0001009891

false

0001009891

2023-07-10

2023-07-10

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported):

July 10, 2023

AIR INDUSTRIES GROUP

(Exact Name of Registrant as Specified in its Charter)

| Nevada |

|

001-35927 |

|

80-0948413 |

| State of Incorporation |

|

Commission File Number |

|

IRS Employer I.D. Number |

1460 Fifth Avenue, Bay Shore, New York 11706

(Address of Principal Executive Offices)

Registrant’s telephone number: (631) 968-5000

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

| ☐ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.001 |

|

AIRI |

|

NYSE American |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On July 10, 2023, Air Industries Group (the “Company”)

issued a press release announcing its financial results for the three months ended March 31, 2023. In the release the Company also announced

that it will host a conference call to discuss its financial results on Wednesday, July 12, 2023, at 4:15 PM Eastern Time. The toll-free

conference number for the call is:

Investor Conference Toll-Free

Number 877-524-8416

The information in this Form 8-K, including Exhibit

99.1 attached hereto, shall not be deemed as “filed” for purposes of Section 18 of the Securities Exchange Act of 1934

(the “Exchange Act”), or otherwise subject to the liability of such Section, nor shall it be deemed incorporated by reference

in any filing by Air Industries under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation

language in such filing, unless expressly incorporated by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

Dated: July 10, 2023

| |

AIR INDUSTRIES GROUP |

| |

|

|

| |

By: |

/s/ Michael Recca |

| |

|

Michael Recca

Chief Financial Officer |

2

Exhibit 99.1

July 10, 2023: 08:30 AM Eastern Time

Air Industries Group Announces Financial

Results for the Three Months Ended March 31, 2023

Conference Call Scheduled for

July 12, 2023

Bay Shore, N.Y.--(BUSINESS WIRE)--Air Industries Group (NYSE American:

AIRI), an integrated Tier 1 manufacturer of precision assemblies and components for mission-critical aerospace and defense applications,

and a prime contractor to the U.S. Department of Defense, today announced its financial results

for the quarter ended March 31, 2023.

First Quarter 2023 Comparisons

| ● | Consolidated net sales for the three months ended March 31, 2023 were $12.5 million, an increase of $487,000 or 4.0% from the first

quarter of 2022. First quarter 2023 net sales were lower by $1.3 million or (9.7%) compared with sales of $13.9 million reported for the

fourth quarter of 2022 ended December 31, 2022. |

| ● | Consolidated gross profit for the first quarter of 2023 was $1.9 million compared with $2.1 million in the first quarter of 2022

and $1.6 million in the fourth quarter of 2022. The fourth quarter of 2022 included realized losses and an accrual for estimated future

losses totaling $850,000 related to a single unprofitable contract as previously reported. The Company also corrected its policy for determining

the reserve for slow-moving and excess inventory, which led to an increase in the reserve, further decreasing the gross profit and gross

profit percentage for the fourth quarter of 2022. |

| ● | Gross profit margin was 15.0% of sales for the first quarter of 2023, 17.2% for the first quarter of 2022, and 5.1% for the fourth

quarter of 2022. |

| ● | Operating expenses for the first quarter of 2023 were $2.04 million, an increase of $167,000 or 8.9% from $1.88 million in the first

quarter of 2022, and an increase of $508,000 or 33.2% from $1.53 million in the 2022 fourth quarter. |

| ● | The operating loss for the first quarter of 2023 was $158,000, versus operating income of $207,000 in the first quarter of 2022, and

an operating loss of $830,000 in the fourth quarter of 2022. |

| ● | Interest and financing costs for the three months ended March 31, 2023 were $476,000 compared with $323,000 in the first quarter of

2022, and $403,000 for the three months ended December 31, 2022. The increases in interest expense resulted from increases in the prime

rate and from higher loan balances. |

| ● | Net loss for the first quarter of 2023 was $618,000 versus a net loss of $28,000 in the first quarter of 2022, and a net loss of $899,000

in the fourth quarter of 2022. |

CEO Commentary

Lou Melluzzo, CEO of Air Industries Group, said:

“Air Industries’ results for the first quarter of 2023

continued to reflect the supply chain disruption that has challenged our industry since the onset of the pandemic. Specifically, our ability

to process and deliver product was hampered by delays in receiving raw materials, especially the high-performance alloys that are a mainstay

of many aviation components. We are making every effort to overcome these supply chain bottlenecks.

