Evrima Plc Botswanan Venture Option Exercised

November 13 2020 - 1:00AM

UK Regulatory

TIDMEVA

THE INFORMATION CONTAINED WITHIN THIS ANNOUNCEMENT IS DEEMED BY THE COMPANY TO

CONSTITUTE INSIDE INFORMATION AS STIPULATED UNDER THE MARKET ABUSE REGULATION

(EU) NO. 596/2014, AS AMENDED ("MAR"). ON THE PUBLICATION OF THIS ANNOUNCEMENT

VIA A REGULATORY INFORMATION SERVICE ("RIS"), THIS INSIDE INFORMATION IS NOW

CONSIDERED TO BE IN THE PUBLIC DOMAIN.

Evrima plc

AQSE: EVA

("Evrima" or the "Company")

Acquisition of a further 17.2% interest in KKME

Exercise of Option over 17.2% of Kalahari Key Mineral Exploratiom Company (Pty)

Limited ("KKME"), resulting in Evrima having a 19.6% interest in KKME.

Particulars of the RIS Announcement

1. Exercise of Option, increasing Evrima's interst in KKME to 19.6%

2. KKME Operational Update

3. CEO's Statement

4. Admission of New Shares & Total Voting Rights

1. Exercise of Option, increasing Evrima's interst in KKME to 19.6%

Pursuant to the option agreement ("Option Agreement") that Evrima entered into

with two of the founding shareholders of KKME (please refer to the Company's

news release of 8th September 2020 headed "Re. Option Agreement"), the Company

is pleased to announce that, after a period of evaluation and due diligence,

Evrima is exercising its option granted in the Option Agreement.

Prior to signing the Option Agreement, Evrima held a 2.4% interest in KKME;

following the optionexercise, it will have acquired a further 17.2% of KKME

resulting in Evrima holding an interest of 19.6% in the capital of KKME.

The aggregate consideration of GBP138,000 (one hundred and thirty-eight thousand

pounds Sterling) payable upon exercise to the grantors of the opton

("Grantors") shall be satisfied through the issue of 2,300,000 new ordinary

shares in the capital of the Company to be allotted at the price of GBP0.06 (six

pence) per share ("Consideration Shares"). In addition to the Consideration

Shares, the Grantors shall be awarded, 2,300,000 warrants over one further new

ordinary share each in the capital of the Company at an exercise price of GBP0.12

(twelve pence) per share and a life to expiry of three years from the date on

which the Consideration Shares shall have been admitted to trading on AQSE

Growth Market.

Following the allotment of the Consideration Shares, the Grantors will be

interested in 9.18% of the enlarged issued share capital of Evrima as follows:

Name of Grantor Shares Holding after Warrants Total Shares Percentageof

/Shareholder Currently Consideration Held after Enlarged

Held Shares Allotment of Issued Share

Allotted Consideration Capital of

Shares Company

Rickey Gerhard None 1,150,000 1,150,000 1,150,000 4.59%

Bonner

Simon John Bate None 1,150,000 1,150,000 1,150,000 4.59%

1. KKME Operational Update

KKME's flagship project, the Molopo Farms Complex ("MFC") has been extensively

developed over a number of years. The opportunity was originally identified by

four seasoned metal explorers who evaluated a number of prospecting licenses

that demonstrated no historical exploration targeting "feeder" styles of

Ni-Cu-PGE mineralisation had hitherto been completed within the Molopo Farms

ultramafic complex.

In 2019, KKME entered a financing and earn-in agreement with AIM-quoted Power

Metal Resources plc (AIM: POW). POW currently owns 18.26% of KKME and has

elected to exercise an option granting it the right to earn a 40% direct

project interest in the MFC by completing qualifying expenditures totalling

US$500,000 by the end of this calendar year.

Despite the difficulties surrounding exploration campaigns in light of the

global pandemic, POW and KKME have shown immense operational ability in

announcing the commencement of a 2,505 metre maiden diamond drill campaign.

KKME has identied 14 targets, with this maiden campaign focusing on four of

these. The target hole depths will vary between 525 and 710 metres.

The purpose of the programme is to validate the considerable technical work

that has been done to date, indicating the targets to be prospective for

massive nickel sulphide mineralisation which, if confirmed, could lead to a

number of highly favourable outcomes and an accelerated revaluation of the

Molopo Farms Complex.

