TIDMPDL

RNS Number : 3809X

Petra Diamonds Limited

20 December 2023

20 December 2023 LSE: PDL

Petra Diamonds Limited

("Petra" or the "Company" or the "Group")

Board Changes

Petra today announces a series of changes that will result in a

smaller and more efficient Petra Board. Once these changes take

effect, Petra's Board will reduce from eight to seven Directors,

having been ten Directors immediately prior to the Company's AGM

last month.

These changes are a small but important part of the ongoing cost

saving measures that are being implemented across the Group to

provide further flexibility should prevailing market conditions

continue and also in response to feedback from shareholders. The

changes outlined below (including the reduction in the Board from

ten to seven Directors; the merger of the Sustainability and Health

& Safety Committees; and the Chair and Non-Executive Director

("NED") fee reductions) will, once effective, reduce Petra's Board

fees by at least c. 25% on an annualised basis.

-- Jon Dudas will step down from the Board in his role as

independent NED (and therefore as a member of the Company's Audit

& Risk, Remuneration, Nomination and Investment Committees)

with effect from 17 February 2024 but will assume the role of Board

advisor for 6 months until 17 August 2024. Jon's advisor fee will

be less than the reduced basic annual fee for NEDs over this

period.

-- Alex Watson will step down from the Board in her role as a

non-independent NED (and therefore as a member of the Company's

Sustainability and Investment Committees) also with effect from 17

February 2024 but will assume the role of Board Observer with

effect from this date.

Alex was appointed as a non-independent Non-Executive Director

on 1 July 2021, having been nominated by Franklin Templeton

pursuant to a Nomination Agreement that was entered into following

the successful completion of the recapitalization of the Company.

The Nomination Agreement gives Franklin Templeton the right to

nominate an Observer to Petra's Board, with the Observer being

entitled to attend but not vote at Board meetings. While Franklin

Templeton does not currently intend to nominate a Director to

replace Alex, it retains the right to do so under the Nomination

Agreement. Alex's annual fee as an Observer will be less than the

reduced basic annual fee for NEDs.

-- José Manuel Vargas has been appointed as a non-independent

NED of the Company, effective 1 January 2024. José Manuel is a

significant shareholder of Petra, currently holding c. 8.57% of

Petra's issued share capital.

José Manuel is currently Executive Chairman and CEO of MAXAM,

one of the world's largest explosives manufacturers , having been

appointed in 2020. In addition, José Manuel also serves on the

Board of Directors of Fluidra S.A. (since 2018) and is a Senior

Advisor to Rhone Capital, having previously been a Managing

Director. With effect from 1 January 2024, José Manuel will step

down from his role as CEO of MAXAM (remaining Chairman) and resume

his position as Managing Director of Rhone Capital.

José Manuel was previously the Chairman and CEO of Aena SME,

S.A. leading its restructuring, partial privatization and IPO in

2015. Prior to joining Aena, he held senior management positions at

Vocento S.A., where he served as CFO until his promotion to CEO.

Before his tenure in the communications sector, he was the CFO and

General Secretary of JOTSA (part of the Philipp Holzmann Group).

Mr. Vargas has also served on several other Boards of Directors,

including Aena, Vocento, Diario ABC, Cadena COPE, Net TV, Diario El

Correo and Wellbore Integrity Solutions.

José Manuel, a Spanish citizen, holds a degree in Economics and

Business Sciences from the Complutense University of Madrid, a

degree in Law from UNED and is a Chartered Accountant.

-- New Safety, Health & Sustainability Committee : with

effect from 1 January 2024, the Company's Sustainability and Health

& Safety Committees will be merged to form a single Safety,

Health & Sustainability Committee that will be Chaired by

Lerato Molebatsi, the current Sustainability Committee Chair. The

merger of these Committees will make the Board more efficient and

result in one less Chair fee, without impacting the importance of

health and safety matters at Petra which remain a key focus.

Members of this Committee will be Lerato Molebatsi (Committee

Chair), Varda Shine (Board Chair), Richard Duffy (CEO) and Bernie

Pryor (SID and current Health & Safety Committee Chair).

