Shell Profit Soars on Oil Recovery -- 2nd Update

April 26 2018 - 3:13AM

Dow Jones News

By Sarah Kent

LONDON -- Royal Dutch Shell PLC on Thursday reported its highest

quarterly profit since 2013, as higher oil prices and years of cost

cutting boosted earnings.

The Anglo-Dutch oil giant said its first-quarter profit on a

current cost-of-supplies basis -- a number similar to the net

income that U.S. oil companies report -- rose 69% from a year

earlier to $5.7 billion.

The company delivered more than $5 billion in free cash flow --

a newly important metric for investors concerned about big oil

companies' ability to finance their dividends after the oil price

collapsed in 2014.

In a sign of how important cash-flow numbers have become, Shell

shares opened down roughly 2% in London after its operating cash

flow of $9.4 billion missed expectations.

The company also stopped short of launching an anticipated $25

billion share buyback program, though it is still on track to

repurchase at least that much stock by 2020.

Shell is the biggest oil company yet to report results for the

quarter -- a period where the industry has everything to prove.

After years of retrenchment, investors are expecting companies to

deliver billions of dollars in free cash flow, buoyed by rising oil

prices and stringent cost cuts.

Exxon Mobil Corp. and Chevron Corp. are due to publish their

first-quarter results Friday. BP PLC reports on May 1.

Write to Sarah Kent at sarah.kent@wsj.com

(END) Dow Jones Newswires

April 26, 2018 03:58 ET (07:58 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

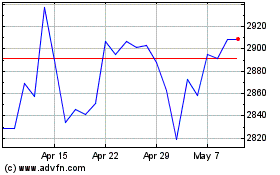

Shell (LSE:SHEL)

Historical Stock Chart

From Apr 2024 to May 2024

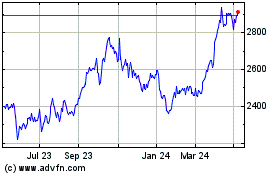

Shell (LSE:SHEL)

Historical Stock Chart

From May 2023 to May 2024