Barnwell Industries, Inc. Reports Results for its First Quarter Ended December 31, 2024

February 14 2025 - 5:00AM

Barnwell Industries, Inc. (NYSE American: BRN) today reported

financial results for its first quarter ended December 31, 2024.

For the quarter, the Company had revenue of $4,477,000 and a net

loss of $1,917,000 or $0.19 per share. In the three months ended

December 31, 2023, the Company reported quarterly revenue of

$6,155,000 and a net loss of $664,000 or $0.07 per share. The

Company remains debt free and ended the quarter with $642,000 in

working capital, including $1,957,000 in cash and cash equivalents.

Oil and Gas Prices and

Production

During the three months ended December 31, 2024,

oil, gas and natural gas liquids prices decreased 2%, 40% and 8%,

respectively, compared to the prior year’s quarter. Additionally,

oil, gas and natural gas liquids production decreased 17%, 21% and

17%, respectively, for the three months ended December 31, 2024,

compared to the prior year’s quarter. The decreases in production

are primarily the result of natural declines as the wells age. The

production decreases were also partially due to properties sold and

certain wells that were temporarily shut-in for workovers. The

Company's latest Canadian well drilled, which is 100%-owned and

operated, started producing in mid-September 2024 and contributed

approximately 107 net barrels of equivalent per day for a total of

approximately 10,000 net barrels of equivalent during the three

months ended December 31, 2024.

Non-Cash Impairment, foreign currency

loss

The net loss for the three months ended December

31, 2024, was due in part to a $613,000 non-cash impairment of our

US oil and natural gas properties during the current quarter. This

impairment is largely due to the changing rolling average

first-day-of-the-month prices used in the ceiling test calculation.

Additionally, the loss was due in part to a $351,000 foreign

currency loss recorded in the current year period as compared to a

$126,000 gain in the prior year period due to the weakening of the

Canadian dollar against the U.S. dollar.

Reduction in General and Administrative

Expenses

General and administrative expenses decreased

$123,000, 9%, for the three months ended December 31, 2024,

primarily due to a decrease in professional fees in the current

year period as compared to the prior year period.

Contract Drilling Segment

Our contract drilling segment entered into an

agreement during the quarter to sell a drilling rig and related

ancillary equipment for proceeds of $585,000, which will close on

the sale in the second quarter ending March 31, 2025. The Company

received payment of the purchase price in the quarter ended

December 31, 2024.

In the coming months, the Company will move

forward with appropriate strategic, business and financial

alternatives for Water Resources which may include, among other

things, a sale of its stock or assets, or an orderly wind-down of

its operations and liquidation of equipment.

Summary and Outlook

Craig D. Hopkins, CEO, stated, “A potential

proxy contest in the near term could harm the company’s liquidity

and hinder investment and growth opportunities. This is

particularly concerning, as we have valuable oil and gas assets

with significant potential. Our new well is performing as

anticipated, and we are well-positioned to drill two additional

wells from the same pad once sufficient capital is secured. The

planned wind-down of our contract drilling business will help

refocus our efforts and reduce fixed costs in the coming quarters.

We are also actively seeking ways to further reduce costs and

enhance profitability. With a streamlined cost structure, Barnwell

will be positioned to invest more aggressively in operations and

deliver the growth our shareholders deserve.

“Regarding the potential proxy contest and board

operations, I have found all current board members to be

collaborative and constructive in supporting my efforts to improve

Barnwell’s financial performance. Given the forgoing, I am

surprised by the prospect of a contested election.”

The information contained in this press release

contains “forward-looking statements,” within the meaning of the

Private Securities Litigation Reform Act of 1995, Section 27A of

the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. A forward-looking

statement is one which is based on current expectations of future

events or conditions and does not relate to historical or current

facts. These statements include various estimates, forecasts,

projections of Barnwell’s future performance, statements of

Barnwell’s plans and objectives, and other similar statements.

Forward-looking statements include phrases such as “expects,”

“anticipates,” “intends,” “plans,” “believes,” “predicts,”

“estimates,” “assumes,” “projects,” “may,” “will,” “will be,”

“should,” or similar expressions. Although Barnwell believes that

its current expectations are based on reasonable assumptions, it

cannot assure that the expectations contained in such

forward-looking statements will be achieved. Forward-looking

statements involve risks, uncertainties and assumptions which could

cause actual results to differ materially from those contained in

such statements. The risks, uncertainties and other factors that

might cause actual results to differ materially from Barnwell’s

expectations are set forth in the “Forward-Looking Statements,”

“Risk Factors” and other sections of Barnwell’s annual report on

Form 10-K for the last fiscal year and Barnwell’s other filings

with the Securities and Exchange Commission. Investors should not

place undue reliance on the forward-looking statements contained in

this press release, as they speak only as of the date of this press

release, and Barnwell expressly disclaims any obligation or

undertaking to publicly release any updates or revisions to any

forward-looking statements contained herein.

|

COMPARATIVE RESULTS |

|

(Unaudited) |

|

|

Three months ended December 31, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

|

|

|

|

Revenues |

$ |

4,477,000 |

|

|

$ |

6,155,000 |

|

|

|

|

|

|

|

Net loss attributable to Barnwell Industries, Inc. |

$ |

(1,917,000 |

) |

|

$ |

(664,000 |

) |

|

|

|

|

|

|

Net loss per share – basic and diluted |

$ |

(0.19 |

) |

|

$ |

(0.07 |

) |

|

|

|

|

|

|

Weighted-average shares and |

|

|

|

|

equivalent shares outstanding: |

|

|

|

|

Basic and diluted |

|

10,047,173 |

|

|

|

9,996,760 |

|

| CONTACT: |

|

Craig D.

HopkinsChief Executive Officer and PresidentPhone: (403)

531-1560Email: info@bocl.ca |

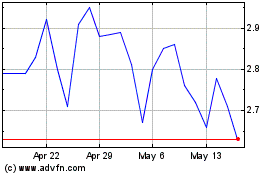

Barnwell Industries (AMEX:BRN)

Historical Stock Chart

From Jan 2025 to Feb 2025

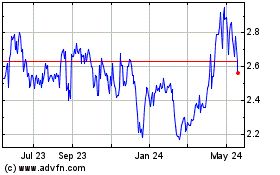

Barnwell Industries (AMEX:BRN)

Historical Stock Chart

From Feb 2024 to Feb 2025