TIDMTAND

RNS Number : 0674O

Tan Delta Systems PLC

29 September 2023

Tan Delta Systems plc

("Tan Delta", or the "Company")

Interim results for the six months ended 30 June 2023

Tan Delta, a provider of advanced industrial and commercial

monitoring systems, is pleased to report its first set of financial

results for the six months ended 30 June 2023 ("H1 2023" or the

"Period"), since its admission to AIM in August 2023.

Financial highlights:

-- Revenue increased by 54% to GBP0.96m (H1 2022: GBP0.62m)

-- Gross profit increased by 52% to GBP0.61m at 63% margin (H1

2022: gross profit of GBP0.4m at 64% margin)

-- Profit from operations (excluding non-underlying items

relating to the IPO) of GBP0.18m (H1 2022: GBP0.03m)

-- Strengthened balance sheet following receipt of net proceeds

of GBP4.8 million, from successful AIM IPO

For further enquiries:

Tan Delta Systems plc Tel: +44 (0) 845 094

8710

Chris Greenwood, CEO

Steve Johnson, CFO

Zeus (Nominated Adviser & Broker) Tel: +44 (0) 203 829

5000

David Foreman, James Hornigold, Ed Beddows

(Investment Banking)

Nick Searle (Sales)

Chairmans Statement

It gives me great pleasure to present my first chairman's statement

since the Company's successful IPO in August 2023. Whilst we are

a relatively small team at present, all members of the Board and

employees went above and beyond, to ensure the continuing commercialisation

of our products and services, alongside the IPO, which necessarily

requires huge time and focus.

In terms of financial performance, the management team have performed

well during H1 2023 achieving 54% year on year revenue growth whilst

also preparing the business for rapid scaling.

Our target markets are large commercial and industrial operators

and manufacturers of any equipment with an engine, gearbox or hydraulics

which thus relies on lubrication oil for reliable and efficient

operation. In these days of intense global competition, high oil

prices and a drive to decarbonise, our proposition of reduced operating

costs, reduced break downs and oil consumption through waste reduction,

resonates loudly and provides Tan Delta with a very significant

global opportunity.

In anticipation of a successful IPO, the management undertook significant

planning during the period to commence sales and marketing in the

second half of the year ("H2 2023") with an initial focus on European

and North American markets, expanding later on in 2024 to the Middle

East, Asia, Africa and South America. The Company is now in a strategically

advantageous situation with an innovative and proven product addressing

a significant global market with a compelling proposition. Furthermore,

as a result of our IPO we now have the cash to commence material

and sustained sales activities and execution of the Board's long-term

strategy.

In order to provide further support and governance strength during

H2 2023 we will add a new independent Non-Executive Director to

our Board. This will complete the Board of Directors and provide

the Company with the management depth and governance to maximise

its opportunities and deliver shareholder growth.

Finally, I would like to take this opportunity to thank our staff,

advisers and investors who supported us through and at IPO.

Chief Executive Review

We are pleased to have achieved our targets for H1 2023. Following

our successful IPO in August 2023 we are now well placed to continue

performing in line with expectations in H2 2023 and beyond, as the

business continues to grow and benefit from the ability to invest

in product evolution and global sales and marketing.

Revenue increased by 54% to GBP0. 96m (H1 2022: GBP0.62m) whilst

broadly maintaining gross margin which slightly fell to 63% (H1:

2022 64%) as a result of a change in product sales mix. Underlying

operating profits, excluding one-off IPO related costs, also increased

by 608% to GBP0.18m (H2 2022: GBP0.03m) as our cost base growth

is not directly coupled to revenue growth.

During the Period revenue was primarily driven by a small number

of prospects who commenced implementations following their evaluation

period, and by a number of small sales to new customers commencing

their evaluations. In the second half we expect more customers to

enter and commence implementation on their equipment fleets, as

well as contribution from our off the shelf SENSE-2 and MOT products.

