TIDMQLT

RNS Number : 8318M

Quilter PLC

26 January 2021

26 January 2021

Quilter plc

Fourth Quarter 2020 Trading Statement

Quilter plc (the "Group") reports strong Q4 net flows and

expects to complete the final Platform migration by the end of

February 2021

Highlights: Flows

-- Assets under Management and Administration ("AuMA") of

GBP117.8 billion at the end of December 2020 (+7% from 31 December

2019), with growth supported by improved net flows and positive

market movement:

o Fourth quarter gross sales of GBP2.8 billion (2019: GBP3.5

billion) and net inflows of GBP0.4 billion (2019: GBP0.5

billion).

o 2020 total gross sales of GBP10.9 billion (2019: GBP12.3

billion) and net inflows of GBP1.6 billion (2019: GBP0.3

billion).

o Average 2020 AuMA of GBP107.9 billion (2019: GBP105.7

billion), an increase of 2% in volatile equity markets.

-- Strong flow performance from the Quilter Investment Platform.

Modestly lower gross sales of GBP5.7 billion in 2020 (2019: GBP6.0

billion) offset by improved retention, driving higher net inflows

of GBP1.5 billion (2019: GBP0.9 billion) notwithstanding completion

of two significant adviser migrations over the year.

-- Resilient net inflows in Quilter Investors, Quilter Cheviot

and Quilter International in a volatile year. Integrated net flows

of GBP2.3 billion.

Highlights: Strategic Progress

-- Following the successful second client asset migration at the

end of November, by end-2020 c.80% (approx.GBP50 billion) of UK

Investment Platform assets had been migrated onto the new Platform

technology, despite UK lockdowns. Initial feedback from advisers

has been positive and the Group has continued to focus on ensuring

customers and advisers are fully supported during this

post-migration phase.

-- The final migration of assets onto the new UK platform

continues to be scheduled to complete over the weekend of 27/28

February 2021, with notice given to advisers and customers involved

in the final migration. Working practices and migration plans fully

reflect updated Covid-19 guidance from the four UK devolved

Administrations, and the team continue to monitor staff wellness

closely as this remains a critical consideration for the successful

execution of the migration.

-- As at 31 December 2020, 118.3 million shares had been

acquired for cancellation under Quilter's capital return programme,

at a cost of GBP153.0 million representing an average price of

129.3 pence per share. Fully diluted period end and average shares

for 2020 were 1,729 million and 1,797 million respectively.

Quilter plc: Three months ended 31 December

2020

Quilter plc (GBPbn), unaudited Q4 2020 Q4 2019

-------------------------------------------------- ------- -------

AuMA 117.8 110.4

Gross sales 2.8 3.5

NCCF 0.4 0.5

Total integrated net flows 0.5 0.8

of which Quilter Financial Planning generated 0.6 0.6

Defined Benefit to Defined Contribution transfers 0.2 0.2

-------------------------------------------------- ------- -------

Quilter plc: Twelve months ended 31 December

2020

Quilter plc (GBPbn), unaudited 2020 2019

-------------------------------------------------- ----- -----

AuMA 117.8 110.4

Gross sales 10.9 12.3

NCCF 1.6 0.3

Total integrated net flows 2.3 2.6

of which Quilter Financial Planning generated 2.3 2.6

Defined Benefit to Defined Contribution transfers 0.9 0.8

-------------------------------------------------- ----- -----

Paul Feeney, CEO of Quilter plc, commented:

2020 was a year of unprecedented challenges in so many respects

and one of extraordinary market volatility. It is in challenging

times like these that our advice-based model comes to the fore and

this is reflected through the higher levels of client retention

experienced in 2020, at 92% versus 88% in 2019. We finished the

year strongly with improved year-on-year net inflows, AuMA ending

around 7% higher over the year, and modestly higher average AuMA

over 2019 despite market volatility.

I am particularly pleased by the consistent performance of our

UK Platform throughout the year and with it delivering a good final

quarter despite the major migration completing at the end of

November. This is testament to the quality of our franchise coupled

by the extraordinary planning and execution efforts from our teams

to deliver a successful migration in a lockdown environment. Our

learnings from this process underpin our confidence to continue

with the final migration at the end of February. We continue to

monitor colleague wellness closely to ensure we remain

appropriately staffed for the migration event itself and the period

following in order that advisers and customers are supported to the

level which both they and Quilter expect. Our new UK Platform will

be transformational for Quilter. I am delighted that the finishing

line is now in sight and am excited about the opportunity ahead of

us to drive further business growth.

