TIDMITX

RNS Number : 0806M

Itaconix PLC

12 September 2023

Itaconix plc

("Itaconix" or the "Company")

Half year results for the period ended 30 June 2023

Itaconix (LSE: ITX) (OTCQB: ITXXF), a leading innovator in

sustainable plant-based polymers used to decarbonise everyday

consumer products, is pleased to announce its unaudited interim

results for the six months ended 30 June 2023.

A copy of the Interim Report & Accounts is available for

download on Itaconix's website at www.itaconix.com.

John R. Shaw, CEO of Itaconix, commented:

" Recurring and new orders from our expanding customer base

generated our fifth consecutive year of record first- half

revenues. With this commercial progress, we are leveraging our

proprietary technology platform to achieve key milestones towards

our goal of becoming a large, profitable specialty ingredient

company.

With higher revenues, higher gross profits, and continued

control over operating expenses, our Adjusted EBITDA(1) improved to

the lowest loss in the last five six-month periods.

With our proprietary technology platform, established production

capabilities, and successful fundraise in February 2023, we have

entered a new era of development with immediate and long-term

prospects for expansive growth . Our current products and customer

project pipeline are expected to allow us to pursue much larger

revenues. The Company is on course to deliver full year 2023

results in line with expectations. Importantly, our plant-based

solutions for sustainable consumer needs are also continuing to

make a notable contribution to the development and success of the

Low-Carbon Economy."

Financial Highlights

-- First half revenues of $4.0 million were 32% higher than the

first half of 2022, 59% higher than the second half of 2022.

-- Gross profits were $1.1 million, representing an increase of

49% over the first half of 2022 and an increase of 56% over the

second half of 2022.

-- Gross profit margin was 28% compared to 25% for the first

half of 2022. Gross profit margin on Performance Ingredients was

34% compared to 29% for the first half of 2022. This improvement in

gross profit margin was due to selective price increases, stable

raw material costs, lower transportation costs, more favorable USD

exchange rates, a more favorable blend of product and account

revenues, and higher volumes.

-- Adjusted EBITDA(1) was a loss of $0.4 million, compared to a

loss of $0.6 million for the first half of 2022 and a loss of $0.8

million for the second half of 2022, including continued investment

spending on major new revenue opportunities.

-- In February 2023, the Company completed an equity raise with

net proceeds of $11.5 million for working capital, select capital

spending, and continued investment in new revenue opportunities for

the Company's next chapter of growth.

-- Cash and Cash Equivalents as at 30 June 2023 was $10.9

million, compared to $0.6 million as at 31 December 2022.

Company Milestones:

-- Cleaning revenues were $3.7 million for the first half of

2023 compared to $2.7 million in the first half of 2022, reflecting

market gains for non-phosphate detergents using Itaconix(R) TSI(TM)

322. Continued growth is expected in North America and Europe as

current customers gain market share, new customers go into full

production with new formulations, and additional customers emerge

in the second half of 2023 from the current pipeline of new

cleaning projects.

-- Combined hygiene and beauty revenues were unchanged at $0.4

million for the first half of 2023. Initial successes with new

direct accounts are expected to generate higher revenue growth in

the second half of 2023 and into 2024.

-- Polymer research and process development on the Company's

plant-based superabsorbents have succeeded in achieving absorption

performance that is closer to the incumbent acrylate superabsorbent

polymers. These breakthroughs are milestones towards the Company's

goal of introducing a more competitive product with broader market

appeal in late 2024 or 2025.

-- The Company completed its first capital expenditure

investment from the most recent fundraise with the purchase and

installation of a new laboratory reactor for small scale-up

production of its BIO*Asterix plant-based intermediates. Continued

development through 2023 is expected to allow the marketing and

sale of research quantities in the first half of 2024.

-- Dr. Peter Nieuwenhuizen, who joined as an Independent

Non-Executive Director and Interim Chair in July 2022, was

appointed as Non-Executive Chair in January 2023.