“At the same time, we are excited about the opportunities

that lie ahead as we pivot to future growth prospects. We are building on our solid position in the defense ecosystem by expanding our

penetration of existing platforms, adding new platforms, and targeting new markets. Specifically, we will focus on markets that offer

attractive sales and margin potential, and where our capabilities and competitive strengths will enable us to take advantage of those

opportunities in the near-to-mid-term.

“For example, we are actively seeking additional business

in our traditional markets of military fixed-wing and rotary aircraft, as well as commercial aircraft engine components. We also are making

solid progress with our recent entry into the nuclear submarine market, which aligns well with our core competencies and has the potential

to be a significant addition to our business going forward.

“During the balance of 2023 and beyond, Air Industries will

further refine and execute on our strategies to pursue both existing and new opportunities in the aerospace and adjacent markets, combined

with a disciplined focus on improving profit margins.”

Investor Conference Call

Management will host a conference call on Wednesday,

July 12, 2023 at 4:15 PM Eastern Time

Conference

Toll-Free Number 877-524-8416

Additional information about the Company can be found in its filings

with the SEC and by visiting the website at www.airindustriesgroup.com.

AIR INDUSTRIES GROUP is an integrated Tier

1 manufacturer of precision assemblies and components for mission-critical aerospace and defense applications, and a

prime contractor to the U.S. Department of Defense.

Forward Looking Statements

Certain matters discussed in this press release

are ‘forward-looking statements’ intended to qualify for the safe harbor from liability established by the Private Securities Litigation

Reform Act of 1995. In particular, the Company’s statements regarding trends in the marketplace, future

revenues, earnings and Adjusted EBITDA, the ability to realize firm backlog and projected backlog, cost cutting measures, potential

future results and acquisitions, are examples of such forward-looking statements. The forward-looking statements are subject to numerous

risks and uncertainties, including, but not limited to, the timing of projects due to variability in size, scope and duration, the inherent

discrepancy in actual results from estimates, projections and forecasts made by management, regulatory delays, changes in government funding

and budgets, and other factors, including general economic conditions, not within the Company’s control. The factors discussed herein

and expressed from time to time in the Company’s filings with the Securities and Exchange Commission could cause actual results and developments

to be materially different from those expressed in or implied by such statements. The forward-looking statements are made only as of the

date of this press release and the Company undertakes no obligation to publicly update such forward-looking statements to reflect subsequent

events or circumstances.

Adjusted

EBITDA

The Company

uses Adjusted EBITDA, a Non-GAAP financial measure as defined by the SEC, as a supplemental profitability measure because management finds

it useful to understand and evaluate results, excluding the impact of non-cash depreciation and amortization charges, stock based compensation

expenses, and nonrecurring expenses and outlays, prior to consideration of the impact of other potential sources and uses of cash, such

as working capital items. This calculation may differ in method of calculation from similarly titled measures used by other companies

and may be different than the EBITDA calculation used by our lenders for purposes of determining compliance with our financial covenants.

This Non-GAAP measure may have limitations when understanding performance as it excludes the financial impact of transactions such as

interest expense necessary to conduct the Company’s business and therefore are not intended to be an alternative to financial measure

prepared in accordance with GAAP. The Company has not quantitatively reconciled its forward looking Adjusted EBITDA target to the most

directly comparable GAAP measure because such items such as amortization of stock-based compensation and interest expense, which are specific

items that impact these measures, have not yet occurred, are out of the Company’s control, or cannot be predicted. For example,

quantification of stock-based compensation is not possible as it requires inputs such as future grants and stock prices which are not

currently ascertainable.

Contact Information

Air Industries Group

Investor Relations

631.328.7078

ir@airindustriesgroup.com

3

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

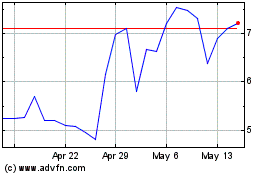

Air Industries (AMEX:AIRI)

Historical Stock Chart

From Mar 2024 to Apr 2024

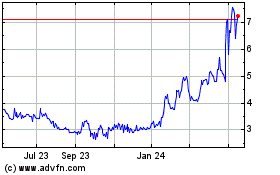

Air Industries (AMEX:AIRI)

Historical Stock Chart

From Apr 2023 to Apr 2024