Quilter plc data tables for the three months ended 31 December 2020 (GBPbn)

AuMA AuMA

as at Market as at

Q4 gross flows, net flows 30 September Gross Gross and other 31 December

& AuMA (GBPbn) 2020 sales outflows Net flows movements 2020

------------- ------ --------- --------- ----------

Quilter Investors 21.3 1.2 (1.2) - 1.9 23.2

Quilter Cheviot 23.6 0.4 (0.3) 0.1 1.6 25.3

Advice & Wealth Management 44.9 1.6 (1.5) 0.1 3.5 48.5

---------------------------- ------------- ------ --------- --------- ---------- ------------

Quilter Investment Platform 57.7 1.5 (1.1) 0.4 4.4 62.5

Quilter International 20.6 0.5 (0.4) 0.1 1.1 21.8

Wealth Platforms 78.3 2.0 (1.5) 0.5 5.5 84.3

---------------------------- ------------- ------ --------- --------- ---------- ------------

Elimination of intra-group

assets (13.7) (0.8) 0.6 (0.2) (1.1) (15.0)

Quilter plc 109.5 2.8 (2.4) 0.4 7.9 117.8

---------------------------- ------------- ------ --------- --------- ---------- ------------

AuMA AuMA

as at Market as at

30 September Gross Gross and other 31 December

2019 sales outflows Net flows movements 2019

---------------------------- ------------- ------ --------- --------- ---------- ------------

Quilter Investors(1) 21.0 2.0 (1.9) 0.1 0.5 21.6

Quilter Cheviot 23.8 0.7 (0.7) - 0.4 24.2

Advice & Wealth Management 44.8 2.7 (2.6) 0.1 0.9 45.8

---------------------------- ------------- ------ --------- --------- ---------- ------------

Quilter Investment Platform 55.7 1.6 (1.3) 0.3 1.2 57.2

Quilter International 20.2 0.8 (0.5) 0.3 - 20.5

Wealth Platforms 75.9 2.4 (1.8) 0.6 1.2 77.7

---------------------------- ------------- ------ --------- --------- ---------- ------------

Elimination of intra-group

assets (12.5) (1.6) 1.4 (0.2) (0.4) (13.1)

Quilter plc 108.2 3.5 (3.0) 0.5 1.7 110.4

---------------------------- ------------- ------ --------- --------- ---------- ------------

(1) Quilter Investors' AuMA restated for comparative purposes by

GBP0.8 billion for 30 September and 31 December 2019 respectively

to include Quilter Financial Planning assets transferred as at 1

January 2020.

Quilter plc data tables for the twelve months ended 31 December 2020 (GBPbn)

AuMA AuMA

as at Market as at

Gross flows, net flows & 31 December Gross Gross and other 31 December

AuMA (GBPbn) 2019 sales outflows Net flows movements 2020

------------ ------ --------- --------- ----------

Quilter Investors 21.6 5.0 (4.7) 0.3 1.3 23.2

Quilter Cheviot 24.2 2.1 (1.8) 0.3 0.8 25.3

Advice & Wealth Management 45.8 7.1 (6.5) 0.6 2.1 48.5

---------------------------- ------------ ------ --------- --------- ---------- ------------

Quilter Investment Platform 57.2 5.7 (4.2) 1.5 3.8 62.5

Quilter International 20.5 1.6 (1.3) 0.3 1.0 21.8

Wealth Platforms 77.7 7.3 (5.5) 1.8 4.8 84.3

---------------------------- ------------ ------ --------- --------- ---------- ------------

Elimination of intra-group

assets (13.1) (3.5) 2.7 (0.8) (1.1) (15.0)

Quilter plc 110.4 10.9 (9.3) 1.6 5.8 117.8

---------------------------- ------------ ------ --------- --------- ---------- ------------

AuMA AuMA

as at Market as at

31 December Gross Gross and other 31 December

2018 sales outflows Net flows movements 2019

---------------------------- ------------ ------ --------- --------- ---------- ------------

Quilter Investors(1) 18.5 4.9 (4.4) 0.5 2.6 21.6

Quilter Cheviot 22.2 2.6 (3.4) (0.8) 2.8 24.2

Advice & Wealth Management 40.7 7.5 (7.8) (0.3) 5.4 45.8

---------------------------- ------------ ------ --------- --------- ---------- ------------

