RNS Number:2623O

Terrace Hill Group PLC

19 February 2008

19 February 2008

Terrace Hill Group PLC ('Terrace Hill' or 'the group')

Preliminary Announcement of Results for the year to 31 October 2007

Terrace Hill Group PLC, the AIM listed property group, announces its results for

the year ended 31 October 2007.

Highlights

* Triple net asset value (TNAV) increased 13.8% to 83.7p per share (2006:

73.6p per share) - adding back dividend payments, underlying TNAV growth

for the year was 16.1%

* Adjusted diluted net asset value (ADNAV) increased 7.6% to 96.3p per

share (2006: 89.5p per share)

* Final dividend of 1.3p per share being recommend bringing the total

dividend for the year to 2.1p per share, an increase of 16.7% over last

year's figure

* �1.3 billion projected end value of commercial development programme

* Fall in projected end value of some commercial developments offset by the

value added to projects through successful lettings, sales and planning

gains

* Valuation of residential investment portfolio remained largely unchanged

* Value of residential investments sold or under contract for sale totalled

�57.9m realising profit on cost of 19.8%

* Scottish housebuilding business beginning to gather momentum - new sites

purchased and planning consents gained - landbank has capacity for over

1,400 units and projected annualised turnover of 250 units by December 2009

* Strong cash position of over �26 million together with �37.7 million of

undrawn debt facilities and excellent relationships with lenders

* Proven track record of adding value through managing risk: structuring

finance, portfolio diversification, stock selection and managing

construction

* Well positioned to take advantage of opportunities in the property market

by purchasing attractive assets from distressed or forced sellers

Chairman's Statement

I am delighted to present our results for the year to 31 October 2007, which are

particularly pleasing given the uncertain economic environment.

During the period our triple net asset value (TNAV) has increased by an

encouraging 13.8% to 83.7 pence per share (2006: 73.6 pence per share). The

adjusted diluted net asset value (ADNAV) has increased by 7.6% to 96.3 pence per

share (2006: 89.5 pence per share). ADNAV is affected by the timing of tax

payable on realised profits whereas TNAV takes full account of all deferred and

contingent tax on the revaluation of investment properties and gains on trading

properties and is calculated after deducting dividends paid during the year.

Adding back these dividend payments, underlying TNAV growth was 16.1% for the

year. Our target remains to grow underlying TNAV, as adjusted for dividend

payments, by at least 20% per annum and we have achieved an average growth since

2003 of 30.9% per annum.

The board is recommending a final dividend of 1.3 pence per share to be paid on

4 April 2008. Taken with the interim dividend of 0.8 pence per share paid in

August, the total dividend in respect of the year to 31 October 2007 will be 2.1

pence per share, an increase of 16.7% over last year's figure. This is in line

with our progressive dividend policy and demonstrates our confidence in the

future of the business.

Our results include the effect of a fall in the projected end value of some of

our commercial developments due to weakening investment yields, but this has

been substantially offset by the value added to projects through successful

lettings, sales and planning gains. The valuation of our residential investment

portfolio has remained largely unchanged reflecting falls in value in parts of

the Midlands and north of England, but modest gains in Scotland, London and the

south east of England.

These are the first full year results that the group has prepared under

International Financial Reporting Standards (IFRS), the most significant impact

of which is the requirement to include the movement on the revaluation of

investment properties in the income statement. The group's profit before tax for

the year on this basis was �18.1 million (2006: �25.8 million). The profit

before tax for 2006 includes our share of a net revaluation uplift as a result

of the acquisition of the at.home Nationwide portfolio of �16.7 million, with no

comparable uplift included in the profit for 2007.

In May 2007 we raised �24.3 million of capital net of costs through the placing

of 24,752,475 new shares at 101 pence per share with a number of institutions,

many of whom were new to our shareholder register. We were delighted with the

success of this issue which was completed at a premium to the share price at the

time and has increased our available funds to take advantage of good

opportunities in a weakening market.

It is pleasing to note that the occupational market for our developments has

remained strong with lettings and owner occupier sales continuing to take place

across the portfolio. In some areas we are even seeing exceptional levels of

demand, for example at Kean House in Covent Garden where rents achieved on

lettings have risen by 35% in the past 12 months.

