TIDMNYR

RNS Number : 8635Y

Newbury Racecourse PLC

10 May 2023

The information contained within this announcement is deemed by

the Group to constitute inside information as stipulated under the

Regulation 11 of the Market Abuse (Amendment) (EU Exit) Regulations

2019/310 ("MAR"). With the publication of this announcement via a

Regulatory Information Service, this inside information is now

considered to be in the public domain.

10 May 2023

NEWBURY RACECOURSE PLC

(the "Racecourse" or the "Company")

Preliminary results for the 12 months ended 31 December 2022

Newbury Racecourse plc, the racing, entertainment and events

business, today announces its preliminary results for the twelve

months ended 31 December 2022.

2022 Financial and Business Summary

-- Revenue of GBP17.42m (2021: GBP14.83m), an increase of 17%.

-- Consolidated group profit on ordinary activities before tax

of GBP0.13m (2021: GBP0.18m), including exceptional profit of

GBP0.01m (2021: GBP0.15m).

-- Consolidated group profit on ordinary activities after tax of

GBP0.07m (2021: loss of GBP0.88m).

-- Raceday attendances of 141,000 (2021: 105,000). Thirty race

meetings compared with twenty-nine in 2021, including one insured

abandoned meeting (due to adverse weather) on 14 th December

2022.

-- Total prize money of GBP5.17m (2021: GBP4.71m) with executive

contribution of GBP2.47m (2021: GBP1.51m), an increase of 64%.

-- Final GBP10.7m payment received from David Wilson Homes in

March under the 2012 development agreement.

-- Nat West Bank and Compton Beauchamp loans fully repaid

resulting in the Company currently being debt-free.

-- The Company satisfied the commitment made in 2012 to return

capital to shareholders with a special interim dividend of 89.6

pence per share, which was announced in May 2022 and paid in June

2022.

-- GBP1.2m investment in the Berkshire Stand's first floor

facilities alongside Levy Restaurants (the Company's catering

partner).

-- Updated commercial relationship between the Company and

Entain Group meaning that Coral became the title sponsor of the

Company's prestigious two-day Coral Gold Cup Meeting at the end of

November in a new three-year deal.

-- Alongside a reputable events partner, Underbelly Limited

("Underbelly"), the Company launched the Great Christmas Carnival

which took place at the racecourse for thirty-five days commencing

on 25 th November 2022. The Company had expected this arrangement

to create an important new revenue stream and broaden the business

base beyond racing. However, the event failed to deliver the

attendances that Underbelly expected resulting in a material loss

for both the Company and Underbelly. Final agreement now reached

with Underbelly, and the Company's share of this loss (being

GBP0.67m) is less than that expected by the board when the Company

updated shareholders in January of this year. The event, under this

arrangement, is not expected to be repeated.

-- Excluding the financial loss on the Great Christmas Carnival,

the underlying Racecourse business performed strongly, in line with

the Board's expectations.

2023 Update

-- The Company's new Betting Office retail rights agreement

commenced on 1 st April 2023, which will be followed by all other

media rights on 1 st January 2024. Subject to normal trading

conditions continuing and the Government review of the Gambling Act

not materially impacting betting turnover on the Company's racing

activities, the Board is currently committing to investing a

minimum of 40% of its total media rights income into prize money.

This percentage will then be reviewed in two years from now.

-- The Company announced a substantial increase in its prize

money commitment for 2023 to a record GBP6.06m (17% increase) with

an executive contribution of GBP3.1m (26% increase).

-- The Great Christmas Carnival project enabled the Company to

create an important upgraded site in the centre of the racecourse

for future event use. Following these works the Company has

completed a review of its Conference & Events business and

decided to recommence its activities within this sector.

-- As previously reported, subject to future financial

performance, the Board intends to declare an annual dividend,

funded from trading activities in respect of future years, with the

dividend per share being declared annually alongside the Company's

preliminary results announcement.

Dominic Burke, Chairman of Newbury Racecourse plc commented:

"Following two years of restrictions and disruption caused by

the COVID-19 pandemic, 2022 saw the business return to normal

trading with growth reported in the underlying business. Turnover

grew by 17% as we were able to host 30 fixtures during the year,

all with a paying crowd in attendance. Both our Nursery business

and The Lodge Hotel also operated fully throughout the year. This

financial performance was broadly in line with management's

expectations, but as advised in January 2023, the Great Christmas

Carnival generated a material loss for the Company. Despite this,

our reported 2022 profit before tax was similar to 2021,

demonstrating a strong underlying business performance.

I'm pleased that the final payment for the balance of the

guaranteed minimum land value was received from David Wilson Homes

in March which enabled the Company to settle the outstanding

balances on our loans meaning that the Company is currently free of

debt. Given these transactions we were also able to satisfy the

commitment made in 2012, and in many subsequent announcements, to

return capital to shareholders which was made via a special interim

dividend paid in June 2022. Additionally, our commitment to

improving facilities at the racecourse has been demonstrated with a

major investment in the Berkshire Stand's facilities. We also

committed to invest in a similar project in the Hampshire Stand

Hennessy Restaurant completed for re-launch in April 2023. These

developments have been made in the face of a very challenging

environment for racing, both at Newbury and throughout rest of the

UK, but we believe in the importance of providing high class

facilities for all of our racegoers.

Likewise, our commitment to investing in our racing programme

was again evident in 2022 with a 10% increase in prize money to

GBP5.17m of which our Executive Contribution increased by 64% to

GBP2.47m, with further record increases confirmed and announced for

2023.

Our sincere thanks, as ever, to all sponsors, partners, owners,

trainers, stable staff, members, racegoers and all customers for

their ongoing support."

For further information please contact:

Newbury Racecourse plc Tel: 01635 40015

Julian Thick, Chief Executive

Allenby Capital Limited Tel: 0203 328 5656

Nick Naylor/George Payne (Corporate Finance)

Hudson Sandler Tel: 0207 796 4133

Charlie Jack

CHAIRMAN'S STATEMENT

Year ended 31 December 2022

2022 Financial Performance

Following two years of restrictions and disruption caused by the

pandemic, 2022 enabled the business to return to normal trading

with growth reported in the underlying business. Revenue grew by

17% to GBP17.42m in 2022 (2021: GBP14.83m). We were able to host 30

fixtures during the year, compared with 29 in 2021, with 1 fixture

abandoned on 14th December 2022 due to adverse weather. The Nursery

business operated throughout the year and generated turnover of

GBP1.72m (2021: GBP1.56m). The Lodge Hotel re-opened in January

after 22 months of closure and generated income of GBP0.74m (2021:

GBP0.04m).

It has always been the board's strategy to develop the

racecourse into a year-round leisure and events business. The

Company entered into an agreement with reputable events partner

Underbelly Ltd to launch the Great Christmas Carnival which took

place at the racecourse from 25thNovember 2022 until 2ndJanuary

2023. This was expected to create an important new revenue stream

and broaden the business base beyond racing, but due to a number of

factors, the event was not as well attended as Underbelly expected

and has resulted in a material loss of GBP0.67m to the Company.

