TIDMECP

RNS Number : 7862L

Eight Capital Partners PLC

08 September 2023

8 September 2023

Eight Capital Partners plc

("ECP", "Eight Capital" or "the Company")

Completion of Note Conversion, Related Party Transaction and

Issue of Equity

Eight Capital Partners plc (AQSE: ECP), the financial services

operating company that aims to grow revenue through businesses

engaged in "Fintech" operations including in the digital banking

and lending sectors, announces that, further to the announcement on

11 August 2023, application has been made for 25,577,732,855 new

ordinary shares at a price of 0.02525 pence per new ordinary share

("Conversion Shares") in lieu of the conversion of the Notes and

accrued interest due to be paid on 3 September 2023

("Implementation Date").

The price of the Conversion Shares was calculated by reference

to the volume weighted average price (VWAP) per share of the last

ten trading days before the Implementation Date and the mid-market

exchange rate on the Implementation Date. Based on the GBP/EUR

exchange rate of GBP 1: EUR 1.1686 and share price of 0.02525

pence, this results in the issue of 25,577,732,855 Conversion

Shares, representing approximately 13.64 per cent. of the so

enlarged issued share capital of the Company.

It is important that all Note holders who are receiving

Conversion Shares contact the Company on info@eight.capital in

order to confirm the delivery details for their allocation of

Conversion Shares and they are urged to do so immediately.

Admission

The Company has anticipated admission of the Conversion Shares

to trading on the AQSE Growth Market to occur on or around 13

September 2023 ("Admission"). Trading in the Company's ordinary

shares remains presently suspended as a result of the delayed

publication of the Company's annual report for the year ended 31

December 2022. The annual report is substantially complete and the

Company will shortly be in a position to publish its accounts. The

Conversion Shares will rank pari passu with the ordinary shares of

the Company in issue.

Director Shareholding

Following the issue of the Conversion Shares and the

participation by Trumar Capital LLC ("Trumar"), a company

beneficially owned by Dominic White, a director of the Company, in

the conversions, Trumar will receive 7,417,592,007 new ordinary

shares and will be interested in 150,904,260,453 ordinary shares,

representing 80.50 per cent. of the Company's issued share capital

on Admission.

Related party transaction

Whilst no specific agreement has been separately entered into by

Trumar as a result of the conversion of Notes, the process of the

conversion of the Notes has been treated as a related party

transaction pursuant to Rule 4.6 of the AQSE Growth Market Access

Rulebook (the "Transaction"). The Directors of the Company

independent of the Transaction confirm that, having exercised

reasonable care, skill and diligence, the Transaction is fair and

reasonable insofar as the shareholders of Eight Capital are

concerned.

Total voting rights

Following Admission, the Company's issued share capital will

comprise 187,451,702,503 ordinary shares of 0.01p each, with each

share carrying the right to one vote, therefore the total number of

voting rights in the Company will be 187,451,702,503. This figure

may be used by shareholders as the denominator for calculations by

which they will determine if they are required to notify their

interest in the Company, or a change to their interest in the

Company, under the Financial Conduct Authority's Disclosure

Guidance and Transparency Rules.

The Company notes that the number of shares in issue is very

high. It is the Company's intention to seek a share capital

consolidation shortly and further details will be announced to the

market in due course.

Capitalised terms used in this announcement shall, unless

otherwise defined, have the same meanings as set out in the

Company's announcement of 11 August 2023.

This announcement contains inside information for the purposes

of the UK Market Abuse Regulation and the Directors of the Company

are responsible for the release of this announcement.

Eight Capital Partners plc info@eight.capital

Dominic White, Chairman

Luciano Maranzana, Group CEO

Cairn Financial Advisers LLP

AQSE Corporate Adviser

Jo Turner / Liam Murray +44 20 7213 0880

Walbrook PR Limited +44 20 7933 8780

Paul Vann/Nick Rome +44 7768 807631

eightcapital@walbrookpr.com

About Eight Capital Partners:

Eight Capital partners plc is a financial services operating

company that aims to grow revenue through businesses engaged in

"Fintech" operations including in the digital banking and lending

sectors.

