TIDMCEG

RNS Number : 4228X

Challenger Energy Group PLC

26 April 2023

26 April 2023

Challenger Energy Group PLC

("Challenger Energy" or the "Company")

URUGUAY AREA-OFF 1 UPDATE

Challenger Energy (AIM: CEG), the Caribbean and Americas focused

oil and gas company, with a range of oil production, development,

appraisal, and exploration assets, provides the following

highlights from its technical assessment of the AREA OFF-1 block,

offshore Uruguay.

HIGHLIGHTS

-- An initial prospect inventory of 1 to 2 billion barrels has

been defined from CEG's 2D seismic reprocessing work

-- Three sizeable prospects have thus far been identified,

derived from a range of play types consistent with those de-risked

by recent successful conjugate margin drilling in Namibia by

TotalEnergies and Shell

-- Prospects are seismically-derived, and supported / further

de-risked by Amplitude Variation with Offset ("AVO") analysis

-- Play robustness is corroborated by geochemical sampling and satellite seep analysis

-- Conjugate margin success, competitive recent licensing rounds

in Uruguay, and technical uplift from CEG's 2023 work will drive

farm-out process, soon to be initiated

SUMMARY

-- The geotechnical assessment programme of the Company's AREA

OFF-1 licence is on-track to be completed by Q3 2023. This

accelerated work will satisfy the entire minimum work obligations

for the block's initial four-year exploration period (i.e., to

August 2026).

-- Reprocessing of 2,100 kms of legacy 2D seismic (completed)

and interpretation and mapping (ongoing) has confirmed considerable

value uplift for the AREA OFF-1 licence, with at least three high

potential prospects identified from two material play types to

date.

-- Technical de-risking has resulted from a range of

workstreams, including AVO analysis, geochemistry seabed sampling,

and satellite seep and slick imagery.

-- Prospect details are:

o "Teru Teru" prospect - a Cretaceous turbidite play; analogous

petroleum system and reservoir age to Namibian ultra-deepwater

discoveries; 460 km(2) in areal extent; Class II AVO supported; an

estimated ultimate recoverable resource in excess of 700 MMboe;

located in approximately 750 metres water depth; and with a

reservoir depth of approximately 4,300 metres.

o "Anapero" prospect - a Cretaceous turbidite play; analogous

petroleum system and reservoir age to Namibian ultra-deepwater

discoveries; 500 km(2) in areal extent; Class III AVO supported; an

estimated ultimate recoverable resource in excess of 500MMboe;

located in approximately 750 metres water depth; and with reservoir

depth of approximately 3,800 metres.

o "Lenteja" prospect - an Early Cretaceous alluvial fan

representing a large stratigraphic trap; analogous to proven legacy

shelf discoveries in Namibia and South Africa; 425 km(2) in areal

extent; an estimated ultimate recoverable resource c. 500MMboe;

located in approximately 85 meters water depth; and with a

reservoir depth of approximately 5,000 metres.

-- Continuing discretionary technical work will seek to define

additional leads and prospects, further refine previous mapping of

identified prospects, generate volumetrics of identified prospects,

and seek to further constrain key technical risks.

-- The Company has compiled a comprehensive data-room, which

includes all new work completed, and following unsolicited interest

from a number of industry counterparties a farm-out process is to

be formally launched. Further announcements will be made as

appropriate.

-- The objective is for the Company to accelerate value

realisation from the AREA OFF-1 licence in Uruguay by introducing a

strategic partner(s) during 2023, to fast-track 3D seismic

acquisition, potentially via a multi-client acquisition in early

2024, as a precursor to further value-creating field activity.

An update Uruguay AREA OFF-1 presentation is now also available

on the Company's website at www.cegplc.com . Additional details are

also set out in the Appendix to this RNS.

Eytan Uliel, Chief Executive Officer of Challenger Energy,

said:

"In 2020, when no other parties were ready to commit, Challenger

Energy was first-mover into offshore Uruguay, securing the AREA

OFF-1 block on an uncontested basis and on highly advantageous work

terms. Since then, margin-opening discoveries offshore Namibia by

TotalEnergies and Shell have made it possible to correlate what are

now proven, oil producing source rocks directly across into the

conjugate margin basins of Uruguay's waters.

As a result, Uruguay has become a new global exploration

hotspot, evidenced by the fact that in the last 12 months all but

one of the available offshore blocks have been licenced by oil

majors and NOCs, bidding sizeable work programs.