During the Period, we had three main operational objectives. Firstly,

we continued to progress and grow existing customer evaluations

and adoption planning for our sensor systems. Secondly, we planned

and prepared for the acceleration of our business post IPO, so that

we were ready to immediately start expanding sales, increasing marketing

activities and upscaling production. Thirdly, was the successful

completion of our IPO and securing significant capital to fund the

execution of our global expansion plans.

Moving into H2 2023, we are focused on the implementation of our

sales and marketing plan which is primarily focussed on our off

the shelf SENSE-2 and MOT products, both of which can be immediately

installed and used by equipment owners/operators. Our marketing

program will see these products actively promoted to specific market

verticals including power generation, manufacturing and transportation

in Europe, North America, Middle East, Asia and South America. In

parallel we have commenced increased production to fulfil expected

demand.

A major operational focus for H2 2023 will be the increase of our

human resources to support and enable our rapid scaling plans with

a particular focus on sales, customer support and production. I

am pleased to report that we are making good progress. In 2024 we

will turn our attention to our technology and product development

team which we will further develop to meet the needs of our next

generation of technology and product development targeting the global

automotive segment.

Notes to editors

Tan Delta Systems plc has developed innovative technologies,

products and services that enable operators of rotating equipment,

from trucks and ships to generators and wind turbines, to reduce

oil consumption, maintenance costs, breakdowns and carbon

footprint.

Tan Delta's products offer customers a compelling proposition of

being able to reduce operating costs whilst improving reliability.

This is achieved through equipment operators gaining a better

understanding of the actual real time maintenance status of their

active equipment through the real time analysis of lubrication oil

used within engine, gearboxes and hydraulic systems. Tan Delta's

data analytics, enables the following benefits:

-- Reduced oil consumption by approximately 30 per cent, by

ensuring oil is not changed before it has reached the end of its

life;

-- Reduced breakdowns and associated costs by detecting issues

before damage or failure occurs;

-- Increased equipment operating times by enabling intervals

between maintenance to be extended and;

-- Reduced carbon footprint through a reduction in oil use and prolonged equipment life.

The Company currently offers four main products built around its

core oil condition analysis sensor technology, all of which target

primarily large commercial and industrial equipment market

segments.

Tan Delta was admitted to trading on AIM in August 2023 with the

ticker TAND. For additional information please visit

www.tandeltasystems.com .

LinkedIn : http://www.tandeltasystems.com

Twitter: https://x.com/Tandeltasysyems

Unaudited statement of profit or loss and other comprehensive

income

For the six months ended 30 June 2023

Note (Unaudited) (Unaudited) (Unaudited)

--------------------------------- -----

Six months Six months Year ended

ended ended

--------------------------------- -----

30 June 2023 30 June 2022 31 Dec 2022

GBP000 GBP000 GBP000

Revenue 3 959 621 1,575

Cost of sales (351) (222) (585)

--------------------------------- ----- ------------- ------------- ------------

Gross profit 608 399 990

Other operating income 0 0 1

Distribution costs (22) (17) (44)

Administrative expenses (409) (357) (665)

Non-underlying items 4 (471) 0 0

Profit from operations

- Excluding non-underlying

items 177 25 282

- Non-underlying items 4 (471) 0 0

------------- ------------- ------------

(Loss) / Profit from operations (294) 25 282

Interest expense 5 (4) (4) (4)

Interest Income 0 0 0

Profit /(Loss) before tax

------------- ------------- ------------

- Excluding non-underlying

items 173 21 278

- Non-underlying items 4 (471) 0 0

------------- ------------- ------------

(Loss) /Profit before tax (298) 21 278

Taxation 6 0 0 4

--------------------------------- ----- ------------- ------------- ------------

(Loss) / Profit for the

period attributable to equity

holders of the Company (298) 21 282

--------------------------------- ----- ------------- ------------- ------------

Other comprehensive income

Total other comprehensive

income 0 0 0

--------------------------------- ----- ------------- ------------- ------------

Total comprehensive (loss)

