State Street Corporation (NYSE: STT) and Mizuho Financial Group,

Inc. (President & Group CEO: Masahiro Kihara) today announced

they have entered into an agreement for State Street to acquire

Mizuho’s global custody and related businesses outside of Japan.

These businesses support the overseas investments of Mizuho’s

Japanese clients.

Mizuho currently operates its global custody and related

business outside of Japan through its local subsidiaries Mizuho

Trust & Banking (Luxembourg) S.A., owned by Mizuho Trust &

Banking Co., Ltd., and Mizuho Bank (USA), a wholly-owned subsidiary

of Mizuho Bank, Ltd. Both of these entities represent combined

assets under custody of approximately US$580 billion and US$24

billion in assets under administration1.

After this transaction, Mizuho will leverage its expertise and

network as one of Japan’s largest financial institutions to

continue providing Japanese clients with trust and custody services

for their domestic assets and will collaborate with State Street

for global custody and related services.

“Japan, Luxembourg and the United States are all important

markets to State Street. This transaction demonstrates our strong

commitment to further accelerating our growth in these markets,”

said Stefan Gmür, head of Asia Pacific and head of Strategic

Business Growth at State Street. “Mizuho’s decision to entrust

State Street with their valued clients affirms their confidence in

our high-quality client service, industry-leading capabilities and

commitment to product innovation and technology investment. With 35

years of experience on the ground in both Japan and Luxembourg, and

our long history in the United States, State Street is well

positioned to support Mizuho clients’ global growth and business

transformation.”

“In today's increasingly complex investment landscape, clients

require global custody providers with significant scale and

expertise,” said Tsutomu Yamamoto, senior executive officer, head

of Global Transaction Banking Unit at Mizuho. “After careful

consideration, we have decided to transfer our global custody

business to State Street, a recognized leader with a

long-established presence in Japan. This strategic move will ensure

our clients benefit from State Street's global platform and deep

expertise.”

“Having deep familiarity with the requirements and expectations

of Japanese institutional investors, we look forward to meeting

their needs not only in global custody but also data management,

risk and performance analytics, currency management and securities

finance,” said Hiroshi Kobayashi, head of Japan at State Street.

“We expect to provide a seamless transition for Mizuho’s clients.

As the acquired business integrates into our global operating

model, we expect the added scale will allow us to further expand

our technology and service capabilities, which will enhance the

service experience for our existing and new clients in Japan.”

The transaction is expected to be completed by Q4 2025, subject

to the regulatory approvals and other closing conditions.

State Street established its business in Japan more than 35

years ago. With an experienced team of more than 500 employees in

Japan, split between locations in Tokyo and Fukuoka, State Street

provides Japanese institutional investors with a comprehensive

suite of services including trust, global custody, middle/back

office outsourcing, data management, trading and financing

solutions. State Street has an operational centre of excellence in

Fukuoka which has been supporting clients in Japan and across Asia

Pacific for over a decade. State Street has been present in

Luxembourg for 35 years providing services including fund

administration, custody and transfer agency. From its headquarters

in Boston, Massachusetts, State Street operates globally in more

than 100 geographic markets.

1 Source: Mizuho, as of December 31, 2024

About State Street Corporation

State Street Corporation (NYSE: STT) is one of the world's

leading providers of financial services to institutional investors

including investment servicing, investment management and

investment research and trading. With US$46.6 trillion in assets

under custody and/or administration and US$4.7 trillion* in assets

under management as of December 31, 2024, State Street operates

globally in more than 100 geographic markets and employs

approximately 53,000 worldwide. For more information, visit State

Street's website at www.statestreet.com.

*Assets under management as of December 31, 2024, includes

approximately US$82 billion of assets with respect to SPDR®

products for which State Street Global Advisors Funds Distributors,

LLC (SSGA FD) acts solely as the marketing agent. SSGA FD and State

Street Global Advisors are affiliated.

About Mizuho Financial Group

Mizuho Financial Group, Inc. is one of the largest, full-service

financial institutions in the world, with approximately 65,000

employees, 150 years of banking experience, and total assets of

approximately US$2 trillion, according to S&P Global 2024.

Mizuho offers comprehensive financial services to clients in 36

countries and 850 offices throughout the Americas, EMEA, and

Asia.

Mizuho combines extensive industry and local market expertise

with a broad geographic presence and is a leading provider of

retail banking, corporate and investment banking, capital markets,

strategic advisory, fixed income, equities, research, and financing

solutions. For more information, visit www.mizuhogroup.com.

FORWARD LOOKING STATEMENTS

This News Release contains forward-looking statements within the

meaning of United States securities laws, including statements

about our goals and expectations regarding State Street’s planned

acquisition of Mizuho’s global custody and related businesses

outside of Japan, as well as State Street’s strategy, growth and

sales prospects, business, financial and capital condition, the

financial and market outlook and the business environment, in each

case both associated with the planned acquisition or otherwise.

Forward-looking statements are often, but not always, identified by

such forward-looking terminology as “will,” “expect,” “further,”

“forward,” “intend,” “aim,” “outcome,” “future,” “strategy,”

“pipeline,” “trajectory,” “target,” “guidance,” “objective,”

“plan,” “forecast,” “believe,” “anticipate,” “estimate,” “seek,”

“may,” “trend,” and “goal,” or similar statements or variations of

such terms. These statements are not guarantees of future

performance, are inherently uncertain, are based on current

assumptions that are difficult to predict and involve a number of

risks and uncertainties. Therefore, actual outcomes and results may

differ materially from what is expressed in those statements.

important factors that could cause actual results to differ

materially from those indicated by any forward-looking statements

are set forth in State Street’s 2024 Annual Report on Form 10-K and

its subsequent SEC filings. State Street encourages investors to

read these filings, particularly the sections on risk factors, for

additional information with respect to any forward-looking

statements and prior to making any investment decision. The

forward-looking statements contained in this News Release should

not by relied on as representing State Street’s expectations or

beliefs as of any time subsequent to the time this News Release is

first issued, and State Street does not undertake efforts to revise

those forward-looking statements to reflect events after that

time.

© 2025 State Street Corporation

7683221.1.1.GBL.RTL

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250227420613/en/

Media Contact: Kate Cheung +852 3556 1103

Kate.cheung@statestreet.com

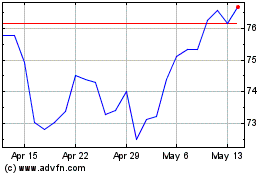

State Street (NYSE:STT)

Historical Stock Chart

From Jan 2025 to Feb 2025

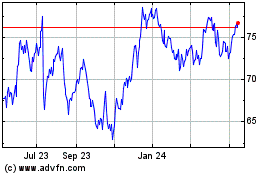

State Street (NYSE:STT)

Historical Stock Chart

From Feb 2024 to Feb 2025