TIDMWTI

RNS Number : 5171C

Weatherly International PLC

17 April 2013

Weatherly International Plc

Quarterly Operations and Production Update

Weatherly International Plc ("Weatherly" or "the Company"

AIM:WTI) is pleased to present its quarterly update for the third

quarter of its 2012/13 fiscal year.

Highlights

-- RK Capital's due diligence at Tschudi has been largely

completed, and the Company has been offered a revised term sheet

which it has accepted in principle. Loan documentation will be

subject to additional review of the Company's operations

-- The Tschudi front end engineering and design work has largely been completed

-- Major contracts with the four main consultants/contractors are being negotiated

-- The Tschudi environmental amendments were filed and are

progressing through the approval process as anticipated

-- A detailed operational review was completed at Central

Operations leading to a restructuring to bring costs into line with

revised production levels

-- Third quarter production from Central Operations was 67,833

tonnes of ore containing 4,948 tonnes of copper concentrate, for

copper production of 1,142 tonnes of copper metal, a decrease in

production over the previous quarter due to a series of one-off

events at the underground operations. Accordingly, Weatherly now

expects 2013 production of around 5,000 tonnes of copper

-- As a result of arbitration proceedings over Tambao being

discontinued, Wadi has paid Weatherly US$2million as full

reimbursement of expenses incurred on Wadi's behalf

-- Cash at the end of the quarter was US$7.2m

Rod Webster CEO of Weatherly commented:

"Weatherly is making significant strides towards becoming a

mid-tier copper producing company by the end of 2014. The Tschudi

Project is progressing and we are currently working with Red Kite

to finalise the outstanding requirements for the loan.

Operationally we have not delivered against our plans at the

Central Operations and during the quarter we completed a detailed

review of both our underground mines. As a result of our review, we

are now implementing a number of changes which will reduce our

costs in line with achievable production and ensure continuing cash

flow".

Tschudi Copper Project

RK Capital's due diligence at Tschudi has been largely

completed, and the Company has been offered a revised term sheet,

for the full funding of Tschudi US$88 million, which it has

accepted in principle. Loan documentation will be subject to

additional review of the Company's operations.

We continue to progress the project and are funding the initial

development through existing cash flow to avoid delays to the

project.

Front end engineering and design is largely complete and the

various tender packages and orders for long lead items are ready to

go as soon as funding has been finalised. Concurrently we have been

advancing contractual arrangements with the four main

consultants/contractors working on the Tschudi project.

The Ministry for Environment and Tourism is reviewing the

environmental amendments submitted last month and an external

consultant has been appointed by the Ministry to accelerate the

process in recognition of the importance of the project to

Namibia.

Central Operations

Opening Old Matchless

During the last quarter of 2012 the Weatherly Board approved a

work programme for the development of the Old Matchless Mine. Work

is proceeding and a new environmental assessment (EA) and

environmental management plan (EMP) have been submitted to the

Ministry of Environment & Tourism for the Matchless licence

area. Dewatering of the mine is on-going and power to the site is

being procured.

Under revised plans the Company intends to use existing crew and

equipment to advance the decline thus not incurring any incremental

costs. Work on the decline will commence as soon as the preparatory

works noted above are completed.

Opening of Old Matchless will result in increased production

from lower cost primary mining.

Production

Production results for the past four quarters are set out in the

table below.

Jun-12 Sep-12 Dec-12 Mar-13

Ore Treated (t) 85,153 87,645 79,330 67,833

Grade (%) 1.66 1.8 1.81 1.81

Recovery (%) 91.52 93.31 92.58 92.92

Copper concentrate (t) 5605 6499 5780 4,948

Copper contained (t) 1292 1470 1328 1,142

During the quarter, a significant ground subsidence occurred in

the upper levels of the Otjihase compartment, unfortunately

resulting in a decision to abandon the area. Inspections and

monitoring permitted the controlled withdrawal of personnel several

days before the event occurred, so avoiding any risk of injury.

