Time for the Convertible Bond ETF? - ETF News And Commentary

April 03 2013 - 5:15AM

Zacks

Given the current ultra-low yield environment and fears of

interest rate hikes later this year or next, investors are

searching for a safe and higher level of income with lower downside

risk. One such area is the convertible bonds space which provides

investors with some of the benefits of bonds as well as stocks.

What are Convertible Bonds?

Convertible bonds are those that can be exchanged at the option

of the holder, for a specific number of preferred or common

shares.

Like traditional bonds, convertible bonds are issued at par, pay

fixed coupons and have fixed maturities. The main difference is

that convertible bonds offer investors the right to convert their

bond holdings into a company’s shares at the holder’s

discretion.

This allows investors the potential to play both sides of a

company — debt and equity — in a single security offering a lower

risk choice (read: Time for Inverse Bond ETFs?).

The price of these bonds generally moves in-line with the

underlying shares. However, unlike shares, convertible bonds have

some downside protection since investors can redeem them at par on

maturity as long as the issuer remains solvent.

And in the event of bankruptcy, convertible bond holders have

a higher claim than the common shareholders on the company’s

assets. This suggests that convertible bond holders could do better

than their equity counterparts in such a situation.

Convertible Bond ETF in Focus

Investors seeking capital appreciation with a steady flow of

income and lower downside risk can play with the only pure option

in the space — SPDR Barclays Capital Convertible Securities

ETF (CWB). The fund

tracks the Barclays U.S. Convertible Bond > $500MM Index, before

fees and expenses.

The ETF holds 99 securities with average maturity of 10.28

years. The product is quite spread out across individuals as it

puts just 27% of the assets in the top 10 holdings. Securities from

Wells Fargo (WFC), General Motors (GM) and Bank of America (BAC)

occupy the top three positions in the basket.

The fund has heavy investments in the technology sector while

consumer non-cyclical and finance occupy the next two spots (read:

Three Tech ETFs Still Going Strong).

The product is heavily tilted towards intermediate term

securities as those that mature in 5 years and before account for

roughly 63% of the assets. In terms of credit quality, the fund has

a tilt towards low quality bonds, as Baa and lower rated securities

account for 88% of the assets (see more in the Zacks ETF

Center).

CWB charges 40 bps in fees a year from investors. In addition,

it trades in a good volume of more than 250,000 shares per day,

ensuring a relatively tight bid/ask spread. Further, the fund

gathered over $116.0 million in assets in the first quarter of the

year, reaching $1.1 billion in AUM since its inception in April

2009.

In terms of performance, investors should note that the product

has shown resilience, with an upward trend in the second half of

the last year. This positive trend has followed well into 2013,

with a more than 4% gain year-to-date.

The fund pays a solid 3.02% in annual dividend yield and 2.13%

in 30-day SEC yield. While these yields may be lower than the

traditional bond counterparts, it is higher than the dividend yield

of the underlying common stocks (read: Two Unconventional Sources

of ETF Yield).

Further, CWB has outpaced traditional bond counterparts by wide

margins but underperformed broad equity ETFs (such as SPY). This

suggests that the ETF could be an interesting pick for investors

seeking exposure to the fixed income market, while still partaking

in a bit of the equity rally.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

ISHARS-BR AG BD (AGG): ETF Research Reports

VANGD-TOT BOND (BND): ETF Research Reports

SPDR-BC CONV SC (CWB): ETF Research Reports

SPDR-SP 500 TR (SPY): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

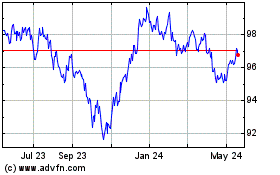

US Aggregate (AMEX:AGG)

Historical Stock Chart

From Feb 2025 to Mar 2025

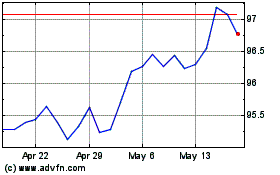

US Aggregate (AMEX:AGG)

Historical Stock Chart

From Mar 2024 to Mar 2025