TIDMCEG

RNS Number : 0231B

Challenger Energy Group PLC

31 May 2023

31 May 2023

Challenger Energy Group PLC

("Challenger Energy" or the "Company")

URUGUAY AREA-OFF 1 UPDATE

Challenger Energy (AIM: CEG), the Caribbean and Americas focused

oil and gas company, with a range of oil production, development,

appraisal, and exploration assets, provides the following update in

relation to the AREA OFF-1 block, offshore Uruguay.

HIGHLIGHTS

-- Volumetric assessment of AREA OFF-1's three primary prospects

(Teru Teru, Anapero, Lenteja) has been completed

-- Assessed estimated recoverable resource (EUR) of

approximately 2.0 billion barrels (Pmean, unrisked), and over 4.9

billion barrels in an upside case (P10, unrisked)

-- Ongoing technical work has also identified additional new

leads and prospects, once evaluation is complete, expected to add

to the overall AREA OFF-1 resource and prospect inventory

-- Formal adviser-led farm-out process has been initiated; strong interest received

Eytan Uliel, Chief Executive Officer of Challenger Energy,

said:

"We continue to be encouraged by the opportunity that our AREA

OFF-1 licence in Uruguay represents. Our technical work highlights

how AREA OFF-1 is clearly world class acreage with massive resource

potential, in what has become a global exploration hotspot. To

capitalise on this, I can confirm that a farm-out process has now

commenced, with very strong initial indications of interest

received from multiple major oil companies. Our target is to

complete a farm-out transaction by year end, so that we can

continue to rapidly progress work on the block, and thereby

generate value for shareholders."

DETAILS

On 26 April 2023, the Company advised of the initial results of

its geotechnical work program at the Company's AREA OFF-1 licence,

offshore Uruguay. Since that time, the Company has continued with

various specific technical and commercial work streams, and is

pleased to provide the following update.

A. Volumetric Assessment

A volumetric assessment of the the three primary prospects

identified on the AREA OFF-1 block (Teru Teru, Anapero and Lenteja)

has now been completed. This assessment has indicated:

-- a total Oil in Place (OIP) of 6.5 billion barrels of oil

equivalent (BBOE) across all three prospects (Pmean, unrisked), and

over 16 BBOE in an upside case (P10, unrisked)

-- a total Estimated Ultimate Recoverable resource (EUR) of 2.0

billion BBOE across all three prospects (Pmean, unrisked), and over

4.9 BBOE in an upside case (P10, unrisked).

Details are summarised as follows:

TABLE A: OIL IN PLACE RESOURCE, AREA-OFF-1, URUGUAY (MAY

2023)

Oil in Place (mmboe) unrisked

--------------------------------------------------------------------------------

Prospect P10 Pmean P50 P90

----------- ------------------ ------------------- --------------------- ----------------

Teru Teru 5,116 2,334 1,777 527

Anapero 5,267 2,190 1,493 304

Lenteja 5,730 1,969 690 59

Total 16,113 6,493 3,960 890

------------ ------------------ ------------------- --------------------- ----------------

TABLE B: ESTIMATED RECOVERABLE RESOURCE, AREA-OFF-1,

URUGUAY (MAY 2023)

EUR (mmboe) unrisked

--------------------------------------------------------------------------------

Prospect P10 Pmean P50 P90

----------- ------------------ ------------------- --------------------- ----------------

Teru Teru 1,647 740 547 158

Anapero 1,627 670 445 88

Lenteja 1,666 576 198 17

Total 4,940 1,986 1,190 263

------------ ------------------ ------------------- --------------------- ----------------

The Company's internal estimates are that the economic field

size for a discovery in these water and reservoir depths to be in

the range of 150 to 200 million barrels. The EUR (P50) for all

three primary prospects exceeds or approximates this commercial

threshold.