In the residential sales market there is some price weakness, but I believe that

the long-term fundamentals underlying the market are strong. Demand exceeding

supply, particularly due to low levels of new housebuilding and relatively low

unemployment coupled with falling short-term interest rates, means that we are

expecting the market will strengthen in the medium term returning to sustainable

levels of good growth. We are positive about the prospects for our portfolio due

to the low average value per unit (�154,000) which helps mitigate the issue of

affordability relative to incomes and the portfolio's geographic predominance in

London and the South East, where the supply and demand imbalance is most acute,

and in Scotland where the ratio of household incomes relative to house prices

remains high.

Clansman Homes, our Scottish housebuilding business, is beginning to gather

significant momentum with the purchase of a number of new sites and success in

gaining new planning consents. We have a landbank with capacity for over 1,400

units and projected annualised turnover of 250 units by December 2009. We expect

the business to continue its excellent growth, both through the existing

landbank and new acquisitions, adding substantial value for shareholders.

Currently, the poor market for new listings means that we will delay the planned

demerger of Clansman until such time as we believe the value to our shareholders

will be maximised.

We have a strong cash position of over �26 million together with �37.7 million

of undrawn debt facilities and excellent relationships with lenders. This will

allow us to take advantage of the weakening in the property market by purchasing

attractive assets from distressed or forced sellers.

Once again, the directors and staff have performed exceptionally and are

demonstrating their determination and ability to succeed in difficult times as

much as in good.

Since the year end we have seen some further weakening in investment yields and

foresee a modest slowdown in occupier demand but I am confident about the long

term outlook and in our ability to deliver enhanced returns to our shareholders.

We have the skills and ambition for significant profitable expansion and I

look forward to the opportunities presented by the current market with

enthusiasm.

Robert FM Adair

Chairman

19 February 2008

Review of Operations

Despite more difficult markets we have continued to let completed commercial

developments well and add significant value through planning gains, site

assembly and development. We have made good progress within the Scottish

housebuilding division, now known as Clansman Homes, acquiring new sites and

achieving planning consents on our landbank allowing us to increase units under

construction. The valuation of the residential investment portfolio has remained

resilient with improving rental levels and reduced voids. We have seen that our

very experienced development skills drive results in changing times and that we

lead our peers by creating desirable space and understanding occupier needs.

A core strength of our business lies in our ability to manage risk effectively.

This competence lies at the heart of our operations and is centred around the

structuring of our finances, portfolio diversity, stock selection and managing

construction. These skills are never more important than in the challenging

economic climate and markets in which we now find ourselves. Our results during

the period and progress since is testament to the fact we can perform well in

difficult times and continue to deliver above average risk weighted returns for

our shareholders.

Commercial development

Once again geographic and sector diversification have proved important, allowing

us to spread our risk and utilise our specialist knowledge of specific locations

and occupier markets.

Our total current and pending commercial development programme has grown to �1.3

billion by projected end value, of which 84.2% is in the office sector, 9.4%

retail and 6.4% industrial. Our philosophy is always to mitigate letting risk

where appropriate and of the schemes currently on site 39% have been pre-let or

pre-sold.

The majority of our schemes at the development stage are carried out in

financial joint ventures where we commit a minority equity stake in return for a

substantial carried interest above benchmark returns. We also earn substantial

development management fees from the joint ventures (�2.3 million in the

period).

Two significant joint venture developments have been established during the

year.

* Two Orchards, Bracknell - a prominent 7.9 acre office development site on the

edge of Bracknell with planning consent for three buildings totalling 270,000

sq ft. The phased development is being carried out in joint venture with

Hypo Real Estate Bank International A.G. and will have an end value of around

�125 million. The first phase will be completed in 2009 when we predict that

there will be a shortage of supply of good quality office space in the

Thames Valley market.

* Howick Place, Victoria, London - we have acquired House of Fraser's office

headquarters in joint venture with a view to redeveloping the site into a

mixed use scheme of office and high quality residential with an end value of

around �180 million. House of Fraser took a lease back of the property until

July 2008 around which time we expect to receive detailed planning consent

for our proposals.

Other significant achievements have been

* At George Street, Croydon we won a planning consent for a 204,000 sq ft

office development. Since then we have decided to submit an application to

increase the size of the building to 240,000 sq ft in order to more closely

match a number of occupier requirements in the Croydon office market and to

enhance value further.

