TIDMPREM

RNS Number : 3578W

Premier African Minerals Limited

11 December 2023

Premier African Minerals Limited / Ticker: PREM / Index: AIM /

Sector: Mining

For immediate release

11 December 2023

Premier African Minerals Limited

Funding of Zulu Project and Update

The Board of Premier African Minerals Limited ("Premier" or the

"Company") is pleased to announce a subscription today to raise

GBP2.4 million before expenses at an issue price of 0.23 pence per

new ordinary share for the Zulu Lithium and Tantalum Project

("Zulu").

The Company is on track to target revenue generating production

by February 2024 following the installation of the 55 tons per hour

ball mill and other associated structures which is expected to be

completed by late January/early February 2024.

In addition, the Company has today conditionally settled payment

of US$2.5 million (equivalent to GBP2 million) in invoices through

the issue of 769,230,769 new ordinary shares of the Company to Zulu

open pit mining contractor, JR Goddard Contracting (Pvt) Ltd,

issued at a price of 0.26 pence per new ordinary share .

George Roach, CEO, commented , "The subscription and the

contractor settlement should see Zulu through to production in

February 2024.

We are deeply encouraged that the subscription was taken up by

two institutional investors with one of the investors having

supported the Company previously. We believe that the attraction of

further institutional investment into Premier demonstrates the

underlying value of Premier.

We would be remiss if we did not also express our appreciation

to our Mining Contractor for their willingness to accept settlement

of invoices in Premier shares".

Subscription

Premier has today issued by way of a direct subscription

("Subscription"), conditional on admission, 1,043,478,261 new

ordinary shares of nil par value ("Subscription Shares") at a

Subscription price of 0.23 pence per Subscription Share. The

Subscription Shares will, when issued, rank pari passu in all

respects with the existing ordinary shares. The direct subscription

was arranged by Fox-Davies Capital Limited with just two

participating institutions.

Application will be made for the Subscription Shares to be

admitted to trading on AIM and admission is expected to take place

on or around 15 December 2023.

The Subscription has been arranged within the Company's existing

share authorities. Premier intends to use the proceeds of the

Subscription principally to assist with the ongoing mining

operations at Zulu including the necessary works for installation

of the 55 tons per hour ball mill with its associated structures

and general working capital.

Contractor Settlement

As previously announced on 25 August 2023, Zulu open pit mining

contractor, JR Goddard Contracting (Pvt) Ltd ("JRG") had agreed to

accept payment of a limited number of future invoices until the end

of December 2023, now extended to when commercial shipments begin

at Zulu in Q1 of 2024, in new ordinary shares of the Company at the

closing middle market price on the day prior to settlement.

Accordingly, the Company has today conditionally settled payment of

US$2.5 million (equivalent to GBP2 million) in invoices through the

issue of 769,230,769 new ordinary shares of the Company at the

price of 0.26 pence ("Settlement Shares").

The issue of the Settlement Shares is conditional on the written

confirmation that JRG has received Exchange Control Approval from

the Reserve Bank of Zimbabwe for receipt of the Settlement Shares

("Condition Precedent"). Application will be made for the

Settlement Shares to be admitted to trading on AIM in due

course.

Any sales of the Settlement Shares will be handled by Premier's

brokers under orderly market conditions with an initial 20-day

lockup of the Settlement Shares following the date that the

Conditional Precedent is satisfied.

Total Voting Rights

Following the issue of the Subscription Shares, the Company's

issued share capital consists of 26,916,580,705 Ordinary Shares,

with voting rights.

This figure may be used by shareholders in the Company as the

denominator for the calculation by which they will determine if

they are required to notify their interest in, or a change to their

interest in, the share capital of the Company under the Financial

Conduct Authority's Disclosure and Transparency Rules.

Market Abuse Regulations

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 as it forms part of

UK Domestic Law by virtue of the European Union (Withdrawal) Act

2018 ("UK MAR").

The person who arranged the release of this announcement on

behalf of the Company was George Roach.