In direct response to the exploration success in adjacent

analogue basins and the emerging industry interest it generated, we

committed to remaining ahead of the game, and in late 2022 opted to

accelerated our AREA OFF-1 work program. The goal was to generate a

newly derived, modern dataset supporting prospect definition. The

resulting prospect inventory is now informed by reprocessed legacy

2D seismic, supported by AVO attribute analysis (hugely significant

as this technique is widely used in the industry as a key indicator

of potential hydrocarbons), and corroborated by additional

geochemical and seep analysis studies.

The results from this work have been extremely promising, in

that we are now able to announce a technically supported prospect

inventory of between 1 to 2 billion barrels in this globally

attractive exploration hotspot.

Our next-step objective is to farm-out to an industry

partner(s), so we can fast-track a 3D seismic acquisition. The

high-quality data set we have now compiled, and the intellectual

property created, positions us well, and we will shortly be

initiating a formal farm-out process.

The world for Challenger Energy is changing rapidly. I look

forward to updating shareholders as the year progresses."

For further information, please contact:

Challenger Energy Group PLC Tel: +44 (0) 1624 647

Eytan Uliel, Chief Executive Officer 882

WH Ireland - Nomad and Joint Broker Tel: +44 (0) 20 7220

Antonio Bossi / Darshan Patel / Enzo 1666

Aliaj

Zeus Capital Limited - Joint Broker Tel: +44 (0) 20 3829

Simon Johnson 5000

CAMARCO Tel: +44 (0) 20 3757

Billy Clegg / Hugo Liddy / Sam Morris 4980

Notes to Editors

Challenger Energy is a Caribbean and Americas focused oil and

gas company, with a range of oil production, development, appraisal

and exploration assets and licences, located onshore in Trinidad

and Tobago, and Suriname, and offshore in the waters of Uruguay and

The Bahamas. In Trinidad and Tobago, Challenger Energy has a number

of producing fields and appraisal / development projects. In

Suriname, Challenger Energy has on onshore appraisal / development

project. Challenger Energy's exploration licences in Uruguay and

The Bahamas offer high-impact value exposure within the overall

portfolio value.

Challenger Energy is quoted on the AIM market of the London

Stock Exchange.

https://www.cegplc.com

COMPETENT PERSON STATEMENT

Technical work referred to in this announcement has been

undertaken by various independent third-party specialist advisors.

This technical work has been overseen by Mr. Randolph Hiscock the

Company's New Business Director and Uruguay Managing Director.

In accordance with the AIM Note for Mining and Oil & Gas

Companies, CEG discloses that Mr. Randolph Hiscock is the qualified

person who has reviewed the technical information contained in this

presentation. He has a Masters in Science (Geology) and is a member

of the AAPG & PESGB, and has over 35 years' experience in the

oil and gas industry. Randolph Hiscock consents to the inclusion of

the information in the form and context in which it appears.

APPIX - AREA OFF-1 UPDATE: ADDITIONAL INFORMATION

Background

-- The Company was awarded the AREA OFF-1 block, offshore

Uruguay, in June 2020. Following presidential approval, formal

signing of the licence took place on 25 May 2022, and the initial

four-year exploration term commenced on 25 August 2022.

-- The AREA OFF-1 block is a large, offshore block covering

approximately 14,557 km(2) located approximately 100 kms offshore

Uruguay, in water depths ranging from 80 meters to 1,000

meters.

-- The Company has a 100% working interest in the AREA OFF-1 licence.

-- The Company's minimum work commitments in the initial

four-year exploration period required licencing 2,000 kms of legacy

2D seismic data from ANCAP (the Uruguayan national oil company and

energy regulatory body), reprocessing of same 2D seismic data, and

completion of a geological and resource potential study. There is

no requirement to acquire 3D seismic or drill a well during the

initial four-year exploration period. The Company is, however,

permitted to accelerate work from future exploration periods into

the current initial exploration period, with any accelerated work

credited against subsequent period obligations.

Conjugate context - the significance of Namibian

super-discoveries

-- The AREA OFF-1 licence is located in the Punta del Este

Basin, along the Uruguay-Argentina continental margin. This basin

is a direct conjugate to the Orange Basin offshore southern Namibia

and northern South Africa - i.e., these two basins were co-joined

prior to continental separation and, are believed to have similar

geological characteristics (as demonstrated by correlating regional

2D seismic data across the South Atlantic), particularly in terms

of the potential presence of source rocks and petroleum

systems.