Quilter Investment Platform 49.4 6.0 (5.1) 0.9 6.9 57.2

Quilter International 18.3 2.0 (1.5) 0.5 1.7 20.5

Wealth Platforms 67.7 8.0 (6.6) 1.4 8.6 77.7

---------------------------- ------------ ------ --------- --------- ---------- ------------

Elimination of intra-group

assets (10.7) (3.2) 2.4 (0.8) (1.6) (13.1)

Quilter plc 97.7 12.3 (12.0) 0.3 12.4 110.4

---------------------------- ------------ ------ --------- --------- ---------- ------------

(1) Quilter Investors' AuMA restated for comparative purposes by

GBP0.8 billion for 31 December 2018 and 31 December 2019

respectively to include Quilter Financial Planning assets

transferred as at 1 January 2020.

Financial Calendar Date

Results for the year ended 31

December 2020 10 March 2021(1)

(1) Assuming no significant disruption from the current Covid-19

lockdown.

Enquiries

Investor Relations:

John-Paul Crutchley +44 (0)7741 385 251

Keilah Codd +44 (0)7776 649 681

Media:

Jane Goodland +44 (0)7790 012 066

Tim Skelton-Smith +44 (0)7824 145 076

Camarco

Geoffrey Pelham-Lane +44 (0)20 3757 4985

Company Secretary:

Patrick Gonsalves +44 (0)20 7778 9670

About Quilter plc

Quilter plc is a leading wealth management business in the UK

and internationally, helping to create prosperity for the

generations of today and tomorrow.

Quilter plc oversees GBP117.8 billion in customer investments

(as at 31 December 2020).

It has an adviser and customer offering spanning financial

advice, investment platforms, multi-asset investment solutions and

discretionary fund management.

The business is comprised of two segments: Advice and Wealth

Management and Wealth Platforms.

Advice and Wealth Management encompasses the financial planning

businesses (Quilter Private Client Advisers, Quilter Financial

Planning and Quilter Financial Advisers), the discretionary fund

management business (Quilter Cheviot) and the Multi-asset

investment solutions business (Quilter Investors). Wealth Platforms

includes the Old Mutual Wealth UK Platform and Quilter

International, including AAM Advisory in Singapore.

Since its IPO in June 2018, the Group's businesses have progressively

re-branded to Quilter. The UK Platform will be the final business to

rebrand; this will follow the safe delivery of the new platform technology.

Descriptor for the re-branded business units:

Previous New

Intrinsic Quilter Financial Planning

Old Mutual Wealth Private Client

Advisers Quilter Private Client Advisers

Quilter Investors Quilter Investors

Quilter Cheviot Quilter Cheviot

UK Platform Quilter Investment Platform

International Quilter International

-------------------------------------

Disclaimer

This announcement may contain certain forward-looking statements

with respect to certain Quilter plc's plans and its current goals

and expectations relating to its future financial condition,

performance and results.

By their nature, all forward-looking statements involve risk and

uncertainty because they relate to future events and circumstances

which are beyond Quilter plc's control including amongst other

things, international and global economic and business conditions,

market related risks such as fluctuations in interest rates and

exchange rates, the policies and actions of regulatory authorities,

the impact of competition, inflation, deflation, the timing and

impact of other uncertainties of future acquisitions or

combinations within relevant industries, as well as the impact of

tax and other legislation and other regulations in the

jurisdictions in which Quilter plc and its affiliates operate. As a

result, Quilter plc's actual future financial condition,

performance and results may differ materially from the plans, goals

and expectations set forth in Quilter plc's forward-looking

statements.

Quilter plc undertakes no obligation to update the

forward-looking statements contained in this announcement or any

other forward-looking statements it may make.

Nothing in this announcement should be construed as a profit

forecast.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTPPUMAGUPGGRA

(END) Dow Jones Newswires

January 26, 2021 02:00 ET (07:00 GMT)

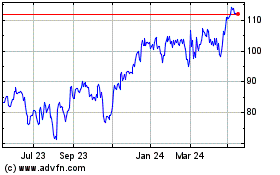

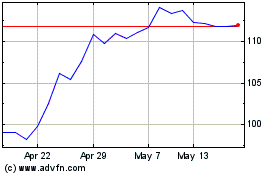

Quilter (LSE:QLT)

Historical Stock Chart

From Jun 2024 to Jul 2024

Quilter (LSE:QLT)

Historical Stock Chart

From Jul 2023 to Jul 2024