Operating loss in the year was GBP0.01m (2021: Profit of

GBP0.20m). The company Profit before tax was GBP0.13m (2021:

GBP0.18m). Excluding the impact of the Great Christmas Carnival

event loss, the Profit before tax was GBP0.80m (2021: GBP0.18m)

2022 Racing Highlights

The 2022 racing programme returned to its normal calendar

following the disruption of the previous two years with over

141,000 racegoers (2021:105,000) being welcomed to the

racecourse.

We played host to some top-class racing during the year,

enhancing our ability to attract the very best horses across both

codes and once again providing our racegoers with some outstanding

performances on the track. Highlights early in the year included

wins in the Betfair Hurdle for Glory and Fortune and for Eldorado

Allen in the Betfair Denman Chase.

The start of the 2022 flat season was held over the Easter

weekend in April, with Wild Beauty, Max Vega and Perfect Power

winning the main races in the Dubai Duty Free Spring Trials. In May

the Al Shaqab Lockinge Stakes was won in majestic fashion by

Baaeed, which kicked off an outstanding campaign for one of the

world's top-ranked racehorses.

The first Party in the Paddock event took place after the

Weatherby's Super Sprint meeting, with a crowd of over 15,000

enjoying the return of Craig David who performed after an excellent

day's racing, which saw Eddie's Boywin the Super Sprint and Minzaal

win the Bet365 Hackwood Stakes. Our second Party in the Paddock in

August saw the Ministry of Sound Classical orchestra perform at the

BetVictor Hungerford meeting where Jumby was victorious in the

day's feature race.

Rounding off 2022 in style, Le Milos delighted crowds by winning

the rebranded Coral Gold Cup. A new commercial relationship between

the Company and Entain Group means that Coral has become the title

sponsor of the two-day Gold Cup Meeting in a three-year deal. Coral

also sponsored the 2022 running of the Grade 1 Challow Novices

Hurdle won by Hermes Allen.

Liquidity and Investments

The David Wilson Homes ('DWH') residential development continued

throughout 2022 with construction now continuing into the final

phase at the Eastern end of the site. Approximately 1,100 homes out

of the planned total of c.1,500 are now built. The final payment

for the balance of the guaranteed minimum land value of GBP10.7m

due from DWH, under the 2012 development agreement, was received in

March 2022 so the Company does not expect to receive any further

payments from this agreement.

Subsequently this enabled the business to settle the outstanding

GBP4.5m balance on the NatWest Bank loan as well as make the final

GBP2.7m repayment of the Compton Beauchamp Estates Loan, meaning

that the Company is currently free of debt. Given these

transactions we were able to satisfy the commitment made in 2012,

and in many subsequent announcements, to return capital to

shareholders. The Board announced on 5 May 2022 the declaration of

an 89.6 pence per share special interim dividend totalling GBP3m

which was paid in June.

Our commitment to investing in our racing was again evident with

a 10% increase in prize money to GBP5.17m of which our Executive

Contribution increased by 64% to GBP2.47m.

Additionally, our commitment to improving facilities at the

racecourse has been demonstrated with a joint GBP1.2m investment

in

the Berkshire Stand's first floor facilities shared equally with

our catering operator Levy Restaurants as well as a further

joint

GBP1.8m for a similar project in the Hampshire Stand Hennessy

Restaurant in the first quarter of 2023. These developments have

been made in the face of a very challenging environment for racing

both at Newbury and throughout rest of the UK, but we believe in

the importance of providing high class facilities for all of our

racegoers.

On behalf of the board, I would like to thank our staff for

their continued hard work during the year. In addition, I would

also like to thank our sponsors for their ongoing support as well

as members, customers, owners, trainers and all those associated

with racing industry for their continued support of Newbury

Racecourse.

DOMINIC J BURKE

Chairman

9 May 2023

STRATEGIC REPORT

Year ended 31 December 2022

STRATEGY AND OBJECTIVES

The Board's strategy is for Newbury Racecourse plc to provide a

profitable and diversified business for the benefit of all

stakeholders. This will be delivered through first class facilities

including a modern market-leading racecourse, hotel, children's

nursery, hospitality, and events businesses. Where commercially

viable these will be supported by further innovative activities.

One of the key aims of this Strategic Report is to set out and

appraise the business model through which we deliver that

strategy.

THE BUSINESS MODEL

Newbury Racecourse plc is the parent of a Group of companies

which own Newbury Racecourse and engages in racing, hospitality and

associated food and beverage retail activities. In addition, the

Group operates a conference and events business, a children's

nursery, and an on-site hotel. Alongside its trading activities,

the Group also owns freehold property from which it receives annual

income and, until March 2022, benefitted from the sale of

residential properties on the site, as part of a long-term

development agreement with David Wilson Homes.

PERFORMANCE REVIEW

Consolidated group profit on ordinary activities before tax in

the year ended 31st December 2022 was GBP0.13m (2021: GBP0.18m)

which included the GBP0.67m loss incurred by the Great Christmas

Carnival event.

Turnover increased by 17% to GBP17.42m (2021: GBP14.83m). Racing

revenues increased by 12% on the prior year, mainly through an

increase in media rights income but with one abandonment in the

year (2021: none). Our Conference & Events business income was

in line with 2021, the Nursery has seen a 10% increase in income

and the Lodge delivered revenue of GBP0.74m having been closed from

March 2020 until re-opening January 2022.

Total costs increased by 17% to GBP17.4m (2021: GBP14.9m). Gross

profit reduced to GBP2.64m (2021: GBP2.74m) with the margin

reducing from 18% to 15% due to the Great Christmas Carnival costs

as well as the year-on-year revenue improvements being through

lower margin income streams, due to the prior year impact of the

pandemic.

Loss before interest, tax and exceptional items was GBP0.02m

(2021: Profit of GBP0.04m).

Exceptional items in 2022 were a credit of GBP0.01m (2021:

credit of GBP0.15m) being the fair value movement on the David

Wilson Homes ("DWH") debtor, based upon the expected timing and

value of future receipts. Following the final receipt being

received in 2022, the DWH debtor has now been fully settled so will

have no impact on future financial statement reporting.

The profit after tax was GBP0.07m (2021: loss GBP0.88m).

The negative movement in cash reserves of GBP1.88m in the period

(2021: GBP0.48m increase) includes GBP10.71m of final cash receipts

from DWH in respect of the minimum guarantee, GBP4.5m repayment of

the Nat West bank loan, GBP2.71m repayment of the Compton Beauchamp

loan and GBP2m invested in short-term deposits. GBP3.0m of cash was

distributed to shareholders in 2022 by way of a special interim

dividend. The company is now debt free.

Racing

In 2022 we hosted two additional BHA fixtures so the accounts

include a total of 30 days racing (2021: 29) with one abandonment

on 14th December. Overall raceday attendances in 2022 were 141,000

(2021: 105,000). In the prior year, racing with a crowd commenced

in June 2021.

Total media related revenues of GBP5.14m, were up 17% compared

with 2021. In the year this accounted for 30% of our total trading

revenue which compares exactly with 2021.