* The acquisition of a prominent 1.7 acre site in Southampton city centre for

�7.4 million. The proposed mixed use development will comprise around 180

residential units, a 150 bedroom hotel and 110,000 sq ft of offices. The

residential element has been sold, conditional on planning, to Crest

Nicholson and the completed development is expected to have an end value of

around �61 million.

* Lettings at Kean House, our 25,200 sq ft office refurbishment in Covent

Garden, London, have exceeded expectations where four floors were pre-let to

Adecco at a headline rent of �42.50 psf. Since completion in August a further

five floors have been let at rents up to �57.50 psf and the remaining retail

unit fronting Kingsway has been let to Costa Coffee.

* Redd 42, our 232,680 sq ft distribution warehouse developed within the

Terrace Hill Development Partnership (THDP) was let to iForce Ltd at an

initial rent of �5.75 psf. iForce use the unit as the national e-fulfilment

centre for John Lewis Direct.

* The forward sale of a new 19,400 sq ft office development at Baltic Business

Quarter, Gateshead to the Open University for �5.25 million. At the same

scheme the 180,000 sq ft development for Gateshead College has been completed

and handed over on schedule.

* Bristol Bridge House has been acquired for �9.2 million. An office

refurbishment opportunity overlooking the floating harbour in one of the

city's most central and attractive locations. We expect to make a planning

application in Spring 2008.

* The sale of a 4.5 acre industrial site at Edmonton, north London, to an owner

occupier for �7.7 million, realising a profit of �3.2 million.

* Our appointment by Middlesbrough Borough Council as preferred developer of

Central Gardens East, a town centre urban regeneration scheme, which will

include up to 130,000 sq ft of offices and a 100 bed hotel.

* In Ashington town centre in Northumberland we have, conditional on planning,

contracted to acquire a 3.3 acre retail warehouse development site for a

development of around 30,000 sq ft of open A1 non food retail warehouses. The

site has the potential to be extended to accommodate up to 100,000 sq ft of

additional retail space through an agreement with adjoining landowners.

* In December, following the year end, we entered into unconditional contracts

to sell our riverside site at Queens Wharf in Hammersmith for �30.75 million.

We completed the acquisition of the property in November from a private

investor for �17.0 million having held an option on the site for the

preceding 12 months. We identified Queens Wharf as a site with great

potential for redevelopment for a variety of uses and worked with the local

authority to maximise value through different planning options as a result

of which we decided to sell the site to a specialist high quality residential

developer.

Residential investment

We have continued to manage our residential investment assets aggressively.

Since the purchase of the at.home Nationwide portfolio in July 2006, where we

hold a 49% interest, we have continued to drive performance through increased

rental levels, improved occupancy rates and reduced management costs. We are

experiencing good demand from tenants and fully expect to maintain and improve

upon these results. Further, we have continued to rationalise the portfolio

through the sale of selected properties, aiming to maintain a balanced portfolio

for future growth. By the year end we had properties sold or under contract for

sale totalling �57.9 million, realising profit on cost of 19.8%.

The overall value of our residential investments has remained static since the

half year. Some weakness has been seen in properties in the north of England and

Midlands with London, the South East and Scotland proving most resilient.

We believe that, whilst not immune from a downturn in the housing market, our

properties are well located to withstand these pressures, being predominantly in

London and Scotland, and with a low average value of �154,000 which will remain

affordable. Furthermore, we continue to see strong rental demand across the

portfolio.

Clansman Homes

Clansman Homes, our Scottish housebuilding division, has made good progress

during the period. We have acquired new sites for development at Fenwick, south

of Glasgow and Carnwath, near Lanark, a prime commuting area for both Edinburgh

and Glasgow. As a result, our landbank now has capacity for over 1,400 units and

we are currently on site in four different locations. Significantly, we obtained

detailed planning consent for 168 units at Shotts in north Lanarkshire where the

first homes will be delivered to the market in Spring 2008.

Demand for our homes remains strong with the Scottish housing market appearing

to hold up well compared to other parts of the UK. We believe that our focus on

affordable, suburban homes with no exposure to high cost city centre dwellings,

will help us to withstand the challenges of any housing downturn. It continues

to be our intention to demerge Clansman Homes from the Group when markets are

appropriate.

