TIDMZIOC

RNS Number : 0732O

Zanaga Iron Ore Company Ltd

29 September 2023

29 September 2023

INTERIM RESULTS FOR THE SIX MONTHSED 30 JUNE 2023

Zanaga Iron Ore Company Limited ("ZIOC" or the "Company") (AIM:

ZIOC) is pleased to announce its unaudited interim results for the

six months ended 30 June 2023 and an update on post reporting

period end events to 28 September 2023.

Highlights

Corporate strategy

-- Corporate strategy approved by the ZOIC Board of Directors,

focused on leveraging recent discussions with potential partners in

order to progress the Zanaga Project through positive defined

milestones

-- Key milestone objectives through to the end of Q1 2024 include:

o Feasibility Study update - End 2023

o Hydro power partnership - Q1 2024 (Memorandum of

Understanding)

o Port partnership - Q1 2024 (Memorandum of Understanding)

o Strategic partner initiative - Q1 2024 (Memorandum of

Understanding)

Zanaga Iron Ore Project (the "Project" or the "Zanaga

Project")

-- Partnership launched with Chinese iron ore technical expert

engineering firm ("Chinese EPC Partner") as part of a two stage

optimisation process of the Zanaga 30Mtpa staged development

project.

o Phase 1 - Feasibility Study update (the "FS Update")

-- 2014 Feasibility Study cost estimates to be updated to

current market pricing using Chinese contractor pricing for both

phases of 12Mtpa Stage One ("Stage One"), plus 18Mtpa Stage Two

expansion ("Stage Two") projects.

-- Chinese EPC Partner possesses specific, specialised, design

and construction expertise in slurry pipeline projects as well as

iron ore pellet feed concentrate projects similar to that proposed

at the Zanaga Project.

-- Initial guidance provided by the Chinese EPC Partner is that

potential capital and operating cost savings of more than 20% could

be achieved.

-- The results of this exercise are expected to be received in

Q4 2023.

o Phase 2 - Processing technology application study

-- Chinese EPC Partner possesses a proprietary new processing

technology for iron ore processing, with the potential to provide

further capital and operating cost savings beyond the results of

the FS Update.

-- The application of this processing technology to the iron ore

from the Zanaga Project is planned to undergo technical assessment

as initial results from the FS Update are received in the coming

months.

-- Port infrastructure discussions underway

o Discussions are in progress with a large port infrastructure

development firm, including consideration of:

-- Opportunity for expansion of the existing port of

Pointe-Noire.

-- Potential development solutions for a large bulk mineral port

capable of supporting the Zanaga 30Mtpa staged development

project.

-- Early Production Project ("EPP Project" or "EPP")

o Multiple production scenarios remain under investigation on

processing facilities and suitable logistics solutions, with a

particular focus on an export solution through the Republic of

Congo ("RoC").

Funding

-- Shard Merchant Capital Ltd ("SMC") equity subscription agreements ("Shard ESAs").

o Original SMC equity subscription agreement (ESA) fully

completed ("2020 ESA").

-- In 2022 SMC subscribed for 7 million shares of no par value

in ZIOC, as part of the final tranche of the 21 million ordinary

share facility signed in 2020.

-- Total proceeds of GBP1,318,126.12 were received from the

facility, following the placement of the final 7,000,000 tranche

shares by SMC in 2022.

o New ESA signed with SMC on 1 July 2023 ("2023 ESA").

-- Following the successful completion of the 2020 ESA, ZIOC has

entered into the 2023 ESA with SMC.

-- Under the terms of the 2023 ESA the Company will issue and

SMC will subscribe for up to 36 million ordinary shares of no par

value in the Company ("Subscription Shares") in up to three

tranches of up to 12 million shares each.

-- Pursuant to the 2023 ESA, SMC has undertaken to use its

reasonable endeavors' to place the relevant Subscription Shares

that it has subscribed for and to pay to ZIOC 95% of the gross

proceeds of any such sales.

o Proceeds of the Shard ESAs applied to general working capital,

including the provision of further contributions to the Zanaga

Project's operations.

-- Cash balance of US$0.6m as at 30 June 2023 and cash balance of US$0.5m as at 31 August 2023.

o Current available cash on hand is expected to cover ZIOC's

corporate overheads until end Q1 2024 assuming an extension of the

term of the current facility from Glencore which is currently due

to be repaid on 31 December 2023, with current SMC facility

placement expected to extend ZIOC working capital into Q3 2024

following that extension.

