SQN Asset Finance Income Fund Ltd Completion of Capital Return (4244P)

May 29 2018 - 1:01AM

UK Regulatory

TIDMSQN

RNS Number : 4244P

SQN Asset Finance Income Fund Ltd

29 May 2018

29 May 2018

SQN Asset Finance Income Fund Limited

Completion of Capital Return

Further to the announcement on 1 May 2018 in relation to a

proposed capital return of GBP40 million, SQN Asset Finance Income

Fund Limited (the "Company"), the leading diversified equipment

leasing fund listed in the UK, today announces 41,075,778 C Shares,

approximately 22.82% of the C Shares in issue, were redeemed at a

price of 98.32 pence per C Share on 25 May 2018 (the "Redemption").

Accordingly, 138,924,222 C Shares remain in issue. Fractions of

shares have not been redeemed and so the number of C Shares

redeemed from each holder of C Shares was rounded down to the

nearest whole number of C Shares.

The remaining C Shares, which have not been redeemed, will trade

under a new ISIN GG00BFXYHJ13 (the "New ISIN"), which will be

enabled and available for transactions from 8.00 a.m. today, 29 May

2018. CREST will automatically transfer any open transactions to

the New ISIN.

It is expected that payments of redemption monies will be

effected either through CREST (in the case of C Shares held in

uncertificated form) or by cheque (in the case of C Shares held in

certificated form) by 11 June 2018.

Following the Redemption, the total number of voting rights of

the C Shares is 138,924,222 and the total number of voting rights

of the Ordinary Shares is 356,760,141, excluding shares held in

treasury. The total number of Ordinary Shares held in treasury is

947,366; there are no C Shares held in treasury. As such, the

aggregate voting rights figure of 495,684,363 may be used by

shareholders as the denominator for the calculations by which they

will determine if they are required to notify their interest in, or

a change to their interest, in the Company under the FCA's

Disclosure Guidance and Transparency Rules

Terms used in this announcement shall, unless the context

otherwise requires, bear the meanings given to them in the circular

published by the Company on 1 May 2018.

For further information please contact:

BNP Paribas

Sharon A Williams 01481 750 853

Winterflood Securities Limited 020 3100 0000

Neil Langford

Chris Mills

Buchanan

Charles Ryland

Henry Wilson 020 7466 5000

Notes to Editor

The Company invests in equipment lease and asset finance

arrangements across a diverse portfolio of assets and industries

predominantly in the UK, Northern Europe and US. The Company

focuses on business-essential, revenue-producing (or cost saving)

equipment and other assets with high in-place value and long

economic life relative to the investment term.

The Company's Investment Managers are SQN Capital Management,

LLC, a Registered Investment Advisor with the United States

Securities and Exchange Commission and its subsidiary, SQN Capital

Management (UK) Limited. The principals responsible for managing

the portfolio are Jeremiah Silkowski and Neil Roberts.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCPGUPCAUPRGUR

(END) Dow Jones Newswires

May 29, 2018 02:01 ET (06:01 GMT)

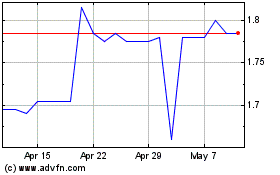

Slf Realisation (LSE:SLFR)

Historical Stock Chart

From Apr 2024 to May 2024

Slf Realisation (LSE:SLFR)

Historical Stock Chart

From May 2023 to May 2024