May marked the eighth year of Al Shaqab's sponsorship of

Lockinge Day, Newbury's richest race meeting, which was attended by

almost 11,000 racegoers. This meeting has established itself as the

flagship event in our flat racing calendar and the action on the

track once again featured a string of outstanding performances.

Our cornerstone jump meeting at the end of November celebrated

the start of our new three-year partnership with Entain and

featured the inaugural running of the renamed Coral Gold Cup

(formerly the Ladbrokes Trophy). Attendances across the two-day

meeting were just over 18,000.

We continued to make further significant investment into

prizemoney, with a 10% (GBP0.46m) like for like increase in our

contributions to GBP5.17m (2021: GBP4.71m). We also increased our

Executive Contribution to prizemoney by 64% to GBP2.47m (2021:

GBP1.51m).

We are grateful to have received continued significant support

from all of our sponsors, with particular thanks to Al Shaqab

Racing, bet365, Betfair, BetVictor, Dubai Duty Free and Coral for

their commitment in 2022.

Catering, Hospitality and Conference & Events

Conference & Events revenues were GBP0.26m (2021: GBP0.26m),

resulting in an operating Gross Operating Profit of GBP0.18m

(2021:

GBP0.15m). These are encouraging figures given the decision in

early 2022 to cease proactive marketing in this sector whilst we

reviewed the market.

Having concluded this review, going forward our restructured

Conference & Events team is now focused entirely on growing

this part of our business, through proactive selling and

relationship building within key sectors and with several

agents.

Our Catering business transferred to an outsourced arrangement

with Levy Restaurants in 2021 which, following a joint commitment

to facility investment, means that the contractual arrangement will

continue through to the end of 2031. Despite challenges within the

hospitality sector we have been encouraged by trading with reported

income of GBP0.62m (2021: GBP0.43m).

The Rocking Horse Nursery

The Rocking Horse Nursery traded positively throughout 2022 with

revenues of GBP1.72m, up 10% against 2021. This business unit

reported an operating profit of GBP0.57m (2021: GBP0.53m).

The Lodge

Having reopened in January 2022 following a 22-month closure,

our on-site hotel performed strongly with revenues of GBP0.74m

(2021: GBP0.04m). This business unit reported an operating profit

of GBP0.1m (2021: Loss of GBP0.05m)

The Redevelopment

The final balance of the guaranteed minimum land value to be

paid by DWH was received in March 2022 which concludes the final

arrangement from the 2012 Development Agreement. However, the

residential development continues with the final phase of

construction at the Eastern end of the site. Approximately 1,100

homes out of the total c.1,500 are now built and sold with a

further 80 currently under construction.

FINANCIAL COMMENTARY

Consolidated Group profit before tax in the year ended 31

December 2022 was GBP0.13m (2021: GBP0.18m) which includes GBP0.01m

of exceptional profit (2021: GBP0.15m).

Total statutory turnover in 2022 was GBP17.42m (2021:

GBP14.83m). Overall racing revenues increased to GBP14.03m compared

with 2021 (GBP12.48m). Overall media and betting rights revenues

(included in overall racing income) were GBP5.14m (2021: GBP4.38m),

in part due to LBO's being closed for the early part of 2021.

Our Conference and Events revenues were GBP0.26m (2021:

GBP0.26m) and The Lodge was GBP0.74m (2021: GBP0.04m) due to the

former trading consolidating after the impact of the pandemic and

the latter re-opening to the public in January after 22 months of

closure. The Nursery turnover was GBP1.72m (2021: GBP1.56m) which

was up 10% as a result of normal business being fully resumed.

Total costs for the year were GBP17.44m (2021: GBP14.86m) due to

the cost of the Great Christmas Carnival and year-on-year increased

number of racedays with a paying attendance.

Exceptional profits during 2022 were GBP0.01m (2021: GBP0.15m)

being the final movement in the fair value of the DWH debtor.

Overall operating loss before interest was GBP0.01m (2021:

GBP0.20m profit). Interest payable was GBP0.05m (2021: GBP0.19m)

due to the decrease in interest charges on loan facilities which

were settled during the year. Net interest was a receivable of

GBP0.14m (2021 payable of GBP0.02m) The tax charge of GBP0.05m

(2021: charge GBP1.06m) relates to the movement in deferred tax

during the period. Profit after tax was GBP0.07m (2021: GBP0.88m

loss).

KEY PERFORMANCE INDICATORS

The Group uses raceday attendance, trading operating profit and

cash generated from operating activities, as the primary

performance indicators. Total attendance was 141,000 (2021:

105,000). Operating profit is shown within the profit and loss

account on page 29 and cash generated from operating activities is

shown within the consolidated statement of cashflows on page

33.

PRINCIPAL RISKS AND UNCERTAINTIES

Cashflow Risk

The main cash flow risks, under normal trading circumstances,

are the vulnerability of race meetings to abandonment due to

adverse weather conditions, animal disease and fluctuating

attendances particularly for the Party in the Paddock events,

together with the previous possibility of delayed property receipts

from David Wilson Homes. The practice of covering the racetrack to

protect it from frost and investment in improved drainage, as well

as insuring key racedays, mitigates some of the raceday risk.

Regular review of variable conferencing costs reduces the impact of

a decline in conference sales.

Short term cash flow risk is mitigated by regular review of the

expected timing of receipts and by ensuring that the Group has

committed contingencies in place in order to manage its working

capital and investment requirements.

Credit Risk

The Group's principal financial assets are trade and other

receivables. The Group's credit risk is primarily attributable to

its trade receivables. The amounts in the balance sheet are net of

allowances for doubtful receivables. Payment is required in advance

for ticket, hospitality, sponsorship, and conference and event

sales, reducing the risk of bad debt.

Liquidity Risk

In order to maintain liquidity to ensure that sufficient funds

are available for both ongoing operations and the property

redevelopment, the Group uses a mixture of term debt and revolving

credit facilities which are secured on the property assets of the

Group. The Board regularly review the facilities available to the

Group to ensure that there is sufficient working capital

available.

Price Risk

The Group operates within the leisure sector and regularly

benchmarks its prices to ensure that it remains competitive, as

well as having a dynamic pricing model in place.

Cost Risk

The Group has had a historically stable cost base. The key risks

are unforeseen maintenance liabilities, movement in utility costs

and additional regulatory costs for the racing business. A

programme of regular maintenance is in place to manage the risk of

failure in the infrastructure, while utility contracts are

professionally managed. The Group is a member of the Racecourse

Association, a trade association which actively seeks to manage

increases in regulatory risk.

Interest Rate Risk

The Group previously managed its exposure to interest rates

through an appropriate mixture of interest rate caps and swaps,

although this is currently not required.

GOING CONCERN

The Board has undertaken a full, thorough and continual review

of the Group's forecasts and associated risks and sensitivities,

over the next twelve months. The extent of this review reflects the

current economic climate as well as the specific financial

circumstances of the Group.