-- Paul LeBlanc was appointed as an Independent Non-Executive

Director and Chair of the Audit Committee in January 2023. He

brings decades of financial and operating experience as CFO of

Bemis Associates, Inc., a global manufacturer of specialty films

and adhesives for the industrial and apparel markets.

-- Itaconix received the Frost & Sullivan 2022 North

American Enabling Technology Leadership Award in the bio-based

polymer industry, announced in March 2023.

-- The Company appointed Canaccord Genuity Limited as Joint Broker in April 2023.

The Company also announces that its Nominated Adviser and Joint

Broker, finnCap Ltd, has now changed its name to Cavendish Capital

Markets Ltd following completion of its own corporate merger.

(1) Adjusted EBITDA is defined and reconciled to Operating loss

in Note 4 of the Interim Report.

For further information please contact:

Itaconix plc +1 603 775-4400

John R. Shaw / Laura Denner

Belvedere Communications +44 (0) 20 3576 0320

John West / Llew Angus

Cavendish Capital Markets Ltd +44 (0) 20 7220 0500

Nominated Adviser & Joint Broker

Ed Frisby / Abigail Kelly / Milesh Hindocha

(Corporate Finance)

Andrew Burdis / Sunila de Silva (ECM)

Canaccord Genuity +44 (0) 20 7523 8000

Joint Broker

Adam James

About Itaconix

Itaconix uses its proprietary plant-based polymer technology

platform to produce and sell specialty ingredients that improve the

safety, performance, and sustainability of consumer products. The

Company's current ingredients are enabling and leading new

generations of products in cleaning, hygiene, and beauty.

www.itaconix.com

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION AS DEFINED IN

ARTICLE 7 OF THE MARKET ABUSE REGULATION NO. 596/2014 AS IT FORMS

PART OF UK DOMESTIC LAW BY VIRTUE OF THE EUROPEAN UNION

(WITHDRAWAL) ACT 2018 ("MAR"). UPON THE PUBLICATION OF THIS

ANNOUNCEMENT, THIS INSIDE INFORMATION IS NOW CONSIDERED TO BE IN

THE PUBLIC DOMAIN.

Chief Executive's Statement

With record revenues and new funding, Itaconix has entered a new

era of development toward our long-term goal of becoming a large,

highly profitable, capital-efficient specialty ingredient

company.

More brands are turning to Itaconix's plant-based ingredients

for new generations of consumer products that are safer and more

sustainable without compromising on performance or cost. We intend

to expand our base of recurring revenues to reach profitability by

continuing to grow current accounts and adding new accounts from

our $30 million customer project pipeline.

Our $11.5 million fundraise in February 2023 provides us with

the funds needed to achieve our profitability goal and advance our

long-term goal of at least $100 million in annual revenues. We are

focused in the near term on increasing revenues from our current

customers and converting our $30 million customer project pipeline

into new revenues from new customers. We are also initiating new

efforts on higher-volume applications to capture more share of the

current $2.3 billion addressable market for the Itaconix technology

platform. As detailed below, we have begun to use the proceeds of

our fundraise to expand our staffing, to invest in new laboratory

equipment, and to accelerate the introduction of new products and

applications within the Company's VELAFRESH(R) hygiene and

BIO*Asterix(R) intermediates businesses.

We are applying nature to create a Low-Carbon Economy by using

itaconic acid to produce key ingredients for safer and more

sustainable everyday products with better performance and value.

Itaconic acid is a material produced in nature that can replace

synthetic chemistries such as acrylic acid and styrene when made

into a polymer. The Itaconix technology platform currently has 16

families of patents and patent applications that protect processes,

compositions, or uses for polymers of itaconic acid.

We are continuing to research and protect new polymers and new

applications that can expand the current $2.3 billion addressable

market for our ingredients within the $20 billion potential for our

technology platform. The success of our development processes was

recognised in March 2023 when Itaconix announced receipt of the

Frost & Sullivan Enabling 2022 North American Technology

Leadership Award in the bio-based polymer industry. Each year Frost

& Sullivan presents these awards to companies that have

developed pioneering technology that not only enhances current

products, but also enables the development of new products and

applications. The awards also recognize the high market acceptance

potential of recipients' technologies.