The shareholders of KKME are frequently kept up to date through both our fellow

KKME-shareholder and earn-in party, Power Metal Resources plc (AIM: POW), and

KKME itself. At present, the programme has commenced successfully and the first

of the four holes has reached a depth of 445 metres (as at 10th November 2020)

which is fast approaching the target zone with the modelled target 1-14

conductor being at a depth of approximately 505 metres.

1. CEO Statement, Burns Singh Tennent-Bhohi

"It is with much excitement that we announce the acquisition of a further 17.2%

interest in KKME. That company is now entering a critical period of its

development cycle through the support of our fellow KKME-shareholder, Power

Metal Resources plc (AIM: POW), which is engaging its rights under an earn-in

agreement entered into in 2019 with KKME.

Evrima sits in a rare position as an investor in the junior exploration market,

whereby it has become the beneficiary of a fully-funded, $500,000 maiden

diamond drill campaign that has commenced notwithstanding the global conditions

that have restricted so many in the industry from accessing capital and

operational workforces.

The Company has increased its equity interest in KKME as close to potential

discovery as one could reasonably hope, deploying non-cash consideration and

welcoming as shareholders of Evrima two co-founders of KKME who understand the

significance of the project more than most, creating a strong exchange of

mutual value.

The Directors look forward to providing further updates with relation to the

Molopo Farms Complex drill programme over the weeks and months ahead."

1. Admission of Shares & Total Voting Rights (TVRs)

Application will be made for the Consideration Shares to be admitted to trading

on AQSE Growth Market and this is expected to occur on or around 4th December

2020. No application shall be made to admit to trading on AQSE Growth Market or

to any other forum of quotation the warrants being issued alongside the

Consideration Shares.

Following the allotment of the Consideration Shares, Evrima plc's ordinary

issued share capital shall comprise of 25,036,728 ordinary shares of GBP0.001

(22,736,728 shares) . This number will represent the total voting rights in the

Company, and upon admission, may be used by shareholders as the denominator for

the calculation by which they can determine if they are required to notify

their interest in, or change to their interest in, the Company under the

Financial Conduct Authoriry's Disclosure and Transparency Rules. The news

shares will rank pari passu in all respects with the Ordinary Shares of the

Company currently traded on AQSE.

Following the issue of the Consideration Shares the Directors of the Company

will be interested in:

Director/Connected No.of Percentage Percentage of Enlarged share Capital

Party Shares of Issued upon Admission of Consideration

Currently Share Shares

Held Capital

Simon Grant-Rennick* 3,540,000 15.57% 14.14%

Burns Singh 700,000 3.07% 2.79%

Tennent-Bhohi

Guy Miller 500,000 2.19% 2%

*Simon Grant-Rennick is interested in 3,540,000 voting rights through Alpha

Corporate Services (Bermuda) Ltd., a trust to which he is an adviser.

Evrima plc,

London, 13th November 2020

The Directors of the Company, who have issued this RIS announcement after due

and careful enquiry, accept responsibility for its content.

Enquiries

Company:

Burns Singh Tennent-Bhohi (CEO & Director)

burnsstb@evrimaplc.com

Simon Grant-Rennick (Executive Chairman)

simongr@evrimaplc.com

Direct Office Line: +44 (0) 20 3778 0755

Keith, Bayley, Rogers & Co. Limited (AQSE Corporate Adviser):

Graham Atthill-Beck: +44 (0) 20 7464 4091; +44 (0) 7506 43 41 07; +971 (0) 50

856 9408; Graham.Atthill-Beck@kbrl.co.uk; blackpearladvisers@gmail.com

Peterhouse Capital Limited (Corporate Stockbroker):

Lucy Williams: +44 (0) 20 7469 0930

Duncan Vasey: +44 (0) 20 7220 9797 (Direct)

END

(END) Dow Jones Newswires

November 13, 2020 02:00 ET (07:00 GMT)

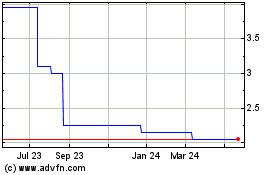

Evrima (AQSE:EVA)

Historical Stock Chart

From Jun 2024 to Jul 2024

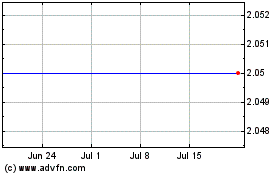

Evrima (AQSE:EVA)

Historical Stock Chart

From Jul 2023 to Jul 2024