The Board identified that the Group's cash flow forecasts are

sensitive to fluctuating revenue streams from ticket sales,

corporate hospitality, conference and event income. A system of

regular reviews of the forecasted business has been implemented to

ensure all variable costs are flexed to match anticipated revenues.

In addition, a number of race meetings have been insured for

adverse weather conditions (and other factors such as animal

disease and national mourning), reducing the levels of risk carried

by the Group.

The Board has reviewed the cash flow and working capital

requirements in detail. Following this review the Board has

concluded that it has reasonable expectation that the Group has

adequate resources in place to continue in operational existence

for the foreseeable future and has not identified a material

uncertainty in this regard. On this basis the going concern basis

has been adopted in preparing the financial statements.

SECTION 172 STATEMENT

Section 172 of the Companies Act 2006 requires Directors to take

into consideration the interests of stakeholders and other matters

in their decision making. The Directors continue to have regard to

the interests of the Company's employees, members, partners, the

horseracing community and other stakeholders, the impact of its

activities on the local community, the environment and the

Company's reputation for good business conduct, when making

decisions. The board identifies stakeholders through its annual

strategic review. As the business evolves the board recognises that

those with a direct interest and involvement in the decisions of

the company changes.

In this context, acting in good faith and fairly, the Directors

consider what is most likely to promote the success of the Company

and for these stakeholders in the long term. For example:

-- The engagement of the business with the horseracing community

and stakeholders, such as the Racecourse Association

and Horsemen's Group is routinely considered during the board's

decision-making process.

-- The Company has a frequent forum with local residents to

ensure communication lines are open & accessible.

-- The Company continues to regularly engage with Annual members

and corporate box holders and to encourage feedback.

-- The Company encourages a supportive and inclusive working

culture within the business as set out in our 'Uniquely Newbury'

employee programme, alongside supporting personal development and

promoting wellness & mental health awareness.

Key board decisions made during the year in the interests of

overall business success set out below:

Significant Key S172 matters Actions and impact

events/decisions affected

Racecourse catering Customers, suppliers,

refurbishment employees, * Following the outsourced catering arrangement with

shareholders. Levy Restaurants signed in 2021, the company had the

option to accept investment as part of this which

would extend the contract through to 31 st December

2031.

* Financial analysis was conducted to calculate the

benefits of this method of funding against other

external borrowing options, alongside commercial

returns.

* A decision was made by the board to accept the Levy

investment proposal and therefore extend the contract

in the best interests of the combined arrangement.

* Agreeing to extend the arrangement through to the end

of 2031 gives the business certainty around its

future catering management, along with consistency of

relationship and product offering.

* It also enables the company to continue to gain

access to technology, innovation, human resources and

with the most effective commercial benefits.

----------------------- --------------------------------------------------------------------

Prize Money policy Customers, employees,

shareholders, industry * During 2022 the board considered the impact of

stakeholders. increasing prize money in response to its previous

position, relative to peer racecourses.

* Financial analysis of the race programme from August

onwards was undertaken and the cost impact versus the

benefit of high-quality racing for all stakeholders.

* The board decided that in order for the company to

remain competitive and attract the best horses that a

significant increase in prize money and executive

cost would be the most appropriate approach.

* A further review of the company's position would be

considered for the 2023 race programme.

----------------------- --------------------------------------------------------------------

Payment of a Special Shareholders

Interim Dividend * Following the final David Wilson Homes Development

Agreement receipt the company was in a position of

having surplus cash funds available once all

outstanding debt had been repaid.

* The board had previously made announcements since

2012, when the agreement was made to sell the land,

that its strategy would be to return any surplus

capital to shareholders in the most tax efficient

manner available.

* Having carefully considered all the options along

with advice from the company's Corporate Advisers,

the board decided that this manner would be by way of

a special interim dividend.

* The amount to be distributed in May was decided at

GBP3m given other cash demands

that the business faced at the

time, which represented 89.6pence

per share.

The board also decided to adopt

a future dividend policy from 2024

onwards which would be subject

to the financial performance of

the company.

----------------------- --------------------------------------------------------------------

Significant Key S172 matters Actions and impact

events/decisions affected

Great Christmas Customers, suppliers,

Carnival employees, * The company had been in discussions since 2018 with a

shareholders, quality respected event provider, Underbelly Ltd, to

West Berkshire deliver a Christmas carnival experience at the

community racecourse.

* Due to the impact of the COVID-19 pandemic the

earliest opportunity to launch and deliver this event

was set, following several board meetings in the

preceding years, for 2022.

* In order for the event to be able to go ahead a

number of consultations with local residents and

interested local stakeholders were factored in, as

well as extensive market research and an economic

impact study, before planning permission was sought

and approved for the 35-day event.

* The board considered the impact on a wide range of

further stakeholders when considering whether to

proceed with the event commencing on 25 th November

2022.

The final decision was made to

proceed (on a 50:50 profit share

arrangement) on the basis of all

the information available at the

time, along with financial sensitivity

analysis.

----------------------- --------------------------------------------------------------------

During the period to 31 December 2022 the Company has sought to

act in a way that upholds these principals. The Directors believe

that the application of Section 172 requirements can be

demonstrated in relation to some of the key decisions made and

actions taken during 2022.

CORPORATE GOVERNANCE

The Company is committed to maintaining the highest standards in

corporate governance throughout its operations and to ensure all of

its practices are conducted transparently, ethically and

efficiently. The Company believes scrutinising all aspects of its

business and reflecting, analysing and improving its procedures

will result in the continued success of the Company and deliver

value to shareholders. Therefore, and in accordance with the Aquis

Growth Market Apex Rule Book, (the "AQSE Rules"), the Company has

chosen to comply with the UK's Quoted Companies Alliance Corporate

Governance Code 2018 (the "QCA Code"). The Company is committed to

the ten principles of corporate governance as practiced by the AQSE

market. These principles are disclosed in the 'Corporate Governance

Statement' within this report.

CORPORATE AND SOCIAL RESPONSIBILITY

Employee Consultation

The Group places considerable value on the involvement of its

employees and has continued to keep them informed on matters

affecting them as employees and on the various factors affecting

the performance of the Group and the Company. This is achieved

through formal and informal meetings, and distribution of the

annual financial statements. Employee representatives are consulted

regularly on a wide range of matters affecting their current and

future interests with our 'Uniquely Newbury' employee engagement

programme at the forefront of these initiatives.

Policy on Payments to Suppliers

Although no specific code is followed, it is the Group's and

Company's policy, unless otherwise agreed with suppliers, to pay

suppliers within 30 days of the receipt of an invoice, subject to

satisfactory performance by the supplier. The amount owed to trade

creditors at 31 December 2022 is 7% (2021: 11%) of the amounts

invoiced by suppliers during the year. This percentage, expressed

as a proportion of the number of days in the year, is 25 days

(2021: 40 days).

Business Relationships

The Directors recognise the need to foster the company's

business relationships with suppliers, customers and others. To

that effect, the Company have policies and procedures in place, by

which principal decisions taken by the company during the financial

year were followed.