B. Mapping, Interpretation and AVO work

As previously advised, the Company has continued with various

technical workstreams to complete prospect mapping, to finalise the

prospect and lead inventory, and to expand amplitude variation vs.

offset (AVO) analysis from initially 6 reprocessed 2D seismic lines

to 15, driven by the strong results from the initial AVO work

conducted.

Whilst this work remains to be completed, AVO analysis shows

strong Class II / Class III AVO anomalies have been identified for

the Teru Teru and Anapero prospects and are present on multiple

seismic lines, which serves to confirm the areal extent of both

prospects.

C. Additional Leads and Resource Potential

Ongoing technical work has also identified further leads and

prospects on AREA OFF-1. Interpretation and mapping of these

additional leads and prospects is continuing. It is anticipated

that once work is complete, these newly identified leads and

prospects may add further to the overall AREA OFF-1 resource and

prospect inventory. The Company will advise of this additional

exploration potential once work is completed.

Farm-out process

As previously advised, the Company has compiled a comprehensive

data-room, which includes all new work conducted inclusive of the

recently completed volumetric assessment.

A formal adviser-led farm-out process has now commenced, with

the Company having received several unsolicited approaches, and

strong interest from leading industry participants.

The farm-out process has been structured to meet the Company's

commercial objective, which is to complete a farm-out transaction

prior to the end of 2023. Introducing a strategic partner(s) during

2023 will enable the Company to accelerate value realisation from

the AREA OFF-1 licence, by fast-tracking 3D seismic acquisition,

potentially via a multi-client acquisition in early 2024.

An update Uruguay AREA OFF-1 presentation is now available on

the Company's website at www.cegplc.com .

For further information, please contact:

Challenger Energy Group PLC Tel: +44 (0) 1624 647

Eytan Uliel, Chief Executive Officer 882

WH Ireland - Nomad and Joint Broker Tel: +44 (0) 20 7220

Antonio Bossi / Darshan Patel / Enzo 1666

Aliaj

Zeus - Joint Broker Tel: +44 (0) 20 3829

Simon Johnson 5000

CAMARCO Tel: +44 (0) 20 3757

Billy Clegg / Hugo Liddy / Sam Morris 4980

Notes to Editors

Challenger Energy is a Caribbean and Americas focused oil and

gas company, with a range of oil production, development, appraisal

and exploration assets and licences, located onshore in Trinidad

and Tobago, and Suriname, and offshore in the waters of Uruguay and

The Bahamas. In Trinidad and Tobago, Challenger Energy has a number

of producing fields and appraisal / development projects. In

Suriname, Challenger Energy has on onshore appraisal / development

project. Challenger Energy's exploration licences in Uruguay and

The Bahamas offer high-impact value exposure within the overall

portfolio value.

Challenger Energy is quoted on the AIM market of the London

Stock Exchange.

https://www.cegplc.com

COMPETENT PERSON STATEMENT

Technical work referred to in this announcement has been

undertaken by various independent third-party specialist advisors.

This technical work has been overseen by Mr. Randolph Hiscock the

Company's New Business Director and Uruguay Managing Director.

In accordance with the AIM Note for Mining and Oil & Gas

Companies, CEG discloses that Mr. Randolph Hiscock is the qualified

person who has reviewed the technical information contained in this

presentation. He has a Masters in Science (Geology) and is a member

of the AAPG & PESGB, and has over 35 years' experience in the

oil and gas industry. Randolph Hiscock consents to the inclusion of

the information in the form and context in which it appears.

ENDS

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDNKKBKCBKKFPN

(END) Dow Jones Newswires

May 31, 2023 02:00 ET (06:00 GMT)

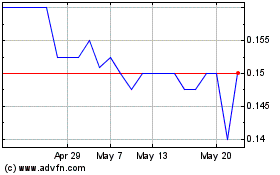

Challenger Energy (AQSE:CEG.GB)

Historical Stock Chart

From Nov 2024 to Dec 2024

Challenger Energy (AQSE:CEG.GB)

Historical Stock Chart

From Dec 2023 to Dec 2024