-- Annual General Meeting to be held in November 2023, with the

requisite notice to be sent to shareholders in due course.

Clifford Elphick, Non-Executive Chairman of ZIOC, commented:

"During the first half of 2023, ZIOC launched a process with its

Chinese EPC Partner to secure Chinese contractor pricing and to

update the cost estimates of the 30Mtpa Feasibility Study, while

also considering the application of new iron ore processing

technology to reduce estimated costs further. This is a completely

different exercise to the study work conducted by consulting firms

in the past, as the Chinese EPC Partner is a constructor and

developer of iron ore mining projects, with specific expertise in

slurry pipelines and pellet feed concentrate processing. We look

forward to concluding the process by year end.

Furthermore, port infrastructure discussions are underway with a

large port infrastructure development firm seeking to expand the

existing port of Pointe-Noire. Consideration is also being given to

potential development solutions for a large bulk mineral port

capable of supporting the 30Mtpa staged development project.

Following the acquisition of full ownership and control of the

Zanaga Project we are now engaging with strategic entities

interested in participating in the Zanaga Project, and intend on

securing a selected partner by the end of Q1 2024".

Copies of the unaudited interim results for the six months ended

30 June 2022 are available on the Company's website at

www.zanagairon.com

The Zanaga Iron Ore Company Limited LEI number is

21380085XNXEX6NL6L23.

For further information, please contact:

Zanaga Iron Ore

Corporate Development and Andrew Trahar

Investor Relations Manager +44 20 7399 1105

Liberum Capital Limited

Nominated Adviser, Financial Scott Mathieson, Kane Collings

Adviser and Corporate Broker +44 20 3100 2000

About us:

Zanaga Iron Ore Company Limited ("ZIOC" or the "Company") (AIM

ticker: ZIOC) is the owner of the Zanaga Iron Ore Project based in

the Republic of Congo (Congo Brazzaville) through its subsidiary

Jumelles Limited. The Zanaga Iron Ore Project is one of the largest

iron ore deposits in Africa and has the potential to become a

world-class iron ore producer.

Business Review - Operations

Chinese EPC contractor engagement

ZIOC has entered into an engagement with a Chinese EPC partner

with substantial experience in the design, engineering and

construction management of large iron ore projects. The Chinese EPC

contractor possesses specific, specialised, design and construction

expertise in slurry pipeline projects as well as iron ore pellet

feed concentrate projects similar to the Zanaga Project.

The process involves a two stage project optimisation work

programme.

The initial FS Update will involve updating the 2014 Feasibility

Study cost estimates to current market pricing using Chinese

contractor pricing for both phases of the 30Mtpa staged development

project, including both 12Mtpa Stage One, plus 18Mtpa Stage Two

expansion.

The Chinese EPC has initially guided that cost savings of more

than 20% could be available through the utilisation of Chinese

construction contractor firms capable of building the Zanaga

Project utilising lower cost construction solutions than

traditional Western EPC firms would typically be able to

provide.

The results of this exercise are expected to be received in Q4

2023.

The second phase of work will involve investigating the

potential to apply proprietary iron ore processing technology that

the Chinese EPC Partner possesses, with the potential to provide

further capital and operating cost savings beyond the results of

the FS Update.

The application of this processing technology to the iron ore

from the Zanaga Project is planned to undergo technical assessment

as initial results from the FS Update are received in the coming

months.

Port infrastructure discussions underway

Discussions are in progress with a large port infrastructure

development firm to investigate opportunities to align the Zanaga

Project with their planned port infrastructure facilities in

Pointe-Noire. Consideration is being given to both of the following

port infrastructure initiatives:

-- Opportunity for expansion of the existing port of

Pointe-Noire, potentially enabling a larger solution for the EPP

Project.

-- Potential development solutions for a large bulk mineral port

terminal capable of supporting the Zanaga 30Mtpa staged development

project.