ECP seeks to grow its group revenue in these high growth fintech

sub-sectors, which it expects to also increase in value, such that

they generate an attractive rate of return for shareholders,

predominantly through capital appreciation.

www.eight.capital

Eight Capital Partners operates two subsidiary businesses:

Epsion Capital:

Epsion Capital is an independent corporate advisory firm based

in London with an extensive experience in UK and European capital

markets. The team of senior and experienced ECM and M&A

professionals is specialised across multiple markets, sectors and

geographies and it prides itself on a commercial approach that

allows the clients to achieve their growth ambitions.

www.epsioncapital.com

Innovative Finance:

Innovative Finance is a corporate finance advisory business that

develops mergers and acquisitions and financing solutions across

multiple sectors, primarily in Europe, with access to international

transactions. It focuses on investments in Europe which are linked

to technological developments in the financial services industry.

www.innovfinance.com

Forward Looking Statements

Certain statements in this announcement, are, or may be deemed

to be, forward looking statements. Forward looking statements are

identi ed by their use of terms and phrases such as "believe",

"could", "should", "envisage", "estimate", "intend", "may", "plan",

"potentially", "expect", "will" or the negative of those,

variations or comparable expressions, including references to

assumptions. These forward-looking statements are not based on

historical facts but rather on the Directors' current expectations

and assumptions regarding the Company's future growth, results of

operations, performance, future capital and other expenditures

(including the amount, nature and sources of funding thereof),

competitive advantages, business prospects and opportunities. Such

forward looking statements re ect the Directors' current beliefs

and assumptions and are based on information currently available to

the Directors.

Notification of a Transaction pursuant to Article 19(1) of Regulation

(EU) No. 596/2014

1 Details of the person discharging managerial responsibilities/person

closely associated

-----------------------------------------------------------------------

a. Name Dominic White

--------------------------- ------------------------------------------

2 Reason for notification

--------------------------- ------------------------------------------

a. Position/Status Chairman

--------------------------- ------------------------------------------

b. Initial notification/ Initial notification

Amendment

--------------------------- ------------------------------------------

3 Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

-----------------------------------------------------------------------

a. Name Eight Capital Partners Plc

--------------------------- ------------------------------------------

b. LEI 213800U1F5CGRZJ47X73

--------------------------- ------------------------------------------

4 Details of the transaction(s): section to be repeated for

(i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions have

been conducted

-----------------------------------------------------------------------

a. Description of Ordinary shares of GBP0.0001 each

the financial

instrument, type

of instrument

ISIN: GB00BYT56612

Identification

Code

--------------------------- ------------------------------------------

b. Nature of the Issue of ordinary shares in lieu of debt

transaction conversion

--------------------------- ------------------------------------------

c. Price(s) and volume(s) Price(s) Volume(s)

0.02525 7,417,592,007

--------------------------- ------------------------------------------

d. Aggregated information

- Aggregated Volume

N/A

- Price

--------------------------- ------------------------------------------

e. Date of the transaction 7 September 2023

--------------------------- ------------------------------------------

f. Place of the transaction AQSE, London

--------------------------- ------------------------------------------

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NEXEANNXELNDEFA

(END) Dow Jones Newswires

September 08, 2023 02:00 ET (06:00 GMT)

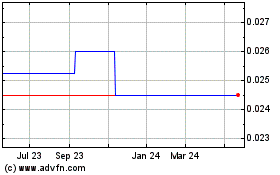

Eight Capital Partners (AQSE:ECP)

Historical Stock Chart

From Jan 2025 to Feb 2025

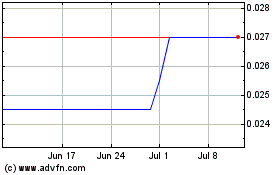

Eight Capital Partners (AQSE:ECP)

Historical Stock Chart

From Feb 2024 to Feb 2025