Philip Leech

Chief Executive

19 February 2007

Finance Review

Basis of accounting

The key figures for the year ended 31 October 2007 are summarised in the

highlights. These are the first full year results that the group has prepared

under International Financial Reporting Standards (IFRS) and this has required

the results of prior periods to be restated using IFRS. The application of these

new reporting standards does not affect the economic value of the business but

it has led to differences in the level of profits and net assets reported.

Triple net asset value (TNAV) and adjusted diluted net asset value (ADNAV)

In line with many publicly quoted property companies we highlight both TNAV and

ADNAV as the principal measures of the group's performance. The following

adjustments are made to the audited net asset value in arriving at our ADNAV:

1. Property revaluation: properties and rights to properties held as

current assets are revalued from cost (or realisable value if less) to

market value. The valuation has been performed by relevant directors

qualified as chartered surveyors based on valuation advice from

CB Richard Ellis and takes account of costs to complete and whether or

not the property has been let and/or pre-sold.

2. Share dilution: the nominal value of shares to be issued under the

employee long-term incentive plan is added to net assets.

3. Taxation: the amount of deferred tax provided in respect of investment

properties is added to net assets. The ADNAV per share at 31 October

2007 was 96.3 pence (2006: 89.5 pence) an increase of 7.6%.

The following adjustments are made to ADNAV in calculating our TNAV:

4. Taxation: the amount of taxation estimated to be payable were all of the

group's properties to be sold at the value used for the TNAV calculation

has been deducted. This includes the deferred tax provided on investment

properties and the taxation estimated to be payable on realisation of the

uplift of trading properties to market value.

5. Goodwill: positive goodwill is excluded.

The TNAV per share at 31 October 2007 was 83.7 pence (2006: 73.6 pence) an

increase of 13.8%. This TNAV is calculated after the deduction of dividends paid

to shareholders during the period. Adding back these dividend payments,

underlying TNAV growth was 16.1% for the year.

Income statement

The most significant impact of the change from reporting under UK GAAP to IFRS

has been the effect on the income statement of including movements in the

revaluation of investment properties and the consequent tax thereon in the

disclosed profit for the year. The majority of the group's property interests

are held for trading purposes and are not revalued in the group's balance sheet.

However, our residential investments, largely comprising our interest in the

at.home Nationwide portfolio, held in an associated undertaking, are included in

the balance sheet at their revalued amount. The income statement for 2006

prepared under IFRS includes a revaluation uplift net of tax amounting to �16.7

million as a result of the acquisition of the at.home Nationwide portfolio with

no comparable uplift included in the profit for 2007. The revaluation of the

at.home Nationwide portfolio is based on advice received from CRGP Robertson for

the Scottish properties and Savills for the remainder of the portfolio.

Gross profit for the period was �20.7 million (2006: �14.6 million) an increase

of 42% despite a reduction in turnover during the period of 13% to �69.8 million

for 2007 (2006: �80.5 million). Operating profit for the period was �18.6

million (2006: �12.6 million) an increase of 47.6%. The major contributors to

profit for the period comprise �7.5 million from the sale of a site at

Wokingham, �6.1 million received from an associate in respect of additional

consideration following receipt of planning consent at our site in Maidenhead

and �3.5 million from the pre-sale of the group's interest in Time Central,

Newcastle.

Group overheads for the year are �9.6 million (2006: �6.7 million) an increase

of 43.2%. This increase is due to including charges for the cost of the share

based payment scheme of �1.5 million (2006: �0.3 million); additional

remuneration costs by way of bonuses, costs of our new housebuilding division

and additional costs relating to the continued expansion of our team and

operations.

Our investment in joint ventures and associated undertakings generated a profit

of �0.5 million (2006: �15.7 million). The most significant being Terrace Hill

Residential PLC, the company that owns the at.home Nationwide residential

portfolio, of which our share is 49%. The group's share of the results of

Terrace Hill Residential PLC comprised a revaluation gain net of tax of �5.9

million (2006: �16.7 million) and a trading loss in the period of �5.3 million

(2006: �0.8 million). The trading loss includes �1.3 million being our share of

exceptional redundancy and management costs associated with the acquisition of

the portfolio.

