TIDMEVA

THE INFORMATION CONTAINED WITHIN THIS ANNOUNCEMENT IS DEEMED BY EVRIMA PLC TO

CONSTITUTE INSIDE INFORMATION AS STIPULATED UNDER THE MARKET ABUSE REGULATION

(EU) NO. 596/2014, AS AMED ("MAR"). ON THE PUBLICATION OF THIS ANNOUNCEMENT

VIA A REGULATORY INFORMATION SERVICE ("RIS"), THIS INSIDE INFORMATION IS NOW

CONSIDERED TO BE IN THE PUBLIC DOMAIN.

EVRIMA PLC

(formerly Sport Capital Group plc; "Evrima" or the "Company")

RESULTS FOR THE PERIODED 30TH JUNE 2020

Chairman's Statement

The Directors present below the unaudited financial statements for the

half-year ended 30th June 2020, which show a loss before taxation of GBP(15,540)

(30th June 2019: GBP(73,331)) and cash-at-bank of GBP2,038 (30th June 2019: GBP

11,845). The financial statements which follow have not been reviewed by the

Company's statutory auditors. The loss for the half-year was in line with the

Directors' expectations at the beginning of the period under review.

Trading Performance

During the period under review, the Company retained investment property in

Leeds, West Yorkshire, which is let on a commercial lease until 2021. Despite

the impact of the Covid-19 lock-down which began on 24th March in England, the

lessee of the property continued to perform in accordance with the lease terms.

Other Developments

In May this year, the Company appointed Peterhouse Capital Limited as corporate

stockbroker. Keith, Bayley, Rogers & Co. Limited remains Corporate Adviser for

the purposes of the Company's share quotation on AQSE.

When, on 8th June 2020, I presented the Company's full-year results for 2019, I

stated that the Directors remained focused on opportunities with the potential

to bring rewards for shareholders. Since the end of the first half of 2019,

there has been a number of important developments within the Company; although

each has been publicly disclosed between July 2020 and earlier this month, as

and when required, I summarise them below under the heading "Post- Balance

Sheet Events".

Post- Balance Sheet Events

i. Equity Financing

In July of this year, the Company raised GBP324,000 gross of new, permanent

equity capital by means of a placing of 108,133,133 new shares with new and

existing investors.

ii. Changes of Directorate

At the same time as announcing the re-financing, I was able to announce that

two new Directors, Burns Singh Tennent-Bhohi and Guy Miller, had joined the

Board of Directors. Mark Jackson, FCA, MBA, left the Board shortly following

the re-financing, to concentrate on other business ventures with which I wish

him every success.

iii. Shareholders Approve New Investment Strategy, Capital Streamlining and

Name-Change

On 5th August 2020, the Company posted a circular seeking shareholders' consent

to certain measures, including the re-focusing of the investment objectives

onto the natural resources exploration and extraction sector, a re-organisation

of the Company's issued share capital in which the ordinary shares would be

consolidated in the ratio of one-for-ten and changing the Company's name from

Sport Capital Group plc to Evrima plc. All the steps sought to be taken were

approved on 24th August 2020.

iv. Option Significantly to Increase Existing Resource Investment

On 8th September 2020, Evrima announced that it had entered into a 60-day,

exclusive option to acquire a further 17.2 percent of the issued share capital

of Kalahari Key Minerals Exploration (Pty.) Limited ("KKME"), a private

Botswanan company which is exploring licences in a highly prospective

geological formation straddling the border of Botswana and the Republic of

South Africa for nickel and platinum group elements. In 2018, the Company

acquired a modest interest in KKME and subsequently participated in a capital

increase by KKME so that, should the Company elect to exercise the current

option announced on 8 September 2020, the Company would be interested in 19.6

percent of the issued share capital of KKME.

I look forward soon to informing shareholders concerning the outcome of the due

diligence and evaluation work on KKME that the Company is conducting during the

period of exclusivity under the Option Agreement; and of other investment

initiatives and developments as these unfold.

Simon Grant-Rennick,

Chairman,

Registered number

06474216

Evrima plc

Interim Accounts

30 June 2020

Evrima plc

Condensed Profit and Loss Account

for the year ended 30 June 2020

30-June 30-June

2020 2019

GBP GBP

Revenue 10,090 10,090

Operating expenses (16,194) (78,421)

Operating loss (6,104) (68,331)

Loss on revaluation of property (4,436)

-

Interest payable (5,000) (5,000)

Loss on ordinary activities before (15,540) (73,331)

taxation

Corporation tax 13,970

-

Total comprehensive loss for the (15,540) (59,361)

period

attributable to members

Evrima plc

Condensed Balance Sheet

as at 30 June 2020

30-June 30-June

Notes 2020 2019

GBP GBP

Fixed assets

Tangible assets 2 200,000

204,436

Investments 3 65,250

65,250

265,250 269,686

Current assets

Debtors 42,604 65,936

Cash at bank and in hand 2,038 21,697

44,642 87,633

Creditors: amounts falling (118,949) (117,026)

due within one year

Net current liabilities (74,307) (29,393)

Net assets 190,943 240,293

Capital and reserves

Called up share capital 119,234 118,567

Share premium 336,482 367,149

Profit and loss account (264,773) (245,423)