-- Offshore Namibia, two substantial margin-opening discoveries

have been made over the past 15 months, being TotalEnergies' Venus

well (February 2022), later confirmed by Shell's Jonker well (March

2023) and a second play by Shell with its Graff & La Rona

discoveries (February and April 2022).

-- These discoveries have transformed industry perception not

just of Namibia, but also of the potential of the South Atlantic

conjugate margin (i.e., those basins across the Uruguay-Argentina

continental margin, including the AREA OFF-1 in the Punta del Este

Basin). This is because the Early Cretaceous Aptian source interval

that charges Venus and Jonker can be seismically correlated to the

South Atlantic (Uruguay-Argentina) conjugate basins , including the

Punta del Este Basin in which AREA OFF-1 is located. This

establishes the potential for a new, prolific petroleum system

along the South Atlantic (Uruguay-Argentina) conjugate basins.

Impact on activity in Namibia

-- The recent discoveries in Namibia have resulted in

considerable additional industry activity in Namibia now being

planned over the next 12 to 18 months. TotalEnergies has commenced

a drilling campaign to drill up to four appraisal wells from March

2023, the objective being to define the scale and scope of the

Venus discovery, and fast-track an ultra- deepwater development. It

has been announced that over 50% of TotalEnergies' global

exploration budget for 2023 is earmarked for Namibia.

-- Similarly, Shell has indicated that it intends to drill up to

ten Namibian wells in 2023 / 2024 (a mix of exploration and

appraisal wells), GALP has advised it will be drilling a well in

2023 on PEL83 in Namibia, and Maurel & Prom have indicated a

five well campaign offshore Namibia, commencing 2023.

-- Additionally, the recent discoveries in Namibia have seen an

increase in high-value transactional activity relating to Namibian

licences. In October 2022, Chevron farmed-in to PEL 90 offshore

Namibia, for a reported majority interest and operatorship, and

with a carry to the farminee that covers a seismic campaign and

initial exploration well drilling - estimated transaction value

circa US$80 million. In March 2023, Woodside secured an exclusive

option to acquire 56% working interest in PEL 87 offshore Namibia

by funding a fully carried 3D seismic survey - estimated value at

US$35m - and an optional carry on an initial exploration well.

-- The Company believes a similar activity trajectory is likely

over the coming years in Uruguay and northern Argentina.

Impact on activity regionally

-- The recent discoveries in Namibia have also had an impact

south of Uruguay, offshore Argentina. There, the country's first

ultra-deepwater well (Argerich-1) is planned for spud during Q2

2023 with Equinor (the Norwegian state-owned oil and gas company)

as the operator and Shell as partner. The well is to be drilled

approximately 300 kms offshore Argentina, in water depths of

approximately 1,500 meters, to a projected total depth (TD) of

approximately 4,050 meters. The well is targeting Cretaceous basin

floor sandstones similar to TotalEnergies' Venus well offshore

Namibia.

-- Additionally, Equinor in conjunction with partner YPF has

received environmental approvals to acquire 3D seismic across three

blocks offshore Argentina, and other operators including Shell and

TotalEnergies, along with partners BP and Qatar Energy, are

likewise anticipated to acquire 3D seismic during 2023 / 2024.

-- The Company considers that Uruguay will benefit from these

activities / operations being conducted in the broader area and

which are now being accelerated as a result of the Namibian

conjugate margin discoveries.

Uruguay licensing activity

-- The Company considers that the conjugate margin discoveries

in Namibia have also validated its early entry strategy in

Uruguay.

-- Specifically, the Company was the first operator to enter

Uruguay in 2020, pre-dating the conjugate margin discoveries

offshore Namibia. Until the start of 2022, the Company was the only

offshore acreage holder in Uruguay, having bid for the AREA OFF-1

licence on the basis of a modest, low-cost work programme.

-- However, since the discoveries offshore Namibia, five blocks

offshore Uruguay have been awarded, all in 2022, to Shell, APA

Corporation (formerly, Apache) and YPF (the Argentinian state-owned

oil and gas company), such that now all but one available Uruguay

offshore blocks is licenced, and the Company is the only junior

present.

-- These new entrants have made substantial work programme

commitments for the first four-year exploration periods of their

relevant licences, including 3D seismic licensing, acquisition and

reprocessing, exploration well drilling and geological and

geophysical studies. The estimated aggregate value of the work

program bid for these subsequent licences is approximately US$250

million (in aggregate, across the five blocks).