Financial Results

First half revenues of $4.0 million were 32% higher than the

first half of 2022 and 59% higher than the second half of 2022. In

addition, they are 71% of the full year revenues for 2022. Revenue

growth came from increased demand from current customers, new

recurring orders from new 2022 customers, and initial orders from

new 2023 customers. The Company is in a strong position to deliver

2023 revenues in line with current expectations and is making major

progress towards building the customer base to meet expectations

for revenues in 2024.

Gross profits were $1.1 million, representing an increase of 49%

over the first half of 2022.

Gross profit margin improved to 28.1% compared to 26.6% for the

full year of 2022, which remains below our long-term gross profit

margin target of 35%. The Company succeeded with price increases to

pass on higher raw material prices, experienced some easing in

transportation costs, and benefited with more favorable exchange

rates for the US dollar. The Company expects continued improvements

to gross margins in the second half of 2023.

Adjusted EBITDA(1) was a loss of $0.4 million, compared to a

loss of $0.6 million for the first half of 2022 and a loss of $0.8

million for the second half of 2022. As noted above, the Company

continues to make judicious investments in the research and

development for new products and applications that are adding new

addressable markets and major new revenue opportunities.

Loss for the period was $0.7 million, compared to a loss of $1.1

million in the first half of 2022 and a loss of $1.3 million in the

second half of 2022.

In February 2023, the Company completed an equity raise with net

proceeds of $11.5 million to fund working capital and support

continued growth.

Cash and Cash Equivalents as at 30 June 2023 were $10.9 million,

compared to $0.6 million as at 31 December 2022.

Commercial Progress

The Company is leading the introduction of new generations of

products in major consumer care applications, particularly within

the 360 million households across Europe and North America. As

brands and retailers face increased pressure from consumers to act

on climate change, Itaconix's plant-based ingredients have the

functional value to decarbonise everyday products with performance,

safety, cost, and sustainability.

Used as key ingredients in over 150 consumer brands, Itaconix

products are found in cleaning, hygiene, and beauty products in

major retailers across North America and Europe. With new products

continuing to emerge from its technology platform and over $30

million in new revenue potential currently in its customer project

pipeline, the Company expects sustained high growth in new and

recurring orders.

Cleaning

Cleaning revenues were $3.7 million for the first half of 2023

compared to $2.7 million in the first half of 2022. A new

generation of non-phosphate dishwashing detergents based on the

multifunctional value of Itaconix(R) TSI(TM) 322 is capturing

market share in North America and gaining more traction in Europe.

Itaconix(R) TSI(TM) 322 is the key ingredient in this new

generation of detergents for managing water hardness and assuring

shiny, spotless glasses and dishes. When formulated correctly into

a detergent, our plant-based polymer provides these detergents with

excellent shine performance, lower overall cost, and

industry-leading bio-based content.

The Company offers formulation solutions to transition brands

quickly and effectively to formulations that realise the full

functional value of its proprietary ingredients, including

performance testing and reliable supply of other key ingredients.

The Company generated $1.1 million in revenues in the first half of

2023 from providing these solutions, up from $0.6 million for the

first half of 2022.

The Company currently generates new demand from major detergent

producers in North America and Europe through direct selling

efforts and from smaller detergent customers through an expanding

network of distributors.

Hygiene

Hygiene revenues from direct sales of VELAFRESH(R) products and

through Croda for ZINADOR(R) products were $0.1 million for the

first half of 2023 compared to $0.2 million in the first half of

2022. Although overall revenues declined, the Company is encouraged

by new traction generated through its selling efforts, particularly

in pet care and household cleaning.

The Company continues to see significant revenue opportunities

for its plant-based superabsorbent. Early commercial work indicated

a need for higher absorption capacity to compete more effectively

with current acrylate incumbents. Polymer research and process

development initiated after the February 2023 fundraise has

generated desired performance improvements. These breakthroughs are

expected to allow the Company to introduce a more competitive

product with broader market appeal in late 2024 or 2025.

