TIDMTIME

RNS Number : 2782X

Time Finance PLC

19 December 2023

19 December 2023

Time Finance plc

("Time Finance", the "Group" or the "Company")

Half Year Trading Statement

Notice of Interim Results and Investor Presentation

Ten consecutive quarters of growth in lending book; significant

increases in revenues and profits

Time Finance plc, the AIM listed independent specialist finance

provider, is pleased to provide a trading update in respect of the

Group's performance for the six-months ended 30 November 2023 ("H1

2023/24"). This update is in advance of the scheduled release of

the Group's full H1 2023/24 unaudited Interim Results on 25 January

2023 .

H1 2023/24 Highlights

-- Own-Book lending origination of GBP47.2m, an increase of 29% (H1 2022/23: GBP36.6m)

-- Lending-book continuing to grow, increasing 11% to GBP188.5m

since financial year-end (31 May 2023: GBP170.1m) and 23% from the

same date 12 months prior (30 November 2022: GBP152.7m)

-- Revenue of GBP15.7m, an increase of 19% (H1 2022/23: GBP13.2m)

-- Profit before Tax of GBP2.7m, an increase of 35% (H1 2022/23: GBP2.0m)

-- Net Arrears remain stable at 6% of the lending book (31 May 2023: 6%; 30 November 2022: 6%)

-- Net Tangible Assets continue to increase - up 6% to GBP36.4m

since financial year-end (31 May 2023: GBP34.2m) and 13% from 12

months prior (30 November 2022: GBP32.1m)

-- Continuing positive trading momentum, leading to expectation

of Group trading for the full year to be at least in line with

recently upgraded market guidance

The increase in revenue is attributable to the compounding

effect of continued growth in the size of the lending book. As a

key element of the Company's four-year strategic plan from June

2021 to May 2025, the increased size of the lending book is driven

by Invoice Finance and the 'Hard' subset of Asset Finance. These

two products, being typically larger ticket and more secured in

nature, have accounted for approximately 80% of new deal volume

originated in H1 2023/24, and make up over 70% of the total lending

book as at 30 November 2023.

Ed Rimmer, Chief Executive Officer commented:

"The Board and I are very encouraged by performance in the first

half of the current financial year. In line with our strategy, we

have continued to increase the size of our lending book and,

crucially, have done so without compromising on quality, as borne

out by the stable nature of our arrears. This approach has led to

increased revenues and profitability. We now have real confidence

that the Group is very well placed to continue on this growth

trajectory, building long-term value for our shareholders."

Notice of Interim Results and Investor Presentation

The Company is also pleased to announce that Ed Rimmer, CEO, and

James Roberts, CFO, will deliver a live presentation covering the

H1 2023/24 Interim Results via the Investor Meet Company platform

at 1pm on Thursday, 25 January 2023. This follows the publication

of the Interim Results earlier that same day.

The presentation is open to all existing and potential

shareholders. Questions can be submitted pre-event via the Investor

Meet Company dashboard up until 9am the day before the meeting or

at any time during the live presentation. Investors can sign up to

Investor Meet Company for free and add to meet Time Finance plc

via:

https://www.investormeetcompany.com/time-finance-plc/register-investor

. Investors who already follow Time Finance plc on the Investor

Meet Company platform will automatically be invited.

For further information, please contact:

Time Finance plc

Ed Rimmer, Chief Executive Officer 01225 474230

James Roberts, Chief Financial Officer 01225 474230

Cavendish Capital Markets Limited (NOMAD and Broker)

Ben Jeynes / Dan Hodkinson (Corporate Finance) 0207 220 0500

Michael Johnson / George Budd / Charlie Combe (Sales and

ECM)

Walbrook PR Limited

Paul Vann / Joe Walker 0207 9338780

timefinance@walbrookpr.com 07768 807631

About Time Finance :

Time Finance's purpose is to Help UK Businesses Thrive and

Survive through the provision of flexible funding facilities. It

offers a multi-product range for SMEs concentrating on Asset, Loan

and Invoice Finance. While focussed on being an 'own-book' lender,

the Group does retain the ability to broke-on deals where

appropriate, enabling it to optimize business levels through market

and economic cycles.

More information is available on the Company website:

www.timefinance.com .

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 as amended by

regulation 11 of the Market Abuse (Amendment) (EU Exit) Regulations

2019/310. Upon the publication of this announcement via Regulatory

Information Service, this inside information is now considered to

be in the public domain.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTUKSNROWUUARA

(END) Dow Jones Newswires

December 19, 2023 02:00 ET (07:00 GMT)

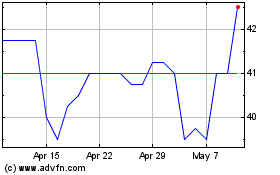

Time Finance (LSE:TIME)

Historical Stock Chart

From Oct 2024 to Nov 2024

Time Finance (LSE:TIME)

Historical Stock Chart

From Nov 2023 to Nov 2024