Evrima Plc Re. Option Agreement

September 08 2020 - 1:00AM

UK Regulatory

TIDMEVA

THE INFORMATION CONTAINED WITHIN THIS ANNOUNCEMENT IS DEEMED BY THE COMPANY TO

CONSTITUTE INSIDE INFORMATION AS STIPULATED UNDER THE MARKET ABUSE REGULATION

(EU) NO. 596/2014, AS AMENDED ("MAR"). ON THE PUBLICATION OF THIS ANNOUNCEMENT

VIA A REGULATORY INFORMATION SERVICE ("RIS"), THIS INSIDE INFORMATION IS NOW

CONSIDERED TO BE IN THE PUBLIC DOMAIN.

To be renamed Evrima Plc

(formerly Sport Capital Group Plc)

(the "Company")

Option Agreement entered into to acquire a 17.2% equity interest in Kalahari

Key Mineral Exploration Company (Pty) Limited ("KKME") from Existing

Shareholders, enabling the Company to increase its Investment from 2.4% to

19.6%

Particulars of the RIS Announcement

1. Information about KKME

2. Option to acquire a further 17.2% of KKME

3. CEO's Statement

1. Kalahari Key Mineral Exploration Company (Pty) Limited ("KKME")

KKME is a private mineral exploration company registered in Botswana, engaged

in the development of its Nickel-Copper-Platinum Group Metals (Ni-Cu-PGM)

project called the Molopo Farms Complex ("MFC"). The Company is currently

interested in 2.4% of the issued share capital of KKME.

The KKME opportunity developed from a recognition that no historical

exploration targeting "feeder" styles of Ni-Cu-PGE mineralisation had been

completed within the Molopo Farms ultramafic complex. The founder's group of

four seasoned metals explorers identified a number of prospecting licences over

a prospective geological feature often associated with feeder-style deposits.

The exploration work conducted to date by KKME continues to support the

prospectivity of the licence area and a series of exciting targets has been

identified for a proposed drilling campaign.

In 2020, KKME has been completing preparations for a scheduled maiden drill

campaign. Through the course of the year the technical work and studies have

included: ground geo-physics to better understand the most conductive targets,

an AMT survey and, arguably most significantly, KKME has successfully submitted

its Environment Impact Statement resulting in approval of a proposed drilling

programme on the MFC.

Further information can be found at KKME's website: https://

www.kalaharikey.co.uk

2. Option to acquire 17.2% of KKME

The Company has entered into an option agreement with two existing shareholders

of KKME who hold in aggregate 17.2% of KKME ("The Grantors"). The Grantors have

granted the Company a 60-day period of due diligence and exclusivity. During

this period of exclusivity, the Company will be conducting a review of KKME's

developments to date, completing respective valuation exercises and assessing

the capital requirements for the next 12-months associated with increasing the

Company's investment position in KKME.

The option is conditional on all parties (the Company, KKME & the Grantors)

receiving all appropriate Board and Regulatory approvals to proceed.

The Terms of the Option

* 60-day option and period of exclusivity to acquire 17.2% (3,332 shares) of

KKME

* The Company has proposed to acquire the shares at a price of USD$55 per

share, representing the last price at which the Company participated in a

private placement and new equity capital was raised by KKME.

* Subject to exercise with the period of exclusivity of the Company's option,

the total consideration payable to the Grantor shall be USD$183,260.

* The consideration payable shall be satisfied through the issue of 2,300,000

new ordinary shares in the capital of the Company at a price of 6 pence per

share ("Consideration Shares"). Additionally, the Grantors shall be awarded

2,300,000 warrants over one further new share each in the capital of the

Company with an exercise price of 12 pence per share and a life to expiry

of three years from the date on which the Consideration Shares shall have

been admitted to trading on AQSE Growth Market.

* The Consideration Shares shall be locked-in for a period of six months from

the date of issue. In the event that the Company's shares should trade

within this period for seven consecutive trading days at a volume-weighted

average price exceeding 12 pence, 25% of the consideration-equity shall

become freely tradable.

The Company currently has an interest of 2.4% in KKME and should the Company

elect to exercise the option, the Company would be interested in 19.6% of the

issued share capital of KKME.

3. CEO Statement, Burns Singh Tennent-Bhohi

"The Molopo Farms Complex already represented a compelling opportunity for the

Company's investment portfolio. The Board has been considering opportunities

whereby the Company can strategically position itself whilst avoiding the

immediate requirement to meet direct capital expenditure contributions in

relation to progressing project development.

In 2019, KKME entered a financing and earn-in agreement with AIM-quoted Power

Metal Resources plc (AIM: POW). POW currently owns 18.26% of KKME and has

elected to exercise an option granting it the right to earn a 40% direct

project interest in the MFC by completing qualifying expenditures totalling

US$500,000 by the end of this calendar year.

Conditional on the successful completion of its due diligence, the Company can

increase its equity-interest at a critical point in the project's exploration

cycle whilst assuming no liability to contribute to the proposed exploration

costs (US$500,000) but benefit greatly in the event of a commercially viable

discovery.

The level and depth of technical mitigation that has been undertaken by KKME in

preparation for a maiden drill campaign is impressive. The Board is confident

that the years of work completed by KKME will reduce the risk associated with

exploration campaigns of this nature and is interested in increasing the

Company's exposure to underlying commodities where long-term supplies are

presently limited."

The Company,

London, 8th September 2020

The Directors of the Company, who have issued this RIS announcement after due

and careful enquiry, accept responsibility for its content.

Enquiries

Company:

Burns Singh Tennent-Bhohi (CEO & Director)

burnsstb@evrimaplc.com

Simon Grant-Rennick (Executive Chairman)

simongr@evrimaplc.com

Direct Office Line: +44 (0) 20 3778 0755

Keith, Bayley, Rogers & Co. Limited (AQSE Corporate Adviser):

Graham Atthill-Beck: +44 (0) 20 7464 4091; +44 (0) 7506 43 41 07; +971 (0) 50

856 9408; Graham.Atthill-Beck@kbrl.co.uk; blackpearladvisers@gmail.com

Peterhouse Capital Limited (Corporate Stockbroker):

Lucy Williams: +44 (0) 20 7469 0930

Duncan Vasey: +44 (0) 20 7220 9797 (Direct)

END

(END) Dow Jones Newswires

September 08, 2020 02:00 ET (06:00 GMT)

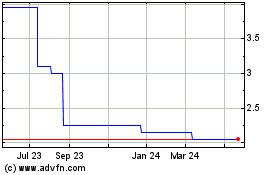

Evrima (AQSE:EVA)

Historical Stock Chart

From Jun 2024 to Jul 2024

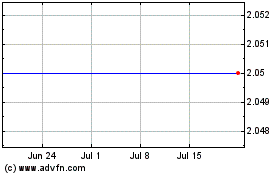

Evrima (AQSE:EVA)

Historical Stock Chart

From Jul 2023 to Jul 2024