Beauty

Beauty revenues from direct sales of VELASOFT(R) products and

through Nouryon for its Amaze(R) SP product were $0.1 million for

the first half of 2023 compared to $0.1 million in the first half

of 2022.

The Company is continuing development of new haircare

ingredients based on a new patent filing in April 2022.

BIO*Asterix

BIO*Asterix products did not generate any revenues in the first

half of 2023, similar to the first half of 2022. The Company

continues to see large revenue opportunities for Itaconix products

that are sold to specialty chemical producers to use as

intermediates or components in their ingredients. The Company

completed its first major capital investment from the most recent

fundraise with the purchase and installation of a new laboratory

reactor for small scale-up production of its BIO*Asterix

plant-based intermediates. Continued development through 2023 is

expected to allow the marketing and sale of research quantities in

the first half of 2024.

Operational Review

We met all customer orders in the first half of 2023 and have

the capacity and capabilities in place to meet expected customer

needs through 2023 and into 2024. We are building our finished

goods inventories in North America and Europe to ensure we meet

these needs. We are also planning some investment in production

upgrades and modifications to improve process efficiencies and

production rates to meet future customer needs at our current

facility.

The cost and delivery times for the raw materials used in our

production processes have stabilized. We expect this stability to

transition into some easing in material and transportation costs

over the next six months.

We are selectively expanding our staffing to meet the demands of

current and future revenue development and growth. New hires were

made in research and development, quality control, production, and

customer support following the most recent fundraise. We plan to

expand our revenue generating capabilities by adding marketing and

sales staff.

Governance

Dr. Peter Nieuwenhuizen, who joined as an Independent

Non-Executive Director and Interim Chair in July 2022, was

appointed as Non-Executive Chair in January 2023.

Paul LeBlanc was appointed as an Independent Non-Executive

Director and Chair of the Audit Committee in January 2023. He

brings decades of financial and operating experience as CFO of

Bemis Associates, Inc., a global manufacturer of specialty films

and adhesives for the industrial and apparel markets.

Effective 22 August 2023, the Company completed the 50:1 share

consolidation approved by shareholders in June 2023.

Current Trading and Outlook

The Company's base of recurring revenues continues to grow and

generate record levels of revenues. With the cash resources in

place to support this growth and introduce further new Itaconix

plant-based ingredients, Itaconix is firmly in a new stage of

progress towards reaching its near-term targets and setting its

sights on bigger and broader opportunities for its technology

platform.

We are focused on more consumer brands using our current

ingredients and on entering higher-volume applications within our

current $2.3 billion addressable market. Key measures of success

for us through 2024 are the number of new brands we add and the

number of new products that we introduce in new applications.

The Company remains on course to deliver full year 2023 results

in line with expectations.

John R. Shaw

Chief Executive Officer

11 September 2023

Condensed consolidated income statement and statement of

comprehensive income

For the six months ended 30 June 2023

Unaudited Unaudited

6 Months 6 Months

to to

30 June 30 June

2023 2022

Notes $000 $000

Revenue 5 4,032 3,057

Cost of sales (2,899) (2,296)

--------- ---------

Gross profit 1,133 761

Other income 4 - -

Administrative expenses (1,863) (1,701)

--------- ---------

Group operating loss (730) (940)

Interest income 48 -

Exceptional expense on movement

of contingent consideration 6 - (174)

--------- ---------

Loss before tax (682) (1,114)

Taxation expense (12) (6)

--------- ---------

Loss for the period (694) (1,120)

Other comprehensive income, net

of income tax

Items that may be reclassified

subsequently to profit or loss:

Exchange differences on translated

foreign operations 439 97

--------- ---------

Total comprehensive loss for the

period (255) (1,023)

========= =========

Basic and diluted loss per share

(GBP) 7 (0.00p) (0.20p)