/ profit for the period

attributable to equity holders

of the Company (298) 21 282

--------------------------------- ----- ------------- ------------- ------------

Basic and diluted earnings

per share (GBP) 7 (0.01) 0.00 0.01

--------------------------------- ----- ------------- ------------- ------------

Unaudited statement of financial position

As at 30 June 2023

Note (Unaudited) (Unaudited) (Unaudited)

As at As at As at

30 June 2023 30 June 2022 31 Dec 2022

GBP000 GBP000 GBP000

Non-current assets

Intangible assets 141 26 121

Right of use asset 107 134 120

Property, plant and equipment 61 70 64

309 230 305

-------------------------------- ----- ------------- ------------- ------------

Current assets

Inventories 229 193 240

Trade and other receivables 8 277 248 320

Cash and cash equivalents 9 332 458 186

-------------------------------- ----- ------------- ------------- ------------

838 899 746

Total assets 1,147 1,129 1,051

-------------------------------- ----- ------------- ------------- ------------

Current liabilities

Trade and other payables 10 (786) (682) (367)

Short term borrowings 11 (24) (24) (24)

Short term lease liability 11 (27) (26) (27)

-----

(837) (732) (418)

-------------------------------- ----- ------------- ------------- ------------

Non-current liabilities

Long term borrowings 11 (26) (49) (38)

Long term lease liability 11 (86) (113) (99)

-----

(112) (162) (137)

-------------------------------- ----- ------------- ------------- ------------

Total liabilities (949) (894) (555)

-------------------------------- ----- ------------- ------------- ------------

Net assets 198 235 496

-------------------------------- ----- ------------- ------------- ------------

Equity attributable to

equity holders of the Company

Ordinary share capital 12 50 0 0

Share premium account 13 0 1,565 1,565

Retained earnings/(accumulated

losses) 13 148 (1,330) (1,069)

-------------------------------- ----- ------------- ------------- ------------

Total equity 198 235 496

-------------------------------- ----- ------------- ------------- ------------

Unaudited statement of changes in equity

For the six months ended 30 June 2023

Share capital Share premium Retained earnings Total equity

GBP000 account / (accumulated GBP000

GBP000 losses)

GBP000

-------------------------

Balance at 1 January

2022 0 1,565 (1,351) 214

------------------------- -------------- -------------- ------------------ -------------

Ordinary share capital 0 0 0 (0)

Comprehensive income:

Profit for the period 0 0 21 21

------------------------- -------------- -------------- ------------------ -------------

Balance at 30 June 2022 0 1,565 (1,330) 235

------------------------- -------------- -------------- ------------------ -------------

Balance at 30 June 2022 0 1,565 (1,330) 235

------------------------- -------------- -------------- ------------------ -------------

Ordinary share capital 0 0 0 0

Comprehensive income:

Profit for the period 0 0 261 261

------------------------- -------------- -------------- ------------------ -------------

Balance at 31 December

2022 0 1,565 (1,069) 496

------------------------- -------------- -------------- ------------------ -------------

Balance at 31 December

2022 0 1,565 (1,069) 496

------------------------- -------------- -------------- ------------------ -------------

Ordinary share capital 0 0 0 0

Comprehensive income:

Loss for the period 0 0 (298) (298)

Bonus issue of shares 50 (50) 0 0

Cancellation of share

premium 0 (1,515) 1,515 0

------------------------- -------------- -------------- ------------------ -------------

Balance at 30 June 2023 50 0 148 198

------------------------- -------------- -------------- ------------------ -------------

Unaudited statement of cash flows

For the six months ended 30 June 2023

(Unaudited) (Unaudited) (Unaudited)