Disabled Employees

Applications for employment by disabled persons are always fully

considered, bearing in mind the abilities of the applicant

concerned. In the event of members of staff becoming disabled every

effort is made to ensure that their employment with the Group

continues and the appropriate training is arranged. It is the

policy of the Group and the Company that the training, career

development and promotion of disabled persons should, as far as

possible, be identical to that of other employees.

Charitable Donations

During the year the Group made charitable contributions

totalling GBP3,500 to national charities (2021: GBP3,000). This

report was approved by the board and signed on its behalf by:

J M THICK

Chief Executive

9 MAY 2023

Consolidated Profit and Loss Account

Year ended 31 December 2022

2022 2021

GBP'000 GBP'000

---------------------------------------------- -------- --------------

Turnover 17,422 14,831

Cost of sales - other (14,108) (12,107)

Cost of sales - exceptional (674) -

---------------------------------------------- -------- --------------

Gross profit 2,640 2,724

---------------------------------------------- -------- --------------

Administrative expenses (2,659) (2,748)

---------------------------------------------- -------- --------------

Other operating income - 66

---------------------------------------------- -------- --------------

Net exceptional items 7 154

---------------------------------------------- -------- --------------

Operating (loss)/profit (12) 196

---------------------------------------------- -------- --------------

Interest receivable and similar income 190 175

Interest payable and similar charges (52) (192)

---------------------------------------------- -------- --------------

Profit before tax 126 179

---------------------------------------------- -------- --------------

Tax (charge)/credit (52) (1,062)

---------------------------------------------- -------- --------------

Profit /(loss) after tax 74 (883)

---------------------------------------------- -------- --------------

Profit per share (basic and diluted)

(Note 13) 2.21p (26.4)p

All amounts derive from continuing operations

Consolidated Statement of Comprehensive Income

Year ended 31 December 2022

2022 2021

GBP'000 GBP'000

----------------------------------------- -------- ------------

Profit/(loss) for the financial year 74 (883)

----------------------------------------- -------- ------------

Remeasurement of the net defined benefit

liability 585 737

Deferred tax on actuarial (loss)/gain (176) (116)

Other comprehensive profit for the year 409 621

----------------------------------------- -------- ------------

Total recognised profit/(loss) in the

year 483 (262)

----------------------------------------- -------- ------------

Consolidated Balance Sheet

As at 31 December 2022

2022 2021

GBP'000 GBP'000

------------------------------------------ -------- -------------

Fixed assets

Tangible assets 41,395 40,811

Investments 117 117

------------------------------------------ -------- -------------

41,512 40,928

------------------------------------------ -------- -------------

Current assets

Stocks 40 22

Debtors

- due within one year 2,676 12,695

- due after more than one year 3,533 3,618

Short term deposits at bank 2,000 -

Cash at bank and in hand 4,127 6,009

------------------------------------------ -------- -------------

12,376 22,344

------------------------------------------ -------- -------------

Creditors: amounts falling due within one

year (3,787) (10,160)

------------------------------------------ -------- -------------

Net current assets 8,589 12,184

------------------------------------------ -------- -------------

Total assets less current liabilities 50,101 53,112

------------------------------------------ -------- -------------

Creditors: amounts falling due after more - -

than one year

Provisions for liabilities (3,987) (3,759)

------------------------------------------ -------- -------------

Pension deficit - (705)

------------------------------------------ -------- -------------

Net assets 46,114 48,648

------------------------------------------ -------- -------------

Capital grants

Deferred capital grants 19 36

------------------------------------------ -------- -------------

Capital and reserves

Called up share capital 335 335

Share premium account 10,202 10,202

Revaluation reserve 75 75

Equity reserve 143 143

Profit and loss account surplus 35,340 37,857

------------------------------------------ -------- -------------

Shareholders' funds 46,095 48,612

------------------------------------------ -------- -------------

Net assets 46,114 48,648

------------------------------------------ -------- -------------

Consolidated Statement of Changes in Equity

As at 31 December 2022

Capital Profit

Share Share redemption Revaluation and

Capital Premium Reserve reserve loss Total

GROUP GBP'000 GBP'000 GBP'000 GBP'000 account GBP'000

GBP'000

================ ====================== =============== =========== ============= ================ =============

At 1 January

2022 335 10,202 143 75 37,857 48,612

---------------- ---------------------- --------------- ----------- ------------- ---------------- -------------

Profit for the

year - - - - 74 74

Other

comprehensive

income - - - - 409 409

---------------- ---------------------- --------------- ----------- ------------- ---------------- -------------

Total

comprehensive

income - - - - 483 483

---------------- ---------------------- --------------- ----------- ------------- ---------------- -------------

Dividends Paid (3,000) (3,000)

================ ====================== =============== =========== ============= ================ =============

At 31 December

2022 335 10,202 143 75 35,340 46,095

================ ====================== =============== =========== ============= ================ =============

Capital Profit

Share Share redemption Revaluation and

Capital Premium Reserve reserve loss Total

GROUP GBP'000 GBP'000 GBP'000 GBP'000 account GBP'000

GBP'000

================ ====================== =============== =========== ============= ================ =============

At 1 January

2021 335 10,202 143 75 38,119 48,874

---------------- ---------------------- --------------- ----------- ------------- ---------------- -------------

Loss for the

year - - - - (883) (883)

Other

comprehensive

income - - - - 621 621

---------------- ---------------------- --------------- ----------- ------------- ---------------- -------------

Total

comprehensive

income - - - - (262) (262)

================ ====================== =============== =========== ============= ================ =============

At 31 December

2021 335 10,202 143 75 37,857 48,612

================ ====================== =============== =========== ============= ================ =============

Consolidated Cash Flow Statement

Year ended 31 December 2022

2022 2021

GBP'000 GBP'000

Cash flows from operating activities

Profit/(loss) for the financial year 74 (883)

Adjustments for:

Exceptional items (7) (154)

Amortisation of capital grants (17) (17)

Depreciation charges 1,322 1,262

Interest payable 52 192

Interest receivable (190) (175)

Tax charge/(credit) 52 1,062

(Increase)/decrease in stocks (18) 155

(Increase)/decrease in debtors (553) 2

Increase/(decrease) in creditors 645 672

Corporation tax received - 287

Other associated property receipts 148 128

Pension top up payments (138) (122)

------------------------------------------- -------- ------------

Net cash inflow from operating activities 1,370 2,409

------------------------------------------- -------- ------------

Cash flows from investing activities

Interest received - 10

Loan repayments received 9 9

Purchase of fixed assets (1,737) (532)

Purchase of short term investments (2,000) -

Receipts from exceptional sale of fixed

assets 10,706 167

------------------------------------------- -------- ------------

Net cash inflow/(outflow) from investing

activities 6,968 (346)

------------------------------------------- -------- ------------

Cash flows from financing activities

Repayment of CBEL Loan (2,712) -

Repayment of bank loan (4,500) (1,500)

Interest paid (18) (83)

Dividends paid (3,000) -

------------------------------------------- -------- ------------

Net cash outflow from financing activities (10,230) (1,583)

------------------------------------------- -------- ------------

Net increase/(decrease) in cash in the

year (1,882) 480

------------------------------------------- -------- ------------

Cash as at 1 January 2022 6,009 5,529

Cash as at 31 December 2022 4,127 6,009

------------------------------------------- -------- ------------

Notes to the Financial Statements

Year ended 31 December 2022

1. GENERAL INFORMATION

Newbury Racecourse plc (the "Company") is a public company

incorporated, domiciled and registered in England in the UK.