Shareholders' funds 190,943 240,293

Evrima plc

Condensed Statement of Changes in Equity

for the year ended 30 June

2020

Share Share Profit Total

capital premium and loss

account

GBP GBP GBP GBP

At 1 January 2019 97,990 293,726 (186,062) 205,654

Loss for the financial (59,361) (59,361)

period - -

Shares issued 20,577 73,423 94,000

-

At 30 June 2019 118,567 367,149 (245,423) 240,293

At 1 January 2020 119,234 336,482 (249,233) 206,483

Loss for the financial (15,540) (15,540)

period - -

At 30 June 2020 119,234 336,482 (264,773) 190,943

Evrima plc

Condensed cashflow statement

as at 30 June 2020

30-June 30-June

2020 2019

GBP GBP

Cashflows from operating activities

Operating loss (15,540) (73,331)

Depreciation/revaluation 4,436

-

Movement in working capital:

(Increase)/ decrease in trade and other (2,390) (1,763)

receivables

(Decrease)/ increase in trade and other (6,313) 855

payables

Cash used in operations (19,807) (74,239)

Investing activities

Payments to acquire investments 7,840

-

Financing activities

Loans received 10,000

-

Net share proceeds in 94,000

period -

10,000 94,000

Increase/(Decrease) in cash and cash (9,807) 11,921

equivalents

Cash and cash equivalents at beginning of the period 11,845 9,776

Cash and cash equivalents at end of the 2,038 21,697

period

Evrima plc

Notes to the Abridged Accounts

for the year ended 30 June 2020

1 Financial information

The financial information set out above does not constitute statutory

accounts within the meaning of Section 434 of the Companies Act 2006. It

has been prepared on a going concern basis in accordance with the

recognition and measurement criteria of the IFRS as adopted by the European

Union.

The accounting policies used in the preparation of this set of condensed

interim financial are consistent with those set out in the Company's annual

financial statements for the year ended 31 December 2019 and those that

will be used in the preparation of the financial statements for the year

ended 31 December 2020. Statutory accounts for the year ended 31 December

2019 were approved by the board of directors on 5 June 2020 and delivered

to the Registrar of Companies. The report of the auditor on those financial

statements was unqualified.

The financial information for the period ended 30 June 2020 has not been

audited or reviewed. As permitted the Company has chosen not to adopt IAS34

'Interim Financial Statements' in preparing this financial information.

Going concern

The directors, having made appropriate enquiries, consider that adequate

resources exist for the Company to continue in operational existence for

the foreseeable future, therefore, it is appropriate to adopt the going

concern basis in preparing the condensed interim financial statements for

the period ended 30 June 2020.

2 Tangible fixed assets

Freehold

property

GBP

Cost

At 1 January 2020 205,363

Surplus on revaluation (4,436)

At 30 June 2020 200,927

Depreciation

At 1 January 2020 927

At 30 June 2020 927

Net book value

At 30 June 2020 200,000

At 1 January 2020 204,436

Evrima plc

Notes to the Abridged Accounts

for the year ended 30 June 2020

3 Investments

Other

investments

GBP

Cost

At 1 January 2020 65,250

At 30 June 2020 65,250

The investment consists of a 15% shareholding in Mighty Oak Exploration

Limited, a company with exploration licences for cobalt and lithium projects in

Uganda, and 2.4% in KKME, a battery metals exploration company with licences in

Botswana prospecting for nickel and platinum within the Molopo Farms complex.

4 Earnings per share

The calculation of basic earnings per share is based on the loss attributable

to ordinary shareholders divided by the weighted average of ordinary shares in

issue being 119,233,945 during the period. This results in a loss per share of

0.01p (2019 - 0.05p).

5 Directors remuneration

the directors will not be remunerated until such time as the net assets of the

Company exceed GBP500,000.

This announcement has been made after due and careful enquiry; the Directors of

the Company accept responsibility for the information contained in it.

REGULATORY ANNOUNCEMENT ENDS

* :

Evrima plc (formerly Sport Capital Group plc):

Simon Grant-Rennick

E-mail: simon@evrimaplc.com

Mob: +44 797 325 3124

Keith, Bayley, Rogers & Co. Limited (Aquis Exchange Corporate Adviser):

Graham Atthill-Beck

E-mail: Graham.Atthill-Beck@kbrl.co.uk

Tel: +44 20 7464 4091

Mob: +44 750 643 4107; +971 50 856 9408

Brinsley Holman

E-mail: Brinsley.Holman@kbrl.co.uk

Tel: +44 20 7464 4098

Mob: +44 777 630 2228

Peterhouse Capital Limited (Corporate Stockbroker):

Lucy Williams: +44 (0) 20 7469 0930

Duncan Vasey: +44 (0) 20 7220 9797 (Direct)

END

(END) Dow Jones Newswires

September 21, 2020 02:30 ET (06:30 GMT)

Evrima (AQSE:EVA)

Historical Stock Chart

From Jun 2024 to Jul 2024

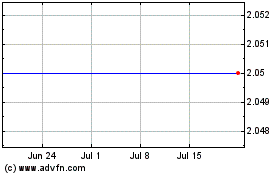

Evrima (AQSE:EVA)

Historical Stock Chart

From Jul 2023 to Jul 2024