----------------------------------------

Six months Six months ended Year ended

ended

----------------------------------------

Note 30 June 2023 30 June 2022 31 Dec 2022

GBP000 GBP000 GBP000

Cash flows from operating

activities

(Loss) / Profit before Tax (298) 21 278

Adjustments for non-cash/non-operating

items:

Depreciation 5 4 11

Amortisation of intangible

assets 5 0 0

Amortisation of right of

use assets 13 13 27

Taxation 0 0 4

Loss on disposal of plant

and equipment 0 0 4

Interest income 0 0 0

Interest expense 4 4 4

---------------------------------------- ----- ------------- ----------------- ------------

Operating cash flows before

movements in working capital (271) 42 328

(Increase)/decrease in inventories 11 (140) (187)

(Increase)/decrease in trade

and other receivables 43 41 (31)

Increase/(decrease) in trade

and other payables 419 412 97

---------------------------------------- ----- ------------- ----------------- ------------

Net cash generated from

operating activities 202 355 207

---------------------------------------- ----- ------------- ----------------- ------------

Cash flows from investing

activities

Purchase of property, plant

and equipment (2) (34) (39)

Purchase of intangibles

assets (25) (26) (121)

Net cash used in investing

activities (27) (60) (160)

---------------------------------------- ----- ------------- ----------------- ------------

Cash flows from financing

activities

Borrowings and finance lease

obligations (29) (29) (53)

Net cash used in financing

activities (29) (29) (53)

---------------------------------------- ----- ------------- ----------------- ------------

Net decrease in cash and

cash equivalents 146 266 (6)

Cash and cash equivalents

at the beginning of the

period 186 192 192

------------- ----------------- ------------

Cash and cash equivalents

at the end of the period 9 332 458 186

---------------------------------------- ----- ------------- ----------------- ------------

Notes to the unaudited condensed interim financial

statements.

1. General information

The interim financial statements were approved by the Board of

Directors on the 28 September 2023.

2. Basis of preparation

The interim financial statements of the Company are for the six

months ended 30 June 2023.

The comparative figures for the financial year ended 31 December

2022 are not the Company's statutory accounts for that financial

year. The comparative figures were prepared under International

Financial Reporting Standards ('IFRS') for the purposes of

presentation in the Company's AIM Admission Document published on

11 August 2023 ('Admission Document'). The statutory accounts filed

at Companies House were prepared under the historical cost

convention and in accordance with Financial Reporting Standard 102

'The Financial Reporting Standard applicable in the UK and Republic

of Ireland' including the provisions of Section 1A 'Small Entities'

and the Companies Act 2006. The financial statements were audited

and prepared in accordance with the provisions applicable to

companies subject to the small companies' regime even though they

were exempt from audit under Section 477 of the Companies Act

2006.

The condensed interim financial statements for H1 2023 do not

include all the information and disclosures required in the annual

financial statements and have not been audited or reviewed by an

auditor pursuant to the Auditing Practices Board guidance on Review

of Interim Financial Information. However, selected explanatory

notes are included to explain events and transactions that are

significant for an understanding of the changes in the Company's

financial position and performance in the period.

The condensed interim financial statements for H1 2023 have been

prepared based on the accounting policies adopted within the

Admission Document, and those expected to be adopted for the year

ending 31 December 2023. These accounting policies are drawn up in

accordance with adopted International Accounting Standards ('IAS')

and International Financial Reporting Standards ("IFRS") as issued

by the International Accounting Standards Board and adopted by the

EU.

AIM-listed companies are not required to comply with IAS 34

'Interim Financial Reporting' and accordingly the Company has taken

advantage of this exemption.