The

registered number is 00080774 and the registered address is The

Racecourse, Newbury, Berkshire, RG14 7NZ.

2. ACCOUNTING POLICIES

2.1 Basis of preparation of financial statements

The Group and company financial statements have been prepared

under the historical cost convention unless otherwise specified

within these accounting policies and in accordance with Financial

Reporting Standard 102, "the Financial Reporting Standard

applicable in the UK and the Republic of Ireland" (FRS 102) and the

Companies Act 2006.

The Company has taken advantage of the exemption allowed under

section 408 of the Companies Act 2006 and has not presented its own

Profit and Loss Account in these financial statements.

The Parent Company is included in the consolidated financial

statements and is considered to be a qualifying entity under FRS

102 paragraphs 1.8 to 1.12. The following exemptions available

under FRS 102 in respect of certain disclosures for the Parent

company financial statements have been applied:

-- No separate Parent Company Cash Flow Statement with related

notes is included

The accounting policies set out below have, unless otherwise

stated, been applied consistently to all periods presented in these

financial statements. Judgements made by the directors, in the

application of these accounting policies that have significant

effect on the financial statements are discussed in note 3.

2.2 Basis of consolidation

The consolidated financial statements incorporate the financial

statements of the Company and its subsidiaries Newbury Racecourse

Enterprises Limited and Newbury Racecourse Management Limited.

2.3 Going concern

The cash position during 2022 enabled the company to pay a GBP3m

dividend to shareholders and as at the balance sheet date was free

of debt. The Board has subsequently undertaken a full, thorough and

continual review of the Group's forecasts and associated risks and

sensitivities, over, not less than, the next twelve months. The

extent of this review reflects the current economic climate as well

as the specific financial circumstances of the Group.

The Board identified that the Group's cash flow forecasts are

sensitive to fluctuating revenue streams from ticket sales,

corporate hospitality, conference and event income, and has given

due consideration to the potential future impacts of COVID-19 on

attendances and the racing calendar. A system of regular reviews of

the forecasted business has been implemented to ensure all variable

costs are flexed to match anticipated revenues. In addition, a

number of race meetings have been insured for adverse weather

conditions (and other factors such as animal disease and national

mourning), reducing the levels of risk carried by the Group.

The Board has reviewed the cash flow and working capital

requirements in detail. Following this review, the Board has

concluded that it has reasonable expectation that the Group has

adequate resources in place to continue in operational existence

for the foreseeable future and has not identified a material

uncertainty in this regard. On this basis the going concern basis

has been adopted in preparing the financial statements.

2.4 Revenue recognition

Services rendered, raceday income including admissions, catering

arrangement & hospitality revenues, sponsorship and licence fee

income is recognised on the relevant raceday. Income from the

arrangement with outsourced caterers, and other activities where

the company is considered the agent rather than the principal, is

recognised at the agreed share rate on profits or losses generated

from such operation. Annual membership income and box rental is

recognised over the period to which they relate.

Other income streams are also recognised over the period to

which they relate, for example, conference income is recognised on

the day of the conference, the Lodge Hotel income is recognised

over the duration of the guests stay and nursery income is

recognised as the child attends the nursery.

For purposes of improved transparency over revenue, all income

relating to prizemoney such as HBLB grants and Owner's entry

stakes are allocated as revenue rather than offsetting cost of

sales.

Sale of goods: revenue is recognised for the sale of food and

liquor when the transaction occurs.

Turnover is stated net of VAT (where applicable) and is

recognised when the significant risks and rewards are considered to

have been transferred to the buyer.

Property receipts are recognised in accordance with the

substance of the transaction being that of an exceptional sale of

land to David Wilson Homes. The minimum guaranteed sum, as set out

in the agreement with David Wilson Homes, is recognised at the

point of sale. In accordance with FRS102, at each reporting date,

the sum receivable, which is included in Other Debtors, is re

estimated based upon currently projected land value with the

difference between this value and the discounted net present value

recorded in the profit and loss account.

2.5 Other investments

Investments in subsidiaries are measured at cost less

accumulated impairment.

Investments in unlisted Group shares, whose market value can be

reliably determined, are remeasured to market value at each balance

sheet date. Gains and losses on remeasurement are recognised in the

Consolidated Profit and Loss Account for the period. Where market

value cannot be reliably determined, such investments are stated at

historic cost less impairment.

2.6 Investment income

Dividends and other investment income receivable are included in

the Profit and Loss Account inclusive of withholding tax but

exclusive of other taxes.

2.7 Lease assets receivable

Lease assets receivable relates to freeholds that the Group has

acquired from David Wilson Homes. The freeholds concerned relate to

residential apartment buildings constructed as part of the overall

residential development. Individual apartments in the development

were sold by David Wilson Homes to purchasers under long term

leases, typically of 125 years. Under the terms of their long-term

leases, lessees are required to pay 'ground rent' to the freehold

owner for the duration of their lease. As the majority of the risks

and rewards, for much of the life of the property, lie with the

lessee, the Group does not recognise a fixed asset in relation to

the freehold to the extent attributable to the lease.

These are initially recognised at fair value which is calculated

based on the net present value of future cashflows arising from the

ground rents receivable over the lease term. This also represents

the market value of the freehold agreed at the time of the

underlying transaction. These amounts are included in the balance

sheet as debtors less than and greater than one year. Ground rent

receipts relating to the period, are applied against the net

receivable balance. The amounts arising from the unwinding of

discounted cashflows are included in interest receivable.

2.8 Tangible fixed assets

Tangible fixed assets are stated at cost or valuation, net of

depreciation and any provision for impairment.

Land is not depreciated. Depreciation on other assets is charged

so as to allocate the cost of assets less their residual value over

their estimated useful lives, using the straight line method.

Depreciation is provided on the following basis:

Freehold buildings and outdoor fixtures 2% - 5% straight line

Tractors and motor vehicles

5% - 10% straight line

Fixtures, fittings and equipment 2% - 25% straight line

The assets' residual values, useful lives and depreciation

methods are reviewed, and adjusted prospectively if appropriate, or

if there is an indication of a significant change since the last

reporting date (see note 3).

Gains and losses on disposals are determined by comparing the

proceeds with the carrying amount and are recognised in the

Consolidated Profit and Loss Account.

2.9 Impairment of assets

Financial assets (including trade and other debtors)

A financial asset not carried at fair value through profit or

loss is assessed at each reporting date to determine whether there

is objective evidence that it is impaired. A financial asset is

impaired if objective evidence indicates that a loss event has

occurred after the initial recognition of the asset, and that the

loss event had a negative effect on the estimated future cash flows

of that asset that can be estimated reliably.

