Aseana Properties Limited Update on the Demerger Proposal (8349G)

November 30 2020 - 1:00AM

UK Regulatory

TIDMASPL

RNS Number : 8349G

Aseana Properties Limited

30 November 2020

30 November, 2020

Aseana Properties Limited ("Aseana" or the "Company")

Update on the demerger proposal and on the sale of two land

plots in Kota Kinabalu

The Demerger proposal

Aseana Properties Limited (LSE: ASPL LN), a property developer

in both Malaysia and Vietnam which is listed on the Main Market of

the London Stock Exchange, entered into certain agreements on 15

July 2020 (the "Demerger Agreements") in relation to proposals to

demerge certain assets held by the Company in exchange for the

buyback and cancellation of a significant percentage of the issued

ordinary shares of US$0.05 each in the capital of the Company (the

"Shares"). Those Demerger Agreements set a long stop date of 14

October 2020 by which date the demerger needed to have been

completed or the date reset by mutual agreement of all signatories.

This date had been extended in a couple of stages to 27 November

2020.

Ireka Corporation Berhad ("Ireka"), one of the Participating

Shareholders in the demerger held an Extraordinary General Meeting

of its independent shareholders today and those shareholders

approved the demerger which is a key condition of the demerger.

However, another key condition to the demerger is the consent of

the Company's lenders and the guarantors of Medium Term Notes to

the demerger and these consents have yet to be obtained.

Accordingly, Aseana and all the other parties to the Demerger

Agreements have today signed addendums to the Demerger Agreements

to extend the long stop date to 11th December 2020. It is hoped

that the remaining consents and approvals can be obtained during

this further extension period.

The sale of two land plots in Kota Kinabalu, Sabah, Malaysia

Aseana entered into two Sale and Purchase Agreements on 16 July

2020 to sell two adjacent plots of land in Kota Kinabalu to a party

related to Ireka for a total cash consideration of approximately

US$4 million. The Company has received cash deposits and a part of

the balance of the proceeds have been used to pay down debt that is

secured against those land plots. The sale of the land plots was

independent of the demerger transaction and completion is pending

release of the charges by the bank.

For further information:

Aseana Properties Limited Tel: +44 20 3325 7050

Nick Paris, Chairman nickparis@btinternet.com

Liberum Capital Tel: +44 20 3100 2000

Gillian Martin / Owen Matthews

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDKZMZMFRZGGZM

(END) Dow Jones Newswires

November 30, 2020 02:00 ET (07:00 GMT)

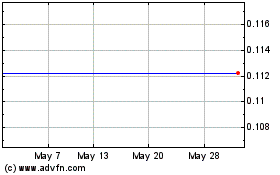

Aseana Prop (AQSE:ASPL.GB)

Historical Stock Chart

From Nov 2024 to Dec 2024

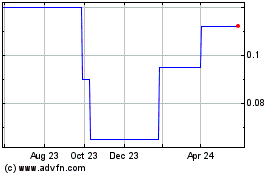

Aseana Prop (AQSE:ASPL.GB)

Historical Stock Chart

From Dec 2023 to Dec 2024