further acquisitions in the coming months.

"These acquisitions, combined with the accelerated

implementation of the new operating model, we expect to compensate

for the recent downturn in advertising sales impacting the

sector."

Trading

Against a difficult background for advertising, total Revenue

for the period has declined by just 5% year-on-year, benefiting

from both continuing growth in digital and recent acquisitions. In

April and May revenue is down 1% year-on-year following an 8%

decline in the first quarter.

Digital revenue is expected to grow by 7% year-on-year for the

period. Video revenues have more than doubled compared to the same

period last year, driven by a 15% increase in video views.

Overall audience for the period increased by 20% year-on-year

with page views reaching a peak of 167 million in the January

football transfer month. Audience increased by 9% year-on-year,

excluding the benefit of the Scoopdragon and Newschain

acquisitions. Although continuing to grow, digital revenue momentum

has been impacted by lower yields reflecting the sector-wide

cooling of advertising demand.

Print revenue decline of 13% in the first quarter has been

reduced to a 3% decline in April and May, again helped by

acquisitions, including the addition of the Rotherham Advertiser,

which is now the Group's highest circulation weekly newspaper.

Acquisitions

For the five acquisitions completed in the period, the Group

paid a total consideration of GBP3.0 million, (GBP1.9 million

consideration net of cash acquired) funded from its existing cash

resources. Revenue of GBP2.0 million and EBITDA contribution of

GBP0.4 million are expected in the first half, with the bulk of

this flowing from 1 May. For the full year, revenues of

approximately GBP7.0 million are expected with an EBITDA

contribution of more than GBP1.0 million.

Management is continuing to look at further potential

value-creating acquisitions that align with the Group's strategy as

it repositions the business towards the new operating model,

underpinned by greater productivity in specialist and original

content.

The acquisition of Insider Media, with its regional B2B

audience, indicates the route to sustainable revenues and growth as

this business focuses on expert coverage of its sectors through

daily online reporting, digital newsletters, events and, soon,

exclusive video content.

Management has accelerated plans to integrate the recent

acquisitions and to adopt the new operating model. We are confident

these actions will deliver the required operating cost savings from

June onwards, rather than rely solely on the more optimistic

forecasts of an advertising pick-up.

Financial position

The Group maintains a strong financial position with a cash

balance of at least GBP21.0 million at the end of May, offset by

GBP1.0 million of outstanding loan note debt. Since the year-end,

National World has made the final deferred instalment of GBP2.5

million in respect of the purchase of JPIMedia Group acquired in

2021.

The Board has recommended the payment of a maiden dividend on 5

July to shareholders on the register at 2 June in recognition of

the Company's significant progress over the last two years, during

which time it has generated Adjusted EBITDA of GBP19.8 million on

the assets acquired at the start of 2021 for GBP10.2 million.

Outlook

The Company remains confident that investment and development of

its digital business, together with the adoption of our new

operating model and careful cost management, will continue to

support profits and cash flow despite challenging economic

conditions. Performance for the year is forecast to be in line with

the Company's expectations.

- Ends -

For the purposes of UK MAR the person responsible for arranging

for the release of this announcement on behalf of National World is

David Montgomery, Executive Chairman.

Enquiries:

National World plc

David Montgomery

c/o Montfort Communications

Dowgate Capital Limited - Financial Advisers

and Brokers

David Poutney

James Serjeant +44 (0)20 3903 7715

Montfort Communications

Nick Miles +44 (0)77 3970 1634

Olly Scott +44 (0)78 1234 5205

Forward-looking statements

This announcement may include statements that are, or may be

deemed to be, "forward-looking statements". These forward-looking

statements can be identified by the use of forward-looking

terminology, including the terms "believes", "estimates", "plans",

"projects", "anticipates", "expects", "intends", "may", "will", or

"should" or, in each case, their negative or other variations or

comparable terminology. These forward-looking statements include

matters that are not historical facts. They appear in a number of

places throughout this announcement and include statements

regarding the directors' current intentions, beliefs or

expectations concerning, among other things, the Company's results

of operations, financial condition, liquidity, prospects, growth,

strategies and the Company's markets. By their nature,

forward-looking statements involve risk and uncertainty because

they relate to future events and circumstances. Actual results and

developments could differ materially from those expressed or

implied by the forward-looking statements. Forward-looking

statements may and often do differ materially from actual results.

Any forward-looking statements in this announcement are based on

certain factors and assumptions, including the directors' current

view with respect to future events and are subject to risks

relating to future events and other risks, uncertainties and

assumptions relating to the Company's operations, results of

operations, growth strategy and liquidity. Whilst the directors

consider these assumptions to be reasonable based upon information

currently available, they may prove to be incorrect. Save as

required by applicable law or regulation, the Company undertakes no

obligation to release publicly the results of any revisions to any

forward-looking statements in this announcement that may occur due

to any change in the directors' expectations or to reflect events

or circumstances after the date of this announcement.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTFFFVIESIVFIV

(END) Dow Jones Newswires

May 24, 2023 02:00 ET (06:00 GMT)

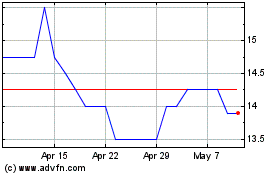

National World (LSE:NWOR)

Historical Stock Chart

From Apr 2024 to May 2024

National World (LSE:NWOR)

Historical Stock Chart

From May 2023 to May 2024