-- Remuneration Committee Chair : following the Board changes

that took effect immediately after the Company's AGM on 14 November

2023, which saw Varda Shine appointed as Chair and Bernie Pryor as

Senior Independent Director ("SID"), Bernie Pryor will become Chair

of the Remuneration Committee, with Varda stepping down from this

role. Bernie has been a member of the Remuneration Committee since

he joined Petra's Board in 2019 and for six years he was Chair of

the Remuneration Committee of MC Mining Limited, listed on the

London and Johannesburg Stock Exchanges. This change will also

become effective on 1 January 2024.

-- Chair and NED fees : the Chair's fee and the NED fees

(including the SID fee, Committee Chair fees and basic

Non-Executive Director fees) will all be reduced by 5%, with effect

from 1 January 2024, apart from the Sustainability, Health &

Safety Committee Chair fee which will be slightly increased to

match the Audit & Risk and Remuneration Committee Chair fees

and reflect the increased responsibilities of the Safety, Health

& Sustainability Committee.

Varda Shine , Non-Executive Chair of Petra Diamonds

commented:

"We very much appreciate the contributions Jon has made to the

Board during his tenure and we look forward to him starting his

role as Board advisor, noting Jon's considerable experience across

the mining and resources sectors, particularly on strategic

matters.

We also thank Alex for her contributions as a Director and

welcome her in her new role as an Observer - Petra is fortunate to

have someone with Alex's wealth of experience continuing to provide

input to the Board in this new capacity.

I am delighted to welcome José Manuel to the Petra Board. We

look forward to drawing on José Manuel's extensive executive and

Board experience across a range of sectors. José Manuel will

provide valuable commercial and entrepreneurial perspectives to the

Board during these challenging market conditions .

I believe the changes announced today will result in a lower

cost, more efficient and right-sized Board which has an appropriate

balance of skills and experience."

Ends

For further information, please contact:

Petra Diamonds, London Telephone: +44 20 7494 8203

Patrick Pittaway investorrelations@petradiamonds.com

Julia Stone

Kelsey Traynor

Financial PR (Camarco)

Gordon Poole Telephone: +44 20 3757 4980

Owen Roberts petradiamonds@camarco.co.uk

Elfie Kent

About Petra Diamonds Limited

Petra Diamonds is a leading independent diamond mining group and

a supplier of gem quality rough diamonds to the international

market. The Company's portfolio incorporates interests in three

underground mines in South Africa (Finsch, Cullinan Mine and

Koffiefontein) and one open pit mine in Tanzania (Williamson). The

Koffiefontein mine is currently on care and maintenance in

preparation for sale or closure.

Petra's strategy is to focus on value rather than volume

production by optimising recoveries from its high-quality asset

base in order to maximise their efficiency and profitability. The

Group has a significant resource base which supports the potential

for long-life operations.

Petra strives to conduct all operations according to the highest

ethical standards and only operates in countries which are members

of the Kimberley Process. The Company aims to generate tangible

value for each of its stakeholders, thereby contributing to the

socio-economic development of its host countries and supporting

long-term sustainable operations to the benefit of its employees,

partners and communities.

Petra is quoted with a premium listing on the Main Market of the

London Stock Exchange under the ticker 'PDL'. The Company's loan

notes due in 2026 are listed on the Irish Stock Exchange and

admitted to trading on the Global Exchange Market. For more

information, visit www.petradiamonds.com.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

BOAUKAURONUUAUA

(END) Dow Jones Newswires

December 20, 2023 02:00 ET (07:00 GMT)

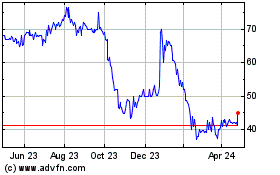

Petra Diamonds (LSE:PDL)

Historical Stock Chart

From Mar 2024 to Apr 2024

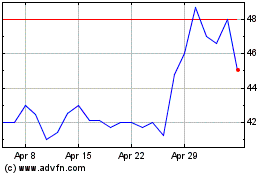

Petra Diamonds (LSE:PDL)

Historical Stock Chart

From Apr 2023 to Apr 2024