Corporate Strategy approved

The ZIOC Board of Directors and management have determined

specific milestones and objectives until the end of Q1 2024. This

strategy intends to leverage recent discussions with potential

partners in order to progress the Zanaga Project through specific

work programs to derisk the project and enable the financing and

ultimately the construction of the project in due course. These

items are outlined below:

-- Feasibility Study update - End 2023 (See section below for further information)

-- Hydro power partnership - Q1 2024 (Memorandum of Understanding)

o The Zanaga project team have been working with a number of

hydro power infrastructure development partners and construction

companies to evaluate potential sites for hydro-power projects

capable to providing power to the 30Mtpa Project as well as the

EPP. A number of these firms have expressed an interest in

developing such power solutions, and a memorandum of understanding

for the evaluation of potential hydro power solutions with a

selected power partner for the Zanaga Project is targeted for Q1

2024.

-- Port partnership - Q1 2024 (Memorandum of Understanding)

o Port infrastructure discussions are underway with a large port

infrastructure development firm seeking to expand the existing port

of Pointe-Noire. Consideration is also being given to potential

development solutions for a large bulk mineral port capable of

supporting the 30Mtpa staged development project.

o A memorandum of understanding with a large port infrastructure

development firm for the port infrastructure is targeted for Q1

2024.

-- Strategic partner initiative - Q1 2024 (Memorandum of Understanding)

o Following the completion of the acquisition of Glencore's

shareholding in the Zanaga Project, ZIOC Early stage strategic

partner discussions are underway and a memorandum of understanding

with a selected partner is targeted for Q1 2024.

Iron Ore Market

The iron ore market has been relatively stable in recent months,

providing a positive backdrop for sustained pricing at these

levels. China continues to consume significant quantities of iron

ore to feed its substantial steel industry. Furthermore, given the

current geopolitical environment, we believe that increased

resource independence will provide impetus to strategic investors

in China and outside of China to secure access to globally

significant assets, especially outside Australia and Brazil - for

Chinese investors. The Zanaga Project therefore has the potential

to deliver substantial iron ore production to strategic customers

looking to secure positions in the commodity.

Subscription Agreement with Shard Merchant Capital Ltd

The Company has been pleased with the success of the 2020 ESA

with SMC which has provided the Company with access to funding

through a relatively low cost structure that minimised dilution to

shareholders.

The proceeds received by the Company from SMC pursuant to the

Subscription Agreement have been applied to general working

capital, including the provision of further contributions to the

Zanaga Project's operations.

As a result, the Company has entered into a new 2023 ESA with

SMC on 1 July 2023, post period end. An overview of the two ESAs is

provided below:

1) 2020 ESA

a. As previously announced, on 26 June 2020 ZIOC announced that

the Company had entered into a Subscription Agreement with SMC, a

financial services provider.

b. Under the Subscription Agreement, and over the course of 2020

to 2022, the Company issued and SMC subscribed for 21 million

ordinary shares of no par value in the Company ("Subscription

Shares") in three tranches of 7 million shares each (First tranche

in 2020 and the subsequent tranches in 2021 and 2022).

c. During 2022, the final 7,000,000 ordinary shares in the

Company were placed by SMC. As a result of such transactions, as at

28 June 2023, all of the 21,000,000 ordinary shares in the Company

had been placed and the Company had received the aggregate net sum

of GBP1,318,126.12.

2) 2023 ESA

a. As announced by the Company, on 1 July 2023 the Company

entered into a new Subscription Agreement (the 2023 ESA) with

SMC.

b. Under the Subscription Agreement, the Company will issue and

SMC will subscribe for 36 million ordinary shares of no par value

in the Company ("Subscription Shares") in three tranches of 12

million shares each (the First tranche was issued immediately on 1

July 2023).

Cash Reserves and Project Funding

As at 29 June 2023, ZIOC has outlined a 2023 Project Work

Programme and Budget as outlined below.

At 30 June 2023 the Company had cash reserves of US$0.6m The

Company had cash reserves of US$0.5m as at 31st August 2023.