AREA OFF-1 Technical work update

-- Following the conjugate margin drilling successes in Namibia

referred to above, and given the interest this has generated in

Uruguay, in late 2022 the Company decided to accelerate its initial

work program for the AREA OFF-1 block. The objective was to rapidly

improve the geotechnical understanding of the block and to assemble

a state-of-the-art offshore data set, thereby optimally positioning

the Company for securing a farm-out partner.

-- Work commenced in late 2022, and since that time the minimum

work program obligation of licencing and reprocessing legacy 2D

seismic has been substantially completed. The Company is on-track

to fully complete the minimum work program obligation in Q3 2023,

through the preparation of required Geological and Geophysical

("G&G") reports. Thereafter, the Company will have no

obligatory work program commitments until the second exploration

period, which will only commence in August 2026.

-- In addition to work required to satisfy the minimum work

program obligation, over the past six months the Company has also

executed certain additional technical work items, aimed at further

de-risking and high-grading the identified leads and prospects.

This includes Amplitude Variation with Offset (AVO) attribute

analysis of select 2023 reprocessed 2D seismic lines, seabed

geochemistry analysis, and acquiring a satellite seeps and slicks

imaging study. Each of these is discussed in brief detail

below.

2D Seismic reprocessing and interpretation

-- The Company acquired 4,760 kilometres of legacy 2D seismic

data from ANCAP (the Uruguayan energy regulatory body), and

licenced a further 2,100 kilometres of high-graded legacy 2D

seismic data from ANCAP for seismic reprocessing. This licenced 2D

seismic data has now been fully reprocessed in both time and depth

domains, the work having been conducted by Down Under Geophysics, a

specialist seismic reprocessing firm in the United Kingdom.

-- This work has resulted in a substantial uplift in seismic

imaging and improved data resolution. This in turn, has provided

enhanced fault definition, and enabled better identification of

seismic facies and refined prospect mapping. The newly reprocessed

2D data has also facilitated an AVO attribute analysis study

referred to below.

AVO attribute analysis

-- Amplitude Variation with Offset (AVO) attribute analysis is

an advanced processing workflow used in the international

hydrocarbon exploration industry because (in general terms) certain

AVO anomalies are considered to be indicators of the presence of

reservoir zones (sand vs. shale) and potentially, hydrocarbons /

fluids in reservoir.

-- The Company selected six reprocessed high-graded 2D seismic

lines for an initial AVO screening. This work was undertaken by

LEAN Geosolutions, a specialist firm in advanced seismic attribute

evaluation based in Houston. This initial AVO analysis has led to

the identification and definition of three primary prospects

(described further below) from the reprocessed and reinterpreted 2D

seismic data, and corroborated by the other geochemical studies

described below.

-- Based on the excellent results from AVO attribute analysis

thus far, a further seven lines of reprocessed 2D seismic data have

now been selected for similar assessment, with work commenced -

this is expected to be completed in approximately two months.

Seabed geochemistry study

-- The Company acquired and integrated a seabed geochemistry

study conducted by Applied Geochemical Imaging, Houston, in 2017.

In this study, 59 box core seabed samples were acquired across all

Uruguay offshore maritime areas, to determine the presence of

active petroleum systems and detect micro-petroleum seepage from

subsurface reservoirs. 117 geochemical samples from these 59

locations were analyzed for hydrocarbons.

-- This study indicates that the highest hydrocarbon values are

to be found within the AREA OFF-1 block. The hydrocarbon compound

responses and signatures are consistent with active petroleum

micro-seepage along the continental shelf break of AREA OFF-1 that

forms an anomalous fairway along the block's southern boundary and

directly overlies seep and slick anomalies (described below) - thus

increasing geological confidence.

Satellite seep and slicks imagery

-- A second study commissioned by the Company was a review of

available satellite seep and slick imagery. Satellite images

covering approximately 4,000 km(2) of AREA OFF-1, analysed over

several decades for repeatability, were analysed for seeps and

slicks. The study was conducted by SAR Satellite Oil Seeps, a

specialist firm in France.

-- This study validated the presence of 31 oil seeps. When

overlaid on the Company's seismic data set, good geospatial

alignment of those identified seeps to mapped seismic prospects is

observed, thus providing additional corroboration of seismically

defined prospects at the same locations.

Integration, seismic interpretation, and mapping

-- A final body of required work was to interpret the results of

the reprocessed 2D seismic, and then integrate that with the result

of the AVO attribute analysis and other workstreams, to identify

leads and prospects, and to generate prospect maps. This work

(still ongoing) is being conducted by Molyneux Advisors,

geotechnical interpretation consultants based in Perth, and has

thus far resulted in three primary prospects being identified and

mapped, each of which is described briefly below.