========= =========

Condensed consolidated statement of financial position

As at 30 June 2023

Unaudited Audited

As at As at

30 June 31 December

2023 2022

Notes $000 $000

Non-current assets

Property, plant and equipment 382 301

Right-of-use asset 252 343

--------- -----------

634 644

Current assets

Inventories 1,113 1,119

Trade and other receivables 482 164

Cash and cash equivalents 3 10,922 597

--------- -----------

12,517 1,880

--------- -----------

Total assets 13,151 2,524

========= ===========

Financed by

Equity shareholders' funds

Equity share capital 8 8,488 5,959

Equity share premium 58,057 47,942

Own shares reserve (5) (5)

Merger reserve 31,343 31,343

Share based payment reserve 752 643

Foreign translation reserve 338 (101)

Retained losses (87,250) (86,556)

--------- -----------

Total equity 11,723 (775)

Non-current liabilities

Long-term lease liability 48 119

--------- -----------

48 119

--------- -----------

Current liabilities

Trade and other payables 1,220 1,866

Contingent consideration 6 - 1,134

Short-term lease liability 160 180

--------- -------------

1,380 3,180

--------- -------------

Total liabilities 1,428 3,299

--------- -------------

Total equity and liabilities 13,151 2,524

========= =============

Interim condensed consolidated statement of cash flows

For the six months ended 30 June 2023

Unaudited Unaudited

6 Months 6 Months

to to

30 June 30 June

2023 2022

$000 $000

Cash flows from operating activities

Operating loss before tax (682) (1,114)

Adjustments for:

Depreciation of property, plant and

equipment 88 79

Depreciation of right-of-use asset 101 101

Share based payment charge 109 192

Revaluation of deferred consideration - 59

Gain on foreign exchange 439 97

Taxation (11) (6)

Decrease in inventories 5 317

Increase in receivables (319) (361)

(Decrease) / increase in payables (646) 622

--------- ---------

Net cash outflow from operating activities (916) (14)

--------- ---------

Cash flows from investing activities

Purchase of property, plant and equipment (168) (36)

--------- ---------

Net cash outflow from investing activities (168) (36)

--------- ---------

Cash flows from financing activities

Cash received from issuing share of

stock, net 11,510 387

Lease payments (57) (72)

Interest expense on lease payments (44) (27)

--------- ---------

Net cash inflow from financing activities 11,409 288

--------- ---------

Net inflow in cash and cash equivalents 10,325 238

Cash and cash equivalents at beginning

of the period 597 683

--------- ---------

Cash and cash equivalents at end

of the period 10,922 921

========= =========

Notes to the interim condensed consolidated financial

statements

1. General information

These unaudited interim condensed financial statements of

Itaconix plc for the six months ended 30 June 2023 were approved

for issue in accordance with a resolution of the Board on 11

September 2023. Itaconix plc is a public limited company

incorporated in the United Kingdom whose shares are traded on the

AIM Market of the London Stock Exchange.

This half-yearly financial report is also available on the

Group's website at https://itaconix.com/investor/reports-documents/

.

2. Accounting policies

These interim consolidated financial statements have been

prepared in accordance with UK adopted International Accounting

Standards (collectively "IFRS") . They do not include all

disclosures that would otherwise be required in a complete set of

financial statements and should be read in conjunction with the 31

December 2022 ('2022') Annual Report. The financial information for

the half years ended 30 June 2023 and 30 June 2022 does not

constitute statutory accounts within the meaning of Section 434 (3)

of the Companies Act 2006 and both periods are unaudited.

The annual financial statements of Itaconix Plc ('the Group')

are prepared in accordance with IFRS . The comparative financial

information for the year ended 31 December 2022 included within

this report does not constitute the full statutory Annual Report

for that period. The statutory Annual Report and Financial

Statements for 2022 have been filed with the Registrar of

Companies. The Independent Auditors' Report on the Annual Report

and Financial Statements for the year ended 31 December 2022 was

unqualified and did not contain a statement under 498(2) - (3) of

the Companies Act 2006.

The interim condensed consolidated financial statements are

presented in US dollars and all values are rounded to the nearest

thousand ($'000) except when otherwise indicated. The interim

condensed consolidated financial statements are prepared on the

historical cost basis except for contingent consideration which has

been measured at fair value.