In order to raise additional funding the Company entered a

Subscription Agreement with SMC (as described above). The financing

structure with SMC enables the Company to access funding for the

costs that the Company is expected to meet in the near future. For

illustrative purposes only, if the average price at which SMC

places the 36,000,000 shares was 4.67 pence (being ZIOC's 90 day

value weighted average share price as at 28 September 2023), the

net proceeds received by ZIOC from such sales would be

approximately GBP1.60m. Based on the current cost base at the

Zanaga Project, the direct loan facility to Jumelles Ltd, the

current low corporate overheads of ZIOC, the agreed cash

preservation plan adopted by the Company (described below), the

Company's existing cash reserves and (on the basis of cautious

assumptions made by the Company in its funding model) the funds

expected to be obtained from the funding facility established by

the Subscription Agreement with SMC, the board of directors of ZIOC

(the "Board") believes that the Company will be adequately

positioned to support its operations going forward in the near

future. As the final cash amounts to be received for each tranche

of issued shares, and the timing of this receipt, are dependent on

SMC successfully selling the shares prior to transferring funds to

the Company, the Board is of the view that the going concern basis

of accounting is appropriate. However, the Board acknowledges that

there is a material uncertainty which could give rise to

significant doubt over the Company's ability to continue as a going

concern and, therefore, that the Company may be unable to realise

its assets and discharge its liabilities in the normal course of

business. Nevertheless, based on and taking into account the

foregoing factors, the Board are satisfied the Company will have

sufficient funds to meet its own working capital requirements up

to, and beyond, twelve months from the approval of these

accounts.

The Company continues to review the costs of its operational

activities with a view to conserving its cash resources. As part of

such review, and in order to preserve the cash position of the

Company, it has been agreed with the Directors (since January 2019)

and Management (since September 2019) that fees previously deferred

would be reviewed. As of today, discussions with management

continue and a resolution is expected to be reached imminently

through the issue of shares in consideration of part of this

deferred consideration.

Financial review

Results from operations

The financial statements contain the results for ZIOC for the

first half of 2023. ZIOC made a loss in the half-year of US$0.4m

compared to a gain of US$8.1m in the full year ended December 2022.

The loss for the 2023 half-year period comprised:

1 January to 1 January to 1 January to

30 June 30 June 31 December

2023 2022 2022

Unaudited Unaudited Audited

US$000 US$000 US$000

-------------------------------------------------------------------------- -------------- ------------ ------------

General expenses (350) (160) (516)

Net foreign exchange (loss)/gain - (32) -

Share of loss of associate - (334) (436)

Gain on revaluation of investment - - 9,050

------------

(Loss)/Gain before tax (350) (526) 8,098

Reclassification of share of other comprehensive (loss) / income of

associate - - (3,447)

Share of other comprehensive income of associate - foreign exchange - 37 61

-------------------------------------------------------------------------- -------------- ------------ ------------

Total Comprehensive income (350) (489) 4,712

-------------------------------------------------------------------------- -------------- ------------ ------------

General expenses of US$0.4m (2022: US$0.2m), consisting of:

Directors' fees of US$Nil (2022: US$Nil), professional fees of

US$Nil (2022: US$Nil), LTIP charge of US$Nil (2022 US$0.1m) and

US$0.4m (2022: US$0.1m) of other general operating expenses.

Financial position

ZIOC's net asset value ("NAV") of US$84.9m is comprised of a

US$85.3m exploration and evaluation assets, US$0.7m of PPE, US$0.6m

of cash balances and US$1,8m net current liabilities.

30 June 2023 30 June 2022 31 December 2022

Unaudited Unaudited Audited

US$ m US$ m US$m

--------------------------------------- ------------ ------------ ----------------

Investment in associate - 37.1 -

Exploration and Evaluation 85.3 - 85.3

PPE 0.7 - 0.7

Cash 0.6 0.3 0.3

Other net current assets/(liabilities) (1.7) 0.1 (1.1)

--------------------------------------- ------------ ------------ ----------------

Net assets 84.9 37.5 85.2

--------------------------------------- ------------ ------------ ----------------

Cash flow

Cash balances have increased by US$0.3m since 31 December 2022.

Operating activities were US$0.5m and the Glencore loan increased

by US$0.8m.

30 June 2023 30 June 2022 31 December 2022

Unaudited Unaudited Audited

US$000 US$000 US$000

------------------------------ ------------ ------------ ----------------

GBP Balances 0.1 0.2 0.2

USD value of GBP balances 0.2 0.3 0.2

USD value of other currencies 0.3 - 0.1

USD balances 0 .1 - -

------------------------------ ------------ ------------ ----------------

Cash Total 0.6 0.3 0.3

------------------------------ ------------ ------------ ----------------

Consolidated Statement of Comprehensive Income for the six

months ended 30 June 202 3

1 January 1 January 1 January

to to to

30 June 30 June 31 December

2023 2022 2022

Unaudited Unaudited Audited

Note US$000 US$000 US$000

Gain on revaluation of investment - - 9,050

Administrative expenses (350) (192) (516)

