Safer Safe-Haven-Treasuries, Gold or US Dollar? - Real Time Insight

November 15 2012 - 7:16AM

Zacks

Uncertainty over the resolution of the fiscal cliff and related

potential tax hikes are making most investors nervous. Many of them

are selling stocks to avoid the potential rise in taxes next year

and seeking refuge in “safe-haven” assets.

While it is most likely that the policymakers will reach some

sort of compromise to avoid the cliff; an early resolution does not

appear likely at present. (Three ETFs for the Fiscal Cliff)

Continued problems in the Euro-zone and weak corporate earnings

in the U.S. are further adding to the investors’ worries. As a

result the stocks fell to their three-month low yesterday, while

the "safe-haven" assets have risen during the same period.

Despite very low or even negative real returns; the investors

continue to pour money into the treasuries. Further, the

minutes of the Federal Reserve’s last meeting indicate that it

would probably announce a new program of long-term bond purchases

in December when the Operation Twist expires. So, while the

treasuries may be very risky for long-term investors, they may be a

good shorter-term trade.

Barclays 20 Year Treasury Bond Fund (TLT) which measures

the performance of longer-term U.S. Treasuries is up about 5% in

the last three months and more than 50% in the last three

years.

Gold (GLD) is back in focus due to fiscal cliff

issue and continued monetary expansion, up about 8% in the last

three months. With its bull-run lasting more than a decade, some

people think that gold prices may be in a bubble but as a matter of

fact, the inflation adjusted prices are still below the highs

reached in the 1980s and the long-term investment case for gold

remains intact.

Among the currencies, the dollar and the yen have attracted

investors’ attention, but the safe-haven demand for the US dollar

is somewhat offset by the expectation that the Fed may be

ready to take further action again to counter the negative impact

of the fiscal cliff on the US economy. Deutsche Bank USD Index ETF

(UUP) is down 2% in the last three months, but it is up more than

2% in the last one month.

Which of the above (treasuries, gold or the dollar) is poised to

benefit most from the “flight-to-safety” trades?

SPDR-GOLD TRUST (GLD): ETF Research Reports

SPDR-SP 500 TR (SPY): ETF Research Reports

ISHARS-BR 20+ (TLT): ETF Research Reports

PWRSH-DB US$ BU (UUP): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

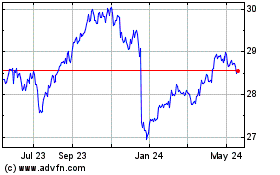

Invesco DB US Dollar Ind... (AMEX:UUP)

Historical Stock Chart

From Jun 2024 to Jul 2024

Invesco DB US Dollar Ind... (AMEX:UUP)

Historical Stock Chart

From Jul 2023 to Jul 2024