The Group has applied the same accounting policies and methods

of computation in its interim consolidated financial statements as

in its 31 December 2022 annual financial statements, except for

those that relate to new standards and interpretations effective

for the first time for periods beginning on (or after) 1 January

2022 and will be adopted in the 2022 financial statements. There

are deemed to be no new and amended standards and/or

interpretations that will apply for the first time in the next

annual financial statements that are expected to have a material

impact on the Group.

Going concern

This Interim Report has been prepared on the assumption that the

business is a going concern. In reaching their assessment, the

Directors have considered a period extending at least 12 months

from the date of approval of this half-yearly financial report.

This assessment has included consideration of the forecast

performance of the business for the foreseeable future and the cash

available to the Group. As such, the Directors have concluded that

the Group continue as a going concern for the foreseeable future.

The interim financial statements do not include the adjustments

that would be required if the Group were unable to continue as a

going concern.

Risks and uncertainties

The principal risks and uncertainties facing the Group remain

broadly consistent with the Principal Risks and Uncertainties

reported in Itaconix plc's 31 December 2022 Annual Report.

3. Cash and cash equivalents

Unaudited Audited

As at As at

30 June 31 December

2023 2022

$000 $000

Cash at bank and in hand 10,922 597

--------- -----------

10,922 597

========= ===========

4. Reconciliation of Operating Loss to Adjusted EBITDA

The detail below shows the reconciliation of operating loss to

earnings before change in value of contingent consideration, share

based payment charge (non-cash), interest, taxes, depreciation and

amortisation (Adjusted EBITDA).

Unaudited Unaudited

6 Months 6 Months

to to

30 June 30 June

2023 2022

$000 $000

Loss for the period (694) (1,120)

Revaluation of contingent consideration - 174

Share based payment charge 109 192

Interest Income (48) -

Taxes 12 6

Depreciation and amortisation 189 180

--------- ---------

Adjusted EBITDA (432) (568)

========= =========

5. Segmental analysis

Revenue by business segments:

The Group has two business segments. Performance Ingredients

develops, produces and sells proprietary specialty polymers that

are used as functional ingredients to meet customers' needs in

cleaning, beauty and hygiene products. Formulation Solutions

provides technical services and ingredient supplies for formulated

products developed for customers based on Performance Ingredients.

These segments make up the continuing operations. Core Operations

include development expense, general and administrative expense,

professional fees, and governance costs to progress and grow the

Groups operations.

Net assets of the Group are attributable solely to Europe and

North America.

Six months ended 30 June 2023

Unaudited

Core 6 months

Operations to

Performance Formulation 30 June

Ingredients Solutions 2023

$000 $000 $000 $000

Revenue

Sale of goods 2,949 1,083 - 4,032

------------ ----------- ------------ ---------

Segment revenue 2,949 1,083 - 4,032

------------ ----------- ------------ ---------

Results

Depreciation and amortization (146) - - (146)

Cost of sales (1,778) (975) - (2,753)

------------ ----------- ------------ ---------

Gross profit 1,025 108 - 1,133

Administrative expense - - (1,864) (1,864)

Interest income - - 48 48

Taxation expense - - (11) (11)

------------ ----------- ------------ ---------

Segment (loss) / gain 1,025 108 (1,827) (694)

------------ ----------- ------------ ---------

Operating assets 1,959 67 11,125 13,151

------------ ----------- ------------ ---------

Operating liabilities (668) (64) (696) (1,428)

------------ ----------- ------------ ---------

Other disclosure:

Capital expenditure* 168 - - 168

------------ ----------- ------------ ---------

Six months ended 30 June 2022

Unaudited

Core 6 months

Operations to

Performance Formulation 30 June

Ingredients Solutions 2022

$000 $000 $000 $000

Revenue

Sale of goods 2,452 605 - 3,057

------------ ----------- ------------ ---------

Segment revenue 2,452 605 - 3,057

------------ ----------- ------------ ---------

Results

Depreciation and amortization (180) - - (180)