3. Revenue from contract

customers

Geographical reporting (Unaudited) (Unaudited) (Unaudited)

--------------------------

Six months Six months ended Year ended

ended

--------------------------

30 June 2023 30 June 2022 31 Dec 2022

GBP000 GBP000 GBP000

United Kingdom 526 325 956

Europe 191 161 270

Rest of the World 242 135 349

959 621 1,575

-------------------------- ------------- ----------------- ------------

4. Non-underlying items

(Unaudited) (Unaudited) (Unaudited)

-------------------------

Six months Six months ended Year ended

ended

30 June 2023 30 June 2022 31 Dec 2022

GBP000 GBP000 GBP000

IPO costs (471) 0 0

------------------------- ------------- ----------------- ------------

(471) 0 0

------------------------- ------------- ----------------- ------------

IPO costs

On Admission to AIM on 18 August 2023, the Company issued

23,074,000 new ordinary shares, taking the number of ordinary

shares in issue to 73,223,800. Total proceeds amounted to circa

GBP6.0m. The costs associated with the IPO, which were committed at

30 June 2023, amounted to GBP0.47m and they have been recognised as

non-underlying expenses in the income statement in H1 2023.

5. Finance expense

(Unaudited) (Unaudited) (Unaudited)

----------------------------

Six months Six months ended Year ended

ended

30 June 2023 30 June 2022 31 Dec 2022

GBP000 GBP000 GBP000

Interest on bank loans (2) (2) 0

Interest on finance leases (2) (2) (4)

---------------------------- ------------- ----------------- ------------

(4) (4) (4)

---------------------------- ------------- ----------------- ------------

6. Income tax expense

No income has yet been recognised in H1 2023 in relation to

R&D tax credits available from HMRC through the SME R&D

relief scheme.

7. Earnings per share

Earnings per share are

as follows:

Six months ended Six months ended Year ended

30 June 2023 30 June 2022 31 Dec 2022

GBP per share GBP per share GBP per share

Basic and diluted earnings

per share (0.01) 0.00 0.01

----------------------------- ------------------- ----------------- --------------

The calculations of basic

and diluted earnings per

share are based upon:

GBP000 GBP000 GBP000

----------------------------- ------------------- ----------------- --------------

(Loss) / Profit for the

period attributable to

the owners (298) 21 282

----------------------------- ------------------- ----------------- --------------

Number Number Number

----------------------------- ------------------- ----------------- --------------

Number of ordinary shares

at the end of the period 50,149,800 50,149,800 50,149,800

----------------------------- ------------------- ----------------- --------------

The calculation of basic earnings per share is based on the

results attributable to ordinary shareholders divided by the number

of ordinary shares outstanding as if the bonus issue and share

split had occurred at the beginning of the earliest period

presented. The earnings per share calculations for the period and

prior period presented are based on the new number of shares.

The number of shares in issue at the end of the period is used

as the denominator in calculating basic earnings per share. As the

Company is loss making the effect of instruments that convert into

ordinary shares is considered anti-dilutive, hence there is no

difference between the diluted and non-diluted loss per share.

During the period ended 30 June 2023, the Company completed a

110 for 1 bonus share issue and a subdivision of shares. Prior to

the bonus issue there were 451,800 shares at GBP0.001, after the

bonus issue there are 50,149,800 shares at GBP0.001

8. Trade and other receivables

(Unaudited) (Unaudited) (Unaudited)

As at As at As at

30 June 2023 30 June 2022 31 Dec 2022

GBP000 GBP000 GBP000

Amounts falling due within

one year:

Trade receivables 162 193 277

Other receivables 58 20 19

Prepayments 53 17 20

Tax recoverable 4 18 4

277 248 320

-------------------------------- ---------------- -------------- ------------

9. Cash and cash equivalents

(Unaudited) (Unaudited) (Unaudited)

As at As at As at

30 June 30 June 2022 31 Dec 2022

2023 GBP000 GBP000

GBP000

Cash at bank available on demand 332 458 186

332 458 186

------------------------------------ ------------ -------------- ------------

10. Trade and other payables

(Unaudited) (Unaudited) (Unaudited)

As at As at As at

30 June 30 June 2022 31 Dec 2022

2023 GBP000 GBP000

GBP000

Trade payables (389) (195) (284)