An impairment loss in respect of a financial asset measured at

amortised cost is calculated as the difference between its carrying

amount and the present value of the estimated future cash flows

discounted at the asset's original effective interest rate. For

financial instruments measured at cost less impairment an

impairment is calculated as the difference between its carrying

amount and the best estimate of the amount that the Company would

receive for the asset if it were to be sold at the reporting date.

Interest on the impaired asset continues to be recognised through

the unwinding of the discount. Impairment losses are recognised in

profit or loss. When a subsequent event causes the amount of

impairment loss to decrease, the decrease in impairment loss is

reversed through profit or loss.

2.10 Impairment of fixed assets

Assets that are subject to depreciation are assessed at each

balance sheet date to determine whether there is any indication

that the assets are impaired. Where there is any indication that an

asset may be impaired, the carrying value of the asset (or cash

generating unit to which the asset has been allocated) is tested

for impairment. An impairment loss is recognised for the amount by

which the asset's carrying amount exceeds its recoverable amount.

The recoverable amount is the higher of an asset's (or CGU's) fair

value less costs to sell and value in use. For the purposes of

assessing impairment, assets are grouped at the lowest levels for

which there are separately identifiable cash flows (CGUs).

Non-financial assets that have previously been impaired are

reviewed at each balance sheet date to assess whether there is any

indication that the impairment losses recognised in prior periods

may no longer exist or may have decreased.

2.11 Stocks

Stocks are valued at the lower of cost and net realisable value.

Provision is made for obsolete, slow moving or defective items

where appropriate.

2.12 Repairs and renewals

Expenditure on repairs and renewals and costs of temporary

facilities during construction works are written off against

profits in the year in which they are incurred.

2.13 Cash and cash equivalents

Cash is represented by cash in hand and cash equivalents, being

short term highly liquid investments that are readily convertible

to known amounts of cash and that are subject to an insignificant

risk of changes in value.

2.14 Provisions for liabilities

Provisions are made where an event has taken place that gives

the Group a legal or constructive obligation that probably requires

settlement by a transfer of economic benefit, and a reliable

estimate can be made of the amount of the obligation.

Provisions are charged as an expense to the Consolidated Profit

and Loss Account in the year that the Group becomes aware of the

obligation and are measured at the best estimate at the Balance

Sheet date of the expenditure required to settle the obligation,

taking into account relevant risks and uncertainties.

When payments are eventually made, they are charged to the

provision carried in the Balance Sheet.

2.15 Dividends

Where dividends are declared, appropriately authorised (and

hence no longer at the discretion of the Group) after the balance

sheet date but before the relevant financial statements are

authorised for issue, dividends are not recognised as a liability

at the balance sheet date because they do not meet the criteria of

a present obligation in FRS102.

2.16 Current and deferred taxation

The tax expense for the year comprises current and deferred tax.

Tax is recognised in the Consolidated Profit and Loss Account,

except that a charge attributable to an item of income and expense

recognised as other comprehensive income or to an item recognised

directly in equity is also recognised in other comprehensive income

or directly in equity respectively.

The current income tax charge is calculated on the basis of tax

rates and laws that have been enacted or substantively enacted by

the balance sheet date in the countries where the Company and the

Group operate and generate income.

Deferred tax is provided on timing differences which arise from

the inclusion of income and expenses in tax assessments in periods

different from those in which they are recognised in the financial

statements. The following timing differences are not provided for:

differences between accumulated depreciation and tax allowances for

the cost of a fixed asset if and when all conditions for retaining

the tax allowances have been met; and differences relating to

investments in subsidiaries, to the extent that it is not probable

that they will reverse in the foreseeable future and the reporting

entity is able to control the reversal of the timing difference.

Deferred tax is not recognised on permanent differences arising

because certain types of income or expense are non-taxable or are

disallowable for tax or because certain tax charges or allowances

are greater or smaller than the corresponding income or

expense.

Deferred tax is provided in respect of the additional tax that

will be paid or avoided on differences between the amount at which

an asset or liability is recognised in a business combination and

the corresponding amount that can be deducted or assessed for

tax.

Deferred tax is measured at the tax rate that is expected to

apply to the reversal of the related difference, using tax rates

enacted or substantively enacted at the balance sheet date. For

non-depreciable assets that are measured using the revaluation

model, or investment property that is measured at fair value,

deferred tax is provided at the rates and allowances applicable to

the sale of the asset/property. Deferred tax balances are not

discounted.

Unrelieved tax losses and other deferred tax assets are

recognised only to the extent that is it probable that they will be

recovered against the reversal of deferred tax liabilities or other

future taxable profits.

Deferred tax assets and deferred tax liabilities are offset when

the entity has a legally enforceable right to set off current tax

assets against current tax liabilities, and when the deferred tax

assets and deferred tax liabilities relate to income taxes levied

by the same taxation authority on the same taxable entity.

2.17 Grants

Coronavirus Job Retention Scheme grants, provided by the

government, are accounted for under the performance model in line

with accounting standards, with these grants credited to the Profit

and Loss Account as other operating income in the month of the

corresponding payroll expense. The corresponding debtor is carried

on the balance sheet until the cash is received.

Capital grants received are accounted for as deferred grants on

the Balance Sheet and credited to the Profit and Loss Account over

the estimated economic lives of the asset to which they relate.

Capital grants are in deferred capital grants on the Balance Sheet

as the associated works have been performed and it is not in any

way repayable.

2.18 Pensions

Defined contribution plans and other long term employee

benefits

A defined contribution plan is a post-employment benefit plan

under which the company pays fixed contributions into a separate

entity and will have no legal or constructive obligation to pay

further amounts. Obligations for contributions to defined

contribution pension plans are recognised as an expense in the

profit and loss account in the periods during which services are

rendered by employees.

Defined benefit plans

A defined benefit plan is a post-employment benefit plan other

than a defined contribution plan. The entity's net obligation in

respect of defined benefit plans is calculated by estimating the

amount of future benefit that employees have earned in return for

their service in the current and prior periods; that benefit is

discounted to determine its present value. The fair value of any

plan assets is deducted. The entity determines the net interest

expense (income) on the net defined benefit liability (asset) for

the period by applying the discount rate as determined at the

beginning of the annual period to the net defined benefit liability

(asset) taking account of changes arising as a result of

contributions and benefit payments.

The discount rate is the yield at the balance sheet date on AA

credit rated bonds denominated in the currency of, and having

maturity dates approximating to the terms of the entity's

obligations. A valuation is performed annually by a qualified

actuary using the projected unit credit method. The entity

recognises net defined benefit plan assets to the extent that it is

able to recover the surplus either through reduced contributions in

the future or through refunds from the plan.

Changes in the net defined benefit liability arising from

employee service rendered during the period, net interest on net

defined benefit liability, and the cost of plan introductions,

benefit changes, curtailments and settlements during the period are

recognised in profit or loss.