Share of (loss)/profit associate - (334) (436)

------------------------------------------------- ---- ---------- ---------- ------------

Operating loss (350) (526) 8,098

(Loss) before tax (350) (526) 8,098

Taxation 5 - -

------------------------------------------------- ---- ---------- ---------- ------------

(Loss) for the period (350) (526) -

Reclassification of share 0f other comprehensive

income / (loss of associate) -` - (3,447)

Share of other comprehensive (loss)/income

of associate - foreign exchange translation - 37 61

------------------------------------------------- ---- ---------- ---------- ------------

Other comprehensive (loss)/gain - 37 (3,386)

------------------------------------------------- ---- ---------- ---------- ------------

Total comprehensive (loss)/gain (350) (489) 4,712

------------------------------------------------- ---- ---------- ---------- ------------

(Loss)/Earnings per share (Cents)

Basic 7 (0.1) (0.2) 0.3

Diluted 7 (0.1) (0-2) 0.3

All other comprehensive income may be classified as profit and

loss in the future.

Consolidated Statement of changes in equity

for the six months ended 30 June 2023

Foreign

currency

Share Retained translation Total

capital earnings reserve Equity

US$000 US$000 US$000 US$000

-------------------------------------------------------- ------- ---------- ----------- -------

Balance at 1 January 2022 270,935 (236,516) 3,317 37,736

-------------------------------------------------------- ------- ---------- ----------- -------

Consideration for share-based payments - other services 82 - - 82

Issued Capital - - - -

Loss for the period - (525) - (525)

Other comprehensive (loss)/ income - - 37 37

-------------------------------------------------------- ------- ---------- ----------- -------

Total comprehensive (loss)/income - (525) 37 (406)

-------------------------------------------------------- ------- ---------- ----------- -------

Balance at 30 June 2022 271,017 (237,041) 3,354 37,730

-------------------------------------------------------- ------- ---------- ----------- -------

Consideration for share-based payments - other services 81 - - 81

Issued Capital 42,591 - - 42,591

P rofit for the period - 8,623 - 8,098

Other comprehensive (loss)/income - - (3,423) (3,423)

-------------------------------------------------------- ------- ---------- ----------- -------

Total comprehensive (loss)/income 8,623 (3,423) 5,200

-------------------------------------------------------- ------- ---------- ----------- -------

Balance at 31 December 2022 313,689 (228,418) (69) 85,202

-------------------------------------------------------- ------- ---------- ----------- -------

Consideration for share-based payments - other services - - - -

Issue of shares - - - -

Loss for the period - (350) - (350)

Other comprehensive (loss)/income - - - -

-------------------------------------------------------- ------- ---------- ----------- -------

Total comprehensive loss - (350) - (350)

-------------------------------------------------------- ------- ---------- ----------- -------

Balance at 30 June 2023 313,689 (228,768) (69) 84,852

-------------------------------------------------------- ------- ---------- ----------- -------

Consolidated Balance sheet

as at 30 June 2023

30 June 31 December

30 June 2022 2022

2023 Unaudited Unaudited Audited

Note US$000 US$000 US$000

----------------------------------------- ---- --------------- ---------- -----------

Non-current asset

Exploration and evaluation assets 85,300 - 85,300

Property, plant and equipment 696 - 703

Investment in associate 6 - 37,067 -

----------------------------------------- ---- --------------- ---------- -----------

85,996 37,067 86,003

----------------------------------------- ---- --------------- ---------- -----------

Current assets

Other receivables 44 157 113

Cash and cash equivalents 573 250 310

----------------------------------------- ---- --------------- ---------- -----------

617 407 423

----------------------------------------- ---- --------------- ---------- -----------

Total Assets 86,613 37,473 86,426

----------------------------------------- ---- --------------- ---------- -----------

Non -current liabilities

Lease liability 105 - 104

Current liabilities

Loans and borrowings 1,185 - 385

Trade and other payables 465 (144) 724

----------------------------------------- ---- --------------- ---------- -----------

Lease liability 5 11

----------------------------------------- ---- --------------- ---------- -----------

Net assets 84,853 37,330 85,202

----------------------------------------- ---- --------------- ---------- -----------

Equity attributable to equity holders of

the parent

Share capital 313,689 271,017 313,689

Retained earnings (228,767) (237,041) (228,418)

Foreign currency translation reserve (69) 3,354 (69)

----------------------------------------- ---- --------------- ---------- -----------

Total equity 84,853 37,330 85,202

----------------------------------------- ---- --------------- ---------- -----------

These financial statements were approved by the Board of

Directors on 30 September 2023.