Other payables (16) (50) (15)

Other taxation and social security (15) (20) (12)

Accruals (295) (11) (19)

Deferred income (71) (406) (37)

(786) (682) (367)

------------------------------------ ------------ ------------- ------------

11. Borrowings and lease liabilities

(Unaudited) (Unaudited) (Unaudited)

As at As at As at

30 June 30 June 2022 31 Dec 2022

2023 GBP'000 GBP'000

GBP'000

Current:

Bank loans (24) (24) (24)

Lease liability (27) (26) (27)

(51) (50) (51)

-------------------------------------- ------------ ------------- ------------

Non-current:

Bank loans (26) (49) (38)

Lease liability (86) (113) (99)

Total borrowings (112) (162) (137)

-------------------------------------- ------------ ------------- ------------

Banks loans comprise a Coronavirus Business Interruption Loan

provided by Lloyds. The loan was taken out in July 2020 and matures

five years after this date.

12. Share capital

(Unaudited) (Unaudited) (Unaudited)

As at As at As at

30 June 30 June 2022 31 Dec 2022

2023 GBP'000 GBP'000

GBP'000

Allotted, called up and fully

paid

Ordinary shares of 45,180 @

GBP0.01 each 0 0

Ordinary shares of 50,149,800

@ GBP0.001 each 50

50 0 0

------------------------------- ------------ ------------- ------------

Called up share capital

Called up share capital represents the nominal value of shares

that have been issued.

All classes of shares have full voting, dividends, and capital

distribution rights.

On 1 June 2023, the ordinary shares were subdivided from GBP0.01

to GBP0.001 (45,180 shares to 451,800 shares). Subsequently a bonus

issue was made for all the shareholders holding 451,800 shares at

that date. The bonus issue offered 110 ordinary shares for every 1

ordinary share in issue, with a nominal value of GBP0.001 per

share. This increased the number of ordinary shares in issue by

49,698,000 to 50,149,800.

13. Reserves

In anticipation of re-registering the Company as a public

limited company, at a general meeting of the Company on 1 June

2023, it was resolved that the Company would reduce its share

premium account by an amount of GBP1.52m by crediting the Profit

and Loss Account.

Share premium account

This represents the excess value recognised from the issue of

ordinary shares above nominal value.

Retained earnings

This represents cumulative net gains and losses less

distributions made.

14. Post balance sheet events

No adjusting events have occurred between reporting date and the

date of authorisation of the condensed interim report. The Company

listed on AIM on 18 August 2023 raising circa GBP6.0m. The Company

issued 23,074,000 ordinary shares thus taking the total number of

ordinary shares in issue to 73,223,800 from 50,149,800. The costs

associated with the issue amounted to approximately GBP1.2m.

GBP0.47m was recognised in H1 2023 and GBP0.73m will be recognised

in H2 2023.

On 18 August 2023, 1,253,745 share options were granted to those

eligible under the scheme in line with the disclosures made in the

Company's admission document dated on 18 August 2023. The options

have an exercise price of GBP0.26.

15. Availability

Further copies of this interim announcement are available on the

Tan Delta Systems plc website, www.tandeltasystems.com .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BLGDCSXDDGXI

(END) Dow Jones Newswires

September 29, 2023 02:00 ET (06:00 GMT)

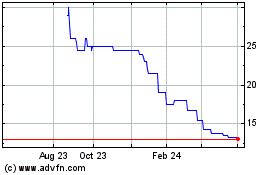

Tan Delta Systems (LSE:TAND)

Historical Stock Chart

From Apr 2024 to May 2024

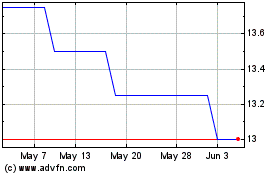

Tan Delta Systems (LSE:TAND)

Historical Stock Chart

From May 2023 to May 2024