A copy of this announcement is available at the Company's

website, www.premierafricanminerals.com

Enquiries:

Premier African Minerals Tel: +27 (0) 100

George Roach Limited 201 281

Michael Cornish / Beaumont Cornish Limited Tel: +44 (0) 20

Roland Cornish (Nominated Adviser) 7628 3396

--------------------------- -----------------

Tel: +44 (0) 20

Douglas Crippen CMC Markets UK Plc 3003 8632

--------------------------- -----------------

Toby Gibbs/Rachel Shore Capital Stockbrokers Tel: +44 (0) 20

Goldstein Limited 7408 4090

--------------------------- -----------------

Tel: +44 (0) 20

Jerry Keen Fox-Davies Capital Limited 3884 7447

--------------------------- -----------------

Important Notice

Beaumont Cornish Limited ("Beaumont Cornish"), which is

authorised and regulated in the United Kingdom by the Financial

Conduct Authority, is acting as nominated adviser to the Company in

connection with the Subscription and will not regard any other

person as its client and will not be responsible to anyone else for

providing the protections afforded to the clients of Beaumont

Cornish or for providing advice in relation to such proposals.

Beaumont Cornish has not authorised the contents of, or any part

of, this announcement and no liability whatsoever is accepted by

Beaumont Cornish for the accuracy of any information or opinions

contained in this announcement or for the omission of any

information. Beaumont Cornish as nominated adviser to the Company

owes certain responsibilities to the London Stock Exchange which

are not owed to the Company, the Directors, shareholders or any

other person.

Fox-Davies Capital Limited is authorised and regulated by the

FCA in the United Kingdom and is acting exclusively for the Company

and no one else in connection with the Subscription and will not be

responsible to anyone (including any Subscriber) other than the

Company for providing the protections afforded to its clients or

for providing advice in relation to the Subscription or any other

matters referred to in this announcement.

Forward Looking Statements

Certain statements in this announcement are or may be deemed to

be forward looking statements. Forward looking statements are

identi ed by their use of terms and phrases such as "believe"

"could" "should" "envisage" "estimate" "intend" "may" "plan" "will"

or the negative of those variations or comparable expressions

including references to assumptions. These forward-looking

statements are not based on historical facts but rather on the

Directors' current expectations and assumptions regarding the

Company's future growth results of operations performance future

capital and other expenditures (including the amount. Nature and

sources of funding thereof) competitive advantages business

prospects and opportunities. Such forward looking statements re ect

the Directors' current beliefs and assumptions and are based on

information currently available to the Directors. A number of

factors could cause actual results to differ materially from the

results discussed in the forward-looking statements including risks

associated with vulnerability to general economic and business

conditions competition environmental and other regulatory changes

actions by governmental authorities the availability of capital

markets reliance on key personnel uninsured and underinsured losses

and other factors many of which are beyond the control of the

Company. Although any forward-looking statements contained in this

announcement are based upon what the Directors believe to be

reasonable assumptions. The Company cannot assure investors that

actual results will be consistent with such forward looking

statements.

Notes to Editors:

Premier African Minerals Limited (AIM: PREM) is a

multi-commodity mining and natural resource development company

focused on Southern Africa with its RHA Tungsten and Zulu Lithium

projects in Zimbabwe.

The Company has a diverse portfolio of projects, which include

tungsten, rare earth elements, lithium and tantalum in Zimbabwe and

lithium and gold in Mozambique, encompassing brownfield projects

with near-term production potential to grass-roots exploration. The

Company has accepted a share offer by Vortex Limited ("Vortex") for

the exchange of Premier's entire 4.8% interest in Circum Minerals

Limited ("Circum"), the owners of the Danakil Potash Project in

Ethiopia, for a 13.1% interest in the enlarged share capital of

Vortex. Vortex has an interest of 36.7% in Circum.

Ends

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDFLFLLFLLLLIV

(END) Dow Jones Newswires

December 11, 2023 06:20 ET (11:20 GMT)

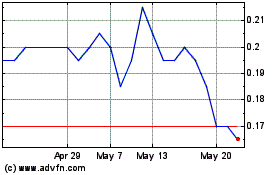

Premier African Minerals (AQSE:PREM.GB)

Historical Stock Chart

From Jan 2025 to Feb 2025

Premier African Minerals (AQSE:PREM.GB)

Historical Stock Chart

From Feb 2024 to Feb 2025