Cost of sales (1,555) (561) - (2,116)

------------ ----------- ------------ -----------

Gross profit 717 44 - 761

Administrative expense - - (1,701) (1,701)

Exceptional expense - - (174) (174)

Taxation expense - - (6) (6)

------------ ----------- ------------ -----------

Segment (loss) / gain 717 44 (1,881) (1,120)

------------ ----------- ------------ ---------

Operating assets 2,618 - 799 3,417

------------ ----------- ------------ ---------

Operating liabilities (1,419) - (618) (2,037)

------------ ----------- ------------ ---------

Other disclosure:

Capital expenditure* 36 - - 36

------------ ----------- ------------ ---------

*Capital expenditure consists of additions of property, plant

and equipment, and intangible assets.

Segmental information

Revenues

Unaudited Unaudited

Six Months Six Months

to to

30 June 2023 30 June 2022

$000 $000

Cleaning 3,723 2,691

Hygiene 144 183

Beauty 139 72

Other 26 111

4,032 3,057

============= =============

Geographical information

Revenues Net assets

Unaudited Unaudited Unaudited Audited

Six Months Six Months Six Months Year to

to to to 31 December

30 June 2023 30 June 2022 30 June 2023 2022

$000 $000 $000 $000

Europe 387 192 10,488 (879)

North America 3,645 2,865 1,235 104

4,032 3,057 11,723 (775)

============= ============= ============= ============

The revenue information above is based on the location of the

customer.

6. Contingent consideration

$'000

As at 31 December 2022 (Audited) 1,134

Settlement of contingent consideration (1,134)

As at 30 June 2023 (Unaudited) -

=======

On 8 February 2023, the Company and the Contingent Consideration

Payees entered into a settlement agreement for the contingent

consideration with the issuance of 18,094,582 new ordinary shares

.

7. Weighted-average number of ordinary shares

Unaudited Unaudited

6 Months 6 Months

to to

30 June 30 June

2023 2022

No No

Weighted average number of ordinary shares

for the

purposes of basic and diluted loss per

share ('000) 640,948 446,018

========= =========

8. Share capital

On 8 February 2023, the Company and the Contingent Consideration

Payees entered into a settlement agreement for the contingent

consideration with the issuance of 18,094,582 new ordinary shares

.

On 8 February 2023, the Company issued 67,519,000 ordinary

shares with a nominal value of 1p per share for 5.1p per share. The

consideration was received in cash.

On 27 February 2023, the Company issued 138,563,048 ordinary

shares with a nominal value of 1p per share for 5.1p per share. The

consideration was received in cash.

9. Events after the reporting period

Effective 22 August 2023, the Company completed a 50:1 share

consolidation. The resulting number of new shares issued are

13,486,122 with a nominal value of 50p per share.

10. Cautionary statement

This document contains certain forward-looking statements

relating to Itaconix plc. The Company considers any statements that

are not historical facts as "forward-looking statements". They

relate to events and trends that are subject to risk and

uncertainty that may cause actual results and the financial

performance of the Company to differ materially from those

contained in any forward-looking statement. These statements are

made by the Directors in good faith based on information available

to them and such statements should be treated with caution due to

the inherent uncertainties, including both economic and business

risk factors, underlying any such forward-looking information.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR EANNFFADDEFA

(END) Dow Jones Newswires

September 12, 2023 02:00 ET (06:00 GMT)

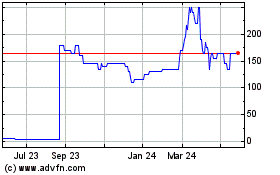

Itaconix (AQSE:ITX.GB)

Historical Stock Chart

From Jan 2025 to Feb 2025

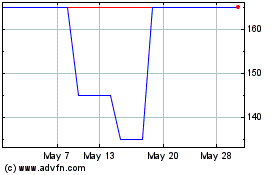

Itaconix (AQSE:ITX.GB)

Historical Stock Chart

From Feb 2024 to Feb 2025