Remeasurement of the net defined benefit liability/asset is

recognised in other comprehensive income in the period in which it

occurs. A defined benefit pension surplus is recognised only to the

extent that the entity has an economic right, by reference to the

terms and conditions of the plan and relevant statutory

requirements, to realise the asset over the course of the expected

life of the plan or when the plan is settled.

2.19 Borrowing and loan issue costs

Interest bearing bank loans and overdrafts are recorded at the

proceeds received, net of direct issue costs. Finance charges,

including premiums payable on settlement or redemption and direct

issue costs are accounted for on an accrual basis in the profit and

loss account using the effective interest method and are added to

the carrying amount of the instrument to the extent that they are

not settled in the period which they arise. Debt issue costs are

initially recognised as a reduction in the proceeds of the

associated capital instrument.

2.20 Financial instruments Trade and other debtors / creditors

Trade and other debtors are recognised initially at transaction

price plus attributable transaction costs. Trade and other

creditors are recognised initially at transaction price less

attributable transaction costs. Subsequent to initial recognition

they are measured at amortised cost using the effective interest

method, less any impairment losses in the case of trade debtors. If

the arrangement constitutes a financing transaction, for example if

payment is deferred beyond normal business terms, then it is

measured at the present value of future payments discounted at a

market rate of instrument for a similar debt instrument.

Interest bearing borrowings classified as basic financial

instruments

Interest bearing borrowings are recognised initially at the

present value of future payments discounted at a market rate of

interest. Subsequent to initial recognition, interest bearing

borrowings are stated at amortised cost using the effective

interest method, less any impairment losses.

Fair value measurement

Assets and liabilities that are measured at fair value are

classified by level of fair value hierarchy as follows:

Level 1 - quoted prices (unadjusted) in active markets for

identical assets or liabilities.

Level 2 - inputs other than quoted prices included within level

1 that are observable for the asset or liability, either directly

or indirectly.

Level 3 - inputs for the asset or liability that are not based

on observable market data.

2.21 Exceptional items

Directors exercise their judgement in classification of certain

items as exceptional and outside the Group's underlying results.

The determination of whether items should be separately disclosed

as an exceptional item or other adjustment requires judgement on

its materiality, nature and incidence.

3. CRITICAL ACCOUNTING JUDGEMENTS AND KEY SOURCES OF ESTIMATION UNCERTAINTY

In the application of the Group's accounting policies, which are

described in note 2, the directors are required to make judgements,

estimates and assumptions about the carrying amounts of assets and

liabilities that are not readily apparent from other sources. The

estimates and associated assumptions are based on historical

experience and other factors that are considered to be relevant.

Actual results may differ from these estimates. The estimates and

underlying assumptions are reviewed on an ongoing basis. Revisions

to accounting estimates are recognised in the period in which the

estimate is revised if the revision affects only that period, or in

the period of the revision and future periods if the revision

affects both current and future periods.

The following are the critical judgements and key sources of

estimation uncertainty that the directors have made in the process

of applying the Group's accounting policies and that have the most

significant effect on the amounts recognised in the financial

statements.

David Wilson Homes

The fair value of the long-term David Wilson Homes debtor

balance is an estimate that is determined with reference to current

market conditions and to reflect the risks specific to the balance

due. Estimates include the current value of the land as determined

by the agreed parameters of the land sale agreement with David

Wilson Homes, together with the application of a suitable discount

rate based on management judgement.

Impairment of assets

Determining whether assets are impaired requires an estimation

of the value in use of the cash generating units to which assets

have been allocated. The value in use calculation requires the

entity to estimate the future cash flows expected to arise from the

cash generating unit and a suitable discount rate in order to

calculate present value. The carrying amount of tangible fixed

assets and investment property at the Balance Sheet date was

GBP41.5 million. No indication of impairment has been identified in

2022 (2021: none identified).

Residual values and useful economic lives

The Group's tangible fixed assets are reviewed, whenever there

is a relevant change in circumstances or after relevant review, in

order to assess whether the residual values and useful economic

lives, based on management estimates, continue to be appropriate

for calculating depreciation in the period. There was no change in

residual values or useful economic lives during 2021.

4. EXCEPTIONAL ITEMS

Cost of Sales - Exceptional Items:

Cost of sales exceptional items relates to the GBP0.67m loss

(2021: GBPnil) incurred by the Great Christmas Carnival event.

Net Exceptional Items:

2022 2021

GBP'000 GBP'000

---------------------------------- -------- ------------

Loss on disposal of fixed assets (24) -

DWH debtor movement in fair value 31 154

---------------------------------- -------- ------------

Total 7 154

---------------------------------- -------- ------------

5. PROFIT PER SHARE

Basic and diluted profit per share is calculated by dividing the

profit attributable to ordinary shareholders for the year ended 31

December 2022 of GBP74,000 (2021: loss of GBP883,000) by the

weighted average number of ordinary shares during the year of

3,348,326 (2021: 3,348,326).

NOTES

The financial information set out above does not constitute the

Company's statutory accounts for the years ended 31 December 2022

or 2021 but is derived from those accounts. Statutory accounts for

2021 have been delivered to the Registrar of Companies and those

for 2022 will be delivered following the Company's annual general

meeting.

The information included in this announcement is taken from the

audited financial statements which are expected to be dispatched to

the members shortly and will be available at

www.newburyracecourse.co.uk. The audit report for the year ended 31

December 2022 and for the year ended 31 December 2021 was

unqualified and did not include a reference to any matters to which

the auditor drew attention by way of emphasis, without qualifying

their report or qualified, including if the audit report contained

a statement under section 498(2) (accounting records or returns

inadequate or accounts or directors' remuneration report not

agreeing with records and returns) or section 498(3) (failure to

obtain necessary information and explanations).

This announcement is based on the Company's financial

statements, which are prepared in accordance with United Kingdom

Generally Accepted Accounting Practice (United Kingdom Accounting

Standards and applicable law), including FRS 102 "The Financial

Reporting Standard applicable in the UK and Republic of Ireland and

with those parts of the Companies Act 2006 that are applicable to

companies reporting under UK GAAP.

Neither an audit nor a review provides assurance on the

maintenance and integrity of the website, including controls used

to achieve this, and in particular whether any changes may have

occurred to the financial information since first published. These

matters are the responsibility of the directors, but no control

procedures can provide absolute assurance in this area.

Legislation in the United Kingdom governing the preparation and

dissemination of financial information differs from legislation in

other jurisdictions.

This preliminary statement was approved by the Board of

Directors on 9 May 2023

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NEXUPUQPAUPWPGB

(END) Dow Jones Newswires

May 10, 2023 02:00 ET (06:00 GMT)

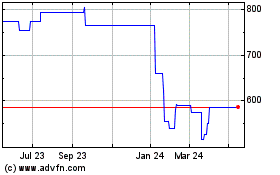

Newbury Racecourse (AQSE:NYR)

Historical Stock Chart

From Nov 2024 to Dec 2024

Newbury Racecourse (AQSE:NYR)

Historical Stock Chart

From Dec 2023 to Dec 2024