Consolidated Cash flow statement

for the six months ended 30 June 2022

1 January 1 January 1 January

to to To

30 June 30 June 31 Dec

2022 2021 2021

Unaudited Unaudited Audited

US$000 US$000 US$000

------------------------------------------------- ---------- ---------- ---------

Cash flows from operating activities

Profit/(Loss) for the year (350) (526) 8,098

Adjustments for:

Share based payments - 82 163

Gain on revaluation of investment in associate - - (9,050)

Decrease in other receivables 69 76 130

Increase in trade and other payables 536 (9) 126

Net exchange (profit)/loss - 32 -

Share of Total Comprehensive income of associate - 334 436

Net cash from operating activities 255 (11) (97)

Cash flows from financing activities

Issue of shares - - -

Net cash from financing activities - - -

------------------------------------------------- ---------- ---------- ---------

Cash flows from investing activities

Interest received - - -

Acquisition of property, plant and equipment - -

Investment in associate - (95) (95)

Net cash from investing activities - (95) (95)

Net i ncrease in cash and cash equivalents 255 (106) (192)

Cash and cash equivalents at beginning of period 310 387 387

Acquired as acquisition of assets - - 115

-------------------------------------------------- ---------- ---------- ---------

Effect of exchange rate difference 8 (31) -

-------------------------------------------------- ---------- ---------- ---------

Cash and cash equivalents at end of period 573 250 310

-------------------------------------------------- ---------- ---------- ---------

Notes to the financial statements

1. Business information and going concern basis of

preparation

As at 29 June 2023, ZIOC has outlined a 2023 Project Work

Programme and Budget as outlined below.

At 30 June 2023 the Company had cash reserves of US$0.6m The

Company had cash reserves of US$0.5m as at 31st August 2023.

In order to raise additional funding the Company entered a

Subscription Agreement with SMC (as described above). The financing

structure with SMC enables the Company to access funding for the

costs that the Company is expected to meet in the near future. For

illustrative purposes only, if the average price at which SMC

places the 36,000,000 shares was 4.67 pence (being ZIOC's 90 day

value weighted average share price as at 28 September 2023), the

net proceeds received by ZIOC from such sales would be

approximately GBP1.60m. Based on the current cost base at the

Zanaga Project, the direct loan facility to Jumelles Ltd, the

current low corporate overheads of ZIOC, the agreed cash

preservation plan adopted by the Company (described below), the

Company's existing cash reserves and (on the basis of cautious

assumptions made by the Company in its funding model) the funds

expected to be obtained from the funding facility established by

the Subscription Agreement with SMC, the board of directors of ZIOC

(the "Board") believes that the Company will be adequately

positioned to support its operations going forward in the near

future. As the final cash amounts to be received for each tranche

of issued shares, and the timing of this receipt, are dependent on

SMC successfully selling the shares prior to transferring funds to

the Company, the Board is of the view that the going concern basis

of accounting is appropriate. However, the Board acknowledges that

there is a material uncertainty which could give rise to

significant doubt over the Company's ability to continue as a going

concern and, therefore, that the Company may be unable to realise

its assets and discharge its liabilities in the normal course of

business. Nevertheless, based on and taking into account the

foregoing factors, the Board are satisfied the Company will have

sufficient funds to meet its own working capital requirements up

to, and beyond, twelve months from the approval of these

accounts.

The Company continues to review the costs of its operational

activities with a view to conserving its cash resources. As part of

such review, and in order to preserve the cash position of the

Company, it has been agreed with the Directors (since January 2019)

and Management (since September 2019) that fees previously deferred

would be reviewed. As of today, discussions with management

continue and a resolution is expected to be reached imminently

through the issue of shares in consideration of part of this

deferred consideration.

2. Accounting policies

The principal accounting policies applied in the preparation of

these financial statements are set out below. These policies have

been consistently applied to all the periods presented, unless

otherwise stated.

3. Basis of preparation

The condensed set of financial statements has been prepared in

accordance with IAS 34 Interim Financial Reporting as adopted by

the EU.