Calculation of ADNAV and TNAV (unaudited)

__________________________________________________________________________________________________________________

31 October 2007 31 October 2006

________________________________ ______________________________

Number Number

of shares Pence per of shares Pence per

Notes �'000 000s share �'000 000s share

__________________________________________________________________________________________________________________

Audited net asset value 136,879 211,971 64.6 100,278 187,219 53.6

Revaluation of property held as current

assets 1 68,560 62,401

Shares to be issued under the LTIP 2 140 6,965 57 2,836

Deferred taxation in respect of

investment properties 3 5,301 7,281

Adjusted diluted net asset value 210,880 218,936 96.3 170,017 190,055 89.5

% increase 7.6%

Estimated taxation on revaluation of

current assets, unrealised gains and

availability of tax losses 4 (23,953) (25,983)

Goodwill 5 (3,589) (4,149)

Triple net asset value 183,338 218,936 83.7 139,885 190,055 73.6

% increase 13.8%

__________________________________________________________________________________________________________________

Balance sheet

Total group assets at 31 October 2007 were �274.3 million (2006: �211.7 million)

an increase of 29.5 % and net assets after deducting minority interests were

�136.9 million (2006: �100.3 million) an increase of 36.5%. The placing of

24,752,475 new ordinary shares of 2 pence at �1.01 per share during the period,

raising �24.3 million net of expenses, contributed to this growth in group

assets.

Gearing

Bank debt at the year end was �65.5 million (2006: �70.4 million) net of cash of

�26.9 million (2006: �8.6 million) and gearing was 47.8% of equity (2006: 70%).

The group had undrawn facilities at the end of the period of �37.7 million

(2006: �28 million).

During the year we arranged two revolving credit facilities totalling �35

million of which �15.7 million remains undrawn. These facilities allow us the

flexibility to drawdown debt quickly to finance new site acquisitions.

The loan to value gearing, net of cash, in relation to the group's property

portfolio held on balance sheet was 38%. Loan to value gearing including the

group's share of joint ventures and associated undertakings was 50%.

Interest rate risk is hedged for 79% of net debt, including that in joint

ventures and associated undertakings. In setting our hedging strategy we always

seek a balance between retaining the flexibility to achieve an early disposal

and ensuring adverse interest rate movements will not compromise the viability

of a development.

Dividends

Dividends paid in the year amounted to 1.9p per share (2006: 1.4 pence) and

comprised the final dividend in respect of the period to 31 October 2006 of 1.1

pence (2005: 0.7 pence) and the interim dividend for 2007 of 0.8 pence (2006:

0.7 pence). In accordance with accounting standards these have been accounted

for through a movement in reserves rather than in the income statement. The

board is recommending to shareholders at the Annual General Meeting on 3 April

2007 a final dividend of 1.3 pence per share making a total dividend for the

year ended 31 October 2007 of 2.1 pence (2006: 1.8 pence) an increase of 16.7%.

The final dividend will be paid on 4 April 2008 to all shareholders on the

register of the company at 25 March 2008.

Total shareholder return (TSR)

This measures the return to shareholders from share price movements and dividend

income and is used to compare returns between companies listed on the Stock

Exchange.

For the first time since the company was listed on AIM the year on year share

price has fallen from 80.0p at 31 October 2006 to 71.75p at 31 October 2007,

this 10.3% fall compares favourably to the reduction in the FTSE 350 Real Estate

Index of 20.8% but results in a negative TSR for the period. On an annualised

basis the TSR since October 2002 was 42.2% per annum with an aggregate TSR since

that date of 458.3%. thus providing shareholders with excellent returns over

this five year period.

Tom Walsh

Group Finance Director

19 February 2008

Consolidated Income Statement

for the year ended 31 October 2007

Year ended Year ended

31 October 31 October

2007 2006

�'000 �'000

__________________________________________________________________________________________________________________

Revenue 69,849 80,493

Direct costs (49,142) (65,941)

__________________________________________________________________________________________________________________

Gross profit 20,707 14,552

Administrative expenses (9,587) (6,708)

Profit on disposal of investment properties 404 457

Gain on revaluation of investment properties 7,062 4,343

__________________________________________________________________________________________________________________

Operating profit 18,586 12,644

Finance income 1,447 1,031

Finance costs (2,400) (3,555)

Share of joint venture and associated undertakings post tax profit 505 15,712

__________________________________________________________________________________________________________________

Profit before tax 18,138 25,832

Tax expenses (3,577) (1,551)