With the loss of future production from this area, the Company

has revised the Otjihase mine plan, bypassing the conveyor system

to improve efficiencies and restructured the contractual

arrangements currently in place. Under the new arrangements

Weatherly has agreed to the appointment by the contractor of a new

Otjihase management team with extensive international experience in

successfully turning around safety and production performance to

achieve best practice.

While these changes are bedding down we expect Central

Operations to produce at around the recent rate of 5,000 tonnes of

copper per annum. Further production uplift is expected when a new

compartment (Hoffnung West) becomes available to replace the ore

blocks lost through subsidence, and, in the longer term, from Old

Matchless.

Very regrettably, an employee of our mining contactors at

Matchless was electrocuted while attending a pump. The fatality

caused a temporary shutdown of Matchless, while an independent

audit of all electrical installations was undertaken, and the

incident is currently under investigation by the Chief Inspector of

Mines in Namibia. Meanwhile, the mine is operating normally.

Commercial

During the quarter, the Company delivered 1,226 tonnes of copper

contained in 5,938 tonnes of concentrate to metal trader Louis

Dreyfus at a weighted average price of US$ 7,743 /t (US$3.51 /lb)

copper. The Company continues its policy of forward selling a

proportion of its production up to 18 months ahead.

The cash cost (C1) for the quarter was US$7,344 (US$3.33 /lb)

while the year the date cost was U$6,238 (US$2.83 /lb). The

unusually high cash cost for the quarter was a consequence of the

abandonment of the Otjihase compartment, the restructuring of the

contractual arrangements and the loss of production associated with

the fatality at Matchless. This cost is expected to be reduced once

the operational changes referred to earlier take effect.

As at 31 March 2013, the Company had:

(1) Cash at bank of US$7.2m equivalent

(2) Reduced its working capital loan with Louis Dreyfus to

US$4.1m, having made loan repayments of US$0.3m in the quarter

(3) Forward contracts over 3,100 tonnes copper at an average price of US$7,965/t (US$ 3.61 /lb)

Burkina Faso

Wadi and the Government of Burkina Faso (GBF) have settled their

dispute with respect to the Tambao manganese deposit. Wadi entered

into an agreement with GBF in April 2007. In June 2007, Wadi

engaged Weatherly to complete a feasibility study on the Tambao

Project. Wadi submitted it to Burkina Faso in September 2008.

A dispute arose between Wadi and the GBF regarding the rights

over the deposit, which was submitted in April 2011 for resolution

by a tribunal constituted under the auspices of the International

Court of Arbitration of the International Chamber of Commerce.

This dispute has now been settled and Wadi has agreed to

discontinue the arbitration. As a result Wadi has paid Weatherly

US$2million as full reimbursement of expenses incurred on Wadi's

behalf.

About Weatherly

Weatherly is an AIM listed, copper focused mining company, the

principal assets of which are located in Namibia. It currently has

two producing copper mines (Otjihase and Matchless), and has

recently completed a bankable feasibility study over the Tschudi

Copper Project. These assets will enable Weatherly to achieve its

medium term strategy of establishing a copper mining business

capable of sustaining approximately 25,000tpa of copper at an

average industry cost of production.

The Company also has a 25% stake in an AIM listed company, China

Africa Resources Plc (CAF), which is currently focused on the

development of the lead/zinc project at Berg Aukas in Northern

Namibia.

For further information please contact:

Weatherly International Plc +44 (0) 20 7917 2989

Rod Webster, Chief Executive Officer

Canaccord Genuity Limited +44 (0) 20 7523 8000

Andrew Chubb / Andrei Kroupnik

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCBRGDSLXBBGXL

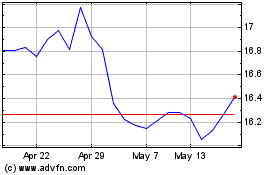

Wti Oil Etc (LSE:WTI)

Historical Stock Chart

From Jun 2024 to Jul 2024

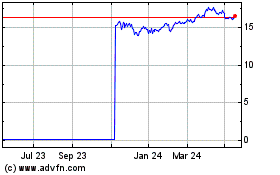

Wti Oil Etc (LSE:WTI)

Historical Stock Chart

From Jul 2023 to Jul 2024