Teru Teru prospect

-- The Teru Teru prospect is a Mid Cretaceous onlap turbidite

play with the same petroleum system and reservoir type as evident

in Venus and Jonker discoveries offshore Namibia. This prospect has

been identified based on three reprocessed seismic lines, mapped to

be approximately 460 km(2) in size, corroborated with AVO analysis

indicating porous sand and potential hydrocarbon presence, and

calibrated with the geochemical seabed survey and satellite seeps

studies. On a preliminary basis the Teru Teru prospect is estimated

to contain in excess of 700 MMboe Estimated Ultimate Recovery

("EUR") (subject to final volumetric determination). Based on

current mapping, this prospect straddles the AREA OFF-1 and AREA

OFF-4 boundary. However, and critically, the up-dip termination is

believed to lie on AREA OFF-1, including the trapped area above the

projected oil-water contact.

Anapero prospect

-- The Anapero prospect is a slightly younger Upper Cretaceous

shelf margin turbidite play with the same petroleum system and

reservoir type as reported in the Venus and Jonker discoveries, as

with the Teru Teru prospect. This prospect has been identified

based on several reprocessed seismic lines, mapped to be

approximately 500 km(2) in size, and further corroborated with AVO

analysis indicating potential porous sands and again calibrated

with the geochemical seabed survey and the satellite seeps studies.

On a preliminary basis the Anapero prospect is estimated to contain

in excess of 500 MMboe EUR (subject to final volumetric

determination). Based on mapping, this prospect also straddles the

AREA OFF-1 and AREA OFF-4 boundary however, stratigraphic trap

extents are largely contained inside AREA OFF-1.

Lenteja prospect

-- The Lenteja prospect is an Early Cretaceous stratigraphic

syn-rift clastic play similar to the Kudu field in Namibia, the

AJ-1 and Ilhubhesi discoveries in South Africa. This prospect has

been identified based on multiple reprocessed seismic lines, and

mapped to be approximately 425 km(2) in size. Early Cretaceous

drift sediments overlie the Lenteja prospect, which is sealed by a

major Early Cretaceous syn-rift unconformity. The Lenteja prospect

has a highly reflective, isolated seismic facies package within a

NW-SE trending horst block that dips south along with significant

stratigraphic entrapment. On a preliminary basis the Lenteja

prospect is estimated to contain c. 500 MMboe EUR (subject to final

volumetric determination).

Remaining technical work for 2023

-- As noted, completion of the minimum work program obligation

for AREA OFF-1's initial four-year exploration period requires the

Company to generate two specified G&G reports. This work is

imminent after the geophysical mapping is complete, and the Company

anticipates to finalize these studies and report out to ANCAP in Q3

2023.

-- In parallel, further discretionary work is also ongoing, to

complete prospect mapping and integrating the 2023 reprocessed 2D

with the historic 2D seismic data, to conduct AVO analysis of a

further seven reprocessed 2D seismic lines, and to finalise

volumetric assessment and risked ranking of all identified leads

and prospects.

Farm-out process

-- The Company's commercial objective through the remainder of

2023 is to introduce an industry partner(s) to AREA OFF-1, with the

objective of providing the Company certain liquidity and at the

same time to fast-track a discretionary 3D seismic acquisition

programme in early 2024 (either independently or, more optimally,

by participating in a multi-client 3D seismic acquisition

programme).

-- Various seismic vendors have already proposed a multi-client

3D seismic acquisition programme offshore Uruguay, commencing early

2024, which would potentially cover up to 5,000 km(2) of AREA

OFF-1, encompassing all the identified leads and prospects on AREA

OFF-1. The Company understands that these seismic vendors have

already made application for requisite environmental permits from

the Uruguayan Ministry of Environment and ANCAP.

-- A virtual data room has been assembled, and the Company will

shortly be launching a formal farm-out process. The Company will

make further announcements as appropriate in due course.

ENDS

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDSEAFLIEDSESL

(END) Dow Jones Newswires

April 26, 2023 02:00 ET (06:00 GMT)

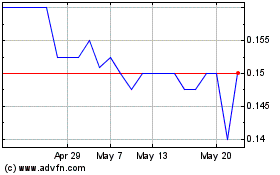

Challenger Energy (AQSE:CEG.GB)

Historical Stock Chart

From Dec 2024 to Jan 2025

Challenger Energy (AQSE:CEG.GB)

Historical Stock Chart

From Jan 2024 to Jan 2025