__________________________________________________________________________________________________________________

Profit from continuing operations 14,561 24,281

__________________________________________________________________________________________________________________

Attributable to

Equity holders of the parent 14,527 24,283

Minority interest 34 (2)

__________________________________________________________________________________________________________________

14,561 24,281

__________________________________________________________________________________________________________________

Basic earnings per share 7.33p 12.97p

Diluted earnings per share 7.09p 12.78p

__________________________________________________________________________________________________________________

Consolidated Balance Sheet

at 31 October 2007

31 October 31 October

2007 2006

�'000 �'000

__________________________________________________________________________________________________________________

Non-current assets

Investment properties 53,887 56,967

Property plant and equipment 594 36

Investments in equity - accounted associates and joint ventures 18,619 18,088

Other investments 147 1,338

Intangible assets 3,589 4,149

Deferred tax assets 661 128

__________________________________________________________________________________________________________________

77,497 80,706

__________________________________________________________________________________________________________________

Current assets

Property inventories 126,950 75,693

Trade and other receivables 42,888 46,700

Cash and cash equivalents 26,958 8,591

__________________________________________________________________________________________________________________

196,796 130,984

__________________________________________________________________________________________________________________

Total assets 274,293 211,690

__________________________________________________________________________________________________________________

Non-current liabilities

Bank loans (64,339) (52,997)

Other payables (7,480) (7,000)

Deferred tax liabilities (1,863) (1,342)

__________________________________________________________________________________________________________________

(73,682) (61,339)

__________________________________________________________________________________________________________________

Current liabilities

Trade and other payables (34,094) (22,915)

Current tax liabilities (1,190) (875)

Bank overdrafts and loans (28,142) (25,969)

__________________________________________________________________________________________________________________

(63,426) (49,759)

__________________________________________________________________________________________________________________

Total liabilities (137,108) (111,098)

__________________________________________________________________________________________________________________

Net assets 137,185 100,592

__________________________________________________________________________________________________________________

Equity

Called up share capital 4,240 3,744

Share premium account 43,208 19,369

Capital redemption reserve 849 849

Merger reserve 8,386 8,386

Retained earnings 80,196 67,930

__________________________________________________________________________________________________________________

Equity attributable to equity holders of the parent 136,879 100,278

__________________________________________________________________________________________________________________

Minority interests 306 314

__________________________________________________________________________________________________________________

Total equity 137,185 100,592

__________________________________________________________________________________________________________________

Approved by the board and authorised for issue on 19 February 2008.

P A J Leech T G Walsh

Director Director

Notes

1. The financial information set out in this announcement does not constitute

the group's statutory financial statements for the years ended 31 October

2007 and 31 October 2006.

2. The financial information is extracted from the audited financial statements

of the group for the year ended 31 October 2007 which were approved by the

board of directors on 19 February 2008.

3. Earnings per ordinary share

The calculation of basic earnings per ordinary share is based on a profit of

�14,527,222 (2006: �24,283,312) and on 198,069,224 (2006: 187,218,824)

ordinary shares, being the weighted average number of shares in issue during

the period. The calculation of diluted earnings per ordinary share is based

on a profit of �14,527,222 (2006 profit: �24,283,312) and on 204,787,224

(2006: 190,055,289) ordinary shares, being the weighted average number of

shares in issue during the period adjusted to allow for the issue of shares

in relation to all performance related share awards.

4. Copies of this announcement are available, free of charge, for a period of

one month from Oriel Securities Limited, 125 Wood Street, London EC2V 7AN.

Copies of the full financial statements will be posted to shareholders as

soon as possible.

For further information please visit www.terracehill.co.uk or contact:

Philip Leech, Chief Executive Tel: 020 7631 1666

Luke Webster, Oriel Securities Tel: 020 7710 7600

Isabel Crossley, St Brides Media & Finance Ltd Tel: 020 7236 1177

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR FKFKNFBKDOBD

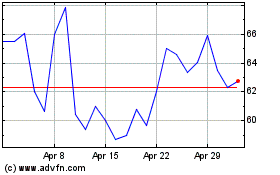

Thg (LSE:THG)

Historical Stock Chart

From Oct 2024 to Nov 2024

Thg (LSE:THG)

Historical Stock Chart

From Nov 2023 to Nov 2024