Value and Indexed Prop Inc Tst PLC Trading Statement (1546Z)

January 21 2022 - 1:00AM

UK Regulatory

TIDMVIN

RNS Number : 1546Z

Value and Indexed Prop Inc Tst PLC

21 January 2022

21 JANUARY 2022

VALUE AND INDEXED PROPERTY INCOME TRUST PLC

ACQUISITION OF FIVE INDEX-LINKED PROPERTIES FOR GBP30.5

MILLION

Value and Indexed Property Income Trust PLC ("VIP" or "the

Company"), the long, strong, indexed property income specialists,

announces the acquisition in Q4 2021 of five freehold index-linked

properties for a total cost of GBP30.5 million at a 5.6% net

initial yield (bringing the current total portfolio average yield

to 5.7%). VIP is now almost fully invested after its transition to

a predominantly Property Trust.

The five properties purchased were three industrial/warehouse

units in Chester, Stoke on Trent and Westbury, a petrol filling

station in Melton Mowbray and a supermarket in Newport, Isle of

Wight, all with index-linked leases and a WAULT of 10 years and let

to MKM Building Supplies, Arla Foods, BP Oil and Marks and Spencer.

The contracted rent on VIP's property portfolio (43 properties) is

now GBP7.99 million per year, up by 26.1% from 30 September 2021.

96% of all contracted rents are now index-linked or with fixed

increases (65% RPI-linked, 8% CPI-linked and 23% with fixed

increases) and the WAULT is 13 years.

These acquisitions have increased the property portfolio's

industrial weighting to 34% and supermarkets to 23%, with 14% in

pubs, 9% in roadside, 9% other, 6% in hotels and 5% in leisure.

As at 31 December 2021, the Company's total assets were 74.3% in

UK Property (59.8% September 2021), 17.9% UK Equities (16.5%

September 2021) and 7.8% Cash (23.8% September 2021), of which 3.3%

is committed for the completion of the new Premier Inn hotel

development in Alnwick in June 2022.

The property portfolio aims to deliver long term above average

real returns (benchmark MSCI Quarterly Property Index) from a well

spread portfolio mainly of commercial properties.

The Company is now negotiating to raise further long-term fixed

rate debt to deploy in similar index-linked property

acquisitions.

END

Enquiries:

OLIM Property Limited, Investment Manager

Tel: 020 7846 3252

Matthew.oakeshott@olimproperty.co.uk

Louise.cleary@olimproperty.co.uk

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTDBLFLLFLLBBB

(END) Dow Jones Newswires

January 21, 2022 02:00 ET (07:00 GMT)

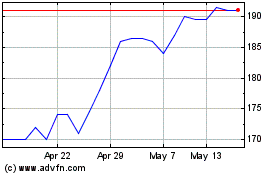

Value And Indexed Proper... (LSE:VIP)

Historical Stock Chart

From Apr 2024 to May 2024

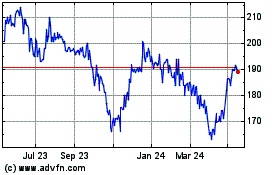

Value And Indexed Proper... (LSE:VIP)

Historical Stock Chart

From May 2023 to May 2024