In accordance with the AIM Rules for Companies, the condensed

set of financial statements has been prepared in applying the

accounting policies and presentation that were applied in the

preparation of the Company's published consolidated financial

statements for the year ended 31 December 2021. The comparative

figures for the financial year ended 31 December 2021 are not the

Company's statutory accounts for that financial year. The 2021

accounts have been reported on by the Company's auditors. The

report of the auditors was (i) unqualified and (ii) did not include

a reference to any matter to which the auditors drew attention by

way of emphasis without qualifying their report.

Up until 30 April 2014, the Company accounted for 100% of the

Jumelles group Comprehensive Income. From May 2014, as a result of

completion of the Feasibility Study (note 1 above) and thus

consideration to complete the Call Option, the Company has

accounted for 50% less one share shareholding portion of that

Comprehensive Income.

4. Segmental reporting

The Company has one operating segment, being its investment in

the Zanaga Project, held through Jumelles. Financial information

regarding this segment is provided in note 6.

5. Taxation

The Company is exempt from most forms of taxation in the British

Virgin Islands ("BVI"), provided the Company does not trade in the

BVI and does not have any employees working in the BVI. All

dividends, interest, rents, royalties and other expense amounts

paid by the Company, and capital gains realised with respect to any

shares, debt obligations or other securities of the Company, are

exempt from taxation in the BVI.

The effective tax rate for the Group is 0.00% (December 2022:

0.00%).

6. Investment in associate

US$000

---------------------------------------------------------- --------

Balance at 1 January 2022 37,269

Additions 95

Share of comprehensive loss (297)

---------------------------------------------------------- --------

Balance at 30 June 2022 37,067

---------------------------------------------------------- --------

Share of comprehensive loss (139)

Share of currency translation reserve 61

Disposal - on account of acquisition of controlling stake (36,998)

Balance at 31 December 2022 -

---------------------------------------------------------- --------

On 16 December 2022, the Company acquired the remaining stake in

Jumelles from Glencore, thereby gaining control, with 100% stake in

Jumelles. The consideration for this acquisition was made by

issuing ordinary shares of the Company.

30 June 30 June

2023 2022 31 December 2022

Unaudited Unaudited Audited

7. Loss per share US$000 US$000 US$000

----------------------------------------------------------- ---------- ---------- ----------------

Profit/(Loss) (Basic and diluted) (US$000) (350) (526) 8,098

Weighted average number of shares (thousands)

Basic and diluted

Issued shares at beginning of period 593,374 307,034 307,034

Shares issued during the year - - 286,340

Weighted average of new shares issued - - 11,767

Weighted average number of shares at end of period - basic 593,374 307,034 318,801

----------------------------------------------------------- ---------- ---------- ----------------

(Loss)/Earnings per share (Cents)

Basic (0.1) (0.2) 0.3

Diluted (0.1) (0.2) 0.3

----------------------------------------------------------- ---------- ---------- ----------------

8. Related parties

The following transactions occurred with related parties during

the period:

Transactions for the period Closing balance

---------- ----------------------------- ----------- -----------------------

30 June 30 June 31 December 30 June 30 June 31 December

2023 2022 2022 2023 2022 2022

Unaudited Unaudited Audited Unaudited Unaudited Audited

US$000 US$000 US$000 US$000 US$000 US$000

----------------------------------- ---------- ------------- -------------- ----------- ---------- -----------

Funding:

Loan from Glencore to Jumelles Ltd

* 800 - 385 1,185 - 385

----------------------------------- ---------- ------------- -------------- ----------- ---------- -----------

* Repayable on 31 December 2023

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR NKFBBOBKDKCB

(END) Dow Jones Newswires

September 29, 2023 02:00 ET (06:00 GMT)

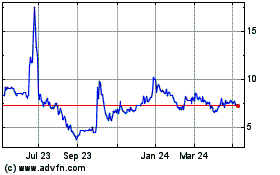

Zanaga Iron Ore (LSE:ZIOC)

Historical Stock Chart

From Mar 2024 to Apr 2024

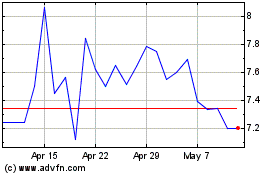

Zanaga Iron Ore (LSE:ZIOC)

Historical Stock Chart

From Apr 2023 to Apr 2024